Economic Trends

April 2020

|

Creighton Institute for Economic Inquiry

|

Greetings!

Welcome to our April report covering results from Creighton's two March economic surveys.

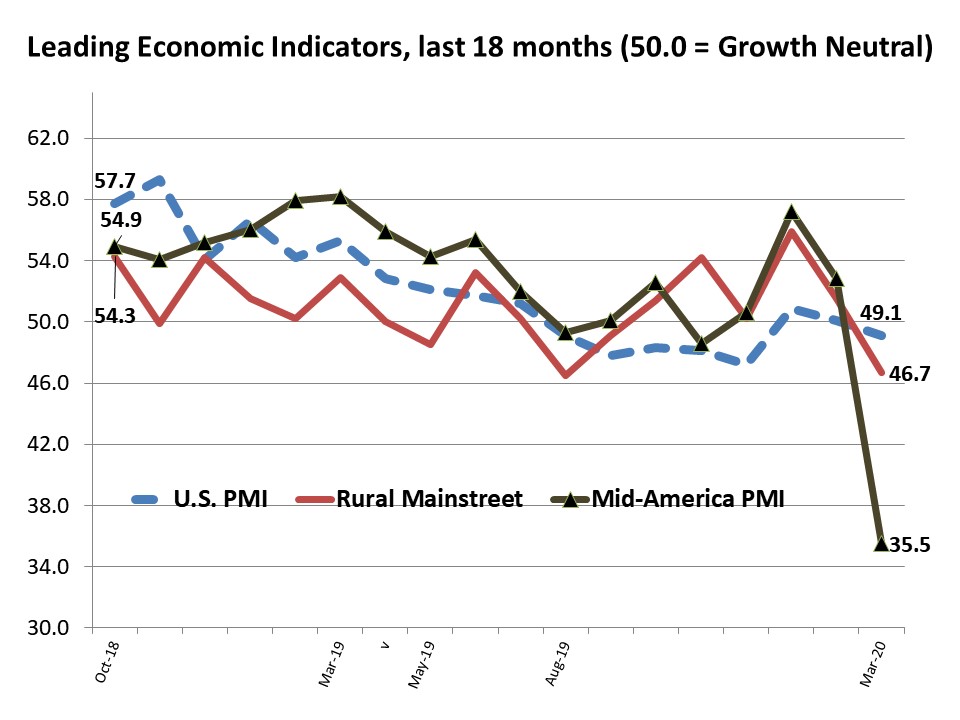

Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating deteriorating and negative manufacturing growth with modest inflationary pressures. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states indicates the Rural Mainstreet Index (RMI) took its largest one month decline since beginning the survey in 2006.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

The Federal Rescue Plan, and Modern Monetary Theory: MMT Assumes Debt No Longer Matters

In March, Congress passed, and the President signed, the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The Act calls for $2 trillion in added federal spending aimed at combating the negative economic impacts of COVID-19.

This package will add on to the already mammoth $1.25 trillion 2020 federal deficit. With 2020 forecasts of a 20% decline in GDP, total federal public debt for the year soars to 150.2% of GDP. This is an increase from 2019's record of 105.2%.

But who ultimately pays for the interest and principal on this debt?

There are only three outcomes, all negative, from this unrestrained spending: 1) higher taxes, 2) elevated inflation, or 3) rising interest rates.

Disagreeing, the so-called modern monetary theorists (MMT), as apologists for excessive government, argue that sovereign governments do not need to borrow or raise taxes since the sovereign can print more fiat money. That is the money is simply dollars the government put into the economy, and did not tax back. The Green New Dealers have embraced this vapid so-called model to support their proposed rapidly expanding federal spending programs.

The U.S. Federal Reserve appears to have embraced MMT by buying and holding more than $4 trillion in U.S. federal debt in the 2008-09 recession. In March and April of 2020 accompanying CARES, the Fed pledged to purchase as much government-backed debt as needed to bolster bond markets. That is, they will support whatever deficit spending is approved by Congress and the President.

This action termed monetizing the debt, unless reversed after the downturn, results in large increases in the money supply with the ultimate outcome of higher inflation and elevated nominal interest rates. To quote Nobel prize winning economist Milton Friedman, "Inflation is always and everywhere a monetary phenomenon...."

After the last recession, the Fed maintained most of its recession purchased U.S. Treasury bonds only to add to them in 2020. Post-2020 Pandemic, the Fed must jettison a high share of these bonds. Otherwise, contrary to MMT, future generations will pick up the tab with rapid inflation ala Venezuela.

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Business Confidence Falls to Record Low:

More Than One-Third of Manufacturers Switched to Domestic Vendors

|

|

|

March 2020 Mid-America Business Conditions Index

|

- The Business Conditions Index plummeted below growth neutral for the month.

- Almost two-thirds of supply managers reported that the coronavirus produced shipping problems to and from vendors.

