Economic Trends

September 2019

|

Creighton Institute for Economic Inquiry

|

Greetings!

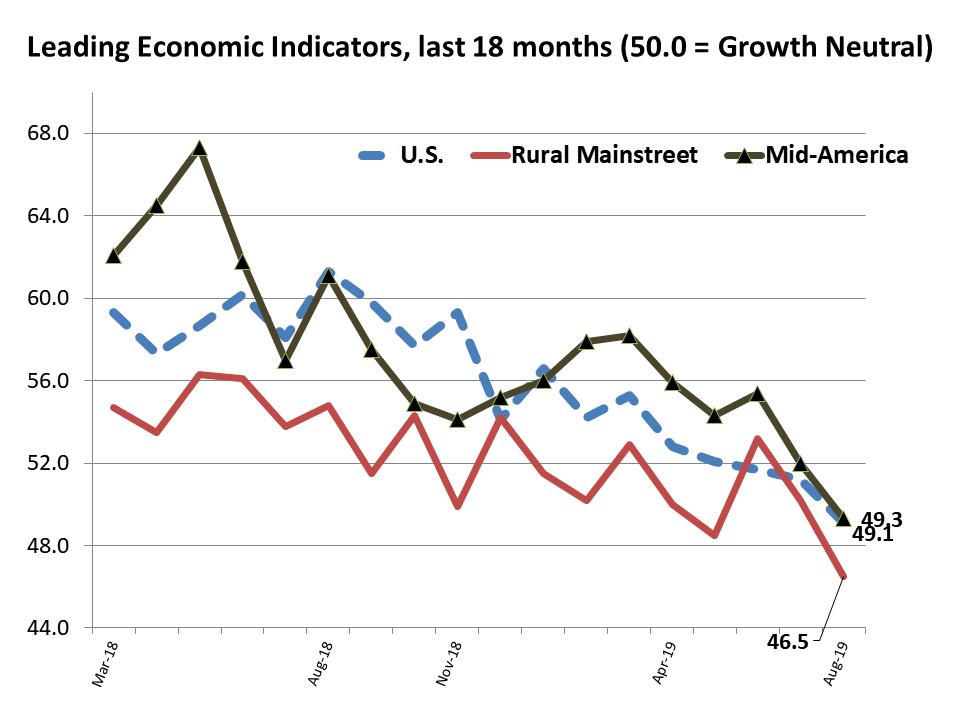

Welcome to our September report covering results from Creighton's two August economic surveys. Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating significantly weaker manufacturing growth and with modest inflationary pressures. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states indicates the Rural Mainstreet Index (RMI) is below growth neutral with declining farmland prices and agriculture equipment sales.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

Do Casinos Reduce Taxpayer Burdens? No!

Casino Gambling States Spent More, Taxed More, with Slower Growth

Located in 24 states, 515 commercial casinos in 2016 collected $8.9 billion in taxes on $40.0 billion in gambler losses for an average tax rate of approximately 23%, or roughly triple the average sales tax rate.

Eleven of the 24 casino states devoted casino tax collections to education spending, while the remaining 13 states dedicated the taxes to a wide array of state and local spending projects. Table 1 shows how casino states differed from non-casino states in terms of spending, taxes, and economic performance.

Did these tax collections result in any meaningful tax relief, or instead fuel an increase in state and local government spending?

- Per $10,000 in gross domestic product (GDP), state and local government agencies in casino states spent and taxed more heavily than non-casino states.

- Moreover, casino states expended more on education as a share of GDP than non-casino states. However, states that dedicated casino tax collections to education spent less as a share of GDP than casino states that did not target education for casino tax collections.

- Additionally, data show that casino states expended more heavily on police operations than non-casino states in 2016.

- In terms of economic performance, as measured by GDP growth, non-casino states expanded more briskly in periods 2014-16, 2016-18 and 2014-18.

In summary, data indicate that, for the period analyzed, casino states spent more on state and local government activities, taxed their citizens more heavily, and experienced slower GDP growth.

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

Index Slumps Below Growth Neutral: Declines in Exports and Hiring Push Index into the Negative

|

|

|

Mid-America Business Conditions Index August 2019

|

August survey highlights:

- Overall index sank for the fourth time in the past five months moving below growth neutral. Lower export orders and hiring pushed index into negative territory.

- Business confidence slumped to 35-month low.

- Export orders and imports slumped for the month.

- Approximately 44% of supply managers indicated that tariffs and trading issues were the greatest economic challenge for their company in the next 12 months.

