|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

A Day in the Life of Hugo.

Hugo calls the CEO of 1st Nor Cal.

|

President's Corner President's Corner

|

After Ebby Calvin ("Nuke") LaLoosh (played by Tim Robbins) pitched a perfect inning for the minor league Durham Bulls baseball team in 1988's Bull Durham, he sat next to his catcher, Crash Davis (played by Kevin Costner), and they had the following conversation:

Nuke

:

That was great, huh?

Crash

:

Your fastball's up, your curveball's hanging. In the Show, they would've ripped you.

Nuke

:

Can't you even let me enjoy the moment?

Crash

:

The moment's over.

"The moment's over" is the way many investors feel about now. After an unprecedented bull market following the worst economic downturn since the Great Depression of 1929, the stock market came crashing down faster than an old Las Vegas hotel. During one February week, almost $1 trillion of market value was wiped away.

The usual self-described stock market gurus showed up on every news and business channel to give their reasons for the "market correction." Some of the reasons given included major shareholder selling, negative economic news, high profile corporations failing to meet unofficial estimates (referred to as "whisper numbers"), declining Gross Domestic Product, revised tax policy, a new administration in the White House, and impending armed conflicts around the world.

There have always been short-term spurts of wild variances in the market, but at no time have we seen more of these wild highs and lows in the history of stock trading. The biggest factor that few talk about is automated trading systems. These systems allow mostly institutional traders to establish specific rules for buying the selling stock automatically executed via a computer. When a stock price gets to a certain price or a technical indicator reaches a specific level, the automated system will simultaneously trigger a trade.

The main advantage to such a system is that it minimizes emotions so that the trader cannot hesitate or question the trade. Secondly, the systems are consistent because the computer is executing the programmed trades. Thirdly, the order entry is made at the same time trade criteria are met, minimizing possible trading losses. Finally, the automated systems can spread risk over various investment instruments while creating a hedge against losing positions. This would be incredibly challenging for a human to accomplish this level of efficiency in a matter of milliseconds.

The biggest disadvantage, other than mechanical failures, is the oversubscription of programmed trades. In other words, if too many trades are automated, it creates larger and potentially more volatile swings in the market as we have recently experienced. According to Wikipedia, as of 2014, more than 75% of stock shares traded on U.S. exchanges originate from high-frequency programmed trading system orders.

That seems like a very big, to the point of being unwieldy, number. For those 25% who trade the old-fashioned way, well, the moment's over. By the time those trades are made, the market will have significantly shifted. That shift could mean the difference between trading at a profit or at a large loss.

The Financial Industry Regulatory Authority (FINRA), which regulates stockbrokers, and the Securities and Exchange Commission (SEC), which regulates publicly held companies, have instituted some restrictions of automated trading to minimize market fragility and volatility, but more needs to be done to keep up with the advancing technology in this area.

One simple thing average investors can do to minimize their downside risk is rather than invest in individual stocks, they can invest in mutual funds that already utilize programmed trading and automated portfolio rebalancing which is simple and effective. These steps can help reduce the "The moment's over" time by at least a few moments.

David M. Green

President/CEO

(925) 335-3802

|

Stat of the Month Stat of the Month

|

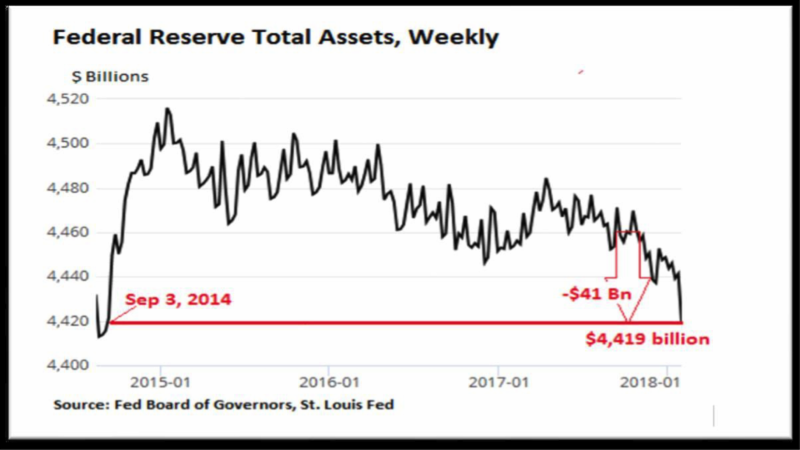

Federal Reserve Bank Total Assets by Week, 2014-18

The Fed is unwinding quantitative easing (QE) and normalizing its balance sheet. As announced in September, the Fed's plan was to shrink Treasury and mortgage-backed security (MBS) holdings by up to $10 billion per month in October, November and December 2017, then accelerate the pace every three months. In January, February and March 2018, the unwinding would be capped at $20 billion/month; in the second quarter, at $30 billion/month; $40 billion/month in the third quarter; and starting in the fourth quarter, at $50 billion/month.

