Gordon T Long Research exclusively located at MATASII.com

| |

|

CENTRAL BANKS A CATALYST FOR A DERIVATIVE DEBACLE

We have yet to see the broad based market capitulation which normally occurs before a Bear Market ends. It is still ahead but fast approaching!

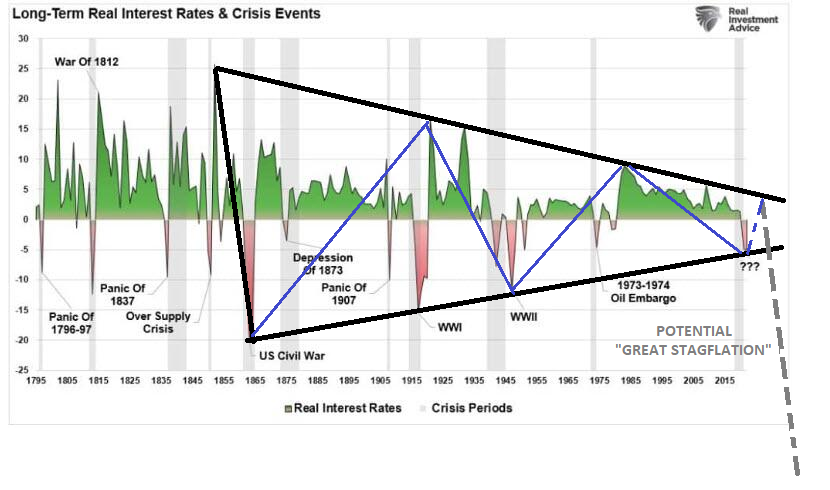

In this session we will outline what we expect and what you need to watch for. However, let me be perfectly clear. Though we are expecting an end to this Bear Market, it is only a leg within a much larger Bear Market. The legs of the current larger Bear Market are large enough to contain important intermediate Bull Markets (driven by Central Bank fallacies) within it. It is all about the coming "Great Stagflation".

The market gyrations we are expecting is driven by a 'Witch's Brew' of rapid, reactive and forced central bank "Regime Change".

| |

|

VIDEO PREVIEW (below)

Pay-Per-View Page Link

| |

THIS WEEK

ADD THE SWISS NATIONAL BANK

... to the previous visible cracking of the BOJ, BoE and just maybe Credit Suisse.

| |

|

=========

WHAT YOU NEED TO KNOW

- CAPITULATION COMETH!

- The global equity markets have yet to experience a Bear Market ending Capitulation. It is coming and will likely be triggered by Unintended Consequences within the Derivative complex, driven by Central Bank policy mistakes - the possibilities of which increase by the day.

- The FRA-OIS is rising rapidly to reflect increasing worries of hidden problems within the GSIB global banks. Credit Default Swaps for banks such as Credit Suisse have signaled where major problems might be hiding, as banks suspect something has broken somewhere and is being temporarily hidden.

- The BoE have unwittingly unearthed (likely as in 2000 & 2008 the first of many) a new Financial Engineering Derivative game called "LDI's".

- WHAT WILL TRIGGER THE CAPITULATION

- The Capitulation Trigger will result from a shock to the overlapping confluence of the following unstable financial engineering instruments within three financial sectors:

-

FIRST: Post 2008 Financial Crisis Developments in Financial Engineering & Hidden Derivatives within the Shadow Banking industry,

-

SECONDLY: Collateral Transformations & the Exploding Growth in the Reverse Repo Markets within the Lending and Banking Industry,

-

THIRDLY: Liability Driven Investments within the Pension and Insurance sector.

CATALYST FOR THE TRIGGER: CRACKING CENTRAL BANK POLICIES

-

BoE: A Flawed Mini Budget Triggers Pension Plan Chaos & BoE reaction

- BOE has been forced to pivot due to the government's Energy Response Fiscal Mini Budget Policy.

- The new Prime Minister Liz Truss's "Mini Budget" to combat expected coming winter energy prices has sent a shock wave through UK financial markets. Unintended Consequences are the order of the day!

