Santa Cruz Real Estate

Digest,

Ed. 28

|

|

|

|

|

|

December, 2017 - In This Issue:

|

|

|

|

|

|

In This Month's Issue

|

|

The Board of Supervisors met on December 5th to revisit

a proposed ordinance change to

regulate short term rentals

in Santa Cruz County. Their decisions may negatively impact the Airbnb and short-term rental markets. Read more below.

Republicans in the Senate have announced that they have sufficient votes to move forward with their tax reform bill. Read about how the Senate and House versions will impact your real estate below.

With 2018 on the horizon, it is that time of year when we write about annual housing market predictions. Get your 2018 Santa Cruz Real Estate market predictions in this month's digest.

Millennials make up the largest living generation

in the US and have already begun to make up a significant proportion of potential homebuyers and renters. Find out

what they are looking for in a home

in Christine's Corner.

|

|

Real Estate Market Statistics

For Santa Cruz, Santa Clara, and

Monterey

The reports contain median home prices, real estate price statistics, valuable information about mortgage rates and much more.

|

An Update: Changing Airbnb & Short-term Rental Regulations in Santa Cruz County

The Board of Supervisors met on December 5th to revisit

a proposed ordinance change to regulate short term rentals in Santa Cruz County. Supervisors listened to a long-line of Santa Cruz residents that

testified

on the importance of Airbnb. These residents include young adults who use Airbnb to save up for a downpayment, retirees and single mothers who depend on the income they get from hosting, and long-time residents who host to offset their largest living expense: rent and mortgage.

On the other side of the argument, these

letters

were written by renters, homeowners, and tenants to a Santa Cruz City official and illustrate the concerns associated with allowing free-reign of short term rentals. The reasons given in these letters include: increases in traffic and noise in areas where Airbnb's and short-term rentals are present and a decrease in the availability of long-term rentals.

This

website

a

ddresses the concerns of Airbnb and short-term rental critics. It points out that barely 1% of the housing units in Santa Cruz are being used by vacationers. Therefore, banning vacation rentals would not change the price of rents or availability. Additionally, of the 288 vacation rentals, over half the rental units are owner occupied, and would not be turned into full-time rentals in the event of a ban. In reality, Santa Cruz cannot solve its housing situation by banning or limiting short-term rentals: the short-term rental inventory pool is too small to make a significant difference.

Due to the outpour of concern by Airbnb hosts and other community members, the board of supervisors abandoned the proposed restriction of "55 nights in the coastal areas and 110 nights in the rest of the unincorporated county" for short-term rental operations. However, an alternative measure was approved: there will be a cap of 250 hosted rental permits and grandfathering in of current hosts. Additionally Hosted rentals will count toward the county's cap on vacation rentals.

This proposal will go to the Planning Commission Jan. 10, and return to the Supervisors Jan. 23, then go to the California Coastal Commission. If successfully passed, this ordinance will make it increasingly difficult for homeowners to turn spare bedrooms into income-generating assets. (

source

)

|

The Tax Cut and Jobs Act's Impact On

Real Estate

On Thursday, November 16th, the House approved its tax rewrite. Republicans in the Senate have announced that they have sufficient votes to move forward with their tax reform bill. A final version of the bill approved by both chambers is expected to be passed by Christmas.

According to San Francisco Democrat and Assemblyman David Chiu, the bill's proposals could "cost California more than $2 billion per year in funding for housing and deter construction of one million homes over the next decade" (

source

).

Though the Tax Plan has yet to be finalized, the proposals put forward by both the House and the Senate pose a serious threat to homeownership as we know it.

Below is a summary of how the passing of this bill may affect your real estate.

Mortgage Interest Deduction

California is one of the ten states with the highest amounts outstanding per mortgage. According to

this

article, more than four million Californians currently claim mortgage interest deductions, averaging $12,000 per return. Currently, taxpayers can deduct interest on mortgages up to $1.1 million for a primary residence and a secondary home, plus an extra $1 million for equity debt (refinancing not related to improving your home).

House Bill

: proposes to grandfather in existing mortgages, but cap new mortgages at $500,000 and make it inapplicable to secondary homes.

