|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

Jen's grandma raps about retirement!

|

*APY = Annual Percentage Yield. Rates as of 8/7/18 and are subject to change. Fees or other conditions could reduce the earnings on the account. A penalty may be imposed for withdrawals before maturity. See Cost Recovery Fee Schedule for more details.

|

President's Corner President's Corner

|

Items From the News Wire:

"The Kardashians Are Closing All DASH Stores"

"Ivanka Trump Is Shutting Down Her Fashion Brand"

"Toys R Us Shutters Its Doors in the U.S."

"Tesla Announces Cutting 9% of Their Workforce"

"Banks After Tax Cuts: Loan Growth Slows & 3,200 Jobs Disappear"

What do these headlines have in common? Aside from the celebrity-centric themes of a couple of the items, there is a strong indication we are not far away from a recession. Let's look at what we already know:

- Government debt is at an all-time high. The household debt to income ratio is currently 130%, which means the federal government spends $1.30 for every $1.00 in revenue received. It's impossible for regular people to maintain spending more than earning for more than a short period of time. Then again, regular people do not have the ability to print money like the federal government can. The problem with endlessly printing money is that if the larger investors (China and Japan, to name two) stop investing, the debt gravy train will crash.

- Corporate tax revenue is quickly declining. We can debate whether the tax cuts have been effective in growing the economy, but declining tax revenue is a leading indicator of a recession. By the way, if tax cuts are supposed to incentivize spending which in turn creates more income for businesses, then why are tax receipts lower? Just asking.

- Mortgage purchase applications are in decline. Building permits and new and existing home sales have declined over the past few months, according to Tom Slefinger at Balance Sheet Solutions. The primary cause for this decline is that home prices are unaffordable. To paraphrase Cher (played brilliantly by Alicia Silverstone) in the 1995 classic movie Clueless, "Duh."

- Inflation is rising, and workers are suffering. The I-word is rearing its ugly head. Mr. Slefinger observed that consumer prices are up 2.9% since last year, while wages for non-managerial workers are up 2.7%. Wages are not keeping up with consumer price increases; thus, the average worker is worse off than a year ago. If savings from the tax cuts are not going to the workers, where are they going? Answer: Stock dividends and buybacks, neither of which help workers.

- There is slow economic growth internationally. Contrary to popular belief within the Washington Beltway, the U.S. does not exist in a vacuum. We are very much affected by the economies of the other 192 countries in the world. During a 1953 congressional hearing, Charles Wilson, CEO of General Motors allegedly was quoted as saying, "As GM goes, so goes the nation." Today, that quote has been modified to "As (insert country here) goes, so goes (insert another country here)." Countries, big and small, are already experiencing economic slowdowns which are washing onto our shores.

What we don't know is why what we know is happening. Depending on one's political bent and which 24-hour news network they watch, we can blame the tax cuts, tariffs, higher interest rates, increased entitlement spending, or the New England Patriots. None of this matters. Recessions happen about every ten years, and we're overdue. They occur when it's most inconvenient, and many times the precursors are so subtle we don't feel it until we are totally engulfed. The next one is coming to your town soon, so hang on, batten down the hatches, and, as my mom always says, "Wear a sweater."

David M. Green

President/CEO

(925) 335-3802

|

Stat of the Month Stat of the Month

|

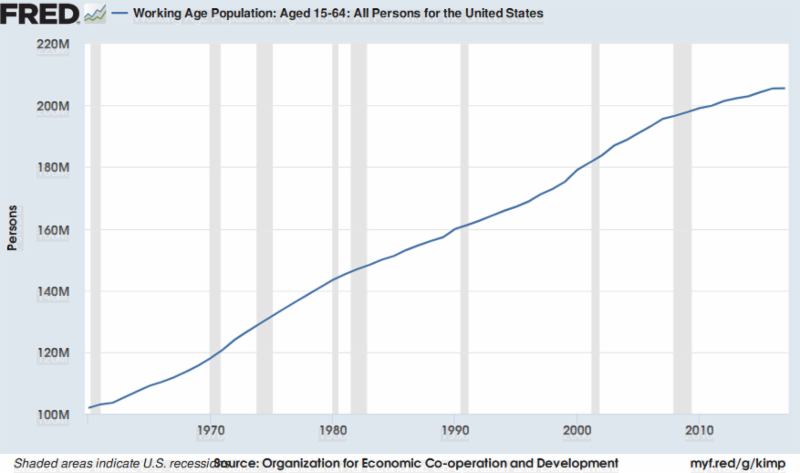

This graph represents the growth of the working age population aged 15-64 from 1960 through 2017. There has been a significant flattening of the curve in the last ten years. There were 205.5 million Americans of working age in 2017, an increase of 9.9 million since 2007. This compares to a growth rate 24.5 million between 1997 and 2007 and 16.5 million between 1987 and 1997. The fewer number of working age workers as the number of available jobs continue to increase has created a job vacuum in terms of number and skill set.

(FIVE ZERO ZERO FIVE FOUR NINE ZERO)

|

New Branch Now Open!

New Branch Now Open!

We are pleased to announce that

we have opened a new branch in the

Pittsburg Century Plaza next to Target

4261 Century Blvd., Pittsburg, CA 94565

We have closed our branch at 1870 A Street in Antioch.

Click

here for other convenient branch and

surcharge-free ATM locations near you.

If you have any questions, please contact us at 925-293-1785.

|

1st Alerts 1st Alerts

|

- If you have @ccessOnline Home Banking with us, you can transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

Hot Summer Night

Thanks to everyone who helped make our Q102.1 Hot Summer Night Concert sponsorship a big success! The folks at Q102.1 were great to work with, the event was awesome, and our onsite staff and support teams really pulled through for us. Thanks to everyone who stopped by our booth!

