1031 CORP. Celebrates 25 Years  of Service of Service

Collegeville, PA.,

August 31, 2016

-This year, 1031 CORP. marks the 25th anniversary of offering our clients superior service in the 1031 Exchange industry. Founded in 1991, 1031 CORP. was created to fill a need for Qualified Intermediaries (QI) created by U.S. Treasury regulations released that same year. A QI is an independent party that facilitates tax-deferred exchanges of business use or investment assets under Internal Revenue Code section 1031.

Over the last quarter century, under the leadership of Margo McDonnell, CES®, President, 1031 CORP. has developed a niche for keeping the exchange process simple for our clients and their advisors and a strong commitment to educate investors, business owners and their professional advisors on the benefits of section 1031. Their "1031 Exchanges Made Easy" presentation has been presented monthly in seminars and now via webinars since 1995. Each year, the company presents dozens of 1031 seminars, workshops and continuing education classes as well as their "Wealth Building Webinar Series" designed to help participants build and preserve wealth.

|

Dealer Property or Investment Property? Dealer Property or Investment Property?

The Answer

Could Cost You

Everyone who purchases real estate considers it an investment and typically considers its potential resale value before acquiring it. However, IRS has different views of what qualifies as an investment property. Property held as stock in trade or primarily for sale is excluded from tax deferral treatment under section 1031. This would include a builder's inventory of lots and spec homes as well as properties acquired with the intention of "flipping" them. Additionally, these types of property are not considered capital assets and their sale are taxed as ordinary income not capital gains.

When explaining this issue to property owners, we are often asked how to make these properties qualify or if holding them longer will make a difference. When it comes to 1031 exchanges, much more important than the length of time a property is held is the intention of the owner. What picture has been painted to IRS regarding your use of the property? Everything from the type of mortgage used to finance the property, the types of improvements made, correspondences with your professional advisors, the insurance coverage on the property and whether or not the property was rented all help demonstrate your intention to either hold the property for investment or hold the property for sale.

|

|

Wealth Building Webinars

Join us for our complementary Wealth Building Webinar Series designed to help you build and preserve wealth.

Register Today!

Thursday, September 1, 2016 12:00 PM EST

Thursday, September 15, 2016 12:00 PM EST

|

Our 25th Anniversary Celebration  Photo Album Photo Album

View the photos from our 25th Anniversary celebration this past January by clicking here.

|

Trending this Month...

LLCs, Everywhere an LLC

In a 1031 exchange, there is a same taxpayer requirement that the relinquished property and the replacement property must have the same owner. One exception is a disregarded entity such as a single member limited liability company (LLC) when its sole member is the same taxpayer that sold the relinquished property. This month saw many Exchangers creating new LLCs to acquire the replacement property for a variety of different reasons. To learn more about using single member LLCs in a 1031,

click here.

View All Recent Trends

|

Article Exchange

Following are articles related to 1031 exchanges, taxes, real estate and related topics you may find of interest

RISMedia.com

August 29, 2016

If you have an article you would like to share, please forward it to Margo McDonnell, CES® and we'll include it in next month's reading list.

|

Message from our President

|

| Margo McDonnell |

Dear Friends,

The year 2016 marks the 25th anniversary of 1031 CORP. and the role of the Qualified Intermediary (QI). Knowing the service we provide helps investors build and preserve wealth and enables business owners to grow their businesses makes us feel very good about what we do.

I want to thank you for helping us reach this milestone and trusting us with your exchange transactions or those of your client. I also would like to thank Sanna Phinney, Bettye Matthew and Rich Heller for their confidence in our 1031 CORP. Team when they let us take over their 1031 businesses and expand the footprint of 1031 CORP. Most importantly, our company's success could not be possible without our extraordinary team of professionals that are committed to exceptional service, attention to detail and keeping the exchange process simple for you. Of course, they are a great group of people to work with, too!

Cheers to working together many more years! Long live section 1031!

Warm regards,

|

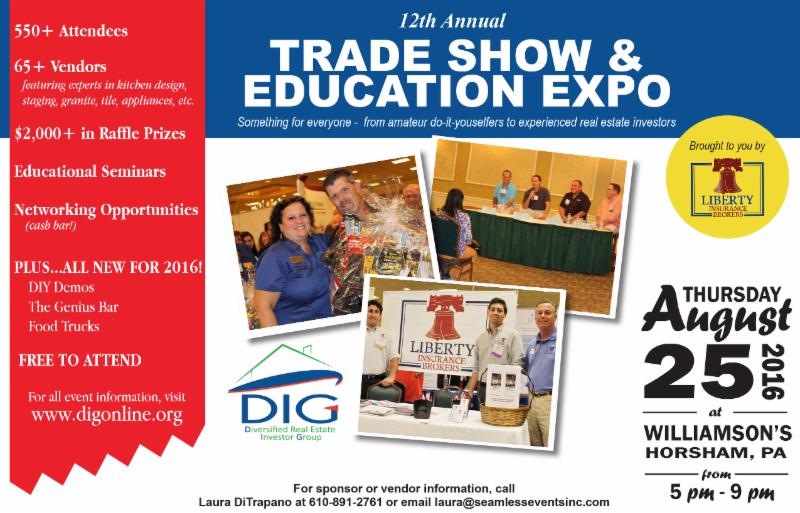

1031  CORP. CORP.

was at the 2016

DIG Trade Show

Thank you to everyone who stopped to visit Margo McDonnell and Rich Heller at the 1031 CORP. table.

|

About 1031 CORP.

Serving as a nationwide qualified intermediary for 1031 tax-deferred exchanges since 1991, 1031 CORP. strives to provide a superior exchange experience for our customers and their advisors. We provide our customers with enhanced security of funds, knowledgeable exchange professionals and a commitment to keep the exchange process simple for our customers and their advisors. Our Exchange Team, which includes Certified Exchange Specialists®, has the experience

and expertise to facilitate even the most complex exchange transaction, including reverse, improvement and personal property exchanges.

Additional information can be found at www.1031CORP.com.

|

|

|

Margo McDonnell, CES®

Certified Exchange Specialist®

President

1.800.828.1031 ext. 212

Mobile: 610.680.6896

|

|

Sue Umstead, CES

®

Certified Exchange Specialist®

Senior Vice President

1.800.828.1031 ext. 208

Mobile: 610.755.8520

|

|

Marissa LoCascio, CES

®

Certified Exchange Specialist®

Vice President, Exchange Manager

1.800.828.1031 ext. 210

Mobile: 610.742.4351

|

|

Cindi Platt-Elliott

Exchange Officer

1.800.828.1031 ext. 216

Mobile: (610) 551-2033

|

|

Marilyn DeAngelis

Exchange Officer

1.800.828.1031 ext. 207

Mobile: 973.879.3846

|

| Not a Subscriber? Interested in receiving our Exchanging Times newsletter each month?

Follow 1031 CORP. "LIKE" 1031 CORP. on Facebook to receive a daily tidbit on 1031 exchanges and related topics.

|

|