Economic Trends

June 2020

|

Creighton Institute for Economic Inquiry

|

Greetings!

Welcome to our June report covering results from Creighton's two May economic surveys.

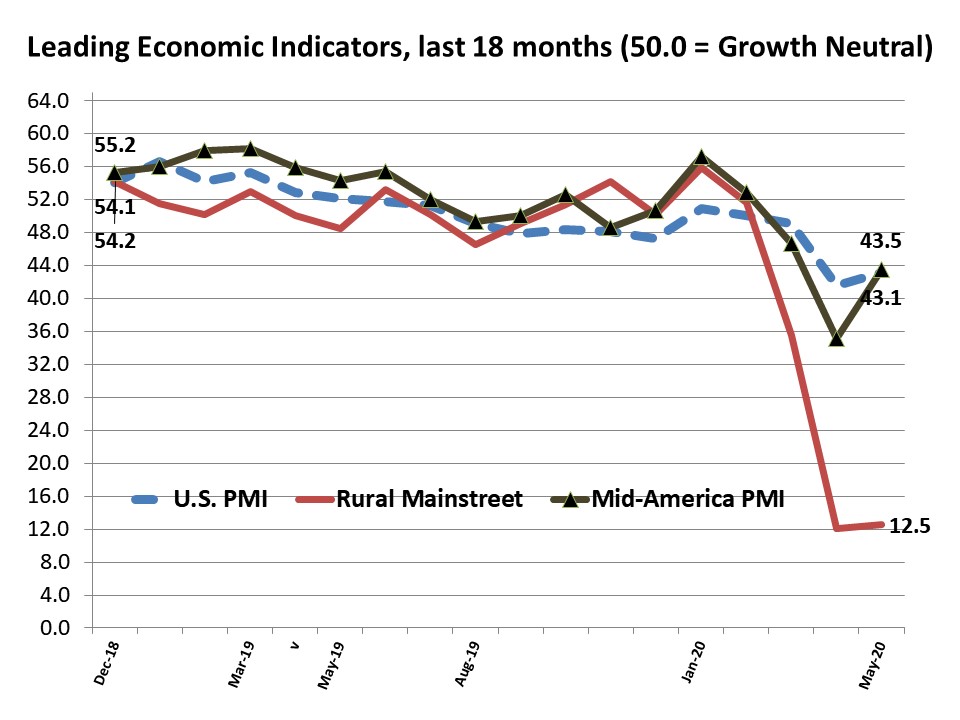

Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating a significant economic downturn. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states rose slightly from April's record low pointing to continuing recessionary economic conditions.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

An Economic Recovery? If so, What Is the Shape?

V, W, or Nike's Swoosh?

The May U.S. jobs report indicated the nation's economy added 2.5 million jobs, the highest monthly addition on record. This news emboldened the optimists who envisioned a V-shaped recovery, and dampened the pessimists who foresaw a W-shaped economic rebound. Other recent economic indicators support an economic recovery somewhere between the extremes, a Nike Swoosh, which would be a sharp downturn followed by a slow recovery.

V-Shaped Recovery

:

Record federal deficit spending via the CARES Act, and the Federal Reserve's support for ultra-low short and long-term interest rates, are punishing savers and rewarding spenders. Furthermore, the ending of the lockdown of most state economies is pushing consumers to spend a share of their pent-up demand. The biggest stimulus for the labor market will come at the end of July

when the federal government's $600 weekly support for jobless workers receiving state unemployment benefits expire. U.S. equity markets are pricing in an economic revival with expanding business profits indicative of a "V."

Nike's Swoosh-Shaped Rebound

: Nike's Swoosh-Shaped Rebound

:

Even after adding 1.2 million jobs in May, the nation's leisure and hospitality industry has shed 7 million employees since Covid-19. Contrary to most recessions, this one was led by the consumer and there is little evidence from consumer spending data of a return to pre-Covid spending levels. State and local regulations have limited most businesses in this industry to approximately 50% of their pre-Covid-19 capacity.

Compared to pre-Covid-19 levels, U.S. bond yields at roughly half their yields, and gold prices up more than 7%, both safe-haven stashes for risk averse investors, continue to indicate that investors remain very, very cautious about the U.S. economy.

U.S. exports and imports both posted their largest monthly decreases on record as imports fell 13.7% between March and April and exports plummeted 20.5% during the same period of time. These are the largest declines since record-keeping began in 1992, and will continue to be a drag on U.S. economic growth.

W-Shaped Recovery & Recession Re-Visit

:

Rising U.S. Covid-19 infection and death rates would put a dagger in the heart of any economic rebound. Growth based on federal government deficit spending and Federal Reserve's ultra-low interest rates is not sustainable. The U.S. and global consumers must return to work and spending. State economic lockdowns will guarantee a return to a recession as the economy reaches the top of the V.