Note to self: HSN concert goers LOVE, LOVE, LOVE our fans - next year we'll bring even more!!

|

1: APR = Annual Percentage Rate. Loan amount and terms subject to approval; your rate may be different depending on loan amount, term, credit score and other factors. Your rate will be disclosed prior to funding. Daily periodic rate for 7.9% APR is .02165. Minimum payment on a 1st Line of credit with a limit up to $2,000.00 is $50.00 per month. Maximum limit is $20,000.00 with a minimum payment of $475.00. Rates are subject to change.

|

Why Americans Save Less in Good Times

By Jason Vitucci, CFP® & Gene A. Schnabel

One of the key indicators of economic growth, the gross domestic product (GDP), grew 4.1% in the second quarter - its best pace since 2014. Yet, according to the U.S. Bureau of Economic Analysis, consumers are saving less of their income now than before the recession.2 In addition, consumer debt has climbed to its highest level since the recession and continues to trend upward with nationwide credit card debt topping $1 trillion in 2018.3 More than a third of Americans don't have a savings account, only 39% of Americans say they could pay for a $1,000 expense out of their savings, and 44% say they couldn't pay for a $400 expense with cash.4

Despite this downward trend in personal savings, a recent Gallup survey found that 59% of Americans describe themselves as people who enjoy saving money rather than spending it.5 So, why the disparity between how Americans view their saving and spending habits and how much they're actually saving and spending?

One reason may be the gradual shift in household spending since the 1990s. A 2018 report on savings and spending trends indicates that Americans are spending more on housing and healthcare, and less on food, clothing and entertainment.6 As the cost of housing and healthcare continues to rise, a larger portion of household spending is directed toward these categories, reducing the amount of household income available to fund other essential (food, clothing, emergency savings) and non-essential (travel, entertainment) expenses.

Attitude may also play a role. That's because According to Bankrate chief financial analyst, Greg McBride, CFA, many Americans view savings as an optional activity. "This is particularly true when economic times are good and it's easiest to move the needle on savings - it's simply not given high priority," McBride said. "By the time households realize the need for savings, it is oftentimes in an economic environment where doing so is noticeably more difficult given rising joblessness, reduced income and deteriorating economic conditions."4

So, how can you buck the trend?

Establish a budget to get a handle on spending and savings. While it sounds basic, a budget is one of the most powerful tools available to create alignment between spending, saving and debt. A monthly budget can help you:

- Identify spending patterns as you track inflows and outflows

- Categorize and view essential vs. discretionary spending

- Identify areas to cut back if you're spending too much so you can increase savings

- Better manage debt and improve your credit score

- Gain the control and confidence you seek over your finances

Thanks to a broad range of free budgeting tools available online and via mobile apps, the heavy lifting is done for you - automatically. The following budget apps, which receive consistently high marks from users, offer different capabilities based on user needs and preferences:

Mint

- automatically updates and categorizes transactions, creating a picture of spending in real time. Users can add their own categories, pay bills, split ATM transactions into the purchases made with that cash, and set budgets that alert you when they start to top out. The service also comes with a free credit score.

NerdWallet

- provides complete view of your income, bills and transactions in one place so you know how much you have and exactly how you're spending it.

PocketGuard

-crunches the numbers so users can view how much money is left "in their pocket" for the day, week or month. Those who want to dial down further can track certain categories of spending, such as groceries, clothing or eating out, and lower their bills.

Once you're able to view where your money's going, it's much easier to make choices about what you're spending your money on, when it makes sense to delay nonessential purchases, and where you can save more to build wealth over time.

To learn more about how the financial planning process can help you define and implement your saving goals, contact our office today. We help our clients navigate through the confusing maze of financial issues as it relates to retirement planning. If you feel that we may be a good fit to work together, please don't hesitate to contact our office. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA

Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought.

2:

https://fred.stlouisfed.org/series/CDSP

3:

https://www.federalreserve.gov/releases/g19/current/default.htm

4:

https://www.bankrate.com/personal-finance/smart-money/why-people-are-saving-less-now/

5:

https://www.cnbc.com/2017/05/05/americans-say-they-prefer-saving-to-spending-but-few-actually-follow-through.html

6:

https://www.businessinsider.com/american-spending-how-it-has-changed-over-the-past-few-decades-2018-6

|

Insurance Tips Insurance Tips

|

Do You Have Collectibles?

If so, you may not want to rely on your Homeowners policy to protect your investment. There are a number of advantages to having a separate policy to cover your collection. A few of these advantages are:

- Covers your collection on an All-Risk Basis, including Fire, Theft, Earthquake, Flood & Accidental Breakage.

- Covered on an "Agreed Value" meaning it is insured for the full stated value.

- NO Deductible.

- Blanket coverage available on items with an individual value under $2000. Items over $2000 are specifically listed.

- Types of Collectibles includes: Stamps (Collectible - US & Foreign), Coins & Bullion (Modern, Ancient & Commemorative), Collectible Dinnerware/Stemware (Lenox, Waterford, etc) Comic Books, Trading Cards, Figurines, Dolls, Teddy Bears, Toys, Collector Plates, Ornaments, Animation Art, Sports memorabilia, Model Trains & Sets to name a few!

- Annual premium can be as low as $100/year

- Allows you to keep the "Loss Free" discount on your Homeowners policy.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, business, and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(SEVEN ZERO ZERO TWO ONE SIX EIGHT)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|