Economic Trends

November 2019

|

Creighton Institute for Economic Inquiry

|

Greetings!

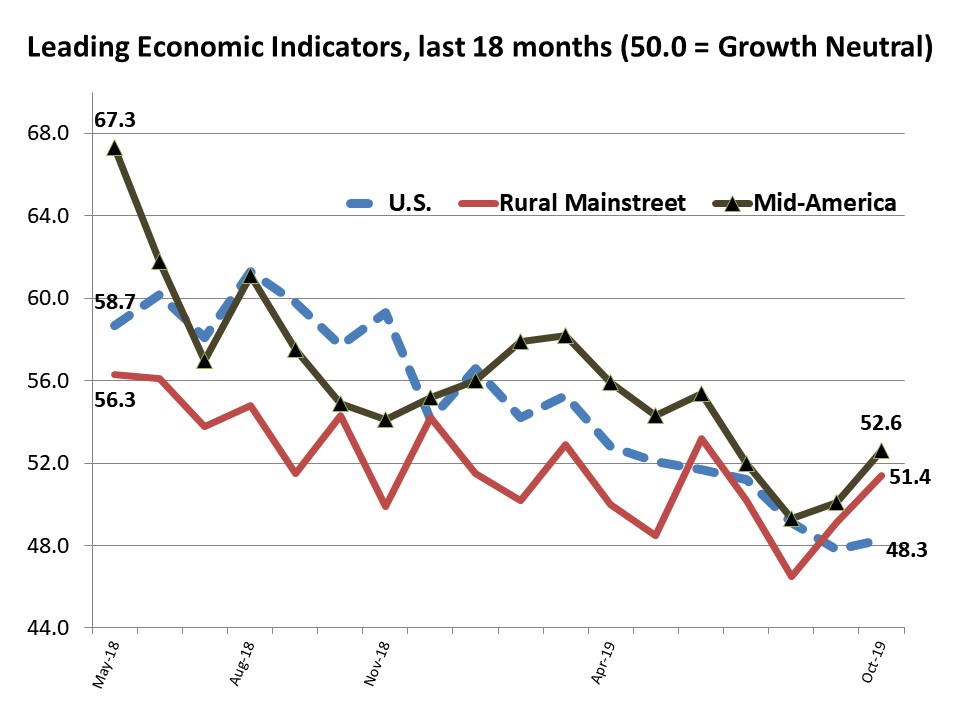

Welcome to our November report covering results from Creighton's two October economic surveys. Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating significantly weaker manufacturing growth and modest inflationary pressures. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states indicates the Rural Mainstreet Index (RMI) remains weak with declining farmland prices and agriculture equipment sales.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

Taxing Wealth is not a Solution:

Just Another Problem

Senator Elizabeth Warren, Democrat presidential contender, has found what she considers to be a pot of gold to fund her "Medicare for All" and other assorted largess. Warren is proposing $20.5 trillion in new federal spending under the "Medicare for All" proposal -- an amount greater than the size of the total federal debt accumulated over the last 80 years.

The Senator

plans to introduce a wealth tax on the ultra-rich

to pay for this program expansion. Since Warren promises to levy this tax on 1% of the population, this plan has resonated among the 99% who would pay nothing, at least in the beginning.

George Bernard Shaw once said: "The Government that robs Peter to pay Paul can always count on the support of Paul."

There are a multitude of reasons that 9 of 12 European nations that adopted a wealth tax have since dropped it. Here are four:

- First, is the high cost of administration. How can administrators accurately measure wealth and collect the tax without incurring excessive costs?

- Second, since initially introducing the tax at 3% of all wealth over $50 million, Warren has raised the rate to 6%. Just as the top federal income tax rate was raised from 7% in 1915 to 92% in 1953, it is likely that the rate and base would be expanded. Would the tax be expanded to eventually swipe the innards of the piggy banks for ambitious, successful teenage newspaper carriers?

- Third, U.S. wealth, for example, corporate investment, would be moved out of the U.S. to lower tax nations.

- Fourth, certain forms of wealth are virtually impossible to value. For example, Leonardo's Mona Lisa sold for $450 million in 2017. Will the buyer have to cough up $27 million annually to fund Senator Warren's Medicare for All? Furthermore, after paying $450 million for the painting, will the buyer have enough to pay this annual tax?

As one of the super rich, Bill Gates, who is giving away his fortune, advised Warren, "I implore you to connect the dots."

Economic jealousy is no basis for a sound functioning tax system that aids, not depletes, economic growth.

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Index Advances Above Growth Neutral: 54% of

Supply Managers Report Tariffs Increasing Prices

|

|

|

Mid-America Business Conditions Index October 2019

|

October survey highlights:

- After two months of below growth neutral readings, the overall manufacturing index bounced above 50.0.