- Many UK Pension funds have default concerns. The BoE is now implementing bail-out measures as Pensions are forced to unload gilt assets.

-

Swiss National Bank: Requires US Federal Reserve Bank to issue $6.3B Swap Line as the situation at Credit Suisse appears still unclear.

-

BOJ: Unable to hold YCC without sacrificing the YEN and hence creating mounting Japanese Inflation.

-

ECB: Overall EU situation only worsens daily.

-

PBOC: An Imploding Residential Housing Sector, Covid Lockdowns, Capital Formation Shortage & Capital Flight as well as weakening export demand and rising import costs have the PBOC in uncharacteristic turmoil.

-

Federal Reserve: Reverse Repos becoming Unmanageable at ~$2.3T and Terminal Fed Funds Rate now approaching 4.8%.

- CENTRAL BANKS NOT BUILT FOR SUPPLY SHORTAGES & POPULIST FISCAL POLICY

- Central Banks are about Demand not Supply, About Monetary Policy not Fiscal Policy!

- Central Banks have no control over Globalized Supply Chains nor Populist Fiscal Spending Policies.

- CONCLUSIONS

-

THE WITCH'S BREW: Unprecedented Rapid Destabilizing Regime Change will only worsen.

We have the scent of a looming Capitulation. Octobers are known as "Bear Market Killers!"

=========

| |

|

CAPITULATION COMETH!

We discussed the graphic to the right in this month's October LONGWave video.

This chart of Earnings Breadth goes back prior to the 2008 Financial Crisis. We see that during 2007 we had an extended period of anxiety, a downward trending market and weakening earnings breadth. This subsequently culminated in 2008 with a major thrust down as capitulation finally took hold.

We appear to have a similar set-up today that has taken most of 2022 to unfold. If it does, it would retrace the entire market movement associated with Quantitative Easing and actually end lower than our current expectations of a reversal on the S&P 500 in the area of 3270!

| |

|

|

WHAT WILL TRIGGER THE CAPITULATION?

SPIKING FRA-OIS RATES

The Money Central Banks are becoming highly cautious with their overnight lending to other banks. This is occurring on a global basis. The FRA-OIS tracking of the cost of lending is rising rapidly to reflect the perceived risk.

Something's going wrong in the market's pipes!

DANGER ZONES

Simply put, if the FRA-OIS spikes another 10-15 points, the Fed will have no choice but to emerge from its paralysis and reassure markets that the financial system isn't about to experience another paralysis.

| |

|

The FRA component of this spread essentially reflects interest rates demanded by banks with international risk to lend to each other (LiBOR), while OIS reflects overnight risk-free interest rates and is Fed Funds based. The FRA-OIS measures liquidity and will increase (the spread between the two rate swaps widens as markets get less liquid) when banks are uncomfortable loaning money to each other.

| |

The fear stems from within the following three areas of unregulated derivative engineering due to a shortage of unencumbered global collateral. | |

|

1- SHADOW BANKING & FINANCIAL LENDERS

As noted global financial expert Alasdair Macleod recently summarized:

- It should be noted that the phenomenal growth of OTC derivatives and regulated futures has been against a background of generally declining interest rates since the mid-eighties. That trend is now reversing, so we must expect the $600 trillion of global OTC derivatives and a further $100 trillion of futures to contract as banks reduce their derivative exposure. In the last two weeks, we have seen the consequences for the gilt market in London, warning us of other problem areas to come.

- Commercial banks are over-leveraged, with notable weak spots in the Eurozone, Japan, and the UK. It will be something of a miracle if banks in these jurisdictions manage to survive contracting bank credit and derivative blow-ups. If they are not prevented, even the better capitalized American banks might not be safe.

- Central banks are mandated to rescue the financial system in troubled times. However, we find that the ECB and its entire euro system of national central banks, the Bank of Japan, and the US Fed are all deeply in negative equity and in no condition to underwrite the financial system in this rising interest rate environment.

