Economic Trends

October 2019

|

Creighton Institute for Economic Inquiry

|

Greetings!

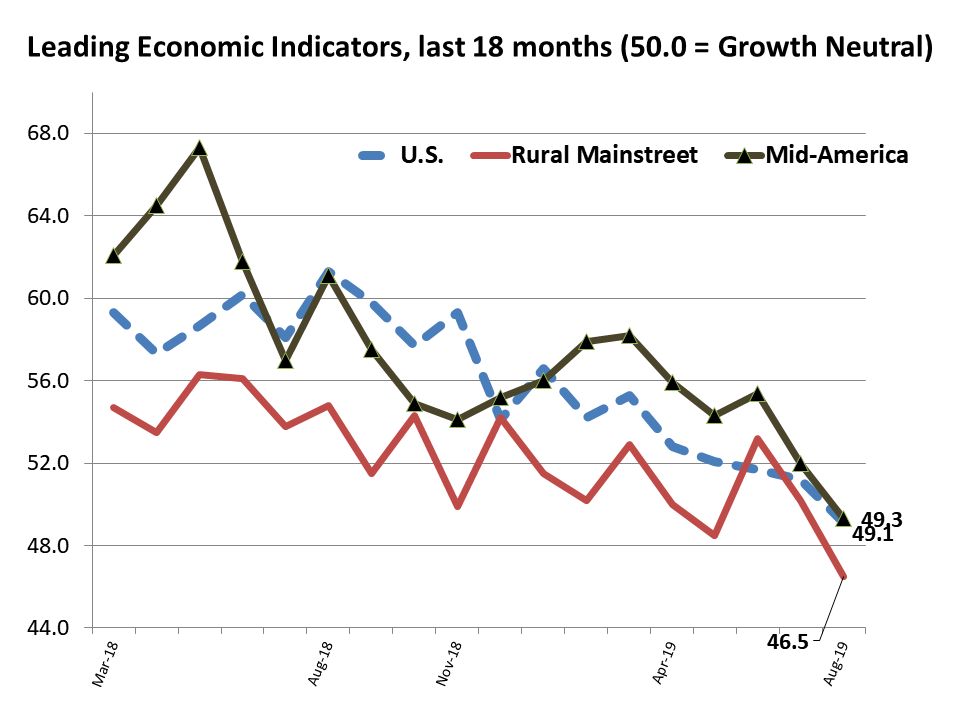

Welcome to our October report covering results from Creighton's two September economic surveys. Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating significantly weaker manufacturing growth with modest inflationary pressures. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states indicates the Rural Mainstreet Index (RMI) remains weak neutral with declining farmland prices and agriculture equipment sales.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

Replacing Fossil Fuel Electricity Generation with Solar: Boosts Costs and Income Inequality

When I was a graduate research assistant at Oak Ridge National Laboratory in 1983, pursuing my PhD. in economics, I worked on a contract with the Solar Energy Research Institute in Boulder, Colorado.

At the time, solar energy electricity production was prohibitively expensive, requiring massive government subsidies for its mere existence. However, solar energy devotees argued that solar energy was an "infant" industry that, if properly supported with tax dollars, would become cost competitive with fossil fuel electricity production before the turn of the century.

Now, 36 years later, U.S. taxpayers subsidize solar electricity production to the tune of $43.75 per billion kilowatt hours (BKWH) compared to $1.04 per BKWH for coal, and $0.46 per BKWH for nuclear. Even with these massive solar subsidies, the levelized cost of electricity (LCOE) produced by photo voltaic solar is approximately 30% above that of electricity produced by coal, while electricity produced by thermal solar is 239% greater than that of coal.

Despite colossal subsidies, coal electricity production represented 29.2% of the total while solar was only 1.2% in 2016. Replacing half of coal production with solar would cost consumers approximately $2.9 billion in generation costs, and tax subsidies per year.

The latest data show that, as a share of income, the lowest quintile of income earners spent roughly 7 times that of the highest quintile of income earners on utilities. Thus, in addition to economically burdening all U.S. consumers, the shift away from coal to solar will exacerbate income inequality in the U.S.

Even with this compelling data, a host of Democrat presidential candidates argue for replacing coal with solar and, at the same time, for cutting income inequality. Julian Castro said he would put a ".... halt to fossil fuel exploration and fracking on federal land and would boost wind, solar and other renewable energies." And late last week Democratic presidential hopeful Senator Warren said that, "By 2030, no more cars with carbon emissions; and by 2035, no more production of electricity that has carbon emissions."

Thus, Democrat presidential candidates who argue for reducing income inequality at the same time as reducing the use of coal electricity generation, are being at best "disingenuous."