- Employment index fell to its lowest level in 10 years.

- Business confidence plunged to a record low.

- More than half, or 54.3% indicated that the virus had increased worker absences for the month.

- More than one-third, or 34.2%, of manufacturers switched to a domestic vendor

|

Rural Mainstreet

Record Fall for the March Rural Mainstreet Index:

6 of 10 Bank CEOs Expect Recession from Coronavirus

March survey results at a glance:

- Overall index fell well below growth neutral taking its biggest one month decline since beginning the survey in January 2006

- More than 6 of 10 bank CEOs expect the coronavirus to push their local area into a recession.

- Approximately 14.3% of banks reported an increase in staff absences due to the coronavirus.

- More than half of bankers indicated their bank had a disaster plan to deal with the coronavirus, while 29% reported their bank was developing such a plan.

- The regional confidence index took its greatest one month decline since the survey was initiated in 2006.

|

|

The Outlook

Professor Goss' Forecast - March 2020:

- Expect Annualized GDP growth to be negative for Q1 and Q2, 2020.

- The annualized Consumer Price Index will move below 1% in the first half of 2020.

- The Federal Reserve Open Market Committee (FOMC) will maintain current 0% - ¼% for 2020 and well into 2021.

- Inflationary pressures should soar in latter half of 2021

The Organisation for Economic Co-operation and Development (OECD) Outlook- March 2020 - Excerpt from

"CORONAVIRUS: THE WORLD ECONOMY AT RISK."

- "The coronavirus (COVID-19) outbreak has already brought considerable human suffering and major economic disruption. Output contractions in China are being felt around the world, reflecting the key and rising role China has in global supply chains, travel and commodity markets. Subsequent outbreaks in other economies are having similar effects, albeit on a smaller scale. Growth prospects remain highly uncertain.

- On the assumption that the epidemic peaks in China in the first quarter of 2020 and outbreaks in other countries prove mild and contained, global growth could be lowered by around ½ percentage point this year relative to that expected in the November 2019 Economic Outlook.

- Accordingly, annual global GDP growth is projected to drop to 2.4% in 2020 as a whole, from an already weak 2.9% in 2019, with growth possibly even being negative in the first quarter of 2020.

- A longer lasting and more intensive coronavirus outbreak, spreading widely throughout the Asia-Pacific region, Europe and North America, would weaken prospects considerably. In this event, global growth could drop to 1½ per cent in 2020, half the rate projected prior to the virus outbreak."

|

|

Opportunities

- The Case-Shiller home price index for January rose 3.1% from 12 months earlier. Because of the two-month lag in the data included in the price index, the effects of the coronavirus pandemic on the housing market were not yet reflected in the data.

- The Dow-Jones Industrial average of 30 industrial stocks dropped by 36.7% between January 29, 2020 and March 23, 2020. However, since that 2020 low, the index has risen by 23.5%.

Bad News

- The U.S. economy lost 701,000 jobs in March as the unemployment rate rose to 4.4% from 3.5% in February.

- U.S. job openings for March fell by 130,000.

- Creighton's Mid-American employment gauge fell below growth neutral for the fifth time in the last seven months.

- As a measure of soaring risks in the U.S. economy from the coronavirus, the yield on the 10-year U.S. Treasury bond sank to record lows in March.

|

|

|

|

9-State

Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

10 million to 200 million

Since the arrival of COVID-19 on U.S. shores, the number of daily active meeting participants has soared from 10 million to 200 million.

Even so, the Zoom's

(ZM) stock price has fallen by 24.5% since peaking on

March 31, 2020. It is still an expensive stock.

|

Goss Eggs

Recent Dumb

Economic Moves

On January 14, the World Health Organization (WHO) tweeted, "Preliminary investigations conducted by the Chinese authorities have found no clear evidence of human-to-human transmission." Tedros Ghebreyesus, WHO director-general stated on January 30, "The Chinese government is to be congratulated for the extraordinary measures it has taken." A University of Southampton study indicated that the number of Covid-19 cases could have been reduced by 95% if the Chinese had moved to contain the virus three weeks earlier.

WHAT is WHO doing with the 22% of its budget furnished by the U.S.?

|

|

Keep an Eye on ...

U.S. BLS's May jobs report for April

On May 8, the BLS releases the number of jobs lost or gained for April. I expected job losses of more than 500,000 for the month. These will be the largest losses for any two consecutive months since August & September 1945.

_ _ _

U.S. Bureau of Labor's weekly initial claims data

Released every Thursday, this is the earliest reading on the U.S. and state labor markets. A multi-millions in losses are expected.

_ _ _

Yield on 10-Year U.S. Treasury bond

Find instantaneously, at finance.yahoo.com.

Watch for this yield to rise back above 1.5% to signal coronavirus impacts waning.

Right now, that yield is pointing to soaring risks, and a deep U.S. recession for 2020.

|

|