|

Election Hangover | Fixed Income | Real Estate

It's fair to say many, if not most of us, are still trying to wrap our heads around the U.S. election and its repercussions. A Trump presidency brings with it more questions than answers, meaning I'll refrain from making too many predictions on the subject. One thing I will say, however, is that the next four years will probably be like nothing we have ever seen in U.S. politics.

Now on to the markets. The expected crash following Trump's win

failed to materialize

. In fact, most markets are fairly close to where they were before the election with a few notable exceptions. Gold and Canadian REITs have fallen a few percentage points, but the biggest decline has been observed in emerging markets (EM), especially the Mexican market that has fallen over 6%. As you may remember

from past newsletters

, I'm particularly bullish on the long-term prospects for EM and am looking to add an additional EM position. Should they continue to fall, this addition may be made sooner than later.

One asset class I rarely comment on is

fixed income

. Little of interest or consequence has occurred in this area over the last few years. The last week has been different. As President-elect Trump is proposing a large fiscal stimulus plan to grow the economy, interest rates have risen as the stimulus plan is expected to cause inflation.

As a reminder, interest rates have an inverse effect on most bonds. In other words, when interest rates rise, it is bad for the bond owners. Just how bad is determined by how long the term of the bond is. The longer the term, the more sensitive it will be to the interest rate.

We've kept our bond durations low. This was not done in anticipation of the election results, but rather to ensure our fixed income positions were situated for safety while still providing some returns.

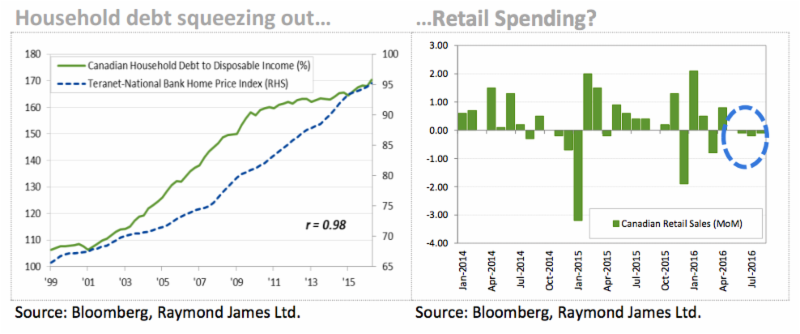

In other, but potentially related news, according to RBC's latest housing affordability reading, the average Canadian consumer debt-to-disposable income ratio is

now at a record 170%

----- the highest in the G7. Put another way, the average Canadian's household servicing costs are now 42.8% of their pre-tax income----- a scary thought. If interest rates do increase in the coming years, that number will surely rise, unless housing prices fall first. The question is, how much higher can that ratio go before it becomes crippling for Canadians?

In the review queue

100 Blocks a Day

by Tim Urban: A short, but poignant article on how every waking day can be split into one hundred 10-minute blocks of time. Urban highlights the importance of making conscious decisions on how to spend them.

Bias from Disliking/Hating

by Farnam Street: I'm slightly obsessed with the way humans (myself included, of course) are inherently biased. This article from Farnam Street, one of my favourite websites (if you hadn't noticed), describes where the bias of disliking and hating comes from. More importantly, it illustrates how this bias causes us to make suboptimal decisions, demonstrating what it has, and will continue to, cost us.

Behind Our Anxiety, the Fear of Being Unneeded

by the Dali Lama & Arthur C. Brooks: A thoughtful article by the Dali Lama on why he believes people, especially in wealthy countries, are unhappy and in pain. Although I think he's on to something, the article seems quick to jump to causation from the little research and few statistics presented.

Just for fun

- The word "shocking" is thrown around too often these days, but I think it's appropriate for how good this 80-year-old Chinese man looks. Part of me expects to find out he's actually only 60 or so----- though he'd still look pretty awesome for that age, too!

- How did the pollsters get the U.S. election wrong? The insightful

|

Matthew Lekushoff, CIMA

Financial Advisor

Raymond James Ltd.

T: 416-777-6368 | F: 416-777-7020 www.Matthewlekushoff.ca

|

|

|

|

|

This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

The views of the author do not necessarily reflect those of Raymond James. This article is for information only. Raymond James Ltd. Member-Canadian Investor Protection Fund

|

|

Copyright © 2014. All Rights Reserved.

|

|

|

|