|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 1.99% APR requires a minimum FICO® 750 Credit Score. 72 months term at 1.99% APR is $14.75 per $1,000.00 borrowed.

|

President's Corner President's Corner

|

ESPN's "The Sports Reporters" ended its 30-year run this month. For those who never saw this quiet Sunday morning program, the show featured four primarily northeast sportswriters discussing the sports issues of the day in an erudite manner. The show stayed true to its roots of professional debate for its entire run.

What ESPN probably didn't know at the time was that "The Sports Reporters" would be the beginning of an endless series of increasingly obnoxious talk shows which include yelling, interrupting, and in a few cases, fist fights. These shows were not exclusive to sports, oozing into the news and entertainment arenas. It's hard to flip the dial without seeing Jerry Springer, the Real Housewives, cable news, or even SportsCenter with "expert" panels whose decibel levels exceed the call of the blue whale.

There is, however, a quiet little corner giving sane personal financial advice. On weekend afternoons when most of us are enjoying our time off from work, radio stations across the country syndicate financial shows discussing such topics as saving for retirement, reducing debt, and how to start a small business. The most popular programs are The Clark Howard Show, The Dave Ramsey Show, and Motley Fool Money, which also has articles in many weekend newspapers nationwide. Dubbed America's dean of personal finance, Jane Bryant Quinn's columns have appeared over the years in newspapers and magazines such as AARP Magazine.

It's too bad these financial radio hosts and columnists have been shoved to the equivalent of the Action/Adventure section of the local bookstore. They give consistent and valuable advice, but it's not exciting and at times painful. Dedication and commitment are required to listen to a Saturday afternoon radio show or to read a newspaper article on personal finance. It may be because it feels like school, and who wants to be in school on a weekend?

The biggest mistake people make about finance is that they try to do everything at once. It becomes overwhelming which leads to just giving up. Start with something small, for instance a small outstanding bill, and pay it off. Or, start putting $10 a week into savings and gradually increase that amount over a period of years. It's amazing how good one feels when even the smallest item on a to-do list gets accomplished.

With more and more technology, our society feels like it's moving faster than ever. People feel pressured to move at that speed to keep up. Slow and steady saving and paying down debt will eventually achieve financial independence. It's not a race; go at your own speed. That's what "The Sports Reporters" did. Slow and steady for them lasted thirty years.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

Source: Tom Slefinger, Balance Sheet Solutions, Weekly Relative Values, March 27, 2017

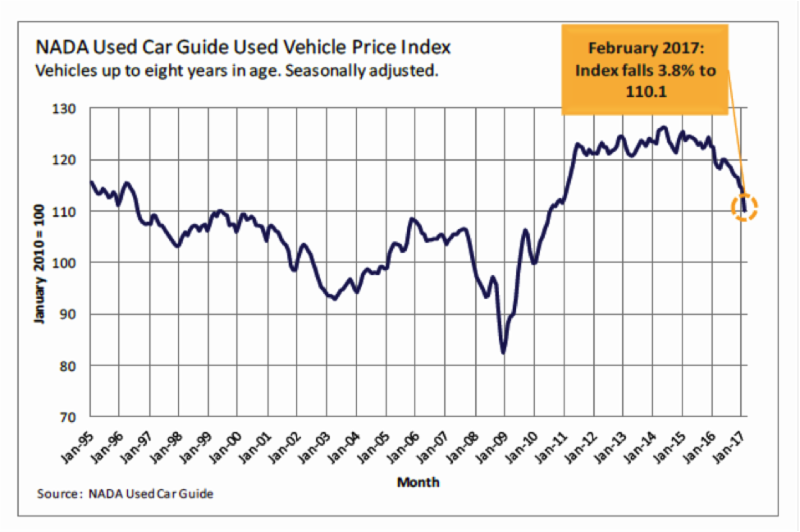

The National Association of Auto Dealers (NADA) used car guide showed an eighth straight month of decline in February - a 3.8% plunge, which was the worst for any month since the depths of the Great Recession back in November 2008. The index is down 8% year-over-year, and down 13% from its peak in 2014.

(FOUR TWO FIVE EIGHT EIGHT)

|

Tips for Teens Tips for Teens

|

Happy Belated World National Password Day! Happy Belated World National Password Day!

Every year, the first Thursday of May (this year it was on May 4th) is considered to be World National Password Day, an unofficial holiday started by Intel back in 2014. The idea is to bring awareness to the importance of not reusing the same password for everything and convince people to change their passwords more often. It's no secret that entering passwords has become part of our daily routine, but this is not an excuse for using the same password over and over again. Is the lock on your door the same one that's on your car? Nope! For the same reason, you shouldn't use the same password for Facebook, Twitter, and Instagram. If someone guesses your password correctly, they can post and share whatever they want on all of your accounts. Sure, you can take the post down later, but can you erase the fact that people that saw the post? So, what should you do?

Here are some useful tips:

- Use two-factor authentication/fingerprint reader

Two-factor authentication, aka two-step authentication, is the simplest way to secure your account. Every time you or someone else tries to sign into an account, say Google, you will receive a text message with a six digit code. Enter the same code into the log in screen and you're all set to go. The account will know that it's truly you and will let you in. No more chinny chin chins!