Senate Bill

: proposes to slightly lower the mortgage interest deduction to $1 million on both primary and secondary homes but eliminates the deduction for home equity debt.

The main issue with this mortgage cap is that housing prices far exceed $500,000 in most areas of California. According to data stated in

this

article, the median price for a single-family home in California is $555,000. This number is higher in areas such as Orange and San Francisco, where the median prices for homes are $799,000 and $1.34 million respectively.

Capital Gains Provision

Under current law, homeowners can exempt $250,000 (or $500,000 for married couples filing jointly) from capital gains taxation on the profit from the sale of a home. This exemption is only permitted if the homeowner has lived in the house for at least two of the last five years.

House Bill

: proposes that the homeowner must have lived in the house for five of the past eight years in order to qualify for the savings.

Senate Bill

: also proposes that the homeowner must have lived in the house for five of the past eight years in order to qualify for the savings.

Housing experts worry that the increase from two years to five years will trap people in their home for longer and "encourage Bay Area homeowners to stay put instead of selling, exacerbating the region's housing shortage" (Kendall).

State and Local Property Tax Deduction

Currently, you can deduct state and local property taxes.

House Bill

: proposes to maintain the state and local property tax deduction, but cap it at $10,000.

Senate Bill

: proposes to eliminate the property tax deduction.

In the highest tax states, either of these changes can result in "a reduction of disposable cash equal to as much as 5% of gross income" for a homeowner (

source

).

According to Kendall's article, these proposed tax deductions could also cause home prices in California to drop between 8 and 12%. While this may seem like a positive effect, especially in the Bay Area where housing prices are at an all-time high, realtors worry this may have unintended negative consequences as well. The principle concern is that these lower prices may make homesellers less likely to put their homes on the market, thus intensifying the housing shortage we are already experiencing.

Affordable Housing

The bill may significantly set back California's efforts to address its shortage of homes for low-income families.

House Bill

: proposes to eliminate private activity bonds, which fund $2.2 billion in affordable housing construction each year.

If the House's tax plan becomes law, California stands to lose over $2 billion in funding for affordable housing, which according to

this

article equates to a loss of 20,000 affordable homes annually. San Jose alone is predicted to lose 1,381 units of planned affordable housing if the bill is passed.

Click here for more information on how the Tax Plan will affect affordable housing in California.

|

Predictions: the 2018 Santa Cruz Real Estate Market

With 2018 on the horizon, it is that time of year when we write about annual housing market predictions. The Tax Cuts and Jobs act, which is making its way through the House and Senate, will be a major determinant of 2018 housing market health. Therefore, we've written about its potential impact on the California real estate market in a separate article above. Here, we will summarize some other major factors that will affect the housing market. Note, real estate is local, so national and even statewide housing stats and predictions may or may not apply to a local market. Therefore, whenever made possible by local-data, we will tie national predictions to our local Santa Cruz Real Estate market.

Millennials and First time Home Buyers

Millennials and other first-time homebuyers made up

34 percent

of the market, which is the fourth lowest share since 1981.

A number of factors are contributing to the lower-than-usual demand from these buyers.

Student debt:

41 percent

of first-time buyers indicate that they have student debt and 25 percent said saving for a downpayment was the most difficult task in the home buying process and 55 percent said that student debt has delayed their savings for a home purchase.

Other

reasons

that millennials are waiting to buy include delaying marriage and having children, higher rental costs, and lower relatively affordability.

Here in Santa Cruz, the problem described above is exacerbated by some of the highest home and rental prices in the state.

With no sign of student-loan debt decreasing in 2018, we expect millennials and other first-time homebuyers to make up a similar fraction of the market, with modest increases attributed to job-growth.

GDP and Wage Growth

While it may disincentivize a home-purchase, the Tax Cuts and Jobs act is poised to boost wages and GDP.

Higher wages and a growth in GDP typically result in higher demand for housing. However, this demand-increase may be dampened by a reduction in home buying incentives proposed in the tax-reform bills. Nevertheless, if wages increase, we do expect housing demand to follow suit.

