Economic Trends

August 2020 | Creighton Institute for Economic Inquiry

|

Greetings!

Welcome to our August report covering results from Creighton's two July economic surveys.

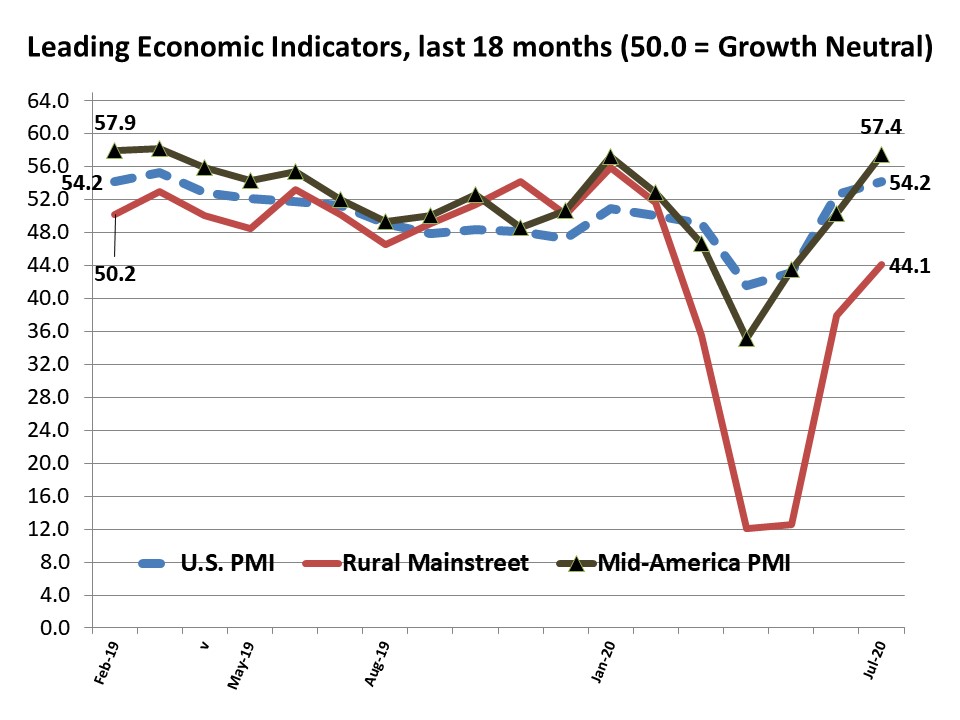

Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating that the negatives are getting less negative with potential growth ahead. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states climbed modestly from June's weak reading and April's record low index. However, the overall index remains well below growth neutral.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

Lockdowns Slow the Economy and COVID-19 Deaths

According to the Washington Post, New Jersey and New York

currently impose some of the most restrictive requirements for business re-openings from the coronavirus in the U.S. At the other end of the closure spectrum, the Post ranks Florida and Georgia as having what they term "minor" restrictions for business re-openings.

How have these contrasting approaches influenced economic outcomes and COVID-19 death rates since Georgia opened its economy on April 24 and Florida opened on May 4? The accompanying table provides insight into that question listing economic metrics that summarize the impacts of restrictions.

Unemployment and job impacts.

Post-May 1 openings data for the economies of Florida and Georgia compared to that of New Jersey and New York show clearly the economic costs to citizens of New Jersey and New York from the shutdowns in terms of the labor force. Since opening, unemployment rates have fallen by 2.8% for Florida and 4.3% for Georgia. During this same period-of-time, jobless rates have actually risen by 0.5% for both New Jersey and New York.

Since May 1, the number of unemployed plummeted by 19.9% for Florida, and by 34% for Georgia. In stark contrast, the number of jobless rose by 5.1% for the Garden State, and by 7.5% for the Empire State. Furthermore, data show that both Florida's and Georgia's rates of job gains were between two and three times that of New Jersey and New York.

COVID-19 Death Rates and Impacts

As presented in Table 1, COVID-19 deaths-per-million state residents have been steadily falling in the two lockdown states, New Jersey and New York, but expanding in the open economy states of Florida and Georgia.

COVID-19 data indicate that coronavirus deaths for New Jersey (population 8.9 million) and New York (population 8.4 million) began the period with significantly higher death rates that have consistently declined since May 1. On the other hand, coronavirus death rates for Florida (21.5 million) and Georgia (population 10.6 million) began the period with much lower rates that have expanded since economic opening.

Two questions not addressed by this admittedly superficial analysis remain: 1) Will the ultimate openings of the New Jersey and New York economies reignite COVID-19 deaths in the states as they have in Europe? 2) Do the economic shutdowns in New Jersey and New York generate non-COVID-19 deaths and illnesses (e.g. suicides from job losses and business bankruptcies) that exceed closure life-saving?

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Index Highest Since March 2019:

But Employment Losses Continue

|

| |

July 2020 Mid-America Business Conditions Index

|

July survey highlights:

- Driven by higher new orders, the Business Conditions Index expanded to its peak reading since March 2019.

