Economic Trends

September 2020 | Creighton Institute for Economic Inquiry

|

Greetings!

Welcome to our September report covering results from Creighton's two August economic surveys.

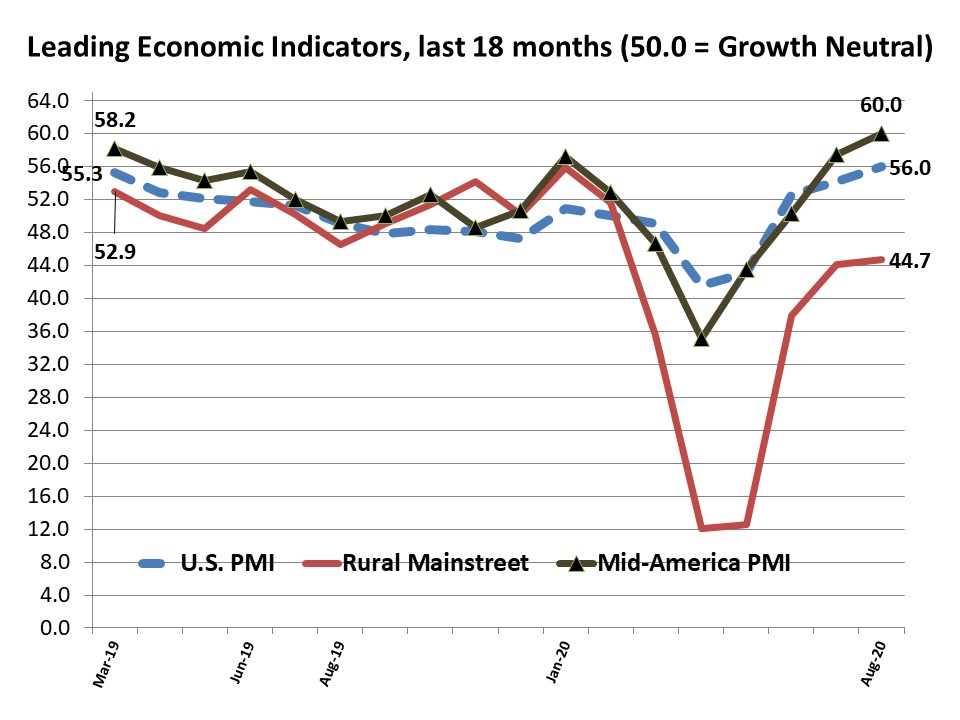

Creighton's monthly survey of supply managers and procurement experts in nine Mid-America states indicates economic growth is in a range indicating the regional economy is rebounding, but current employment is well below their pre-Covid-19 levels. The overall index from Creighton's monthly survey of bank CEOs in rural areas of 10 states climbed modestly from July's weak reading. However, the overall index remains well below growth neutral.

Creighton University

Jack MacAllister Chair in Regional Economics

|

|

|

From the Desk of Ernie Goss

High Tax States Lose Representation in Congress: 2017 Tax Law and Pandemic Reinforce Population Trends

Peter Rex, Founder and CEO of Rex Teams recently announced that, "I'm moving my business headquarters off the West Coast." We tried San Francisco and Seattle. "Both were wonderful in their own ways, especially in natural beauty and personal friendships. But both have become hostile to the principles and policies that enable people to live abundantly in the broadest sense."

Rex joins a parade of individuals and businesses that are relocating from high tax states to low tax states due to 1) 2017 Tax Law that eliminated the deductibility of state and local taxes, 2) Post Covid-19, companies allowing employees to work from locations of their choice, and 3) Individuals and businesses avoidance of large urban centers with higher crime rates and economic lockdowns.

The accompanying table lists the 10 states experiencing the greatest population gains, and the 10 states suffering the largest population losses.

The global pandemic has further enhanced the economic prospects of the gaining states, which experienced an average increase in insured unemployment rates between mid-March, and the end of August of 7.4% compared to a much higher average of 9.9% for the ten losing states.

Many of the unemployed in high tax states will seek the more job friendly employment prospects in low tax states. Furthermore, the data show that the population gainers' average state and local tax rate was 7.82%, and the population losers' average state and local tax burdens was 9.5`%.