- Six of 10 supply managers reported their customers would be paying the greatest share of tariffs.

|

Rural Mainstreet

Index Drops to Lowest Level in Two Years:

Trade War Having Negative Impacts

August survey results at a glance:

- The Rural Mainstreet Index falls below growth neutral to its lowest level in almost two years.

- Three of four bank CEOs reported that the trade war was having a negative impact on their local economy.

- Seven of 10 bankers support continuing, or even raising tariffs on imported Chinese goods.

- Despite worsening economic conditions on the farm, bankers expect only a modest 4% rate of farm loan defaults over the next year.

-

Business confidence index plummets to its lowest level since October 2017.

|

|

The Outlook

Professor Goss' Forecast - September 2019:

- Expect annualized GDP growth of 1.5% for Q3, 2019.

- Year-over-year increase in U.S. housing prices (Case-Shiller) to fall below 2.5% in Q3 (and to continue to drop).

- The Federal Reserve Open Market Committee (FOMC) to reduce short-term interest rates by another ¼ % (25 basis points) at their September 17-18 meetings.

National Association of Business Economics (NABE) - September 2019:

- "Survey respondents indicate that the expansion will be extended by the shift in monetary policy, and most expect the next economic recession will occur later than anticipated when the February policy survey was conducted," said NABE President Constance Hunter, CBE, chief economist, KPMG. "Of the 98% of respondents who believe a recession will come after 2019, the panel is split regarding whether the downturn will hit in 2020 or 2021."

- "Respondent attitudes towards current fiscal policy have shifted significantly as well," continued Hunter. "The percentage of panelists who find current fiscal policy 'too stimulative' has declined from 71% in August 2018 to 51% in the current survey. Just over one-third consider fiscal policy 'about right,' and 8% find it 'too restrictive.'"

- "A majority of respondents believes U.S. monetary policy is 'about right,' but the percentage holding this view has fallen from 75% in the previous two surveys to 62%," added Survey Chair Megan Greene, senior fellow at the Mossavar-Rahmani Center of Business and Government at the Harvard Kennedy School. "The survey was conducted before the Federal Reserve's rate cut on July 31; the majority of survey responses was received prior to that date. A plurality of panelists anticipates the upper end of the federal funds target rate will be 2% in 2019 and 2020, reflecting one more cut in 2019. Survey respondents are nearly unanimous in their support of the Federal Reserve continuing to have congressional oversight and policy independence.

|

|

Opportunities

- The U.S. unemployment rate remained at a 50-year low of 3.7%, while the joblessness rate for Black and Hispanic workers declined to the lowest level on record.

- The U.S. inflation rate as measured by the consumer price index (CPI) rose by 1.8% July 2018 to July 2019. The core CPI, which excludes prices of food and energy, climbed by a higher 2.0% over the same period.

Bad News

- Home price inflation slowed further in June as the Case-Shiller index rose 0.3% in June compared with May. Case-Shiller home-price gains have slowed to a near 7-year low.

- Creighton and U.S. Purchasing Management Indices (PMI) dropped below growth neutral for August (the first time in almost 3 years).

- In just 10 months the U.S. budget deficit exceeded last year's full year deficit. The budget deficit is up 27% from last year.

|

|

|

|

9-State

Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

In total, 51 wealthy individuals have been criminally charged for illegally securing admission to top colleges for their teens. However, no (0%) colleges have been charged for assisting in the scam. U.S. colleges and universities are pampered by our nation's laws and regulations.

|

Goss Eggs

Recent Dumb

Economic Moves

The Business Roundtable, a group of CEOs of nearly 200 major U.S. corporations, last month issued a new definition of the "purpose of a corporation." Instead of serving shareholders and maximizing profits they will now serve employees, customers, the environment, suppliers, and the community. Nothing like adopting amorphous, ill-defined metrics to measure CEO performance. CEOs now have an alibi for their operational failures.

|

|

Keep an Eye on ...

Brexit

On October 31, Great Britain is scheduled to exit the European Union (EU). A messy (hard) exit with no deal will be a significant negative for the global economy. It will not be good for equities, but increase bond prices and reduce yields as investors seek safe financial havens.

ISM and Creighton's PMIs for September

.

_ _ _

ISM and Creighton's PMIs for September

On October 1, the Institute for Supply Management and Creighton University release their surveys of supply managers in the U.S. and Mid-America, respectively. This is an early reading of manufacturing growth. Both are trending downward and both were below growth neutral 50.0 for August.

_ _ _

10-Year U.S. Treasury Bond Yield

Currently 1.62%. (immediate value at

finance.yahoo.com

).

This is the lowest yield in 7 years and indicates a significant increase in global tensions as investors flee risky bets and buy safer U.S. Treasury bonds, driving prices up and yields lower.

|

|