Economic Trends

July 2020

|

Creighton Institute for Economic Inquiry

|

Greetings!

Welcome to our July report covering results from Creighton's two June economic surveys.

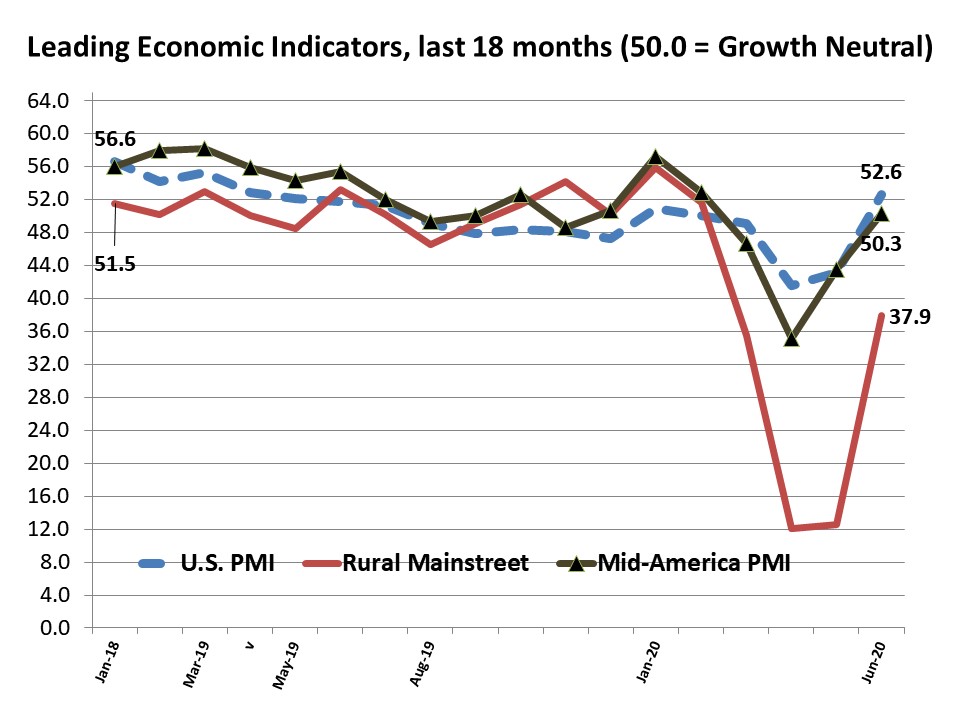

Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating that the negatives are getting less negative. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states rose significantly from May's reading and April's record low index. However, the overall index remains well below growth neutral.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

COVID-19 Death Rates Fall as Infections Rise:

State Shutdowns Hurt Economies, but Not COVID-19

The media and politicians are fixating on the rapid rise in COVID-19 infections. As a result, many medical experts, politicians and pundits are calling for shutdowns of state economies experiencing the greatest growth in infections.

Before taking this drastic action, two questions should be examined: 1) will the latest infections generate the negative outcomes as in previous months and 2) will the negative economic impacts of shutdowns exceed the positive health outcomes from economic lockdowns?

The latest CDC data show that deaths per 10,000 infections have declined from

1,315 on March 7 to 8.9

on July 7. From this data, some assert (but it's not yet proven) that higher infection rates are due to:

- the opening up of state economies, which has encouraged young individuals, who are less likely to suffer negative health consequences from COVID-19, to continue with normal living, and

- an increase in testing rates that now uncover individuals with the infection, but little or no negative health outcomes.

- lower deaths are due to older individuals with other health issues to take greater precautions in daily living (e.g. social distancing),

- improved treatment of COVID-19 illnesses.

