A prolonged dollar rally is pressuring U.S. corporate earnings, hitting commodity prices and threatening to deepen a selloff in emerging markets.

The U.S. currency has continued to grind higher this year despite an escalating trade fight with China and broadsides from President Trump, who has complained that the dollar's strength is curbing growth. Last month, the greenback rose even after the Federal Reserve cut interest rates for the first time in a decade, defying expectations that lower rates would cut the appeal of U.S. assets to yield-seeking investors.

The ICE Dollar Index, which tracks the dollar against a basket of six major currencies, stands near its highest level in more than two years and is up nearly 11% from its 2018 lows.

One key driver of the dollar's gains has been the relative strength of the U.S. economy, which since 2015 until recently has allowed the Fed to raise rates far above the levels of borrowing costs in other developed countries.

As recently as last year, investors were betting that growth would accelerate abroad, boosting foreign currencies as central banks outside the U.S. raised rates.

That pickup never materialized an

d investors now believe the gap in yields is likely to remain in place as central banks ease monetary policy to counter the effects of a global slowdown.

Even with last week's decline in Treasury yields, investors can still expect to collect a far larger payout from U.S. government bonds than from those in any other developed country, including Europe and Japan, where negative yields have proliferated in recent years.

"There is nothing exceptional about U.S. growth, but it still looks pretty exceptional compared to other parts of the world," said Alan Ruskin, chief international strategist at Deutsche Bank.

The dollar's strength has been a double-edged sword, both inside and outside the U.S.

A stronger dollar is a negative for U.S. exporters because it makes their products less competitive abroad. It also is hurting U.S. multinationals by making it more expensive for them to convert foreign revenues into U.S. currency-a worrisome trend for investors betting on an earnings rebound in the second half of the year.

The earnings of S&P 500 companies with more international exposure fell an average of around 12% in the second quarter compared with a year earlier, while those with more domestic revenue posted growth of more than 4%, a FactSet analysis of a selected group of recent earnings reports found.

Companies that have cited the dollar as a negative factor this year run the gamut from Levi Strauss & Co. and International Business Machines Corp. to medical-technology company Hologic Inc.

At the same time, the dollar's strength has made investors more cautious on emerging markets, which in recent months have been hit by fears of slowing global growth stemming from the trade battle between China and the U.S.

A rising dollar makes it more expensive for developing countries to service their dollar-denominated debt, pressuring those that have borrowed heavily in the U.S. currency.

The outstanding dollar-denominated debt of emerging-market companies and governments stood at $6.4 trillion at the end of the first quarter, compared with $2.7 trillion a decade ago, according to the Institute of International Finance.

Prices of commodities, which have been buffeted by growth fears and the trade-war escalation, also have been hurt by the strengthening dollar.

Oil, copper and most other raw materials are denominated in dollars and become more expensive to foreign buyers when the U.S. currency appreciates.

The strong dollar does benefit U.S. companies that import goods from abroad by increasing their buying power. It also, in theory, helps U.S. consumers buying foreign goods. American tourists also will see their money go further abroad.

The dollar's strength also has been a boon to countries trying to boost growth because it makes their own currencies cheaper. That has drawn the ire of President Trump and heightened speculation that the Treasury Department may try to weaken the dollar through intervention in currency markets, a tactic that hasn't been attempted by the U.S. since 2000.

Mr. Trump and his economic advisers discussed a proposal to intervene in foreign-currency markets to weaken the dollar but ultimately decided against such an action, officials said last month.

IRS Introduces New Tax Withholding Estimator To Help Taxpayers Avoid Surprises In 2020

Kelly Phillips Erb, Senior Contributor

Forbes.com

Remember all of the times that the Internal Revenue Service (IRS) reminded you to do a payroll checkup? And remember that you didn't? The IRS is hoping you'll reconsider this year. The agency has launched a new Tax Withholding Estimator that they hope will make it easier for everyone to figure the right amount of tax withheld during the year.

Why the need for a checkup? Under the Tax Cuts and Jobs Act (TCJA), many individual taxpayers experienced significant changes. Those changes included new tax rates, limits on the deductions for state and local taxes (SALT taxes), a cap on the amount that you can borrow for purposes of the home mortgage interest, and exclusions for certain kinds of job-related expenses (like the home office deduction).

With the first official tax season following the TCJA now in the books, the IRS has been exploring ways to help taxpayers have a better tax year in 2020. That includes replacing the old Withholding Calculator with the new Tax Withholding Estimator.

"The new estimator takes a new approach and makes it easier for taxpayers to review their withholding," said IRS Commissioner Chuck Rettig. "This is part of an ongoing effort by the IRS to improve quality services as we continue to pursue modernization and enhancements of our taxpayer relationships."

One of the criticisms of the old Withholding Calculator was that it didn't work well for all taxpayers; it tended to benefit single-wage earners who were also W-2 employees. Now, the IRS says that the new Tax Withholding Estimator offers workers, as well as retirees and self-employed individuals, a more user-friendly tool to figure the amount of income tax they must have withheld from wages and pension payments.

You can find the Tax Withholding Estimator on the IRS website

here. To get started, you'll need to be able to estimate your 2019 income, the number of children you will claim for the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC), and other items that will affect your 2019 taxes like itemized deduction amounts. You'll also want to have your most recent pay stubs and a copy of your last year's form 1040 handy.

