| Partners |

| (click on logo to link to website) |

|

|

|

| |

CalTRUST Update

~~~~~~~~~~~~~~~

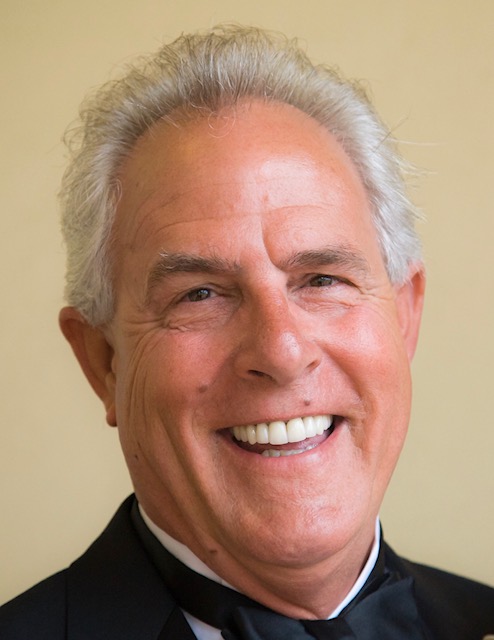

CalTRUST Mourns the Passing of Dave Ciapponi; CalTRUST Trustee and Founding Member

It is with heavy hearts that CalTRUST shares the passing of Trustee Dave Ciapponi. Dave was one of the founders of CalTRUST and were it not for his vision, determination, strong work ethic, k

e

en attention to detail, and invaluable experience, CalTRUST would not be the organization we are today. Dave was a true public servant; joining the armed forces as a young man and then continuing his public servic

e working for the IRS, Fresno County, and Westlands Water District throughout his career. Dave continued to work with Westlands Water District until his passing. Dave served as both Secretary and Treasurer during his tenure on the CalTRUST Board and we will miss him dearly. Dave is survived by his wife Danelle and two daughters.

In addition to being an engaged Trustee, Dave was also a friend to many. We thank Dave for his contributions to CalTRUST and public agencies. Dave's full obituary can be read here.

CalTRUST Annual Meeting Update

The CalTRUST Board of Trustees held their Annual Meeting in Riverside County on April 17-18, 2018. During the meeting the board received reports from the CalTRUST partners including the administrator, investment manager, fund accountant/transfer agent, and custodian. They reviewed the current operating documents, investment policy, and investment strategy. CalTRUST will be moving forward with the launch of the new GASB79 compliant, 2A7 look-alike fund. This new fund, the CalTRUST Liquidity Fund by BlackRock, is scheduled to be launched July 1, 2018. Stay tuned for more information!

|

Financial Markets Update

~~~~~~~~~~~~~~~~~~~~~

Summary: In the fixed income markets, reversing the trend from February, intermediate and long-dated Treasury rates rallied throughout the month while front-end rates remained largely unchanged causing the curve to flatten. Credit spreads continued to be pressured from repatriation related selling and a general risk-off tone. Floating rate securities and securitized sectors priced off of swap spreads also struggled as LIBOR moved higher, driven by supply and demand dynamics and the repatriation of short-dated dollar credit. It is notable, that the advance of LIBOR was not the result of higher bank credit risk unlike previous market cycles. Despite economic data largely beating expectations, the effect on the market was muted, overshadowed by global tariff talks and volatility in the equity markets. International leaders unanimously renounced the United States' decision to impose $50 billion tariffs this month on Chinese goods, as well as the tariffs on steel and aluminum imports. In retaliation, China threatened to impose $3 billion tariffs on 128 US products inciting fears of a trade war. High personal turnover within the Trump administration did little to ease investors' concerns.

FOMC Meeting: As widely expected, the FOMC raised the target range for the federal funds rate by 25 bps to a new band of 1.5%-1.75% and signaled the need for a higher path of rates to prevent fiscal stimulus and a strong global growth from overheating the economy. The message was consistent with Powell's recent testimony, with the committee noting that "the economic outlook had strengthened in recent months." In the Summary of Economic Projections (SEP), the median funds rate assumption was revised up to 3.375% in 2020, with the longer-run rate revising up to 2.875%; however, with no changes to 2018. That leaves the actual funds rate further above the assumed longer-run level at the end of the forecast horizon. Growth was revised up and the unemployment rate down to 3.6% over the next three years. The median expectation for core inflation was revised up to 2.1% in 2019 and 2020, for the first time showing explicit overshooting.

4Q17 GDP: In the third estimate, US economy expanded 2.9% in the fourth quarter, better than the previously reported 2.5%. This upward revision was driven by household spending on services and a smaller than previously estimated drag from inventories.

Retail Sales: For the third straight month, US retail sales February slumped, down 0.1% for the month bringing the annualized number down to 4%, the lowest reading since August of last year. The estimate for the monthly reading was 0.4%. While tax cuts by now should increase disposable incomes and consumer confidence remains at all-time highs, it hasn't so far reflected consumer behavior.

February US Inflation: Both headline and core inflation for the month of February matched estimates, rising an equal 0.2%, respectively. This brought the annualized for headline inflation to 2.2% and core to 1.8%, respectively.

|

Performance (as of March 31, 2018)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1. CalTRUST Short-Term and Medium-Term and LAIF yields are net of fees. Merrill 1-5 Year Indexes are unmanaged; and do not reflect any deduction for administrative fees or expenses.

2. CalTRUST and LAIF returns are net of all investment advisor, administrative and program fees.

3. Annualized.

4. The CalTRUST Short-Term and Medium-Term portfolios commenced operations on February 13, 2005.

|

May 28, 2018

Closed for Trading

July 4, 2018

Closed for Trading

September 3, 2018

Closed for Trading

September 18-19, 2018

Board of Trustees Meeting

October 8, 2018

Closed for Trading

November 12, 2018

Closed for Trading

November 22, 2018

Closed for Trading

December 25, 2018

Closed for Trading

January 1, 2019

Closed for Trading

|

|

| |

|