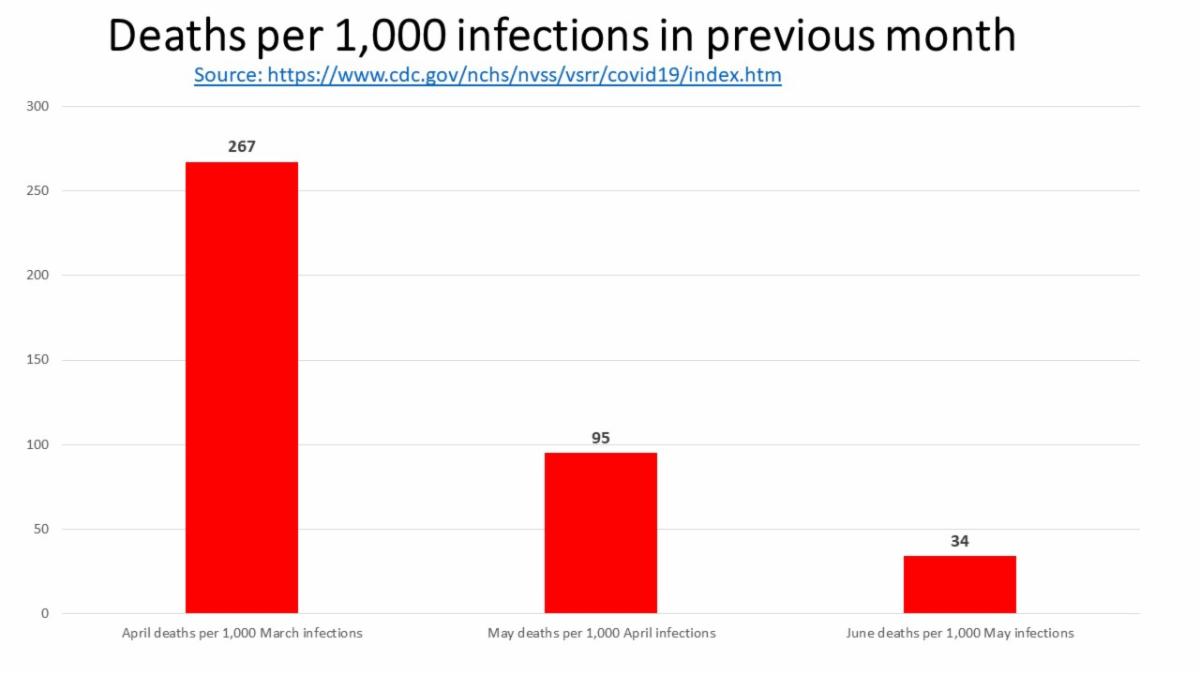

Others argue a lag exists between infections and deaths with today's soaring infection rates leading to zooming death rates ahead. However, the accompanying chart shows that death rates are clearly trending lower even after controlling for the delay between infection and death declining from 267 April deaths per 10,000 March infections to 34 June deaths per 10,000 May infections.

Did State Lockdowns Work?

The 42 states and D.C. that implemented shelter-in-place directives experienced a 10.1% increase in their insured unemployment rates between the first week in March until the second week in June compared to a lower 6.6% increase during the same time period for the 9 states that did not shut down. Using simple linear regression, it is concluded that each 30 days of shutdown was associated with a one percentage point increase in the insured unemployment rate. In terms of infections and deaths per 10,000 for March - June, shelter-in-place states experienced median infection rates of 60.0 compared to a higher 73.6 for non-shelter-in-place states, while non-shelter-in-place states suffered a lower death rate of 1.2 compared to 2.4 for shelter-in-place states. None of the differences were statistically significant.

Summary

. In the back-of-the-envelope calculations in this essay it was concluded that while COVID-19 infections are expanding dramatically yet COVID-19 death rates month ahead death rates per infection are in fact declining.

Furthermore, it is concluded that shelter-in-place, while having a statistically significant impact on increasing insured unemployment rates, had no statistically significant impact on COVID-19 infection rates or death rates. (All analysis available on request

ernieg@creighton.edu

).

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Negatives Get Less Negative in June: Only 6% Expect Additional Layoffs

|

|

| Mid-America Business Conditions Index June 2020 |

June survey highlights:

- The Business Conditions Index expanded to a reading slightly above growth neutral.

- Job losses continued for June with an employment index well below growth neutral.

- In terms of hiring for the rest of 2020, 51% expect no changes, 17% anticipate bringing back furloughed workers, 26% expect to bring back furloughed workers and add new workers, and 6% predicted a continuation of layoffs.

- Regional trade numbers remain near record lows.

View the complete Mid-America Business Conditions Report.

|

Rural Mainstreet

Index

Climbs for June:

One-Third of Bankers Report Ethanol Plant Shutdowns

June

survey results at a glance:

- Overall index advanced to a weak level. More than three fourths of bank CEOs reported an economic downturn in their local area.