- Despite the negative impacts of the trade war, more than half or 54% of supply managers support continuing or even expanding trade restrictions and tariffs on Chinese imports.

- Both exports and imports declined for the month.

- Approximately 59.5% of supply managers reported tariffs had increased the prices of supplies and inputs purchased by their firm.

- The lack of available workers limited job growth in the region.

|

Rural Mainstreet

Index Climbs Again:

Trade War and Stalled USMCA Batters Economic Confidence

October survey results at a glance:

- After falling below growth neutral in August, the Rural Mainstreet Index jumped slightly above 50.0 for September and October.

- Bank CEOs across the region reported significantly lower corn and soybean yields.

- Economic confidence fell to lowest level in two years.

- Almost three of four bankers reported negative impacts from the trade war.

- Approximately 43% of bankers support halting Federal Reserve rate hikes over the next 12 months.

|

|

The Outlook

Professor Goss' Forecast - October 2019:

- Expect annualized GDP growth of 0.9% for Q4, 2019 and 1.2% in Q1, 2020.

- Year-over-year increase in U.S. housing prices (Case-Shiller) will fall below 2.5% in Q4 (and to continue to drop).

- The Federal Reserve Open Market Committee is not likely to make changes in short-term interest rates for the rest of 2019.

- Expect U.S. October job additions of 140,000 (include GM additions).

National Association of Business Economics -

November 2019:

- SUMMARY: "NABE Outlook Survey panelists believe the U.S. economy will continue to expand into 2020, but they anticipate GDP growth will fall below 2% next year for the first time since 2016," said NABE President Constance Hunter, CBE, chief economist, KPMG. "The consensus forecast calls for real GDP growth to slow from 2.9% in 2018 to 2.3% in 2019, and then to 1.8% in 2020."

- "The panel turned decidedly more pessimistic about the outlook over the summer, with 80% of participants viewing risks to the outlook as tilted to the downside," added Survey Chair Gregory Daco, chief U.S. economist, Oxford Economics. "The rise in protectionism, pervasive trade policy uncertainty, and slower global growth are considered key downside risks to U.S. economic activity. While a small majority of panelists expects that any action by the Federal Reserve on interest rates will be on hold through year-end of 2019, over 40% anticipate at least one more rate cut. Three-quarters of respondents expect at least one rate cut by the end of 2020, and a third expects at least two further rate cuts by the end of next year."

|

|

Opportunities

- Both Creighton's and ISM's Purchasing Management Indices (PMI) rose for October, but still pointed to weakness, not recession, for 2020.

- Despite the General Motors strike, the nation added 128,000 jobs in October.

- The Consumer Price Index rose 0.4% in October after being unchanged in September. Over the last 12 months, the all items index increased 1.8%, slightly below the Federal Reserve's target.

Bad News

- The U.S. economy expanded at a tepid 1.9% (annualized) in Q3, 2019.

- Over the past 12 months, average hourly earnings have increased by 3.0%. We need to see this closer to 4%.

- The FY 2019 budget created a $1.09 trillion deficit. Spending of $4.53 trillion was more than the estimated $3.44 trillion in revenue. Tax collections are growing but spending is growing faster.

|

|

|

|

9-State

Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

Democrat Senator Chris Van Hollen introduced what he calls a Millionaires Surtax Act, which adds another 10% on individual income above $1 million. This is despite the fact that the richest 1% of U.S. taxpayers already pay 37% of total income taxes. This is up from 26% in 1986.

|

Goss Eggs

Recent Dumb

Economic Moves

On September 13, 2019, Goldman Sachs downgraded its Apple price target to $165 from $187. Since that downgrade, Apple shares are up 20.3% to $262.20 on November 11, 2019. Only two months earlier, Goldman upgraded Apple stock. More evidence that you should trust your own investment advice.

A client asks his adviser, "is all my money really gone?" "No, of course not," the adviser says. "It's just with somebody else!"

|

|

Keep an Eye on ...

ISM and Creighton's PMIs for November

On December 2, the Institute for Supply Management and Creighton University release their surveys of supply managers in the U.S. and Mid-America, respectively. This is an early reading of manufacturing growth. Both are trending upward but remain weak.

_ _ _

BLS's wage value for November

On December 6, the BLS will report the hourly wage value for November. A gain of less than 3% for the last 12 months will be a concern and sound economic alarm bells.

_ _ _

BLS's CPI for November On December 11,

the BLS will release its CPI for November. Another +0.4% will be a potential warning of climbing inflationary pressures generating higher interest rates.

|

|