|

For better viewing, please download images embedded in newsletter.

|

Title Notes E-News

Stay connected with us:

|

|

13 Things You Should Give Up If You Want To Be Successful

by Zdravko Cvijetic

Sometimes, to become successful, and get closer to the person we can become, we don't need to add more things, we need to give up on some of them.

There are certain things that are universal, which, if you give up on them, you will be successful, even though each one of us could have a different definition of success.

Some of them you can give up today, while it might take a bit longer for others.

Click

HERE

to learn more.

If You Sleep In This Position, You Will Have More Nightmares

by Kyle Schnitzer

Recent studies have shown that everyone has nightmares for different reasons.

|

$221M Lost to Wire Transfer Fraud in 2019

From American Land Title Association

The report shows there were 11,677 victims in 2019 with $221 million in losses. This compares to 11,300 reported victims and $150 million in losses in 2018. We must all be diligent and educate consumers

about how they can protect their money when purchasing a home or refinancing a mortgage.

Click

HERE

to learn more.

______________________________________________________________________

How To Protect Your Financial Institution from Foreign Cyberattacks

by Steve Sanders

Financial institutions should remain vigilant regardless, but the escalating situation in the Middle East serves as a catalyst to ensure your institution is fully prepared to deal with a cyberattack from a foreign adversary.

Reduce Your Attack Surface:

This is an excellent time to take inventory of your technical assets, because every device and piece of installed software you have increases your attack surface, leading to much higher risk.

Eliminating unused devices reduces the amount of assets you must manage and protect. However, getting rid of unused software may be even more important, as all software has the potential for vulnerabilities. Click HERE to learn about additional things you should be doing right now.

|

Investors Title Company Announces Record Fourth Quarter and Fiscal Year 2019 Results

For the year of 2019, net income attributable to the Company increased 43.7% to a record $31.5 million, or $16.59 per diluted share, versus $21.9 million, or $11.54 per diluted share, in the prior year. For the quarter, net income attributable to the Company increased to a record $11.4 million, or $6.00 per diluted share, versus $135,000, or $0.07 per diluted share, in the prior year period. Revenues for the year increased 17.4% to a record $183.5 million, compared with $156.3 million in the prior year. Operating expenses increased 11.2% to $143.7 million, compared with $129.2 million in the prior year.

Chairman J. Allen Fine commented, "We are pleased to report another year of strong performance for the Company. For both the quarter and the year, the Company set new records for revenues, premiums, and earnings. A strong economy led to another year of increases in the level of home sales and average real estate values, while historically low interest rates drove a sharp increase in the level of refinance activity." Click

HERE to review the full press release.

|

The Essential Job Interview Question Almost Nobody Ever Asks

by Geoffrey James, contributing editor, Inc.com

Only ask this question if you really want to know if this individual candidate will be successful in this particular job as it

reveals massively valuable information:

"To do your best work, how do you need to be managed? Feel free to use an example."

A big advantage to this question is that it uncovers three important perspectives and it can't be gamed with a pat answer because the candidate won't know the management style of the person for whom they would be working. A pat answer thus might easily misfire. Click HERE to learn more.

______________________________________________________________________

Here are additional articles related to Leadership that may be of interest:

|

Hey Housing Professionals, Your Jargon Isn't Helping Consumers

by Dustin Brohm

It seems that agents and lenders don't know how to talk to consumers...."Guess what, consumers! Conforming loan limits were just raised! Awesome, right!? Call me!" "Woo hoo! FHA just increased loan limits! Give me a call today!""Fannie and Freddie just did...""FHFA just announced..."Rates! Bond charts! Comps! CMAs! 15-year fixed! Jumbo! How many of these posts do we see on social media from our fellow agents and lenders every day? Like, a bazillion! It's not necessarily the topic that is the issue, it's the delivery of the topic that's the problem. Do you know what was missing from 5.999 bazillion of those posts? An explanation of what in the world a conforming loan even is! An explanation of how a major move in rates actually affects consumers' purchasing power. Nothing tangible, just generic, unhelpful nonsense. Click HERE to read on.

