|

|

HSB Insider's Perspective

By Will Johnson

Dear Friends,

The new and improved South Carolina job tax credits could turn otherwise unviable projects into prudent investments. Yes, you read that correctly. After years of advising companies that what appears to be an eye-popping amount of job tax credits is probably not that valuable in practical terms (often due to good reasons such as our state's income tax apportionment methodology), I have to reassess following the passage of South Carolina Act 83 (2019), as interpreted by recently issued draft guidance from the South Carolina Department of Revenue.

South Carolina Act 83 increased job tax credits from $4,250 to $20,250 per job per year for five years in Tier III counties and from $8,000 to $25,000 per job per year for five years in Tier IV counties.

T

he South Carolina Department of Revenue issued Revenue Ruling 19-11 on December 11, 2019, and it provides that the increased credit amounts apply for jobs created in tax years beginning on January 1, 2019 or later.

If a company created the initial jobs triggering eligibility for job tax credits in a prior year, the initial jobs would continue to generate the lower credit amounts. However, any additional jobs created in tax years beginning on or after January 1, 2019, and within the five-year eligibility period, would earn the higher credit amounts.

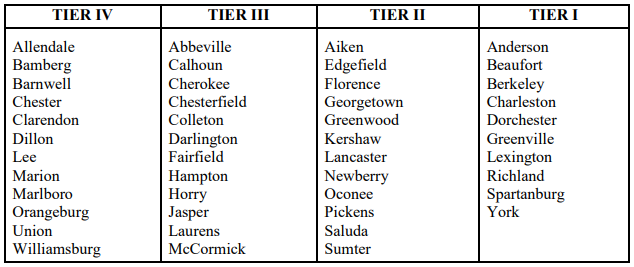

For 2020, Tier III counties are Abbeville, Calhoun, Cherokee, Chesterfield, Colleton, Darlington, Fairfield, Hampton, Horry, Jasper, Laurens (new) and McCormick. Tier IV counties are Allendale, Bamberg, Barnwell, Chester, Clarendon, Dillon, Lee, Marion, Marlboro, Orangeburg, Union and Williamsburg. Please see below for a full list.

In order to earn job tax credits, a taxpayer must be a qualifying business. Generally, this means that a taxpayer must be one of the following types of businesses: manufacturing, tourism, processing, warehousing, distribution, research and development, corporate office, qualifying service-related facility, agribusiness, extraordinary retail establishment, professional sports team, qualifying technology intensive facility, or bank (each type of business is subject to eligibility criteria, including fairly strict criteria for corporate office projects, qualifying service-related facilities, extraordinary retail establishments and professional sports teams). Any qualifying business creating a threshold number of new jobs can claim job tax credits. Typically, projects must generate a net increase of ten full-time jobs in a county in a single tax year based on monthly averaging, although certain small businesses with 99 or fewer employees may earn job tax credits with only a net increase of two full-time jobs in a single tax year. Two half-time jobs (requiring 20 hours or more per week) count as one full-time job for purposes of the job tax credit program.

Once a project qualifies based on the single-year increase, any further new jobs created in the next five years also generate credits. For those projects in Tier III and Tier IV counties, the prospects of job tax credits just got a lot more valuable! For Tier IV counties, retail facilities and service-related industries are also eligible, so the potential for projects with actual, eye-popping amounts of job tax credits has become much more significant.

Notwithstanding these changes, job tax credits are still limited to 50% of a taxpayer's South Carolina income tax liability for any particular tax year, with unused amounts carried forward for up to 15 years. While I have heard a number of site consultants refer to other states that have made job tax credits refundable, I do not see South Carolina taking that leap in the near future. For manufacturers, because of our state's single sales factor for income tax apportionment, South Carolina income tax liability tends to be relatively small. As a result, I would submit that the biggest potential benefactors of the enhanced job tax credits under Act No. 83 are retailers and service-related facilities in Tier IV counties with significant South Carolina income tax liability. Developers considering such projects, taxpayers meeting that description with an interest in expanding in Tier IV counties, and local economic development officials in Tier IV counties seeking investments from retail and service-related facilities would be wise to review and understand the tremendous potential presented by Act 83's changes to the South Carolina job tax credit program.

To illustrate the potential of job tax credits after Act 83, consider a hotel operator that is evaluating a new hotel project in Marion County to capitalize on the county's proximity to the coast and historic sites. The project would create 12 new, full-time jobs. Because Marion County is a Tier IV county, a retail or service-related facility is an eligible business. Based on the new credit amounts, this project would generate $300,000 per year in South Carolina job tax credits. Marion County could actually incorporate the project into a multi-county park and increase the credits by $1,000 per job per year for a total of $312,000 per year for five years. Over a five-year period, the project could generate a whopping $1,560,000 in job tax credits. Remember, the underlying taxpayer can only use job tax credits of up to 50% of income tax liability for any single tax year (with a 15-year carry-forward

), but if the credits can be utilized, they could offset a significant amount of start-up costs and turn a project that has been sitting on the sidelines into an investment that suddenly looks a lot more attractive.

Have you encountered projects that are intrigued by the new possibilities for job tax credits after Act 83? Are you in a Tier III and Tier IV county, and are you hoping to attract businesses that might benefit from the significant increases in credit amounts? Are you associated with a project that created jobs in prior years but may not have recognized the opportunity to utilize job tax credits? If so, please feel free to contact a member of the Haynsworth Sinkler Boyd economic development team. We would love to talk through the intriguing possibilities that the new and improved South Carolina job tax credit program has to offer.

|

2020 County Tiers Set for JTCs and JDCs

Each year, South Carolina's 46 counties are designated as being within one of four "tiers" for job tax credit and job development credit purposes based on a county's unemployment rate and per capita income. The SC Department of Revenue has published the new "tier" designations for South Carolina counties for 2020. The following counties received a new tier designation:

The following is a complete list of counties and their respective tier for 2020:

Please contact us for more information on job development credits and job tax credits.

|

|

Port Volume Cargo Credit

South Carolina Code § 12-6-3375 provides a tax credit to a taxpayer engaged in manufacturing, warehousing or distribution that uses South Carolina port facilities and increases its port cargo volume at these facilities by at least 15% in a calendar year over its base year port cargo volume. Form TC-30, "Port Cargo Volume Increase," is used to claim the credit. It is important to note that tax

credit applications should be submitted early in the year as the maximum amount that all taxpayers may claim pursuant to this section is subject to an annual cap. Please contact a member of the ED team if you have questions.

|

|

New Agricultural Tax Credit

South Carolina introduced a new program in 2018 which provides a tax credit to agribusiness or agricultural packaging operations increasing their purchases of South Carolina agricultural products. If the "base year" of a company's purchases exceeded $100,000, and the company increased such purchases by at least 15%, the company can submit an application for credits against either income or withholding taxes. The amount of the credits is determined by the South Carolina Coordinating Council, based on the information provided in the application. The credit may not exceed $100,000 per taxpayer in any one year. As with port cargo volume credits, these credits are also subject to an annual, statewide cap, so qualifying taxpayers should apply for credits as early in the year as possible.

|

|

Final Regulations on Opportunity Zones Published

On December 19, 2019 the IRS published its final regulations on Opportunity Zones. The final regulations were taxpayer-friendly as they provide quite a bit of flexibility that was not present in the proposed regulations. Specifically, the final regulations made it easier for taxpayers to get money in and out of Opportunity Zone investments, and created leniency in the "substantial improvement" area. The IRS, however, tightened up the rules regarding related party transactions. Please visit our website for a detailed overview of the regulations and contact us if you have any questions about Opportunity Zones.

|

|

|

|

|