- Almost one-third of bankers with local ethanol plants reported current production shutdowns, either permanent or temporary.

- Approximately 33.5% of bankers expect low commodity prices to be the greatest economic challenge over the next 12 months for their Rural Mainstreet bank.

- More than one-fourth, or 27.3%, of bankers indicated that rising loan defaults represented the biggest challenge for their banks for the next 12 months.

View the complete Rural Mainstreet Report.

|

|

The Outlook

Professor Goss' Forecast - June 2020:

-

Contrary to the Conference Board, I expect Q2 GDP growth to come in 25% - 30% lower.

-

The July job additions will be somewhat disappointing in comparison to June's. However, ending the $600 per week federal support for the unemployed at the end of July will super-charge August job additions.

-

The U.S. economic recovery will not resemble a V, or even a U. Unfortunately, it will look more like a Nike swoosh. Too many governors are getting "cold feet" in terms of opening up state economies.

The Conference Board Economic Forecast (June 2020):

- "The second estimate of first quarter 2020 GDP shows a contraction of 5.0 percent (annualized) over the last quarter of 2019. Given the timing of COVID-19 and the 'lockdown' seen around the country, however, we expect to see a much deeper contraction in Q2 with the worst pain concentrated in April. May and June, fortunately, will show a fairly strong rebound as the economy comes back online and solid progress will continue to be made over the summer. However, monthly economic output in September will still be approximately 6 percent lower than it was in December 2019, before the pandemic hit. Growth in Q4 will likely slow further as consumer spending struggles to return to the levels seen in 2019."

- "The Conference Board is adopting a "swoosh" shaped scenario as our base forecast. We expect second quarter GDP to decline by almost 40 percent (annualized). This large drop is driven by a fall in consumer spending of nearly 50%, a drop in real capital spending of just over 20% and a fall in exports of more than 35%. Following a large rebound of over 30 percent in Q3, we expect slower growth in Q4 that will bring December 2020 economic output to about 95% of what it was a year earlier".

|

|

Opportunities

- The nation added 4.8 million jobs, the biggest single-month payroll gain in history and the unemployment rate fell to 11.1% for June.

- Between May 2019 and May 2020, U.S. housing prices advanced by a healthy 4.3%.

- U.S. retail sales advanced in May by 17.7% from the previous month.

- Both Creighton's and ISM's manufacturing PMIs rose above growth neutral for June.

Bad News

- U.S. exports for May fell by 4.4% in May from April, while imports for May sank by 0.9%.

- As fears of the coronavirus rose last week, the yield on high-yield corporate bonds climbed to 7.04% (still too low in my judgment).

- In the week ending June 27, the Dept. of Labor reported that 1,427,000 applied for unemployment insurance (this was 117,500 from the previous week though).

|

|

|

|

9-State

Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

At the time of the writing of this newsletter,

6 Euro Zone nations including non-EU Great Britain had

higher population adjusted death rates than the U.S.:

- Spain

- Italy

- France

- Sweden

- Belgium

- United Kingdom

had higher COVID-19 deaths per 1 million population than the U.S.

|

Goss Eggs

Recent Dumb

Economic Moves

Amtrak

has decided to

forgo its traditional white-tablecloth dining experience on most long-distance routes east of the Mississippi River. This has sparked outrage among labor unions and politicians and inspired six pages about Amtrak food service in the 2,309-page House Democratic infrastructure bill. Essentially, the bill is a way to force Amtrak to bring back fine dining. Taxpayer subsidized pork will be served in abundance at the Amtrak feeding trough upon passage.

|

|

Keep an Eye on ...

U.S. BLS's August jobs report for July

On August 7, the BLS releases the number of jobs lost or gained for July. Another positive and strong reading will be very bullish for U.S. stocks and bearish for the U..S. bond market.

_ _ _

U.S. Bureau of Labor's weekly continuing

claims data

Released every Thursday, this is the earliest reading on the U.S. and state labor markets. The level of unemployed will likely move lower in the weeks ahead as the first-time claims continue to decline.

_ _ _

Yield on 10-Year U.S. Treasury bond

Find instantaneously, at finance.yahoo.com.

Watch for this yield to rise back above 1.2% to signal coronavirus impacts waning. Right now, that yield is pointing to less, but still high, U.S. economic risks.

|

|