Economic Trends

May 2020

|

Creighton Institute for Economic Inquiry

|

Greetings!

Welcome to our May report covering results from Creighton's two April economic surveys.

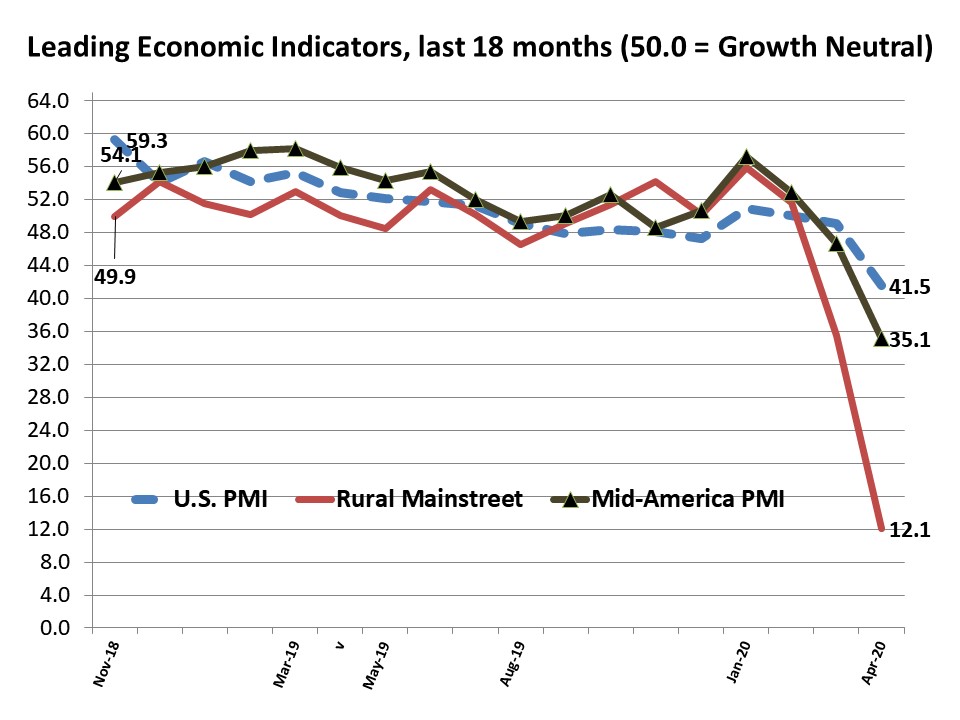

Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates that economic growth is in a range indicating an economic downturn rivaling the Great Depression. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states fell to a record low with declining farmland prices and falling farm equipment sales.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

COVID-19 and the Economy:

Killing the Goose to Save the Eggs

In 1999, researchers at the U.S. Centers for Disease Control (CDC) and Prevention estimated that a global pandemic would inflict up to 207,000 U.S. deaths and trigger a cost to the national economy of roughly 1.5% of GDP.

As of May 13, the CDC calculated that COVID-19 caused a smaller 84,355 U.S. deaths with a steep upward trend.

Moreover, government data point to a devastating larger economic loss. U.S. quarter one GDP fell by 4.8% despite only one month of covid-19 impacts. Moreover, the nation's May 2020 employment report indicated that the U.S. alone lost 20.5 million jobs in April, and the unemployment rate soared to 14.7%. A rough back-of-the envelope calculation points to a 13.5% GDP loss for the U.S. even with no additional job losses in 2020. This would be the greatest yearly decline since 1932 when U.S. GDP tumbled by 12.9%.

Additionally, the 41 states with the most restrictive business closures and mandated shelter-in-place states, show that these states suffered an increase in insured unemployment rates between February and April of 11.8% compared to a much lower 7.7% for the 9 less restrictive states.

Thus, the question should surface: has the cure of shelter-in-place mandates inflicted more economic damage than the disease?

Below are the early estimated impacts for Creighton's 12 survey states in terms of percentage of first-time unemployment claims versus percentage of continuing unemployment claims:

| |

% First-time unemployment claims

|

|

% Continuing unemployment claims

|

| U.S. |

2.3% |

U.S. |

12.5% |

| Oklahoma |

3.3% |

Minnesota |

14.6% |

| Missouri |

2.0% |

Illinois |

11.5% |

| Kansas |

1.8% |

Iowa |

11.0% |

| Illinois |

1.7% |

Missouri |

9.2% |

| Minnesota |

1.7% |

Arkansas |

9.1% |

| Arkansas |

1.5% |

Kansas |

8.7% |

| Iowa |

1.5% |

Colorado |

8.6% |

| North Dakota |

1.5% |

North Dakota |

8.6% |

| Colorado |

1.4% |

Oklahoma |

8.6% |

| South Dakota |

1.3% |

Nebraska |

7.9% |

| Wyoming |

1.3% |

Wyoming |

6.1% |

| Nebraska |

0.9% |

South Dakota |

5.4% |

Even so,

the U.S. ranks 9th globally with Spain occupying unenviable top spot in terms of deaths per capita. The damage to the nation's economy has paralleled, or perhaps exceeded that to the country's health.