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Index Slumps Again: Nearly Half of Supply Managers Report Negative Trade Impacts

|

|

|

Mid-America Business Conditions Index September 2019

|

September survey highlights:

- Overall index sank for the fifth time in the past six months and moved below growth neutral.

- Nearly one-half, or 48%, of supply managers indicated that the trade war was having a negative impact on their company.

- About 18% of supply managers reported their firm had changed vendors due to the trade war and related trade retaliation.

- Business confidence remained fragile.

|

Rural Mainstreet

Index: 4 of 10 Bank CEOs Report Local Economy in Recession

September survey results at a glance:

- After falling below growth neutral for August the Rural Mainstreet Index jumped slightly above the 50.0 reading for September.

- More than four in 10 bank CEOs report that their local economy is in a recession.

- As a result of continuing weakness in the farm sector, more than half of bankers reported increasing collateral for farm loans, and one in four rejected a higher percent of farm loan applications.

- Bankers expect farm equipment sales in their area to decline by another 7.4% over the next 12 months.

|

|

The Outlook

Professor Goss' Forecast - October 2019:

- Expect annualized GDP growth of 1.8% for Q3, 2019 and 1.3% in Q4 2019.

- The year-over-year increase in U.S. housing prices (Case-Shiller) will fall below 2.5% in Q3 (and to continue to drop).

- The Federal Reserve Open Market Committee (FOMC) will reduce short-term interest rates by another ¼ % (25 basis points) at their October 19-30 meetings.

Conference Board -

October 2019:

- "Through the first half of 2019, the slowdown of global growth has clearly taken hold, and we do not see an easy way back up for now. The slowdown has been extraordinary synchronized around the globe, impacting the United States, Europe, China, India and large Latin American economies, notably Brazil and Mexico. At the same time, looking at our leading economic indicators, the risk of outright recession is still low for most large economies, with the exception of the United Kingdom due to Brexit, and possibly Brazil due to high unemployment and persistent ambiguity regarding reforms. But we are also getting more concerned about the growth trajectories in Germany and Japan, which create potential downside risk to the outlook. More broadly, the ongoing uncertainties with regard to trade disputes and other geopolitical upheavals impact in particular on business confidence. This will make companies more reluctant to deliver on large capital expenditure plans. It will also impact the outlook for the remainder of the year and - if this lingers on for much longer - also into 2020."

|

|

Opportunities

- The U.S. unemployment rate fell to 3.5%, its lowest level since 1969. This is good news for workers but not such good news for companies searching for workers.

- The U.S. inflation rate, as measured by the consumer price index (CPI), rose by 1.7% Aug. 2018 to Aug. 2019. The core CPI, which excludes prices of food and energy, climbed by a higher 2.4% over the same period. In my judgment, the inflation rate is getting a bit too high to be ignored by the Federal Reserve.

- The percentage of discouraged (not in labor market) continues to expand, albeit slowly.

Bad News

- The U.S. economy added only 136,000 jobs in September. This is just another signal that U.S. growth is slowing.

- Year-over-year average hourly wage for September sank to 2.9% from 3.2% in August to $28.09 per hour.

- Both Creighton's and the Institute for Supply Management's (ISM) index fell below growth neutral for September. ISM's reading plummeted to its lowest level since the 2008-09 recession.

|

|

|

|

9-State

Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

Presidential candidate Elizabeth Warren proposes to give every Social Security recipient an additional $2,400 a year in benefits to be financed by a 14.8% tax on high income earners. This would cost taxpayers $150 billion annually. President Franklin Roosevelt will not just rollover in his grave, he will somersault, as his beloved retirement program becomes another social entitlement expansion.

|

Goss Eggs

Recent Dumb

Economic Moves

The U.S. now plans to quickly impose $7.5 billion in tariffs aircraft, food products as well as other consumer products from Europe. The French government announced that it would immediately retaliate. Not only will U.S. consumers pay higher prices for European products, U.S. companies selling in Europe will be economically punished. When will national political leaders begin to understand that trade barriers are a losing proposition for both the implementor and the recipient?

|

|

Keep an Eye on ...

Brexit

On October 31, Great Britain is scheduled to exit the European Union (EU). A messy (hard) exit with no deal will be a significant negative for the global economy. It will not be good for equities, but increase bond prices and reduce yields as investors seek safe financial havens.

_ _ _

ISM and Creighton's PMIs for October

On November 1, the Institute for Supply Management and Creighton University release their surveys of supply managers in the U.S. and Mid-America, respectively. This is an early reading of manufacturing growth. Both are trending downward and both were below growth neutral 50.0 for August and September.

_ _ _

FOMC Meetings

On October 29-30 the interest rate setting committee for the Federal Reserve meets to consider changes in short-term interest rates. Listen to Fed Head Powell's comments afterward to gauge future actions.

|

|