| Partners |

| (click on logo to link to website) |

|

|

|

| |

President's Perspective

~~~~~~~~~~~~~~~~~~

CalTRUST Funds Enter 2017 With Over $2.75 Billion in Assets; Portfolios Well-Positioned For Challenges of New Year And New Administration

CalTRUST is pleased to kick-off 2017 on a high note, with assets over $2.75 billion; an increase of $450 million on the year. In addition to asset growth, CalTRUST has seen exceptional participation growth with over 29 new public agencies becoming CalTRUST participants in 2016. Moreover, the funds are well-positioned for further growth in the new year, giving investors the ability to allocate their funds across the 0-5 maturity range permitted under the California statute; and maximum flexibility in the management of local funds. We enter the new year with prospects for:

- Accelerating growth in anticipation of significant fiscal stimulus from tax cuts, increased defense and infrastructure spending;

- A quickened pace of Fed monetary tightening;

- Persistent job growth with diminishing slack in the labor force;

- Expectations turning from deflation to modestly rising inflation; and

- Ongoing anti-globalization risks in developed market countries.

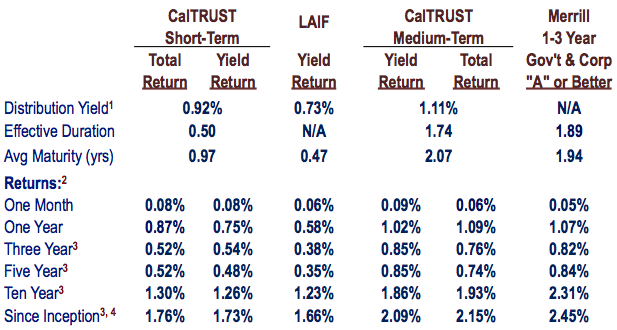

The CalTRUST Short- and Medium-Term Funds are positioned to adapt to this changing, and potentially volatile, rate environment. The duration of the funds are toward the shorter end of their respective targets, at 0.50 years for the Short-Term Fund and 1.74 years for the Medium-Term Fund. In addition to the Short- and Medium-Term Funds, CalTRUST participants also have the option to utilize the Heritage or Government Money Market Funds for a stable NAV and same-day liquidity.

We look forward to another successful year, and thank you for your continued participation. For more information on the CalTRUST funds, please contact me by email at the address listed below, or contact:

Lyle Defenbaugh

Wells Fargo Asset Management |

(916) 440-4890 |

Laura Labanieh

CSAC Finance Corporation |

(916) 650-8186

|

Norman Coppinger

League of CA Cities |

(916) 658-8277 |

Neil McCormick

CA Special Districts Association |

(916) 442-7887 |

Chuck Lomeli is CalTRUST President

and Solano County Treasurer

|

Financial Markets Update

~~~~~~~~~~~~~~~~~~~~

Equity Markets Likely To Continue Moving Upward in 2017 Despite Rising Yields -- Until Inflation Anxieties Overtake Deflation Worries

In his inaugural

Economic and Market Perspective of 2017

, WellsCap Chief Investment Strategist Jim Paulsen, ponders how long equity markets can continue to move up in the face of rising yields.

Historically, Jim notes, when rates rise while the 10-year Treasury bond yield exceeds the S&P 500 earnings yield, the S&P Index has tended to decline. And, the opposite holds true -- when the earnings yield on the S&P exceeds the 10-year bond yield, the S&P has gained. Given that the earnings yield "spread" over the 10-year bond yield is among the widest since at least 1960, suggests the equity markets may continue moving higher in the face of rising yields for longer than most anticipate -- in the short-term.

Interestingly, Jim points out that this positive correlation between bond yields and stock prices (both mostly moving in the same direction) is mostly tied to how investors view inflation/deflation risks. That is, when the prevailing market anxiety is focused on deflationary risks, stocks tend to move in tandem with bond yields; and when inflation fears predominate, stock prices struggle mightily to stay positive in the face of rising bond yields.

Since an increase in inflation has begun to show up -- modestly -- in the numbers, and investors' inflation fears have begun escalating, it is quite likely that, as the year progresses, bond yields will prove to have finally risen too much for stock prices.

Jim's complete

blog post

can be accessed

here.

|

CalTRUST Portfolio Snapshot (as of December 31, 2016)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. CalTRUST Short-Term and Medium-Term and LAIF yields are net of fees. Merrill 1-5 Year Indexes are unmanaged; and do not reflect any deduction for administrative fees or expenses.

2. CalTRUST and LAIF returns are net of all investment advisor, administrative and program fees.

3. Annualized.

4. The CalTRUST Short-Term and Medium-Term portfolios commenced operations on February 13, 2005.

|

CalTRUST Government & Heritage Money Market Funds

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

|

Treasury Yield Curve

~~~~~~~~~~~~~~~~

|

|

2017 Calendar

February 20, 2017

Presidents Day Observed

Closed for Trading

April 13, 2017

Good Friday Observed

Early Closure - 11:00 am PST

April 14, 2017

Good Friday Observed

Closed for Trading

May 26, 2017

Memorial Day Observed

Early Closure - 11:00 am PST

May 29, 2017

Memorial Day Observed

Closed for Trading

July 3, 2017

Independence Day Observed

Early Closure - 10:00 am PST

July 4, 2017

Independence Day Observed

Closed for Trading

September 4, 2017

Labor Day Observed

Closed for Trading

October 9, 2017

Columbus Day Observed

Bond Market Closed for Trading

November 23, 2017

Thanksgiving Day Observed

Closed for Trading

November 24, 2017

Thanksgiving Day Observed

Early Closure - 10:00 am PST

December 22, 2017

Christmas

Observed

Bond Market Early Closure - 11:00 am PST

December 25, 2017

Christmas Observed

Closed for Trading

December 29, 2017

New Year's Eve Observed

Bond Market Early Closure - 11:00 am PST

2018 Calendar

~~~~~~~~~~~

January 1, 2018

New Year's Day Observed

Closed for Trading

|

|

| |

|