Everyone wants financial security, and FSG's Financial Planning Team can help you achieve this. Whether it's investment/retirement planning, estate planning, or disability/life insurance, our team provides trusted advice with the goal of protecting and growing your assets. Contact Mike Edwards at (720) 858-6289 or Jeff Feakes at

(720) 858-6285 to learn how we can help.

|

Need workers' comp and employee benefits, while also considering a PEO option? We can help!

We've teamed up with

Bene-Fit Solutions to provide competitive rates for workers' comp and employee benefits, while also providing the convenience of a PEO. For more information, please contact

Mitch Laycock or

John Kaufman.

|

|

|

|

How to Save for Retirement and a Child's Education at the Same Time |

You want to retire comfortably when the time comes. You also want to help your child go to college. So how do you juggle the two? Saving for retirement and your child's education at the same time can be a challenge, but it's possible if you make smart choices now. Here are a few steps to get started:

- Know your financial needs by answering questions like when you'd like to retire, and what standard of living do you hope to have? For college savings, identify how many years until your child starts college, if your child will attend a public or private college, and if you expect your child to qualify for financial aid.

- Figure out what you can afford to put aside each month by preparing a detailed family budget that lists all your income and expenses.

- Make retirement the priority. If funds are limited, it's better to focus on retirement savings in order to take advantage of potential tax-deferred growth and compounding of your money. Financial aid can be used to attend college, but there's no such thing as a retirement loan.

___________________________________________________________

Securities and Investment Advisory Services offered through Woodbury Financial Services, Inc., Member FINRA, SIPC and Registered Investment Adviser. COPIC Financial Service Group and Woodbury Financial Services, Inc. are not affiliated entities. Insurance services offered through COPIC Financial Service Group. Mitch Laycock and John Kaufman are not registered with Woodbury Financial Services, Inc.

|

|

The Business Benefit of Employee Assistance Programs |

Employee assistance programs (EAPs) help employees access services that address personal and/or work-related issues that may impact their job performance, health, and mental/emotional well-being. EAPs originated as a way to address alcoholism and drug use in the workplace, but have since matured to address a broad range of issues that affect employee performance and engagement.

EAPs are often considered separate from health benefits, but can work concurrently as part of a well-rounded benefit package. Whether offering financial planning services or mental health counseling, providing tools and services can help employees be more proactive in their overall management of stress and anxiety, and in turn helps maintain a happy and healthy workforce.

Read more about the benefits of EAPs in

this article from Workforce.com, and remember COPIC FSG's team can help you find a comprehensive benefits package to suit your small-business needs. Contact

John Kaufman at (720) 858-6287 with questions or for more information.

|

|

Understanding Long-Term Care Riders and Options |

There's no such thing as a standard long-term care insurance (LTCI) policy. Some policies are comprehensive (including most group LTCI policies), building many important features into the base plan----while charging a higher premium. Other lower-priced policies provide only basic coverage, but offer you the choice of buying greater benefits at an additional cost. That's why it's important when comparing policies to look at both the basic coverage an LTCI policy offers and the optional benefits you can add.

Most LTCI policies cover a range of services from full-time skilled care in a nursing home to custodial care to help with daily living activities. Coverage for mental incapacity (including Alzheimer's disease) has become standard in most policies. However, add-on options like home health care and guaranteed insurability can significantly increase your premium if you don't balance the cost with their importance to you.

Learn more about other long-term care riders and options like inflation protection, nonforfeiture of premium, waiver of premium, and third-party notification in this article from our partners at Woodbury Financial. And contact Mike Edwards at (720) 858-6289 for more information on how to best prioritize add-on options to work with your individual needs.

___________________________________________________________

Securities and Investment Advisory Services offered through Woodbury Financial Services, Inc., Member FINRA, SIPC and Registered Investment Adviser. COPIC Financial Service Group and Woodbury Financial Services, Inc. are not affiliated entities. Insurance services offered through COPIC Financial Service Group. Mitch Laycock and John Kaufman are not registered with Woodbury Financial Services, Inc.

|

|

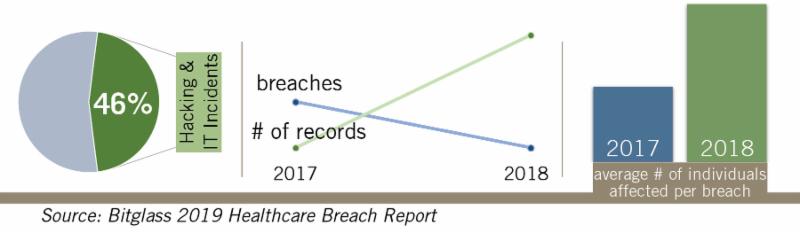

2019 Health Care Data Breach Update |

Each year, Bitglass, a next-gen cloud access security broker company, analyzes data from the U.S. Department of Health and Human Services' database containing information about breaches of protected health information (PHI) that affected 500 or more individuals. In 2019's report, the latest data is compared to that of previous years, revealing key trends and cybersecurity challenges facing the health care industry.

Highlights from the report:

- 46% of health care data breaches are hacking and IT related incidents. The steady rise of this type of breach suggests that health care IT systems are increasingly targeted by malicious actors who recognize these systems as housing massive amounts of sensitive data.

- The number of breaches in 2018 was lower than that of the previous year, however, the total number of records exposed in those breaches was 11.5 million in 2018, more than twice the number of records exposed in 2017.

- The average number of individuals affected per breach was 39,739 in 2018, more than twice the average of 2017.

Read this article from HealthTech Magazine to learn more about what health care organizations are doing to bolster their defenses.

Data breaches remain a viable threat to the business of health care; make sure you have adequate coverage for your practice. Contact

Mitch Laycock at (720) 858-6297 for a complimentary consultation and/or review.

|

|

We are always available to review your current risk and policies to help you get the best coverages at the best prices. Call us at (720) 858-6280!

|

|

|