| Partners |

| (click on logo to link to website) |

|

|

|

| |

CalTRUST Update

~~~~~~~~~~~~~~~

Since launching the new statements we have received clarifying questions from participants as they are slightly different than our previous statement format. In response, we have put together a "Statement 101" piece on how to read your CalTRUST statement. Key information for reading your statement include:

- The Summary of Investments portion of the statement reflects account details as of the last date of the listed date range.

- The Detail of Transaction Activity portion of the statement reflects all transactions that took place within the participant accounts during the statement period.

- Summary of Investments, shows all balances as of the closing date of the statement.

- Value on DA ($) is the rounded calculation of closing shares month end TENAV = Closing Balance in $.

- Average Cost Amount is the total cost of all of the currently owned shares in the account.

- Cumulative Unrealized Gain/(Loss) ($) is the difference (either positive or negative) between the current value and the average cost amount.

- Portfolios Total Value is the sum total of all funds, in all linked accounts, as of the closing date of the statement.

- Beginning Balance should match the closing balance from the prior period's statement.

- Accrual Income Div Reinvestment/(Cash) is the actual amount in both dollars and shares that was earned for the period.

- Closing Balance in shares is the beginning balance, plus or minus the participant activity for the month.

- Closing Balance in Dollars is the rounded calculation of closing shares month end NAV = Closing Balance in $.

Please click here to view the Statement 101 and sample statement. If you have any additional questions regarding statements please contact our CalTRUST Fund Accounting at 833-CalTRUST (225-8787) x1. For more information on the CalTRUST funds, please contact:

|

Financial Markets Update

~~~~~~~~~~~~~~~~~~~~~

BlackRock Q4 Global Investment Outlook

BlackRock's Q4 2017 Global Investment Outlook is now available! Highlights include:

- Growth is cruising at above-trend rates across the world. Inflation is picking up in the U.S. but moving sideways at low levels in the eurozone, supporting monetary policy divergence. Remarkably steady growth is fostering subdued market volatility.

- Inflation is key to the policy and market outlook. BlackRock Inflation GPS suggests U.S. core inflation will rise back toward 2%, giving the Federal Reserve comfort in pushing ahead with policy normalization.

- We see upbeat economic growth pushing bond yields up after a dip caused by a soft inflation patch, geopolitical unease and a downshift in Fed rate increase expectations. Yet we see any yield rises capped by structural factors such as graying populations, excess savings and tepid productivity growth.

- What are the risks? Policy missteps or miscommunications cannot be ruled out as the Fed and some other central banks reduce accommodation. China's economy could slow if the country re-emphasizes reforms over short-term growth after a crucial party congress. Geopolitical risks also lurk.

- Structurally lower yields underpin our positive view on equities and other risk assets.

Read their entire Q4 Global Investment Outlook newsletter here.

|

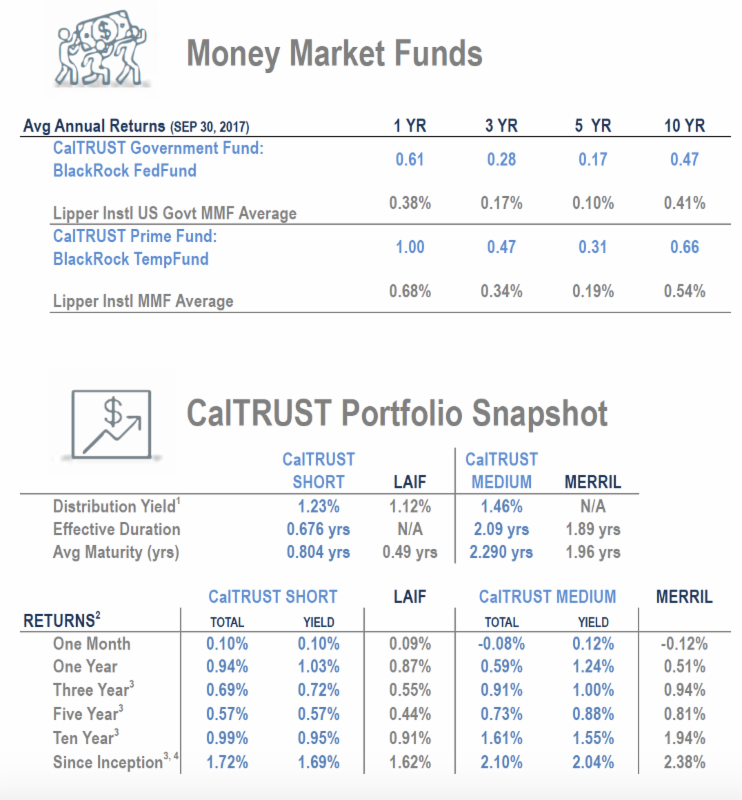

Performance (as of September 30, 2017)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. CalTRUST Short-Term and Medium-Term and LAIF yields are net of fees. Merrill 1-5 Year Indexes are unmanaged; and do not reflect any deduction for administrative fees or expenses.

2. CalTRUST and LAIF returns are net of all investment advisor, administrative and program fees.

3. Annualized.

4. The CalTRUST Short-Term and Medium-Term portfolios commenced operations on February 13, 2005.

|

|

2017 Calendar

November 23, 2017

Thanksgiving Day Observed

Closed for Trading

November 24, 2017

Thanksgiving Day Observed

Early Closure - 10:00 am PST

December 22, 2017

Christmas

Observed

Bond Market Early Closure - 11:00 am PST

December 25, 2017

Christmas Observed

Closed for Trading

December 29, 2017

New Year's Eve Observed

Bond Market Early Closure - 11:00 am PST

2018 Calendar

~~~~~~~~~~~

January 1, 2018

New Year's Day Observed

Closed for Trading

|

|

| |

|