..... with CPI measures rising at a 10% clip, interest rates and bond yields will continue to rise until something breaks. So far, commercial banks are dumping financial assets to deleverage their balance sheets. The effects on listed securities are in plain sight. What is less appreciated, at least before LDI schemes threatened to collapse the UK’s gilt market, is that the $600 trillion OTC derivative market which grew on the back of a long-term trend of declining interest rates is now set to shrink as contracts go sour and banks refuse to novate them. That means that up to $600 trillion of notional credit is set to vanish, in what we might call the Great Unwind.

FINANCIAL ENGINEERRING - COMPLEX HIDDEN DERIVATIVE STRUCTURES

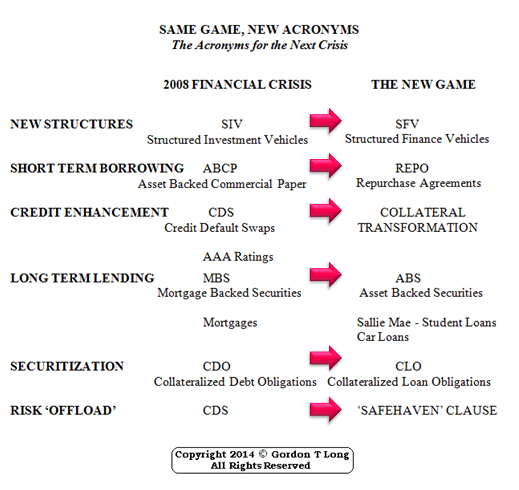

I developed this copyright graphic six years after the 2008 Financial Crisis to illustrate my research that the causes of the 2008 crisis had already been forgotten and more or less just papered over with new acronyms. There is little doubt that each year since newly engineered derivative instruments have been further layered on by clever Financial Lending Intermediaries and Shadow Bankers.

|  | |

2- FINANCIAL INTERMEDIARIES & GSIB's (GLOBALLY SYSTEMICALLY IMPORTANT BANKS)

The Central Banks contributed to the explosion in lending derivatives by fostering the ability to effectively "create collateral". The development of all sorts of "Collateral Transformation" methodologies have exploded. Additionally, the use of Reverse Repos has allowed the use of central bank collateral for lending.

COLLATERAL TRANSFORMATIONS & REVERSE REPOS

-

A Collateral Transformation is a type of transformation which involves a temporary exchange of less liquid forms of collateral for liquid collateral.

-

A Collateral transformation is a key part of central banks' liquidity insurance role in financial markets. Collateral transformation allows participating banks to temporarily exchange less liquid forms of collateral for collateral which is more liquid.

-

Collateral management is the process of two parties exchanging assets in order to reduce credit risk associated with any unsecured financial transactions between them. Such counterparties include banks, broker-dealers, insurance companies, hedge funds, pension funds, asset managers and large corporations.

| |

REVERSE REPO RATES (RRR)

Institutions are looking for overnight security, yield and liquidity.

The Fed's Reverse Repo Facility is exploding higher on both volumes and yield as risk continues to increase across financial market.

Reverse Repos pay lenders for their cash while supplying them with Treasury Collateral which is "Rehypothecated" endlessly and without regulatory control.

| |

The total DAILY PAYMENT to US and international banks (as well as various money market funds) amounts to just under $500M, an amount which will increase to roughly $550 million in three weeks when the Fed hikes rates by another 75bps to 4.00%.

| |

3- PENSIONS, INSURANCE & REINSURANCE

LDI - LIABILILITY DRIVEN INVESTMENT

LDI is but another acronym based on the same fundamental game - the mistaken perception and being able to effectively achieve RISK TRANSFER.

Developments shown above were only further advanced and running rampant without almost any regulatory monitoring when I subsequently discovered LDI's.

A 2017 CFA Institute article brought LDI's to light for myself as I conducted further research into the new developments in Financial Engineering (post 2008 Financial Crisis). I feature the research by Dan Tammas-Hastings, CFA below.

| |

Beyond Modern Portfolio Theory: Liability-Driven Investment Strategies

Posted In: Drivers of Value, Economics, Portfolio Management

The portfolio construction techniques popularized by modern portfolio theory (MPT) are not always practical. This is especially true for investors who are more concerned about unavoidable costs than asset optimization — in other words, a majority of the world’s savers.