Home Prices

As described in the tax reform article above, national housing prices may decrease.

However, due to the persistent inventory shortage throughout California, economists expect to see a continued, yet more mild increase

in home prices. The California Association of Realtors (CAR)

predicts

that, with tight inventory being the new 'norm' for the past few years and at least the upcoming year, we'll continue to see fierce competition driving up prices. However, CAR expect to see slower price growth than the previous year: the California median home price is forecast to increase 4.2 percent following a projected 7.2 percent increase in 2017 to $538,500.

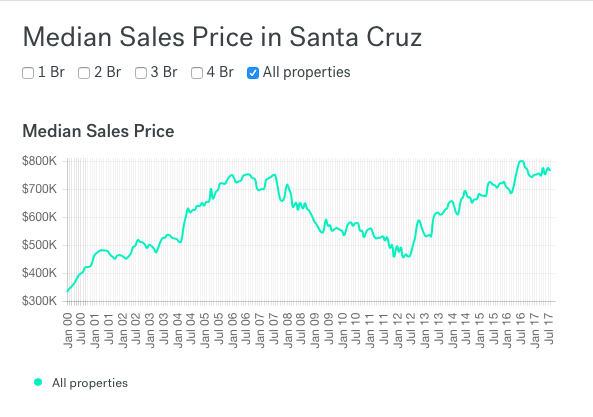

As seen the the graphs below, here in Santa Cruz we've seen prices steadily going up since 2012. Economic growth locally and in the Bay Area has the potential to maintain these historically high home prices. However, due to the tax-reform and saturation of the higher-priced housing market, if housing prices further increase these changes are expected to be mild.

Tightening Inventory and Rising Rates: A Seller's Market

As we've written about in the past, new housing constructio

n in California does not satisfy growing demand. According to this

article

, the state estimates that it needs to build 180,000 homes annually just to keep up with projected population growth and maintain a health prices. Unfortunately, for the past 10 years, the state has averaged less than half of that. If the new tax reform further incentivizes homeowners to wait to sell, we can expect tight inventory to continue throughout 2018.

We've already experienced one rate-increase before the new year, and have three more quarter-point rate increases

planned

for 2018.

National Association of Realtors Chief economist

Lawrence Yun

predicts

that mortgage rates will continue to rise to an average of 4.5%.

Both of these movements push us into a seller's market. What does this mean for buyers? Be ready to act when you see a property that you like. This means having your financing in order, knowing who will be on title, and having a working relationship with a real estate agent who can write a contract at a moment's-notice.

|

Christine's Corner:

What Millennials Look For In A Home

With the total headcount nearing the 90 million, millennials make up the largest living generation in the US. Ranging from early teens to mid-thirties, millennials are going to and have already begun to make up a significant proportion of potential homebuyers and renters. Knowing what this generation is looking for in a home is therefore key to home sellers and investors.

What They Like

According to a late 2016 study that looked at 1,000 millennials across all fifty states, the main things millennials look for in a ho

me are new appliances (such as a fridge, oven, dishwasher, washer/dryer, etc.), a large master bedroom, a two-car garage and energy efficient add-ons (like solar panels), among others. Find the rest of the list

here

.

According to

this

article, other desirable features include a laundry room (55% of millennials say they wouldn't buy a house that doesn't have one) and exterior lighting (88% consider it to be "essential or desirable"). This generation also appreciates a house with smart home features (things like smart alarms, remotely programmable thermostats, etc.), easy maintenance and wood flooring.

For more features that attract millennials, click

here

.

What They Dislike

According to

this

article, 70% of millen

nials consider outdated design and construction features to be a problem. Linoleum floors and popcorn ceilings are at the top of the list.

Tips For Home Sellers & Investors

- Make all upgrades and repairs before listing.

- If possible, incorporate energy efficient features and smart home features.

- Be active and up to date online because websites and photos are important! For 99% of millennials, the first step in looking for a home is searching online. In one study, 58% of participant found their home on a mobile device (per this website). Listings that include photos consistently have more success than those that don't.

|

|

|

|

|