|

OPEC | The Debates | Books to make you smarter

One of the bigger stories over the last two weeks has been from the world's

favourite cartel-----OPEC

. Last week, the notoriously dysfunctional organization announced it would cut its oil output by at least half a million barrels a day, to between 32.5 million and 33 million barrels, from the current 33.5 million.

The final details are set to be hammered out at its November policy meetings, but since the announcement, both Russia and Iran have made supportive statements in favour of reduced output in efforts to increase energy prices.

Given OPEC's poor history of enforcing past supply cuts, one would be forgiven for not taking this one too seriously. Having said that, the price of energy has rallied since the announcement. Should OPEC, under Saudi Arabia's leadership, make this deal hold, we would likely see oil prices continue to rise.

As a core part of our portfolios, any rise in energy will be good for our bottom lines (prices at the pumps notwithstanding). Of course, should oil prices increase significantly, this could lead to unpredictable economic results ranging from inflation to high interest rates to stock market volatility. But I digress. For now, I'd recommend staying tuned to see what comes our way in the near future.

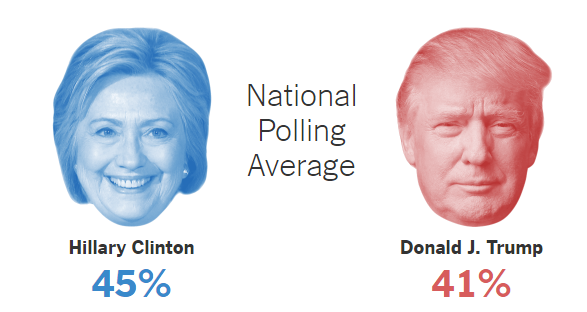

Speaking of the unpredictable, last week was the first of three presidential debates. The result of this year's election will likely produce a far more...varied, shall we say, result than previous ones. The

polls are leaning Clinton's way

, in part due to her perceived victory in the first debate. But, anything can happen between now and the election, especially with two debates remaining.

As mentioned in our last newsletter, if Clinton wins, I'd expect more of what we've had over the last eight years. Should Trump win, well, your guess is as good as mine.

The evolution of the investment industry has brought with it many changes, which are, for the most part, for the good. With that in mind,

one of my latest blogs

compares and contrasts mutual funds and ETFs, outlining how adjustments to the industry affect you and how you can benefit from them.

Lastly, Ottawa is brining

the country's housing fantasy to an end

. New measures will be enforced targeting foreign buyers and those with a down payment of less than 20%, or those who must have mortgage default insurance. The regulations----- necessary given the unaffordable real estate prices, particularly in Toronto and Vancouver----- hope to prevent a painful correction in the future.

In the review queue

Resilience

by Eric Greitens:

I listened to Resilience a while ago and loved it. As it's the current choice for my book club, I decided to read it this time and am glad I did. Pound for pound, it's one of the five best books I've read on practical life advice. Much like Seneca's

Letters From a Stoic

, the book is a collection of letters between two friends who happen to be ex-Navy Seals. One of them is suffering from PTSD, while the other, Greitens, has worked with ex-soldiers facing similar challenges. Filled with examples and advice from the Greeks and Romans, I'd put this under the "must read" section of your book list.

The Rise of ETFs and Passive Investing

by Visual Capitalist:

This infographic illustrates some of the recent growth ETFs have experienced. Although the numbers are not specific to Canada, it gives a good perspective on ETFs' rise in which Canada has participated.

The Top Idea in Your Mind

by Paul Graham:

I've become a big fan of

Paul Graham's blog

. The Silicon Valley start-up investor writes on a wide range of issues that make you think. This essay was no exception. Graham points out how important it is to identify our top ideas and make sure they serve us. If they don't, we need to change that.

The Role of Frugality in Long-Term Financial Success

by Trent Hamm:

It's always interesting to see how mainstream media and Hollywood portray the "lifestyles of the rich and famous". I really have trouble believing these portrayals.

Spending your way to riches is one of the poorer strategies you can take. Although it may not seem as sexy, this article reminds us that being careful with your money is a solid strategy if creating wealth is your goal!

20 Book Recommendations from Billionaire Charlie Munger that will Make You Smarter

by Farnam Street:

The article's Charlie Munger quote says it all: "In my whole life, I have known no wise people (over a broad subject matter area) who didn't read all the time-none. Zero. You'd be amazed at how much Warren (Buffet) reads-and how much I read. My children laugh at me. They think I'm a book with a couple of legs sticking out." Munger isn't talking about what you find on Twitter, Facebook, the news, or even most novels. If you're interested in getting smarter and want to know which books Charlie is talking about, check this list out.

Going viral

- In case you haven't seen it yet, I thought you'd like an SNL skit on the first presidential debate...Enjoy!

|

Matthew Lekushoff, CIMA

Financial Advisor

Raymond James Ltd.

T: 416-777-6368 | F: 416-777-7020 www.Matthewlekushoff.ca

|

|

|

|

|

This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

The views of the author do not necessarily reflect those of Raymond James. This article is for information only. Raymond James Ltd. Member-Canadian Investor Protection Fund

|

|

Copyright © 2014. All Rights Reserved.

|

|

|

|