|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

Which bird represents your money persona?

|

*APR = Annual Percentage Rate. Loan amount and terms subject to approval; your rate may be different depending on loan amount, term, credit score and other factors. Your rate will be disclosed prior to funding. Daily periodic rate for 7.9% APR is .02165. Minimum payment on a 1st Line of credit with a limit up to $2,000.00 is $50.00 per month. Maximum limit is $20,000.00 with a minimum payment of $475.00. Rates are subject to change.

|

President's Corner President's Corner

|

PayPal. Venmo. Zelle. Dwolla. Google Wallet. Skrill. Payoneer. Payza. 2Checkout. Intuit. ProPay. WePay. These names sound like characters from the cantina scene in the original Star Wars movie. All that's missing are R2D2 and C3PO. In fact, these are so-called peer-to-peer payment applications, or in people-speak, methods to pay your friends and relatives without having to give them cash.

Lately, I've been reading articles written by Henry Meier, the General Counsel of the New York Credit Union Association, which is the state trade association representing most New York-headquartered credit unions. While 1st Nor Cal is based locally, and some of his articles reference New York state laws that do not apply to us, he has written several thought-provoking articles relevant to all credit unions nationwide.

His most recent article discusses the convenience and underlying risk of these peer-to-peer money transfer systems. Though not all of these user interfaces are exactly the same, they all have the same purpose in common: facilitating small monetary transfers between individuals for things like splitting the dinner check, paying half the rent, or paying the annual franchise fee for the baseball fantasy league (my personal favorite).

The fees these entities charge vary widely. Some charge a flat fee; others charge a percentage (up to 3% in some cases) of the amount transferred; still others charge both a flat fee and a percentage. Several of the companies utilize simple e-mail to originate the transaction, and others employ their own software system (such as Intuit's TurboTax or Zelle which is only offered by a limited number of large Wall Street banks).

The bigger issue is in the area of disputes. According to Mr. Meier, Venmo's user agreement says clearly that they are not responsible nor liable if the incorrect amount of money is sent, the funds are not accepted by the intended recipient, or funds are sent to an incorrect recipient. For instance, if you send money to David Greene instead of David Green, there is no mechanism to cancel the transaction; hence, you are out of luck. Additionally, the user is responsible for ensuring adequate security of their data on their mobile device or tablet. In other words, it is never a good idea to perform financial transactions using a public WiFi network. Finally, many of the applications prohibit international transfers, which are inherently more risky.

At this point, someone may be thinking, "Ah, I can dispute the transaction through federal electronic fund transfer (EFT) regulations since I used my debit card." Since the cardholder authorized the service to use their debit card, the liability stays with the cardholder. Similarly, if a credit card is used, truth-in-lending regulations are aligned with EFT regulations. Says Mr. Meier, "It's no different than a member who hands over a credit card to a stranger at the bar and then complains to you that he spent too much."

Although peer-to-peer systems are great for small transactions between people, consumer protections have not caught up with the technology. At some point, this will be fixed. However, at the current rate of technological innovation, it may be a long time before consumer rights and technology are balanced. As they say in Latin, "Caveat Emptor (Let the Buyer Beware)."

David M. Green

President/CEO

(925) 335-3802

|

Stat of the Month Stat of the Month

|

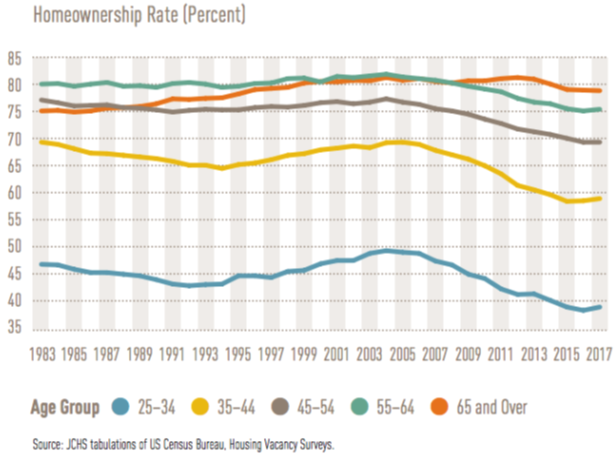

Homeownership Rate by Age, 1983-2017

Home ownership has declined in every age bracket except the 65 and over category since 1983. The lack of affordable housing available for sale, rising interest rates, wages that have not been able to keep up with the increase in home values, and the explosion of student loan debt are the reasons for this decline. This is not strictly a California phenomenon but is happening nationwide.