First proposed in 1952 by Harry Markowitz, MPT reflected a different world, one in which retirement and long-term health-care costs were much lower than they are now. Today, a 65-year-old UK citizen today can expect to live a decade longer than one who retired 60 years ago, according to the UK Office of National Statistics.

Indeed, similar demographic trends are prevalent in almost all other developed economies as increasing wealth and advances in medical technology have lengthened life expectancy.

Incredibly elegant and beloved by finance academics, MPT is probably the most influential financial theory in use today. It rests on the foundation that risk-averse investors can construct portfolios to maximize expected returns based on a certain level of market risk. But elegant solutions aren’t always ideal, and by neglecting one side of an individual or pension plan’s balance sheet, MPT is only looking at half the problem.

Hence the recent focus on liability-driven investment (LDI) strategies, otherwise known as asset-liability management (ALM). More complete and holistic than MPT, LDI explicitly includes an investor’s current and future liabilities.

LDI requires more expertise in fixed income than the traditional approach, as the liabilities could be considered fixed-income instruments. This may be intimidating for pension fund trustees and advisers. After all, fixed-income investment and analysis can often seem counterintuitive: Many government securities yield negative returns, and most investment-grade bonds are expected to lag inflation, implying an expected loss of value. The need for rising equity markets is far easier to understand than fluctuating bond yields.

Nevertheless, there is a growing consensus in the wholesale capital markets that LDI creates better portfolios, particularly when it comes to retirement needs. I believe LDI should filter down to the retail market, both through LDI-style passive investing and active multi-asset class funds and through adviser and user education.

LDI requires accurate cash flows. A defined-benefit (DB) pension scheme is the classic example. But similar LDI frameworks are also being used for defined-contribution (DC) plans, where cash-flow needs are implicit rather than explicit.

The idea is that rational investors would not look to maximize real assets, subject to risk constraints — usually defined as volatility with total portfolio value. Rather they’d seek to maximize the economic surplus — subject to constraints on the variability of the surplus. This makes a difference because the volatility of the present value of the liabilities is related to the volatility of the funding status. It also shifts the focus of investors from equity prices to long-term treasury or government yields.

| |

UK Pension Protection Fund Assets and Liabilities | |

|

For example, falling bond yields have created pension fund deficits in the last five years despite benign market conditions with rising stock prices and limited portfolio impact from credit loss. Rising asset prices have not been enough to counteract the increase in liabilities for the UK Pension Protection Fund, as funding deficits have increased despite an equity bull market. This is due to under-hedging of the liabilities. The implication is that a focus on asset-price optimization may not be enough in a world of long-dated liabilities.

For investors with similar objectives, an LDI framework is a useful risk management tool. A better understanding of ALM will lead to enhanced risk-adjusted outcomes for more investors.

The popular MPT framework of expected value optimization given a risk constraint is ripe for disruption. Digital asset management or robo-advice can help distribute LDI technology to the mass market, and we can expect the industry to move in this direction.

According to Bloomberg this week:

- UK Defined Benefit Pensions that used derivatives as part of LDIs were vulnerable to a sharp move in gilts because they have to post collateral to cover mark-to-market moves.

- Mark-to-market losses on derivative positions related to liability-driven investment strategies may have reached £125 billion to £150 billion cumulatively since early August.

- Bank of England forced intervention to save the UK Pension System may be as high as £150 billion ($168 billion).

- The immense figure points to both the size of the UK pension market -- defined benefit plans had about £1.8 trillion of assets and £1.7 trillion of liabilities at the end of 2021 -- and the steepness of the move in gilts. The yield on 10-year UK government debt soared from below 2% in early August to above 4.5% this week.

- After a selloff triggered by unfunded tax cuts announced by the UK government late last month, pensions had to sell even more bonds, pushing prices down further and triggering more calls for collateral. The BOE then had to step in with a temporary bond buying program. Without that support “a large number of pooled LDI funds would have been left with negative net asset value and would have faced shortfalls in the collateral posted to banking counterparties.