Some apps, like our @ccessMobile App for iPhone and iPad, have Touch ID, the option to ask for your fingerprint to sign into the app. It still requires you to log in as you normally would to set up the fingerprint login, but after that, you can use your fingerprint to sign in as much as your heart desires. For those concerned about privacy, your fingerprint is not uploaded to anything, period. It's kept locally on your phone where it's safe from cyber hackers.

- Use a Password Manager

They're out there to help you stay safe. Use them! Most of them are free, but some require a paid membership. Do some research before choosing your password manager though because it is time consuming having to re-enter all of your login information again if you switch. Most password managers offer to create random passwords, which are recommended since the password they generate is better than any password you would have been able to think of. Best of all, they'll remember what the password was and will even offer to type it in for you if you have the app installed.

Perhaps a day will come when we'll be able to get into our accounts using a blood sample. But until then, the wisest thing to do is ask yourself if you really need an account for that site. The more accounts that are out there, the harder it is to protect yourself. Best of luck this month!

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Here's what you need to know.

By Jason Vitucci, CFP & Gene A. Schnabel

Did you collect a large tax refund this year? You may want to think twice about celebrating the apparent windfall of cash that you received. In 2016, the Internal Revenue Service (IRS) reported that 70 percent of taxpayers received refunds averaging about $2,860.

1

Now, there are two different ways to view getting a refund - either as surplus money you receive from the government to spend however you please or money you could have had to invest and grow throughout the year.

Truth be told you are not necessarily winning with a big refund. It may seem like a long awaited (or surprise) present to get a big refund check, but consider this ... you essentially let the government borrow your money all year without earning any interest! For example, say you received a $4,500 tax refund this year. Think of all the ways you could have better spent that money over the course of the year if it remained in your paycheck in monthly increments of $375.

The good news is if you did receive a refund it could serve as a helpful reminder to change your federal income tax withholding and invest in more than a shopping splurge.

-

Change your withholding amount. First, if your refund is significant and you want to stop giving Uncle Sam an interest-free loan, consider changing your withholding amount on your W-4. Consult your employer about your current withholdings-and consider doing this annually if you've had any lifestyle changes like a marriage or baby. The more allowances you claim, the less tax is withheld from your pay. If your tax refund was considerably high, you likely didn't take enough exemptions.

-

Pay down debt. The average American household debt hovers around $134,000 (including mortgages), according to personal finance website, NerdWallet.2 Start by reviewing what debts you owe, for example credit card debt, and organize it by highest interest rate first. This will help you to determine where your refund check should be used to pay off down your debt first. If you don't have credit card debt but student loans are weighing you down, consider paying down private loans over federal loans that typically have lower interest rates.

-

Invest in retirement. Everyone can benefit from compounding interest over time, right? Well the same goes for investing in retirement throughout the year. If you are loaning the government your money only to get it back once you've filed a tax return, you are missing valuable time to let your money grow. The hundred or few hundred dollars that you could keep each paycheck would go further in the long run invested in a retirement account. Plus, the extra money you earned in interest will continue compounding over time.

At Vitucci Integrated Planning, we would love the opportunity to take a look at your current financial plan as it relates to your tax situation. If you are yet to formulate a plan, we would love to help you do just that. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, our workshops, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal. 1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities. Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

Citations:

1. savingtoinvest.com

2. nerdwallet.com

|

Why a Home Inventory is Important Why a Home Inventory is Important

|

Let's try a little exercise: Can you list everything you own from memory? Didn't think so.

The fact is most people own more things than they realize. It's easy to remember the cars, the computer, the TV. But what about that holiday china in the garage? Or every pair of shoes?

All of it is regarded as personal property for insurance purposes. And if your home is destroyed by fire or some other disaster, having a list of your possessions makes filing a claim easier - and helps you put your life back together.

Why should I complete a home inventory? What's the best way? Comparing the value of your belongings to the "contents" limit listed in your policy helps you make sure you have enough insurance to replace them if they are lost, stolen or destroyed as a result of a covered loss. The easiest way to take an inventory is to use a video camera, recording and describing items as you walk through your house. Or, you can use a regular camera and create a home inventory checklist. Here are a few tips for completing and storing your inventory:

- Add brand names and descriptions where you can, especially on large-ticket items. Serial numbers are helpful to note.

- Keep any receipts you have with the list to make the claims process easier.

- Store your video or photo inventory offsite so you won't lose it if your house is damaged.

- Update your personal property records when you purchase new furnishings and valuables.

Though the task may seem daunting, it's important to try. An incomplete inventory is better than nothing at all.

How much insurance do I need?

You should consider full-value coverage, which will pay for the replacement value of your personal belongings. A standard policy typically covers personal property only up to its actual cash value, determined by taking the replacement cost and deducting depreciation, which can be substantial. (For example, a 5-year-old TV is usually worth much less than what it would cost to purchase a new one.)

Finally, remember your homeowners policy covers valuable items such as jewelry, furs, art and antiques, only up to set dollar amounts. If the cost of replacing them exceeds these limits, you may want to purchase scheduled personal property coverage.

The Insurance Information Institute has a FREE online tool that can help you create your inventory. Just visit www.knowyourstuff.org for more details. We hope you'll never need the home inventory, but preparing for the worst can prevent a lot of hassle later!

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, health, business and many other types of insurance coverage.

Contact me today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(SIX EIGHT EIGHT THREE SIX)

|

YouTube - How To Series YouTube - How To Series

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|