(FOUR FIVE ONE FIVE TWO)

|

New Branch Now Open!

New Branch Now Open!

We are pleased to announce that

we have opened a new branch in the

Pittsburg Century Plaza next to Target

4261 Century Blvd., Pittsburg, CA 94565

We have closed our branch at 1870 A Street in Antioch.

Click

here for other convenient branch and

surcharge-free ATM locations near you.

If you have any questions, please contact us at 925-293-1785.

|

1st Alerts 1st Alerts

|

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

National Night Out

We attended National Night Out on Tuesday, August 7th in both Pittsburg and Martinez. This event, which is celebrated all over the U.S., helps to increase awareness about police programs in communities, such as drug prevention, town watch, neighborhood watch, and other anti-crime efforts.

Pictured here are the booths we set up at the events with information about our credit union to share with the community.

|

1: APY = Annual Percentage Yield. Rates as of 8/7/18 and are subject to change. Fees or other conditions could reduce the earnings on the account. A penalty may be imposed for withdrawals before maturity. See Cost Recovery Fee Schedule for more details.

|

3 Reasons Why Every Family Needs a Legacy Plan Now

By Jason Vitucci, CFP® & Gene A. Schnabel

A common misconception about legacy planning is that only the very wealthy leave legacies. But nothing could be further from the truth. That's because your legacy is about far more than the money or assets you leave to loved ones or the organizations you support. It's also about the family history, values and traditions you pass along to family members and loved ones.

Think about some of the legacies handed down through your own family. Maybe it's your great-grandmother's potato salad recipe, grandpa's World War II medals, a handmade quilt or cherished family stories. While some of these may have little or no monetary value, they may hold tremendous sentimental or historical value for family members. And what about the traditions, beliefs and values you pass down to children, grandchildren or future generations? These are all part of your legacy and how you will be remembered by the people whose lives you touched along the way.

Below are three reasons why it's never too early to begin thinking about and planning your family legacy:

- Legacy planning helps to protect the lifestyle you and your family value. How you care for and protect the people and the causes that mean the most to you during your lifetime and in your absence forms the core of your legacy. How will you protect the income your family depends on in the event of a wage earner's job loss, death or disability? How will you ensure you have the income you need when you need it to accomplish your goals to and through retirement? Legacy planning is part of a broader financial plan developed to help you manage your personal and financial affairs while you're alive and control the distribution of wealth upon your death. By aligning your financial assets and investment strategy with your goals and values, planning helps to ensure your family legacy is carried out according to your wishes.

- It's not what you earn, but what you keep that matters. Taxes make planning paramount at all stages of life. That's because you want as much of your wealth as possible to support the people and organizations that are important to you, not lost to taxes. That requires strategies that seek to manage and reduce your tax exposure now and help to protect the value of assets intended for distribution upon your death.

- Planning helps to ensure the smooth transition of wealth and family values. Serving as an objective family advocate, your financial advisor can help ensure your financial success is shared with your family, friends and the charitable organizations you designate, according to your wishes. That may include educating your children and grandchildren on wealth management concepts and principles; establishing trusts for minors or family members with special needs; helping your heirs make prudent financial decisions; and carrying out your philanthropic goals, among others. Best of all, we can help you implement strategies during your lifetime, enabling you to witness your legacy in action through various investment, asset protection and gifting strategies.

To learn more about how the financial process can help you define and implement your legacy goals, contact our office today. We help our clients navigate through the confusing maze of financial issues as it relates to retirement planning. If you feel that we may be a good fit to work together, please don't hesitate to contact our office. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA

Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought.

|

Insurance Tips Insurance Tips

|

Water Backup - Are You Covered?

Did you know that the basic Homeowners policy specifically excludes coverage for damage that is the result of water that overflows from sumps, sump pumps or water that backs-up through sewers or drains? Most carriers offer as an option Water Back-up and Sump Discharge coverage. This endorsement generally provides $5000 of coverage, for damage that results from the back up through a sewer or drain or overflow or discharge of a sump or sump pump. The additional premium is about $50 per year. You should review your policy with your agent to determine what coverage, if any, is currently provided.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, business, and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(FIVE ONE FIVE EIGHT SIX)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|