LDI funds are typically leveraged TWO to FOUR TIMES!

| |

|

CENTRAL BANKS NOT BUILT FOR SUPPLY SHORTAGES & POPULIST FISCAL POLICY

SUPPLY SHORTAGES COUPLED WITH GOVERNMENT MMT SPENDING

The spike to the right was caused by excess fiscal spending against an environment of Global Supply Chain shortages. Simply put: "too much money chasing too few goods"!

The Fed is helpless to fix this problem other than to let it runs its coarse or force asset destruction through the likes of a recession.

Unfortunately the world is not allowing capitalism to work its magic of cleansing malinvestment and unleashing creative destruction. The world economies will highly likely force the Federal Reserve to "Pivot". Unfortunately, a Fed Pivot too soon brings into play the realities of the chart below.

| |

| |

As GoldFixSubstack keenly observed this week which many missed:

The Fed isn’t pivoting yet. The US Treasury is doing it for them on the heels of the UK’s temporary QE idiocy ..

.... the Fed may keep on hiking at least longer than we feel they should, but bail out the ones (banks, pensions, or industries) they deem worth saving. That is a pivot, even if they do not lower rates. Isn’t that what the UK just did?

In the last 48 hours:

-

DOLLAR WINDOW OPENS: Swiss National Bank this week drew nearly $6.3 billion from the U.S. Federal Reserve's currency swap line facility Oct 13th- RTRS

-

IMF FUNDING REQUEST: Yellen told a news conference that the Treasury has asked the U.S. Congress for permission to lend $21 billion in existing U.S. Special Drawing Rights (SDR) to IMF- Oct 14th- RTRS

-

QE DURING QT: U.S. Treasury asks major banks if it should buy back bonds- Oct 14th- RTRS

How is that any different than Pivoting? The effect is the same on markets if it happens. The only difference is monetary (Powell) policy works immediately, Fiscal ( Yellen) takes more time.

| |

|

CONCLUSION

A WITCH'S BREW

The graphic to the right illustrates the Unprecedented Rapid Destabilizing Regime Change we have been going through.

The problem from my perspective is that it is going to be quickly followed by another regime change!

That "PIVOT" change will be back towards the 2010 list but with some major differences highlighted below:

| |

|

- Instead of Monetary excess it will be Monetary & Fiscal Excess,

- Instead of Invisible Hand it will be Government Dictate,

- Instead of Deregulation it will Regulatory State,

- Instead of Globalization it will be De-Globalization & Nationalism,

- Instead of Stock Buybacks it will be Stock Issuances to reduce rising Debt burdens,

- Instead of Technology it will be Commodities,

- Instead of Credit it will be Collateral,

- Instead of Democracies it will be Regulatory States,

- Instead of Deflation it will be Stagflation.

| |

CURRENT MARKET PERSPECTIVE | |

|

THE WORST IS STILL IN FRONT OF US,

EXPECT ANOTHER SHORT TERM BEAR MARKET COUNTER RALLY ,

FADE THE UNFOLDING COUNTER RALLY - SELL THE RIPS.

| |

|

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

| |

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.

| |

MATASII'S STRATEGIC INVESTMENT INSIGHTS | |

2020 VIDEOS OUTLINING THE COMING RISE IN INFLATION & COMMODITY PRICES | |

|

RELEASED - 10-11-22

VIDEO: 35 Minutes with 62 supporting slides.

NEW RELEASES IMMEDIATELY AVAILABLE TO NON-SUBSCRIBERSON A PAY-PER-VIEW BASIS

$4.99

Pay-Per-View Page Link

| |

|

LINK: SUBSCRIBER LINK

TRANSCRIPTION: SUBSCRIBER LINK

| |

IDENTIFICATION OF HIGH PROBABILITY TARGET ZONES | |

Learn the HPTZ Methodology!

Identify areas of High Probability for market movements

Set up your charts with accurate Market Road Maps

Available at Amazon.com

| |

The Most Insightful Macro Analytics On The Web | |

PO Box 1224,

Norton, MA 02766

(508) 285 2213

| | | | | | |