|

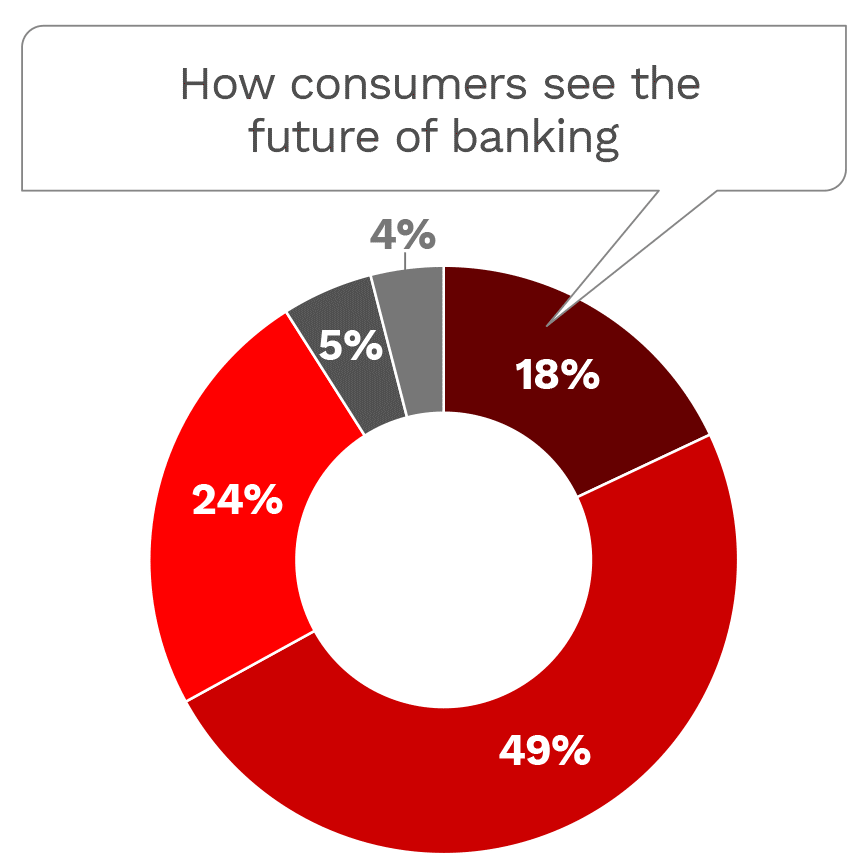

Consumers' Surprising Views on the Future of Banking

by Bill Streeter, Editor at The Financial Brand

According to a new study, tech companies are winning the battle for payments, branches will disappear, and mobile banking dominates delivery options. For now, financial institutions maintain a big edge over fintechs, but consumers would welcome more personalized advice and new security tools. Click HERE to learn great insights from a consumer survey into how they see the future of banking

______________________________________________________________________

Here are additional articles related to Banking that may be of interest:

|

What You Need To Know About Bankers Title, LLC

- Established in 1994

- Managed by the Virginia Bankers Association

- Exclusive underwriter for Investors Title

- Committed to maintaining customer satisfaction by delivering quality title insurance products and closing services in an accurate and timely manner

Single source for all your title and settlement needs:

- Licensed to underwrite title insurance in: Virginia, North Carolina, Maryland, and District of Columbia

- Commercial Certified Underwriters on staff

- Our settlement services can be customized to fit the needs of closing attorneys.

- We can offer full services or simply HUD preparation and disbursement.

- Our staff's vast experience enables us to respond quickly and effectively to detailed title questions, unusual search results, challenging escrow projects, and complex residential and commercial closings.

Did you know BT offers?

- Closing services throughout the Commonwealth of Virginia using a network of professional closers with the convenience of closings at your bank, client's office, etc.

- Specialized competitive pricing and an innovative product line

- Negotiable commercial premiums and discounted premiums for Community Housing

- Reissue rates good for 10 years on ANY company's prior policy

- Facilitation of 1031 exchanges through Investors Title Exchange Corporation

- Online quote calculator that provides title premiums, settlement fees and recording costs

- Free Seminars and customized training for your team

Give us a call to discuss how our talented team can meet your needs!

|

|

NOTE: Recent changes in the details section of the recording cost format

on the Virginia Deed Calculations website. Click

HERE to access.

|

For your convenience, please click

HERE to utilize our online rate calculator to get a quote.

|

"When everything seems to be going against you, remember that the airplane takes off against the wind, not with it.

"

|

|

|

|

**

Remember to offer your borrowers Owner's Coverage on their most valuable investment. It's a one time premium with a lifetime of security.

In addition, they will receive a reduced premium rate when they obtain it simultaneously with your Lender's Coverage and a discount on Lenders Coverage every time they refinance within the next 10 years.**

|

|

|

Click HERE to follow us on Facebook and keep up with hot topics, fun facts, team member updates ... and of course a few team shenanigans!

|

WANTED: YOUR FEEDBACK

What Topics Are On Your Mind?

Bankers Title wants to provide you with pertinent information in future E-Blasts and Webinars. What questions are on your mind regarding the real estate and mortgage lending industry? What Hot Topics would you like to receive greater insights and clarity?

Send Robyn your thoughts.

|

Past issues of the Bankers Title E-news are archived on our website

HERE

|

Hello, just a reminder that you're receiving this email because you have done business with or expressed an interest in Bankers Title, LLC. Don't forget to add [email protected] to your address book so we'll be sure to land in your inbox!

Office Location:

9011 Arboretum Parkway, Suite 110, Richmond, VA 23236

|

|

|

|

|