Importantly, 7 of the 10 gaining states voted Republican in the last presidential election, and 7 of 10 losing states voted Democrat in the same election. In addition to invigorating the economies of low tax states, this migration will have the bonus impact of increasing the representation in Congress of destinations with lower state and local tax rates.

The table below reflects reapportionment post-2020 Census:

- The 10 states with the highest population gains collectively will add 7 congressional representatives.

- The 10 states with the largest population losses will lose 5 congressional representatives.

|

Population Gainers |

Change in Congress

|

State & Local Taxes as % PI

| |

1. Arizona (net gain of 83,240 residents)

|

+1

|

8.25%

| |

2. Texas (net gain of 82,569 residents)

|

+2

|

8.20%

| |

3. Florida (net gain of 69,420 residents)

|

+2

|

6.82%

| |

4. North Carolina (net gain of 66,991 residents)

|

+1

|

8.17%

| |

5. South Carolina (net gain of 50,775 residents)

|

0

|

7.48%

| |

6. Nevada (net gain of 47,596 residents)

|

0

|

8.39%

| |

7. Washington (net gain of 46,549 residents)

|

0

|

8.32%

| |

8. Colorado (net gain of 43,293 residents)

|

+1

|

8.40%

| |

9. Georgia (net gain of 41,914 residents)

|

0

|

7.98%

| |

10. Tennessee (net gain of 39,952 residents)

|

0

|

6.18%

|

|

Average state & local tax burden

| |

| |

7.82% |

|

Population Losers

|

|

State & local taxes as % PI

| |

41. New York (net loss of 180,306 residents)

|

-1

|

12.28%

| |

42. California (net loss of 156,068 residents)

|

-1

|

9.27%

| |

43. Illinois (net loss of 114,154 residents)

|

-1

|

9.62%

| |

44. New Jersey (net loss of 50,591 residents)

|

0

|

9.88%

| |

45. Louisiana (net loss of 27,914 residents)

|

0

|

9.15%

| |

46. Massachusetts (net loss of 25,755 residents)

|

0

|

8.76%

| |

47. Maryland (net loss of 24,518 residents)

|

0

|

9.34%

| |

48. Connecticut (net loss of 21,509 residents)

|

0

|

9.99%

| |

49. Pennsylvania (net loss of 20,463 residents)

|

-1

|

8.53%

| |

50. Michigan (net loss of 16,766 residents)

|

-1

|

8.27%

| |

Average state & local tax burden

| |

9.51% |

2) Change in Congressional Reps. By Goss, 3) State & Local Tax Burdens by WalletHub

|

Mid-America & Rural Mainstreet

Indicators Graph

|

Mid-America

August Index Highest in Two Years:

Manufacturing Employment Gains for the Month

|

| |

Mid-America Business Conditions Index - August 2020

|

August survey highlights:

- The regional Business Conditions Index expanded to its highest level in two years.

- For the first time since January, the employment index rose above growth neutral.

- According to U.S. Bureau Labor Statistics data, the region has lost approximately one million, for a 7.3% decline, of its non-farm jobs since the onset of Covid-19.

- Four of five manufacturers reported difficulty in finding and hiring qualified workers.

- Business confidence climbed to its highest level since February 2018.

|

Rural Mainstreet

Index Inches Up for August: Almost One-Half of Bankers Report Temporary Ethanol Shutdowns

August survey results at a glance:

- Overall index advanced to a weak level and remained below pre-COVID-19 levels.

- Approximately 45.8% of bank CEOs with ethanol plants in their area reported temporary shutdowns. The remaining 54.2% reported ethanol production expanding at a slow pace.

- More than three of four bankers reported negative COVID-19 economic impacts on their local economy.

- Approximately one of six bank CEOs expect farm loan defaults to climb by an average of 15% over the next 12 months.

- On average, bankers estimated farm loan defaults would rise by 5.3% over the next 12 months. This is up slightly from 5.0% recorded last month, and 4.8% registered one year ago.

|

|

The Outlook

Professor Goss' Forecast - August 2020:

- Expect the yield on U.S. long-term Treasury bonds, along with mortgage rates, to climb by as much ¼% (25 basis points) by the end of 2020.