According to this plan, Treasuries and MBS holdings will shrink by $420 billion in 2018, by an additional $600 billion in 2019, and by an additional $600 billion every year going forward until the Fed deems its holdings level "normal." As shown below, since the beginning of the QE unwind, total assets have dropped by $41 billion, the lowest since September 3, 2014.

(TWO EIGHT SEVEN NINE SIX)

|

New Branch Coming Soon! New Branch Coming Soon!

|

We are pleased to announce that we will be opening a new Pittsburg/Antioch branch in the near future. Please be informed that we will be closing the branch at 160 East 10th Street in Pittsburg effective April 16, 2018. In the interim, please feel free to visit our branch at 1870 A Street in Antioch, or any of our other branch locations.

These necessary changes will help us in fulfilling our commitment to providing the best member service experience. We thank you for your understanding. If you have any questions, please contact us at 925-293-1785.

|

1st Alerts 1st Alerts

|

- We upgraded @ccessOnline Home Banking! Learn more: www.1stnorcalcu.org/online-banking/upgrade

- Click here for information regarding the Equifax Breach.

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

Mini Motorland Mini Motorland

Join us at the 2018 Mini Motorland event in downtown Martinez on Saturday, March 24th from 10:00am - 12:00pm!

The Martinez Waterfront Amphitheater will be transformed into a child size interactive village, navigated by rideable toys, trikes and bikes. Mini motorists (age 2-5) will be able to stop for gas or food, go fishing, or run their vehicle through the car wash. Within the village, visit the florist, historical museum, craft shop, and face painters.

Don't forget to stop by the 1st Nor Cal booth!

For more info and to register, visit www.cityofmartinez.org or call (925) 372-3510.

|

We all love saving time and money.

|

Check out how simple it can be!

With a $400,000.00 Mortgage

30 year, fixed rate mortgage at

4.25% APR

2

has a principal and interest payment of

$1967.76

with finance charges estimated at

20 year, fixed rate mortgage at 3.875% APR

2

has a principal and interest payment of

$2397.66

and finance charges estimated at

$175,436.86

So for about $430.00 more per month, you can

Save 10 Years and around $133,000.00

in finance charges!

Call us today to save some

serious time and money!

(925) 335-3870

2: APR = Annual Percentage Rate. Mortgage amount, rates and terms are only examples and estimations.

Call our Mortgage Department at 925 335-3870 for actual costs. Example Quotes: 4.302% APR for 30 years and 3.946% APR for 20 years. Taxes and insurance are not included in these calculations. Rates cannot be guaranteed and are subject to change without notice. Loans subject to all policies and procedures. Quoted conforming rates are based on a loan amount of $400,000 with loan-to-value (LTV) not to exceed 75% of appraised value. There are no pre-payment penalties on these quotes.

1st Northern California Credit Union does not charge points.

1st Northern California Credit Union - NMLS ID # 580488

|

Scam of the Month Scam of the Month

|

Tax Identity Theft (Part 2)

This month's scam comes directly from the U.S. Department of the Treasury. The IRS has identified an existing scam in which cybercriminals have stolen client data from tax professionals and have filed fraudulent refunds using real taxpayer information, including bank account and routing information for direct deposit.

What is new is that the fraudster then contacts the taxpayer posing as an employee of a debt collection agency working on behalf of the IRS. They ask the taxpayer to take certain steps to return the refund, which actually goes to the criminals.

The IRS is advising taxpayers to contact their financial institution where the direct deposit was received and have them return the refund to the IRS. Taxpayers can contact the agency at their main number (800) 829-1040 for individual returns and (800) 829-4933 for business returns.

The IRS will never contact taxpayers by phone or by e-mail. Any such contact should be considered a scam and immediately purged.

|

|

Tips for Teens Tips for Teens

|

Spring Email Cleaning Spring Email Cleaning

Back in November, I received a newsletter in my email inbox. I probably signed up to receive these emails back when I thought 0.05% off $500 dollars was a good deal, so I read and deleted it, thinking that would be it for a while. Later that same week, another newsletter from the same store came in for a different set of deals. This time, I deleted it again but was both a little annoyed and a little surprised that they had sent two emails in the same week after a six month hiatus. That next weekend, I received a third email for a different set of deals! At this point, I was fairly annoyed for two reasons: one, I remember signing up the year before for that measly discount but only for the once a month frequency and two, it made me realize just how many unopened emails I had in my inbox. On top of the junk mail, there was last week's actual news still to be read, some satire news still needing to be laughed at, a couple of order confirmations and tracking numbers for items that I already received, and many more.

