| Partners |

| (click on logo to link to website) |

|

|

|

| |

President's Perspective

~~~~~~~~~~~~~~~~~~

CalTRUST Announces S&P Rating of "A+/S1" for CalTRUST Medium-Term Fund

In its ongoing efforts to provide maximum value and transparency for local agency investors, the CalTRUST Board of Trustees voted in April of this year to procure a fund credit quality rating for the CalTRUST Medium-Term Fund. The Board is pleased to announce that Standard & Poor's has assigned a rating of "A+f" to the CalTRUST Medium-Term Fund, based upon its analysis of the credit quality of the Fund's investments and the likelihood of counterparty defaults. The S&P review finds that "the Fund's holdings provide strong protection against losses from credit defaults". In addition, S&P has assigned a volatility rating of "S1" to the Medium-Term Fund, reflecting "the Fund's low sensitivity to changing market conditions".

For more than ten years, the CalTRUST funds have offered a safe and convenient means for local agencies to maintain a high degree of liquidity and diversification in their investments. The two CalTRUST money market fund options - the CalTRUST Government MMF and CalTRUST Heritage MMF - are each rated "AAAm" and "Aaa-mf" by S&P and Moody's, respectively, and offer same-day liquidity. Similarly, the CalTRUST Short-Term Fund, rated "AAf/S1+" by S&P, provides next-day liquidity. And the CalTRUST Medium-Term Fund, rated "A+/S1", provides weekly liquidity.

Taken together, the CalTRUST funds give local agencies a highly-efficient means of allocating funds across the 0-5 year fixed-income spectrum accessible to local agencies.

For

more information on the CalTRUST funds, please contact me by email at the address listed below, or contact:

Lyle Defenbaugh

Wells Fargo Asset Management |

(916) 440-4890 |

Laura Labanieh

CSAC Finance Corporation |

(916) 650-8186

|

Norman Coppinger

League of CA Cities |

(916) 658-8277 |

Neil McCormick

CA Special Districts Association |

(916) 442-7887 |

Chuck Lomeli is CalTRUST President

and Solano County Treasurer

|

Financial Markets Update

~~~~~~~~~~~~~~~~~~~~

November Truly A Cruel Month For Fixed-Income - Is The Bond Market Bloodbath Over??

In his most recent post to

Advantage Voice

, Wells Fargo Funds Management's Chief Fixed-Income Strategist, James Kochan, looks at the fixed-income markets in November, especially post-election. He notes that the -2.39% total return for the taxable investment grade market index in November was the worst since October of 2008, and that -- barring a rally in December -- total return for the fourth quarter will probably be the worst since 1994 Q1.

Looking beyond the numbers Jim sees four principal factors behind the late-year increase in yields.

These are,

expectations

of:

- Stronger economic growth;

Jim argues that fears of a continued rise in the near term are overblown, for a number of reasons. First, any fiscal stimulus will require Congressional approval, with funds not flowing until 2018 most likely. Second, inflation could continue to trend slowly upward, but a spike is unlikely, given the amount of international competition in today's market. Finally, Jim feels Federal Reserve policy is likely to be less of a threat than feared. Virtually every Fed pronouncement has emphasized that increases should be moderate and gradual.

In summary, Jim concludes that yields in most sectors of the fixed-income market have already increased enough to yield "fair value".

Jim's complete

blog post

can be accessed

here.

|

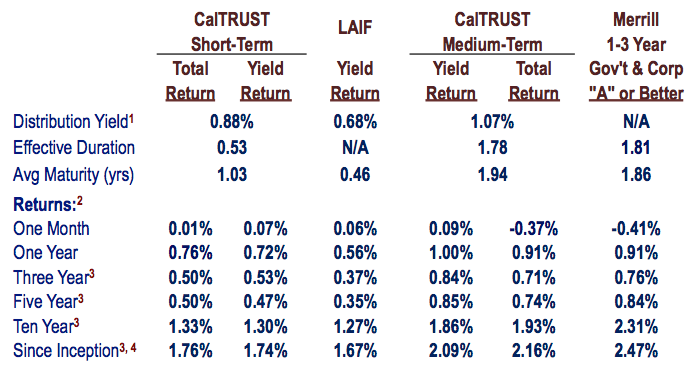

CalTRUST Portfolio Snapshot (as of November 30, 2016)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. CalTRUST Short-Term and Medium-Term and LAIF yields are net of fees. Merrill 1-5 Year Indexes are unmanaged; and do not reflect any deduction for administrative fees or expenses.

2. CalTRUST and LAIF returns are net of all investment advisor, administrative and program fees.

3. Annualized.

4. The CalTRUST Short-Term and Medium-Term portfolios commenced operations on February 13, 2005.

|

CalTRUST Government & Heritage Money Market Funds

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

|

Treasury Yield Curve

~~~~~~~~~~~~~~~~

|

2016 Calendar

~~~~~~~~~~~

December 23, 2016

Christmas Observed

Early Closure - 10:00 am PST

December 26, 2016

Christmas Observed

Closed for Trading

December 30, 2016

New Year's Eve Observed

Early Closure - 10:00 am PST

2017 Calendar

January 2, 2017

New Year's Day Observed

Closed for Trading

January 16, 2017

Martin Luther King Jr. Day Observed

Closed for Trading

February 20, 2017

Presidents Day Observed

Closed for Trading

April 13, 2017

Good Friday Observed

Early Closure - 11:00 am PST

April 14, 2017

Good Friday Observed

Closed for Trading

May 26, 2017

Memorial Day Observed

Early Closure - 11:00 am PST

May 29, 2017

Memorial Day Observed

Closed for Trading

July 3, 2017

Independence Day Observed

Early Closure - 10:00 am PST

July 4, 2017

Independence Day Observed

Closed for Trading

September 4, 2017

Labor Day Observed

Closed for Trading

October 9, 2017

Columbus Day Observed

Bond Market Closed for Trading

November 23, 2017

Thanksgiving Day Observed

Closed for Trading

November 24, 2017

Thanksgiving Day Observed

Early Closure - 10:00 am PST

December 22, 2017

Christmas

Observed

Bond Market Early Closure - 11:00 am PST

December 25, 2017

Christmas Observed

Closed for Trading

December 29, 2017

New Year's Eve Observed

Bond Market Early Closure - 11:00 am PST

2018 Calendar

~~~~~~~~~~~

January 1, 2018

New Year's Day Observed

Closed for Trading

|

|

| |

|