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Business Index Remains in Recession Range:

More Than One-Third of Firms Cancelled Vendor Contracts

|

|

|

May 2020 Mid-America Business Conditions Index

|

May survey highlights:

- The Business Conditions Index expanded to a still recessionary reading.

- Employment reading indicated the rate of job losses slowed from April.

- Stimulus programs from the Federal Reserve and the federal government boosted economic confidence.

- As a result of Covid-19: 34% of firms extended the period of paying outstanding invoices; 35.9% revised or cancelled contracts; and 28.2% moved purchases from foreign sources to domestic sources.

- Between the middle of March and the first week of May, the percent of insured unemployed in the region soared from 1.3% to 10.5%.

View the complete Mid-America Business Conditions Report.

|

Rural Mainstreet

Index Inches Up from April's Record Low:

3 of 4 Banks Restructuring Farm Loans

May

survey results at a glance:

- Overall index advances slightly from April's record low.

- Almost three-fourths of bankers restructured farm loans to deal with weak farm income.

- Bank CEOs expect farm loan defaults to expand by only 5.4% over the next 12 months.

- Fully 100% of bankers gauged the federal Paycheck Protection Plan (PPP) as successful, and more than one of five bank CEOs support expansion of PPP.

- Business confidence sinks from April's very pessimistic outlook.

|

|

The Outlook

Professor Goss' Forecast - May 2020:

- Contrary to NABE, I do not expect GDP economic rebound until 2021. Too few states and communities are "returning to work" in a scale approaching that of the pre-coronavirus economy.

- Job growth for August-September 2020 will be strong with the end of the $600 weekly federal unemployment compensation at the end of July.

- The U.S. economic recovery will not resemble a V, or even a U. Unfortunately, it will look more like a Nike swoosh.

National Association for Business Economics (NABE)

Summary - June 2020:

-

"NABE Outlook Survey panelists expect a 5.6% decline in inflation-adjusted gross domestic product from the fourth quarter of 2019 to the fourth quarter of 2020," said NABE President Constance Hunter, CBE, chief economist, KPMG. "Panelists expect the largest decline, 33.5%, annualized, quarter-over-quarter, in the second quarter of the year. These decreases reflect the impact of the COVID-19 pandemic."

-

"The NABE panel remains decidedly pessimistic about the second quarter of the year, as 80% of participants view risks to the outlook tilted to the downside," added Outlook Survey Chair Eugenio Aleman, economist, Wells Fargo Bank.

|

|

Opportunities

- The nation added 2.5 million jobs and the unemployment rate fell to 13.3% for May. This is very good news but it is too early to pop the Champagne.

- Between January 2, 2020 and June 8, 2020, on average NASDAQ stocks advanced by 8.7% compared to a decline of only 1.2% for S&P stocks, and fall of less than 4.3% for Dow 30 stocks.

- The 2019 U.S. trade deficit fell by 1.7% to $616.8 billion. However, the trade deficit usually sinks during a U.S. economic slowdown.

- Both Creighton's and ISM's manufacturing PMIs are increasing, remain in a negative range.

Bad News

- Covid-19 is hurting the U.S. housing supply. The number of privately-owned housing units authorized by new building permits for the month of April fell to just over 1 million, a decline of 21% from 1.3 million, the revised number for March, and is 19.2% lower than the number of permits for the same month last year

- Every U.S. metropolitan area's April unemployment rate increased from March's reading.

- U.S. exports and imports both posted their largest monthly decreases on record amid coronavirus-related shutdowns around the world. Imports fell 13.7% in April from March, and exports dropped 20.5%, the largest declines since record-keeping began in 1992.

|

|

|

|

9-State

Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

Goss Eggs

Recent Dumb

Economic Moves

"I

just spoke to my brother-in-law who lives near Buffalo, NY. He said his son Ben lost his job at his college fitness center due to the school's shutdown. He worked about 20 hours/week during the school year at $10/hour. Out of curiosity he filed for unemployment benefits and was approved. He now 'makes' $800/week and has taken up golf and purchased a new set of clubs. In light of this very rational behavior, today's jobs report was beyond fantastic. While the extra

$600/week

will eventually run out, so far, in his mind, it's truly been 'The Summer of Ben.' What a horrible lesson to learn." From my Creighton colleague and economics professor, Tim Bastian.

|

|

Keep an Eye on ...

U.S. BLS's July jobs report for June

On July 2, the BLS releases the number of jobs lost or gained for June. Another positive reading will be very bullish for U.S. stocks and bearish for the U..S. bond market.

_ _ _

U.S. Bureau of Labor's weekly continuing

claims data

Released every Thursday, this is the earliest reading on the U.S. and state labor markets. The level of unemployed will likely move lower in the weeks ahead as the first-time claims continue to decline.

_ _ _

Yield on 10-Year U.S. Treasury bond

Find instantaneously, at finance.yahoo.com.

Watch for this yield to rise back above 1.5% to signal coronavirus impacts waning. Right now, that yield is pointing to less, but still high, U.S. economic risks.

|

|