Email, as outdated as the concept may seem, is still the backbone of modern communication. Chances are, email is not your go-to method for daily communication, making it even easier for companies to use it as a data dump. But at the same time, things like password reset links, eStatements, or acceptance letters most likely won't be sent by text message. The fact of the matter is that email is still one of the more secure methods of communication. It's our digital key to reset just about everything else.

With that said, email shouldn't be a place where advertisers have a direct link to your pocket. It should be a place where only the services you've signed up for get to you and the advertisements are filtered in an unobtrusive manner. I made some changes to my email settings and since then, the number of companies sending me ads and distracting me from my important emails has dropped to basically nothing, while the ones I care about are filtered into a particular folder for whenever I have time to take a peak.

In the end, nothing is more important than privacy, which was a lesson hard-learned. To this day, the Prince of Nigeria is still asking me for help with transferring funds. As annoying as these emails are, there is nothing I can do to stop receiving them. For these reasons, take a moment and reflect on whether adding your email address to that mailing list is really necessary, because you don't know where it could end up.

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Insurance Tips Insurance Tips

|

Are You Really Protected?

Whether it's a serious at-fault auto accident or an incident on your property, you can quickly find yourself responsible for damages that exceed the limits on your Auto, Homeowners, Renters, Rental Property or Boat policy. An expensive judgement is the last thing you want to worry about. A Personal Umbrella policy can help protect your assets and provide peace of mind. The purpose of a Personal Umbrella is to provide Liability coverage over and above your Auto, Home, Boat, Rental Property and any other Personal Liability coverage you have already. Many financial planners recommend that everyone have at least a $1 Million Personal Umbrella policy, even if they have less than $1M in assets. The reason being that in the rare event that you are sued, you could be forced to pay a legal judgement from not only your current assets but also your future earnings. This policy can also pay for defense costs which add up very quickly, even if you win your case.

Umbrella policies come in increments of $1,000,000. and policies start at around $200.per year. This goes a long way to protect your personal finances against judgments from a devastating lawsuit. When deciding on a limit, it should exceed your net worth. Shouldn't you look into a Personal Umbrella today?

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, umbrella, earthquake, flood, business and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

Disability and Your Finances: How It Can Affect Your Savings and Retirement Goals

By Jason Vitucci, CFP® & Gene A. Schnabel

The Social Security Disability Insurance program paid out $142.8 billion in benefits in 2016. And with a rush of new applicants lining up each year, the system is expected to exhaust its reserves at the end of 2034 if changes aren't made.1

Rather than depending on a government program to protect their income in the event of a disability, many individuals prefer to protect themselves with personal disability insurance.2

Disability insurance provides protection by replacing a portion of your income, usually between 50% and 70%, if you become disabled as the result of an injury or illness. This type of safeguard may have considerable benefits since a disability can be a two-fold financial problem. Those who become disabled often find they are unable to work and are also saddled with unexpected medical expenses.

What About Workers' Comp?

Many people think of workers' compensation as a disability safety net. But workers compensation pays benefits only to individuals who become disabled while at work. If your disability is the result of a car accident or other off-the-job activity, you may not qualify for workers compensation.

Even with workers compensation, each state makes its own rules about payment and benefits, so coverage may vary considerably. It might make sense to find out what your state offers and plan to supplement coverage on your own, if necessary, especially if you have a high-risk profession. Likewise, if you have an active lifestyle that puts you at a higher risk of disability, considering an extra layer of protection may be an option.

If you become disabled, personal disability insurance can be structured to pay a benefit weekly or monthly. And benefits are not taxable, if you have paid the premiums in full.2

When you purchase a policy, you may be able to tailor coverage to suit your needs. For example, you might be able to adjust benefits or elimination periods. You might opt for comprehensive protection or decide to define coverage more specifically. Some policies also offer partial disability coverage, cost-of-living adjustments, residual benefits, survivor benefits, and pension supplements. Since coverage is designed to replace income, most people choose to purchase protection only during their working years.

Even as changes are made to federal disability programs, they typically provide only modest supplemental income, and qualifying can be difficult. If you don't want to rely solely on Uncle Sam in the event of an unforeseen accident or illness, disability insurance may be a good way to protect your income and savings.

Out of Commission

According to the most recent data available, about 18% of working-age disabled Americans are employed, compared with 65% of working-age non-disabled Americans.

We help our clients navigate through the confusing maze of financial issues as it relates to financial planning. If you feel that we may be a good fit to work together, please don't hesitate to contact our office. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. Our next Retirement Workshop will be held on Saturday, March 24th at Contra Costa Country Club. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

- Social Security Administration, 2017

- The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Federal and state laws and regulations are subject to change, which would have an impact on after-tax investment returns. Please consult legal or tax professionals for specific information regarding your individual situation.

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(SIX NINE EIGHT SEVEN FOUR)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|