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Mid-America Business Index Tumbles to Recession Level: Employment Reading Slumps to Record Low

|

Mid-America Business Conditions Index for April 2020

|

- The Business Conditions Index plummeted to its lowest level since the great recession in February 2009.

- Employment reading slumped to its lowest level since the survey began in 1993.

- Half of supply managers reported business stoppages for their vendors due to COVID-19.

- More than one-third of supply managers detailed shipping problems stemming from COVID-19.

- Between the second week of March to the first week of April, the number of unemployed in the 9-state region receiving unemployment compensation soared from 164,040 workers to 980,196 workers.

|

Rural Mainstreet

Record Fall: 9 of 10 Bank CEOs Expect Recession from Coronavirus

A

pril Survey Results at a Glance:

- Overall index falls to lowest level since beginning survey in January 2006.

- More than nine of 10 bank CEOs expect the coronavirus to push their local area into a recession.

- Approximately 94% of bankers reported a decline in client or customer visits over the past two weeks as a result of the coronavirus.

- Almost one-third, or 30.3%, indicated that their bank had experienced higher loan delinquency rates resulting from the coronavirus threat.

- U.S. Department of Labor's reported initial claims for unemployment benefits for the last two weeks for the nine-state region, urban plus rural, were 1,226,370 which was a 29-fold expansion from the same period in 2019

|

|

The Outlook

Professor Goss' Forecast - May 2020:

- Contrary to NABE, I do not expect an economic rebound until 2021. Too few states and communities are "returning to work".

- Jerome Powell has indicated that he may be receptive to negative interest rates (big mistake!). Recent economic evidence from Japan and Europe indicates that this policy will fail.

- The U.S. economic recovery will not resemble a V, or even a U. Unfortunately, it will look more like a Nike swoosh.

National Association for Business Economics (NABE) - March 2020:

- "NABE Outlook Survey panelists believe that the U.S. economy is already in recession and will remain in a contractionary state for the first half of 2020, as the COVID-19 pandemic severely restricts economic activity," said NABE President Constance Hunter, CBE, chief economist, KPMG. "The consensus is real GDP declined at an annualized rate of 2.4% in the first quarter of 2020, and will shrink at an annualized rate of 26.5% in the second quarter.

-

"The panel is optimistic about a return to economic growth in the latter half of 2020, anticipating an annualized real GDP growth rate of 2.0% in the third quarter," she added. "Despite a sharp deterioration in labor market conditions, the median forecast suggests conditions will improve by the end of the year with support from aggressive fiscal and monetary stimulus, as panelists expect the Federal Reserve to hold steady on near-zero interest rates through 2021."

|

|

Opportunities

- The average 30-year fixed rate mortgage in the U.S. stood at 3.26% last week.

- Fleeing for safe-haven investments, investors have driven the price of gold up by 11.9% since January 1, 2020.

- Despite the Minneapolis Federal Reserve president calling Bitcoin a "giant garbage dumpster," the cryptocurrency has provided investors/speculators with a 25.9% return since January 1, 2020.

Bad News

- The U.S. economy lost 20.5 million jobs in April as the unemployment rate rose to 14.7% from March's 4.4%.

- As of April 25, 2020, the number of workers receiving unemployment insurance was 22.03 compared to 1.71 million in April 2019.

- On an annualized and seasonally adjusted basis, U.S. GDP dropped -4.8% in Q1, 2020. Given that COVID-19 only impacted the U.S. economy beginning in March, this was especially alarming.

|

|

|

|

9-State

Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

Due to the spread of COVID-19 among workers, some 20 U.S. meat packing plants have closed over the past month. This not only jeopardizes the nation's food supply, it damages already unprofitable cattle and hog producers.

|

Goss Eggs

Recent Dumb

Economic Moves

The Coronavirus Aid, Relief, and Economic Security Act

(the "CARES Act")

was signed into law on March 27, 2020.

The $2.2 trillion package included various provisions increasing and expanding unemployment insurance benefits:

1) providing for an extra $600 weekly payment, in addition to the weekly benefit amount an eligible employee otherwise receives under state law; and (2) increases the maximum number of weeks an individual may receive benefits.

This means that a high share of the unemployed make more jobless than working. This provision will have a significant negative impact on the U.S. economy.

|

|

Keep an Eye on ...

U.S. BLS's June jobs report for May

On June 5, the BLS releases the number of jobs lost or gained for May. This will be the largest losses for any three consecutive months in U.S. recorded economic history.

_ _ _

U.S. Bureau of Labor's weekly continuing

claims data

Released every Thursday, this is the earliest reading on the U.S. and state labor markets. The level of unemployed will approach 23 million (a new record).

_ _ _

Yield on 10-Year U.S. Treasury bond

Find instantaneously, at finance.yahoo.com.

Watch for this yield to rise back above 1.5% to signal coronavirus impacts waning. Right now, that yield is pointing to soaring risks and a deep U.S. recession for all of 2020.

|

|