Week of October 2, 2017 | Vol. 6, Issue 38

|

|

Valeant Announces Sale of iNova Pharmaceuticals for $930 Million

Valeant Pharmaceuticals

today announced it has entered into an agreement to sell its iNova Pharmaceuticals business to Pacific Equity Partners and The Carlyle Group

"The sale of iNova is part of the company's ongoing efforts to both simplify our operating model and strengthen our balance sheet," said Joseph C. Papa, chairman and chief executive officer, Valeant. "We will continue to evaluate opportunities that will enable us to deliver on our commitments and unlock value for shareholders."

iNova, which markets a diversified portfolio of prescription and over-the-counter products in several areas, such as weight management, pain management, cardiology and cough and cold, operates in more than 15 countries around the world. iNova holds leading market positions in

Australia

and

South Africa

and also has an established platform in

Asia

. Valeant will maintain a strong footprint in these countries primarily through its Bausch + Lomb franchise.

Valeant will use proceeds from the sale to permanently repay term loan debt under its Senior Secured Credit Facility. The transaction is expected to close in the second half of 2017, subject to customary closing conditions, including receipt of applicable regulatory approvals.

|

Puerto Rico Rushes to Patch Up Health-Care System Ravaged by Hurricane Maria

Some hospitals may not have power restored for months; massive flooding could lead to a proliferation of mosquitoes and outbreaks of disease

Puerto Rico's health-care system is grappling with widespread power losses, crippled hospitals and dwindling medical supplies nearly a week after Hurricane Maria devastated the U.S. territory, according to doctors and relief workers.

Securing more fuel for generators and clean water for patient care are "two important priorities" for the island's hospitals and clinics, said Kenneth Sturrock, the federal health coordinator for the U.S. Department of Health and Human Services who was on the ground in Puerto Rico on Tuesday. The National Disaster Medical System has sent 330 health-care workers from the U.S. mainland to assist Puerto Rico, he said, and U.S. lawmakers are pushing for quick approval of hurricane aid. Already struggling through a protracted economic crisis that led earlier this year to the largest-ever U.S. municipal bankruptcy, the U.S. territory is now dealing with a humanitarian emergency in the wake of Maria, the strongest storm to hit the island in nearly a century.

|

Below are summaries and charts with the past week's transactions from the different healthcare sectors. For a detailed table showing data for each industry transaction click on any of the charts or use the download link above. Total transaction values are provided in USD millions.

|

|

|

|

Pharma & Biotech

9 transactions totaling $31 million

Supplies, Equipment & Services

14 transactions totaling $51 million

Healthcare IT & Managed Care

6 transactions totaling $387 million

Healthcare Facilities & Distributors

8 transactions totaling $215 million

|

|

|

|

|

|

Pharma & Biotech

26 private placements totaling $720 million

Supplies, Equipment & Services

25 private placements totaling $220 million

Healthcare IT & Managed Care

6 private placements totaling $32 million

Healthcare Facilities & Distributors

2 private placements totaling $4 million

|

|

|

|

|

Pharma & Biotech

18 public offering totaling $877 million

Supplies, Equipment & Services

3 public offerings totaling $158 million

Healthcare IT & Managed Care

0 public offerings

Healthcare Facilities & Distributors

1 public offering totaling $895 million

|

|

|

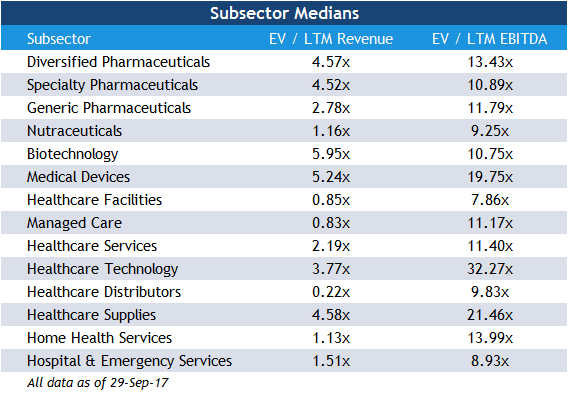

Each week, w

e provide updated trading

comps for leading comp

anies from numerous healthcare subsectors.

To the right you will see a high-level breakdown of median revenue and EBITDA multiples for each of the specific subsectors

For a complete trading comp analysis (including the individual equities that comprise the subsectors), click on the table to the right or use the download link from the top of this newsletter.

Note: data reflects prior week close.

|

RECENT INDUSTRY HEADLINES

A Sampling of Relevant Industry Headlines from the Last Week

Below are snippets from relevant industry news articles from the past week. For additional information or the article's complete text, click the headline link to view the original publication.

|

September 28, 2017 - Fierce Pharma

Megamerger deal speculation

has swirled around Novartis as the Swiss drugmaker eyes its operations-particularly Alcon-for cash-generating sales or spinoffs. But all along, CEO Joe Jimenez has been pledging bolt-on deals instead, and the latest buzz says he has one on tap. That would be Advanced Accelerator Applications, a maker of radioactive tracers used in diagnostic scans, Bloomberg reports. But the target's real attraction might be its pipeline. Its lead candidate is an actual cancer therapeutic in a field Novartis already knows: neuroendocrine tumors (NETs).

September 27, 2017 - Fierce Biotech

As the opioid crisis broadens by the day, the biotech community is doubling down on its efforts to solve the mystery of addiction-and find new ways to combat it. Toward that end, two sets of researchers announced progress this week advancing research aimed at targeting addiction centers in the brain. Scientists at the Medical University of South Carolina have discovered genetic factors in the brain that they believe increase the risk of relapse in drug addicts. The culprit is actually epigenetics, or enzymes that change the behavior of genes but not the genes themselves.

Next-gen CAR-T firm Autolus takes funding tally to $173M

September 26, 2017 -

Fierce Biotech

London-based CAR-T player Autolus has raised $80 million in a third-round financing that it says will fund proof-of-concept testing for three programs.

The company's established investors,

Syncona, Woodford, and Arix Bioscience, have been joined by new backers including Cormorant Asset Management and Nextech Invest, taking the total amount of financing raised by Autolus to date to around $173 million. Autolus bills itself as a next-generation CAR-T therapy company with a technology platform that it hopes will be a safer way to deliver autologous T cell therapies, in which cells are harvested from patients, engineered to ramp up their activity against cancer cells and then reinjected.

|

UPCOMING EVENTS

An Overview of Events Hosted or Attended by the Bourne Partners Team

|

7th Annual Global Healthcare Executive Summit

October 4, 2017 | Charlotte, NC

|

|

As an international, healthcare-focused merchant bank and financial advisory firm, we provide world-class services and capital to middle-market healthcare companies around the globe. We aim to keep our clients well-informed of healthcare news and events. With this additional insight in mind, together, we can recognize trends and opportunities that benefit our clients. We hope that you will reach out to Bourne Partners to help execute your healthcare operational and transactional needs. To learn more about our firm, visit our website or utilize the links below to engage with us on social media.

Sincerely,

The Bourne Partners Team

Bourne Partners

550 South Caldwell Street

Suite 900

Charlotte, NC 28202

704-552-8407

|

STAY CONNECTED

|

|

|

|

|