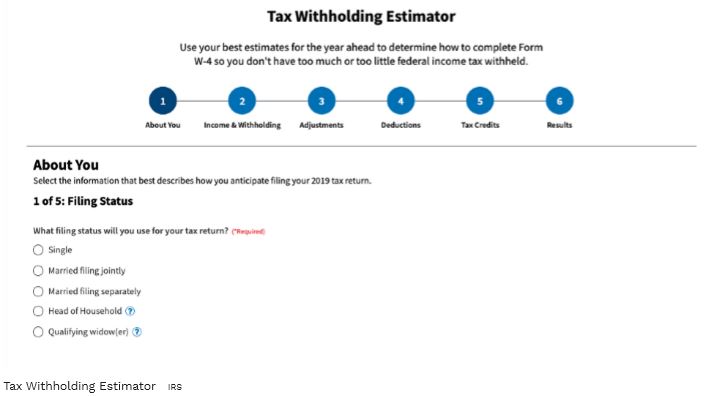

The Tax Withholding Estimator is more user-friendly than its predecessor. Here's what the opening screen looks like:

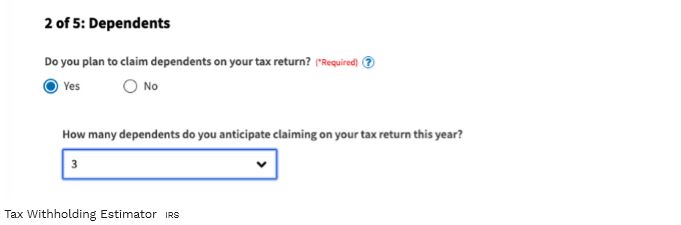

You'll begin by entering information about you, including your dependents:

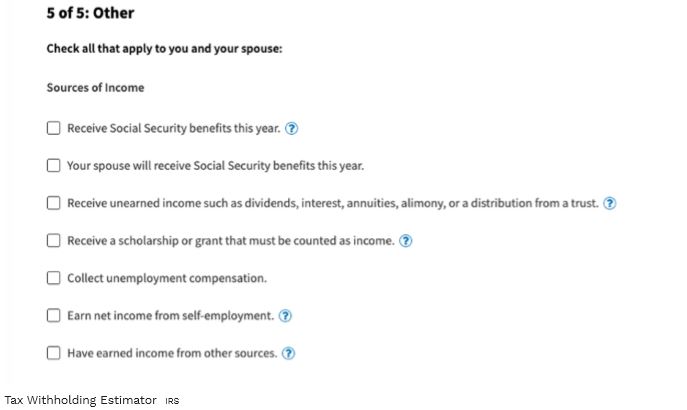

You'll next input information about your income. Unlike the last calculator, the new Tax Withholding Estimator gives you more options related to the kinds of income you might receive, like these:

Along the way, the tool uses plain language, asking taxpayers questions like:

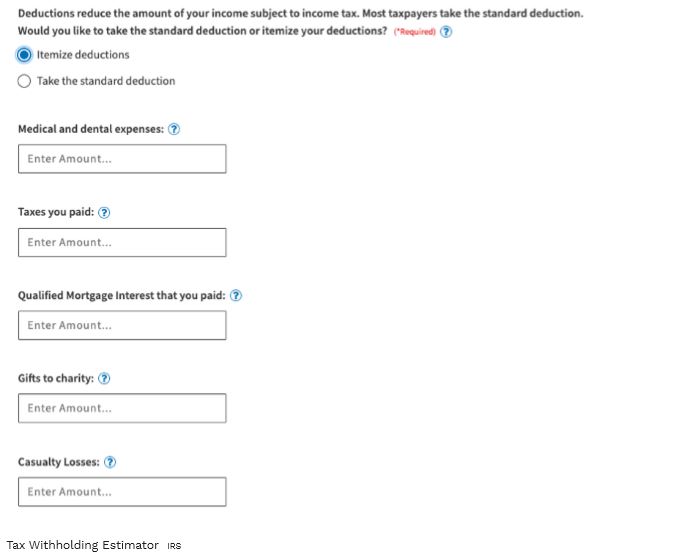

Deductions reduce the amount of your income subject to income tax. Most taxpayers take the standard deduction. Would you like to take the standard deduction or itemize your deductions?

If you itemize, you can estimate the value of those deductions:

The Tax Withholding Estimator also allows you to go back and fix your errors without starting over - and skip questions that don't apply (that's a big change from before).

Remember that the results are only as good as the information you provide. And if your circumstances change during the year (say, for example, that you get a new job, buy a new house or have a baby), you'll want to revisit the Tax Withholding Estimator to make sure that your withholding is still correct.

If you are an employee, the Tax Withholding Estimator can help you determine whether you need to give your employer a new

form W-4, Employee's Withholding Allowance Certificate (downloads as a PDF). You can use your results to help fill out the form and adjust your income tax withholding. For more information about form W-4, click

here. If you receive pension income, you can use the results to complete a

form W-4P (downloads as a PDF).

One more thing: if you're worried about privacy, the Tax Withholding Estimator will not ask you to provide sensitive personally-identifiable information like your name, Social Security number, address or bank account numbers. Additionally, the IRS says that it does not save or record the information you enter on the Tax Withholding Estimator.