Week of October 16, 2017 | Vol. 6, Issue 40

|

|

Pharmacy benefit manager Express Scripts to buy eviCore for $3.6bn

Express Scripts

said it would buy privately held specialty healthcare benefits manager eviCore healthcare to bolster its medical benefits management business amid the threat of losing a major client.

The deal comes as a pre-emptive move with Express Scripts exposed to more competition and the possibility of the pharmacy benefit manager losing Anthem Inc

and rumored entry of Amazon.com Inc

into the prescription drug market. "The deal signals Express Scripts' desire to remain independent even with the likely Anthem loss," said Baird analyst Eric Coldwell, adding that the decision may disappoint some who hoped the company would pursue strategic options. Medical benefits management spending is estimated to be roughly $300 billion annually, Express Scripts said. The acquisition of eviCore would plant the company firmly in the growing market, Leerink analyst David Larsen wrote in a client note. Express Scripts has a minor presence in medical benefit management, the company's spokesman Brian Henry told Reuters, and the deal would expand it to get into the market in a "bigger way."

|

NIH Hooks Up With 11 Top Biopharmas for $215 Million Cancer Moonshot Deal

Some of the biggest names in the pharmaceutical industry have joined forces with the National Institutes of Health

to support the cancer Moonshot goal of exploring relevant biomarkers that will accelerate the development of immunotherapies for cancer patients.

Eleven biopharmaceutical companies and the NIH combined forces on a five-year $215 million public-private research collaboration called PACT-the Partnership for Accelerating Cancer Therapies. The NIH will provide the bulk of the funding at $160 million over five years. The partnering companies will each kick in $1 million annually for each of the five years, totaling $55 million at the end of the partnership. The leading cancer-fighting companies that have signed onto PACT include: 1. AbbVie 2. Amgen 3. Boehringer Ingelheim 4. Bristol-Myers Squibb 5. Celgene Corporation 6. Genentech 7. Gilead Sciences 8. GlaxoSmithKline 9. Janssen Pharmaceutical 10. Novartis 11. Pfizer. The NIH added that the Pharmaceutical Research and Manufacturers Association (PhRMA) is also providing additional support. Notably absent from the alliance is New York-based Merck (MRK). The U.S. Food and Drug Administration will serve in an advisory role.

|

Below are summaries and charts with the past week's transactions from the different healthcare sectors. For a detailed table showing data for each industry transaction click on any of the charts or use the download link above. Total transaction values are provided in USD millions.

|

|

|

|

Pharma & Biotech

15 transactions totaling $783 million

Supplies, Equipment & Services

15 transactions totaling $270 million

Healthcare IT & Managed Care

6 transactions totaling $3,600 million

Healthcare Facilities & Distributors

7 transactions totaling $34 million

|

|

|

|

|

|

Pharma & Biotech

17 private placements totaling $164 million

Supplies, Equipment & Services

10 private placements totaling $33 million

Healthcare IT & Managed Care

5 private placements totaling $9 million

Healthcare Facilities & Distributors

1 private placements totaling $150 million

|

|

|

|

|

Pharma & Biotech

20 public offering totaling $1,115 million

Supplies, Equipment & Services

7 public offerings totaling $11 million

Healthcare IT & Managed Care

0 public offerings

Healthcare Facilities & Distributors

0 public offerings

|

|

|

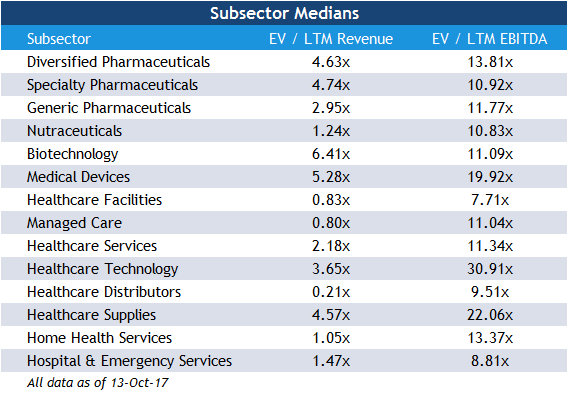

Each week, w

e provide updated trading

comps for leading comp

anies from numerous healthcare subsectors.

To the right you will see a high-level breakdown of median revenue and EBITDA multiples for each of the specific subsectors

For a complete trading comp analysis (including the individual equities that comprise the subsectors), click on the table to the right or use the download link from the top of this newsletter.

Note: data reflects prior week close.

|

RECENT INDUSTRY HEADLINES

A Sampling of Relevant Industry Headlines from the Last Week

Below are snippets from relevant industry news articles from the past week. For additional information or the article's complete text, click the headline link to view the original publication.

|

October 12, 2017 - Fierce Pharma

Shortages of drugs and saline produced in Puerto Rico are beginning to materialize after Hurricanes Irma and Maria wreaked havoc on production on the island, which produces about 10% of the U.S. drug supply including products like Lipitor and blood thinner Xarelto. Saline solution was already suffering supply restraints before the storms knocked out power to plants across island, affecting saline production at a facility operated by Baxter International, one of the key suppliers of the simple but essential treatment. The company, which has said it lost days of production as a result of the storms, has put customers on allocation of sodium chloride and will try to make up for some of that supply by importing saline and glucose from plants in Australia and Ireland.

October 12, 2017 - Fierce Biotech

Embryonic stem stem cells can develop into many different types of cell and could one day lead to regenerative treatments for various diseases. But they have limitations-taken from a fertilized egg about five days old, these stem cells have lost the ability to develop into all cell types. What if we could take stem cells from an earlier stage of embryonic development? Scientists from the Wellcome Trust Sanger Institute have done just that.

Merck pays $760M to buy into KalVista drug for diabetic eye disease

October 10, 2017 -

Fierce Biotech

KalVista has been looking for a big pharma partner for its plasma kallikrein inhibitors, and just had its wish fulfilled by Merck & Co. Merck is paying $37 million up front for an option to buy KalVista's program in diabetic macular edema (DME), an accumulation of fluid in the eye that can cause sight loss, and has also agreed to provide up to $715 million in milestones plus royalties if it leads to a commercial product. It's also paying $9 million for a 9.9% stake in the biotech.

|

UPCOMING EVENTS

An Overview of Events Hosted or Attended by the Bourne Partners Team

|

36th Annual J.P.Morgan Healthcare Conference

January 8-11, 2018 | San Francisco, CA

|

|

As an international, healthcare-focused merchant bank and financial advisory firm, we provide world-class services and capital to middle-market healthcare companies around the globe. We aim to keep our clients well-informed of healthcare news and events. With this additional insight in mind, together, we can recognize trends and opportunities that benefit our clients. We hope that you will reach out to Bourne Partners to help execute your healthcare operational and transactional needs. To learn more about our firm, visit our website or utilize the links below to engage with us on social media.

Sincerely,

The Bourne Partners Team

Bourne Partners

550 South Caldwell Street

Suite 900

Charlotte, NC 28202

704-552-8407

|

STAY CONNECTED

|

|

|

|

|