Financial Tip

What legacy do you want to leave? It might be time to start thinking about what impact you want to have when you're gone.

I am so excited to be able to offer my clients, one more Unique Planning Experience, with the new Assante's Charitable Giving Program. This program allows you to incorporate philanthropic giving into your wealth plan with the use of donor-advised funds through Benefaction, a registered charitable public foundation.

In addition to creating a wealth plan that has a meaningful impact, the Charitable Giving Program offers:

- Tax savings, particularly for families and business owners.

- Legacy planning and the opportunity to include next-generation family members in the wealth planning process.

- Enhanced meaning for the future.

Want to learn more about Leaving a Legacy, listen to my video

here .

Want to hear directly from a Legacy expert, check out our Wealth Planning call on Aug. 8th (details below.)

|

Wealth Matters Webcast

Mark your calendars for the next session of Wealth Matters on Wednesday, August 8 at 2 p.m. ET.

Mark your calendars for the next session of Wealth Matters on Wednesday, August 8 at 2 p.m. ET.

*Legacy planning. How it ties into your overall Wealth Plan.

*Investment & Market Outlook.

|

Change is the one True Constant.

The financial services industry has certainly seen things change faster in the past few years.

We have been inundated with new product, and many company changes over the past 24 months.

Now, there are 28 different ETF (Exchange Traded Fund) providers in Canada, and many more ETF's trade on the TSX than individual stocks. It reminds me of the old Bruce Springsteen quote: 57 Channels and Nothing On. More choice is great, but when there's too much to choose from, it makes any choice overwhelming.

For some of you, who may simply be questioning a holding on your statement, here are the key changes of late:

Front St. Mutual Funds, changed to Redwood and then to Purpose.

Powershares, and Trimark are all now under Invesco. This includes the funds and the ETF's.

Sprott is now Ninepoint.

Can't find something, maybe we can help.

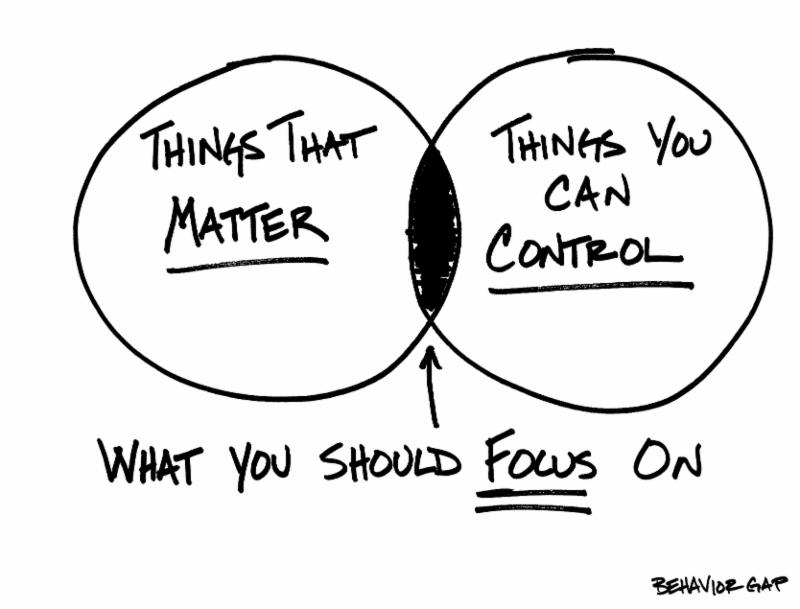

Carl Richards

|

|

Primary Residence - Summer Vacations make us think of Air BnB. But before you rent out your house, understand any financial impact.

|

|

Guide For Business Owners:

A strategy to maximize personal financial security upon the transfer of business ownership

What is Business Succession Planning?

The Process of determining how you are going got transfer your business ownership and transition out of a business management role, while maximizing your personal financial security

This helpful resource guide determines:

- The Steps needed to arrive at a workable succession plan

- The Type of advisory team you'll need to build a succession plan

- The pros and cons of family succession

- The role of business might play in funding your retirement

- The best way to ensure the financial security of both you and your business if unforeseen events such as disability and death occur.

Working with specialist we can determine your business succession plan

|

Interest rates in Canada and the U.S. are expected to head higher over the next two to three years. What are the portfolio managers mandate when investing.

|

.

Thank you to all that have contributed to the charitable cause! I had fun on the Big Bike in June, in Richmond Hill. My team was the largest fundraiser community team in York Region.

"For the investor who knows what he is doing, volatility creates opportunity".

John Train

Wishing you all a beautiful summer, to spend time to relax, rejuvenate and enjoy your family and friends.

Sincerely,

Janine Purves, CFP® , CPCA, CCS

|

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd.

Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada

Assante is an indirect, wholly-owned subsidiary of CI Financial Corp. ("CI"). The principal business of CI is the management, marketing, distribution and administration of mutual funds, segregated funds and other fee-earning investment products for Canadian investors through its wholly-owned subsidiary CI Investments Inc. If you invest in CI products, CI will, through its ownership of subsidiaries, earn ongoing asset management fees in accordance with applicable prospectus or other offering documents.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus and consult your Assante Advisor before investing.

|

|

|

Dates to Remember

August 8: Wealth Matters Webcast

August 15:

Richmond Hill Board of Trade Summer Party and Annual General Meeting

Aug 21-30:

Janine Vacation. Staff still accessible

September 3:

Labour Day

September 12: Portraits of Giving Richmond Hill,

September 15:

3rd Personal Tax installment due

September 19:

Downsizing Seminar

Thornhill. Message if interested

September 20:

Tax and Estate Seminar

September 26:

Downsizing Seminar

Markham Message if interested

October 14, 2018

The Joy of Aging-2018.

10th Anniversary Celebration

October 18:

Downsizing Seminar

Richmond Hill Message if interested

October 24:

Downsizing Seminar

Aurora

|

|

|

Janine Purves

Senior Financial Advisor

Assante Capital Management Ltd.

Ph (905) 707-5220

Fax (905) 707-1035

9130 Leslie St.,

Suite 302,

Richmond Hill,

ON L4B 0B9

Follow Me On

|

|

|