| Partners |

| (click on logo to link to website) |

|

|

|

| |

President's Perspective

~~~~~~~~~~~~~~~~~~

I have been honored to serve as the President of CalTRUST since its original inception 15 years ago. Presiding over the program as it grew from infancy to over $2.8 Billion in assets and over 140 actively participating municipal agencies in the State is one of my proudest accomplishments. None of this would have been possible without the enthusiastic and unwavering support of our program administrator, the CSAC Finance Corporation, and our operational partners, past and present, for all they have done to promote the program.

As with all good things, my time as President is coming to an end. The time has come for me to pass the mantle of responsibility on to a new leadership team and serve as Past President. I do so with every confidence that CalTRUST will continue to grow and flourish. While I will be resigning as President next month, I will remain an active Trustee on the Board. I know I can rely on all of you to extend to the new leadership the same level of enthusiasm and support that you extended to me. Thank you to CalTRUST participants and my fellow Trustees for letting me serve in this lead role, and being such committed partners, over the years.

Liquidity, Diversification & Convenience of CalTRUST Funds Makes Them A Great Option For Property Tax Proceeds

The CalTRUST Funds give local agencies a safe and convenient means of maintaining liquidity while also diversifying their investments. The CalTRUST Government Money Market Fund (MMF) and CalTRUST Heritage MMF, each rated "AAAm" and "Aaa" by S&P and Moody's, respectively, provide same-day liquidity, while the CalTRUST Short-Term Fund, rated "AAf/S1+" by S&P, provides next-day liquidity, and the CalTRUST Medium-Term Fund, rated "A+/S1" by S&P, gives investors weekly liquidity.

Taken together, the CalTRUST Funds give investors a highly-efficient means of allocating funds across the 0-5 year maturity range; and a cost-free means of re-allocating among the funds as local circumstances change.

Given this, CalTRUST is an ideal option for local agencies when it comes to the investment of property tax proceeds. To take maximum advantage of the benefits of CalTRUST, local agencies should ensure their investment policies authorize the use of CalTRUST. We would be happy to assist any interested agency; just contact any of the persons listed below.

CalTRUST

For

more information on the CalTRUST funds, please contact me by email at the address listed below, or contact:

Lyle Defenbaugh

Wells Fargo Asset Management |

(916) 440-4890 |

Laura Labanieh

CSAC Finance Corporation |

(916) 650-8186

|

Norman Coppinger

League of CA Cities |

(916) 658-8277 |

Neil McCormick

CA Special Districts Association |

(916) 442-7887 |

Chuck Lomeli is CalTRUST President

and Solano County Treasurer

|

Financial Markets Update

~~~~~~~~~~~~~~~~~~~~

Recent Bull Market Owes More To Global Economic Momentum Than "Trump Bump"

The S&P 500 is up about 14% since the 2016 election, and nearly 5% since the first of the year, leading many to credit the market rally to a "Trump Bump". It also has led many to worry that the markets will be in for a significant correction if Trump's many campaign promises are not delivered on in short order.

In his most recent

Economic & Market Perspective

, WellsCap Chief Investment Strategist Jim Paulsen, argues that, rather than "Trump Hope", the uptick in the markets has been "underpinned by one of the largest and most persistent economic improvements of the entire global economic recovery".

Jim points out that the Citigroup Global Economic Surprise Index is at a 7-year high, and the 52-week moving average of the index has risen to a six-year high. He notes that, when the Global Economic Surprise Index has been in the lowest quartile, the S&P 500 has appreciated only about 3.4% annually, but when the Index is in the top quartile, the gains have been almost 28.6% per year. Jim also notes that any reading above 18 in the Index is in the top quartile; and that the current reading is slightly above 47. Given this, even if positive economic surprises diminish somewhat, it is quite conceivable they would remain in the top quartile some time.

The bottom line, Jim notes, is that the current market rally is not as dependent on - or vulnerable to - Trump's "antics" or potential government policies as many investors hope or fear.

Jim's complete

blog post

can be accessed

here.

|

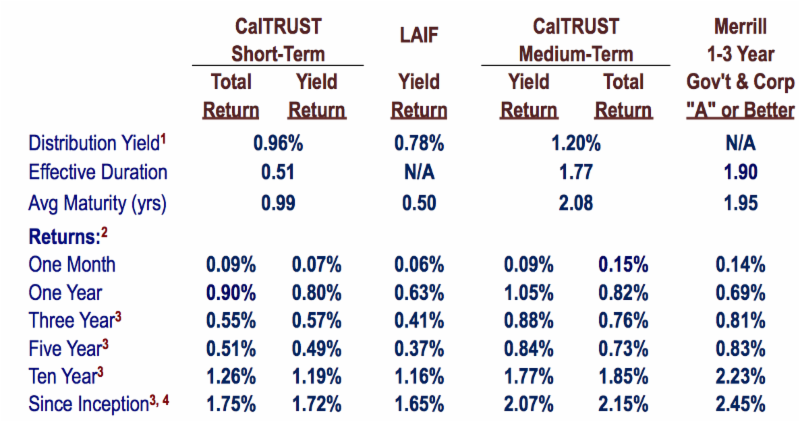

CalTRUST Portfolio Snapshot (as of February 28, 2017)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. CalTRUST Short-Term and Medium-Term and LAIF yields are net of fees. Merrill 1-5 Year Indexes are unmanaged; and do not reflect any deduction for administrative fees or expenses.

2. CalTRUST and LAIF returns are net of all investment advisor, administrative and program fees.

3. Annualized.

4. The CalTRUST Short-Term and Medium-Term portfolios commenced operations on February 13, 2005.

|

CalTRUST Government & Heritage Money Market Funds

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

|

Treasury Yield Curve

~~~~~~~~~~~~~~~~

|

|

2017 Calendar

April 13, 2017

Good Friday Observed

Early Closure - 11:00 am PST

April 14, 2017

Good Friday Observed

Closed for Trading

May 26, 2017

Memorial Day Observed

Early Closure - 11:00 am PST

May 29, 2017

Memorial Day Observed

Closed for Trading

July 3, 2017

Independence Day Observed

Early Closure - 10:00 am PST

July 4, 2017

Independence Day Observed

Closed for Trading

September 4, 2017

Labor Day Observed

Closed for Trading

October 9, 2017

Columbus Day Observed

Bond Market Closed for Trading

November 23, 2017

Thanksgiving Day Observed

Closed for Trading

November 24, 2017

Thanksgiving Day Observed

Early Closure - 10:00 am PST

December 22, 2017

Christmas

Observed

Bond Market Early Closure - 11:00 am PST

December 25, 2017

Christmas Observed

Closed for Trading

December 29, 2017

New Year's Eve Observed

Bond Market Early Closure - 11:00 am PST

2018 Calendar

~~~~~~~~~~~

January 1, 2018

New Year's Day Observed

Closed for Trading

|

|

| |

|