- Manufacturing job losses continue for the region. According to the latest jobs data, the region has lost almost 90,000 manufacturing jobs (5.8%) since the COVID-19 onset.

- Reported impacts of COVID-19 for July

- Eight of 10 supply managers detailed negative overall impacts.

- Approximately 55% reported job reductions compared to April's 49%.

- Worker absences have declined 13% since April.

- Seven of 10 supply managers reported shipping problems.

- Business confidence rose to its best reading since April 2018.

|

Rural Mainstreet

Index Climbs for July:

Bankers Expect Farm Loan Defaults to Rise 5%

July survey results at a glance:

- Overall index advanced to a weak level and remained below pre-COVID-19 levels.

- Compared to June economic conditions in their area, approximately 6% of bank CEOs reported improvements, while 18% detailed deterioration.

- This month, bankers estimated that farm loan defaults would rise by 5% over the next 12 months. This is up slightly from 4.8% registered one year ago.

- Approximately 38% of bankers reported a decline in customer visits due to the coronavirus.

- Employment for Rural Mainstreet economy was down by 372,000, or 8.5% compared to pre-COVID-19 levels.

|

|

The Outlook

Professor Goss' Forecast - August 2020:

- Inflation, interest rates and tax rates will rise significantly as early as the second half of 2021.

- Gold and silver prices will continue to move higher, but at a slower pace for the remainder of 2021.

- The U.S. economic recovery will not resemble a V, or even a U. Unfortunately, it will look more like a Nike swoosh.

- U.S. Q3 GDP growth will be between +14% and +15%.

The National Association of Business Economics - June 2020:

- "NABE Outlook Survey panelists expect a 5.6% decline in inflation-adjusted gross domestic product from the fourth quarter of 2019 to the fourth quarter of 2020," said NABE President Constance Hunter, CBE, chief economist, KPMG.

- "The NABE panel remains decidedly pessimistic about the second quarter of the year, as 80% of participants view risks to the outlook tilted to the downside," added Outlook Survey Chair Eugenio Aleman, economist, Wells Fargo Bank. "Furthermore, 87% of panelists view a second wave of COVID-19 as the greatest downside risk through 2020. Meanwhile, 51% of panelists believe that 'a vaccine' is the greatest upside risk for 2020, while 29% of respondents believe that the greatest upside risk is a 'test and trace policy' that would slow the COVID-19 outbreak, and allow a broader reopening of the economy. A large majority of panelists-84%-believes that companies will reduce their 'dependence on global supply chains.' All panelists indicate that the Federal Reserve will not 'implement a policy of negative interest rates due to COVID-19.'"

- https://tinyurl.com/y6ba4u2h

|

|

Opportunities

- The U.S. economy added 1.8 million jobs in July sending the unemployment rate down for the third straight month to 10.2%.

- The Case-Shiller home price index for May indicated that home prices rose 4.5% annually during the month.

- U.S. retail sales advanced in June by 7.5% from May and by 17.7% in May compared to April.

- Both Creighton's and ISM's manufacturing PMIs rose above growth neutral for June and July signaling that the manufacturing sector in improving.

Bad News

- The federal deficit soared to nearly $3 trillion for the first 10 months of fiscal 2020. *

- In another signal of growing financial fears, the yield on the 10year U.S. Treasury bond fell to 0.52%, its lowest level in 234 years according to Deutsche Bank. Investors are seeking safe havens for their funds pushing demand up, prices up, and yields lower.

|

|

|

|

9-State Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

Apple (AAPL) announced that it would split its stock swapping four shares for every one share held by shareholders. What will this mean? Nothing theoretically. However, it will put Apple's stock in a range more appealing to retail investors and likely push Apple's market cap higher. It will also mean that Apple's stock price will have less of an impact on the Dow-Jones Industrial Average (DJIA.

|

Goss Eggs

Recent Dumb

Economic Moves

Politics overrules economic principles and common sense in a recently competed study by Yale economists (auditioning for a spot in the Biden Administration). In this study, they conclude that the $600 per week add-on to state unemployment compensation has no impact on workers remaining unemployed. Say what?

A California employed worker that previously received $300 in weekly salary now collects $750 per week in unemployment compensation. According to the Wall Street Journal, an average Ohio worker normally making $680 per week now collects $940 per week in unemployment benefits with the $600 federal boost

|

|

Keep an Eye on ...

U.S. BLS's Jobs Report for September

On September 4, the BLS releases the number of jobs lost or gained for August. Another positive and strong reading will be very bullish for U.S. stocks, bearish for the U.S. bond market (prices), and Trump's reelection prospects.

_ _ _

Gold and Silver Prices Prices of these metals are the earliest readings on inflation and investment fears. Higher inflation -- and fears -- higher the prices. For every $1,000 invested in gold and silver on March 12, 2020 resulted in $1,243 for gold investors and $1,777 for silver investors as of August 10.

_ _ _

Yield on 10-Year U.S. Treasury bond

Find instantaneously, at finance.yahoo.com. Right now, that yield is pointing to rising U.S. economic risks.

|

|