- The September job additions will be somewhat disappointing in comparison to August's.

- There will be upturns in municipal bond bankruptcies in the months ahead.

- The annualized and seasonally adjusted Q3 GDP will range between 15% and 16%.

- "Nearly two-thirds of the National Association for Business Economics members who participated in the August 2020 NABE Economic Policy Survey believe the U.S. economy continues to be in a recession that began last February," said NABE President Constance Hunter, CBE, chief economist, KPMG. "Almost half the respondents expects inflation-adjusted gross domestic product to remain below its fourth-quarter 2019 level until the second half of 2022 or later. And 80% of panelists indicate there is at least a one-in-four chance of a 'double-dip' recession.

- "The panel is split in its view on Congress's fiscal response to the recession, with 40% calling the response insufficient, 37% indicating the response is adequate, and 11% saying it is excessive," Hunter continued. "Nearly three out of four panelists believe the optimal size for the next fiscal package to be $1 trillion or greater, compared to 17% who favor a smaller package."

- "More than three-quarters of panelists believe that the current stance of U.S. monetary policy is appropriate, the largest share holding this view since 2007," added Survey Chair Gregory Daco, chief U.S. economist, Oxford Economics. "The majority of panelists-58%-expects the federal funds rate range to remain unchanged at 0-0.25%, or even drop lower, by the end of 2021.

- Daco added. "Combating COVID-19, promoting economic recovery, and health policy were cited more frequently than a dozen other choices."

|

|

Opportunities

- The nation added 1.4 million jobs in August as the unemployment rate tumbled to 8.4% from 10.2% in July.

- The Case-Shiller home price index for June was up 2% from May and 4.3% above June of 2019.

- U.S. August retail sales advanced above pre-Covid-19 levels and rose 1.2% from July's level.

- Both Creighton's and ISM's manufacturing PMIs rose above growth neutral for June, July, and August.

Bad News

- Fall 2020 job cuts announced by U.S. airlines are 16,000 for United, and 40,000 for American, Delta plans to cut 1,900 pilot positions.

- U.S. debt as a percent of GDP reached its highest level since World War II.

- U.S. municipal defaults rose to their highest level since 2011.

- Four of five manufacturing supply managers in Creighton's August survey reported that finding and hiring qualified workers was a significant problem.

|

|

|

|

9-State Supply Manager Report

* Arkansas

* Iowa

* Kansas

* Minnesota

* Missouri

* Nebraska

* North Dakota

* Oklahoma

* South Dakota

Read state-by-state, six-month projections (scroll down) by supply managers from nine states. Participants were surveyed about current economic conditions in their communities.

|

More From

Economic Trends

|

The nation's premier business organization, the U.S. Chamber of Commerce, bowed to political correctness and decided to back reelection of 23 House Democrat freshmen who reliably voted against free market principles such as right-to-work laws.

|

Goss Eggs

Recent Dumb

Economic Moves

The Trump Administration's CDC effectively seized private property by banning rental evictions through the end of 2020.

All renters have to do is attest that they would be homeless absent the moratorium. The renters would owe back rent at the end of the period (fat chance of collecting a lump sum payment instead of the monthly rent). This action will result in landlords failing to maintain properties, cover property taxes, and pay mortgage payments. And in the end, evictions will explode in 2021.

|

|

Keep an Eye on ...

U.S. BLS's Jobs October Report for September

On October 2, the BLS releases the number of jobs lost or gained for September. Another positive and strong reading will be very bullish for U.S. stocks and bearish for the U.S. bond market.

_ _ _

U.S. Bureau of Labor's Weekly Continuing Claims Data

Released every Thursday, this is the earliest reading on the U.S. and state labor markets. The level of unemployed will likely move lower in the weeks ahead as the first-time claims continue to decline.

_ _ _

Yield on 10-Year U.S. Treasury bond

Find instantaneously, at finance.yahoo.com. Watch for this yield to rise back above 1.0% to signal coronavirus impacts waning. Right now, that yield is well-below 1.0%, pointing to less, but still high, U.S. economic risks.

|

|