| Partners |

| (click on logo to link to website) |

|

|

|

| |

President's Message

~~~~~~~~~~~~~~~~~~~~~~

CalTRUST Transition Update

As you are aware, CalTRUST issued Requests for Proposals (RFPs) for custody, investment management, and fund accounting services. CalTRUST received multiple responses to each RFP, and a thorough review process of all proposals was conducted by the CalTRUST Product Review Committee. The CalTRUST Board of Trustees selected new providers for all services; U.S. Bank to provide custody services, BlackRock Financial Management to provide investment management services, and NorthStar Financial Services Group, LLC/Gemini Fund Services to provide fund accounting and record keeping services.

These new providers will assume their duties between July 3rd and August 1st. A timeline and overview of how the transitions will affect CalTRUST participants can be found here. Our CalTRUST staff has called all CalTRUST participants to answer any questions, and in July we will be holding webinars and offering in-depth user guides on the new online trading system that will be implemented on August 1st. We are confident in a smooth transition as the transition teams have been meeting regularly and working closely together.

While we are in a trading blackout period beginning tomorrow, and through July 4th, as of July 5th CalTRUST participants can begin full trading again, including accessing our new money market and government fund offerings through BlackRock. The current online participant access and trading platform will remain in place through July.

We are grateful for the services provided to us over the years by Nottingham, Wells Fargo, and Wells Fargo Asset Management. As CalTRUST continues to grow and evolve and we are excited to move forward with the new team of BlackRock, NorthStar/Gemini, and U.S. Bank.

If you have any questions regarding the transition, please contact CalTRUST's Administrator Laura Labanieh ([email protected] or 916.650.8186) or Member Services Associate Kyle Tanaka ([email protected] or 916.650.8114).

Dan McAllister

San Diego County Treasurer

CalTRUST President

With Economic Data Trending Modestly Higher, Public Agency Investors Should Be Positioned For Challenge of Higher Rates

As expectations build for a June rate hike by the Fed, and modestly rising rates in the short end of the yield curve, fixed income investors face challenges -- whether they be individuals or institutional investors such as public agencies. The stubbornly low yield environment since the 2008 financial crisis has presented investors with near zero yields for short-maturity securities and -- comparatively -- modestly higher yields for longer maturity investments. Given the persistence of this low rate environment, it is understandable that many investors have been tempted to look to longer maturity securities to boost the yield on their portfolios.

This "reach for yield", however, exposes investors to interest rate risk. Since bond prices move in inverse relationship to yield and the general direction of rates, as rates move higher the price of fixed income securities falls. In a rising rate scenario, this inverse relationship can result in negative rates of total return on an individual security or a portfolio; even on "safe-haven" instruments such as US Treasuries.

Public agency investors tempted to "reach" for additional yield by extending the maturity of their holdings should do so only with a full understanding of the additional risk they are assuming. For those unwilling to assume this additional risk, a more prudent approach may instead be to shorten their target duration. This approach enables an investor to manage interest rate risk, while ensuring sufficient liquidity to meet anticipated cash needs, and provides the flexibility -- in the form of available cash -- to take advantage of higher rates when they do arrive.

For

more information on the CalTRUST funds, please contact:

Laura Labanieh

CSAC Finance Corporation |

(916) 650-8186

|

Norman Coppinger

League of CA Cities |

(916) 658-8277 |

Neil McCormick

CA Special Districts Association |

(916) 442-7887 |

|

Financial Markets Update

~~~~~~~~~~~~~~~~~~~~~

Wells Fargo Investment Institute Mid-Year Outlook Sees "Slow But Steady" Growth Continuing Into 2018

In its

2017 Midyear Outlook

, the Wells Fargo Investment Institute finds confirmation -- so far -- of its beginning-of-the-year expectation of steady global economic growth in a low inflation environment, with political uncertainties presenting the most significant risk to the forecast. The midyear update of that outlook essentially sees more of the same for the remainder of 2017 and into 2018.

Overall, the

Outlook

sees improving global economic growth, with flat commodity prices and only modest gains in wages and consumer spending keeping global inflation in check. This modest growth/low inflation environment should provide central banks with sufficient latitude to remove their fiscal stimulus.

For the US, the Outlook team sees:

- Continued moderate job gains;

- Rising wages, which could at some point pinch corporate earnings growth; and

- Continued brisk home sales, with rising prices crimping affordability;

- Consumer and business spending and borrowing consistent with measured growth, with no sign of the over-exuberance which typically foretells the next recession.

I

n light of these factors and the restrained rate environment, the Outlook team does not see a recession coming in the next 12 months.

The complete

blog post

can be accessed

here.

|

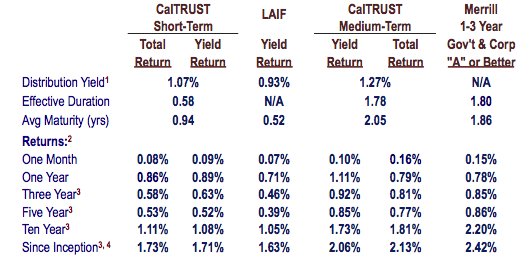

CalTRUST Portfolio Snapshot (as of May 31, 2017)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. CalTRUST Short-Term and Medium-Term and LAIF yields are net of fees. Merrill 1-5 Year Indexes are unmanaged; and do not reflect any deduction for administrative fees or expenses.

2. CalTRUST and LAIF returns are net of all investment advisor, administrative and program fees.

3. Annualized.

4. The CalTRUST Short-Term and Medium-Term portfolios commenced operations on February 13, 2005.

|

CalTRUST Government & Heritage Money Market Funds

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

|

Treasury Yield Curve

~~~~~~~~~~~~~~~~

|

|

2017 Calendar

June 28, 2017 - July 4, 2017

Investment Manager & Custody Transition

Trading Blackout Period

July 3, 2017

Independence Day Observed

Early Closure - 10:00 am PST

July 4, 2017

Independence Day Observed

Closed for Trading

July 5, 2017

Investment Manager & Custody Transition Complete

Trading Resumes

September 4, 2017

Labor Day Observed

Closed for Trading

October 9, 2017

Columbus Day Observed

Bond Market Closed for Trading

November 23, 2017

Thanksgiving Day Observed

Closed for Trading

November 24, 2017

Thanksgiving Day Observed

Early Closure - 10:00 am PST

December 22, 2017

Christmas

Observed

Bond Market Early Closure - 11:00 am PST

December 25, 2017

Christmas Observed

Closed for Trading

December 29, 2017

New Year's Eve Observed

Bond Market Early Closure - 11:00 am PST

2018 Calendar

~~~~~~~~~~~

January 1, 2018

New Year's Day Observed

Closed for Trading

|

|

| |

|