(Left:

Rep. Frank

addresses the Burkburnett Rotary Club at an event on July 2. Right: Rep. Frank pictured with Liz Talbert, President of the Burkburnett Rotary Club)

We are

just over one month removed from the end of the 86th Legislative Session. Since the 20-day deadline for the Governor to veto bills has come and gone, we now know what the final work product of the 86th Legislature looks like. These next few newsletters are my attempt to give you an overview of what the Texas Legislature did for you (and sometimes to you) during the 2019 legislative session.

With everything that took place in the 140-day legislative session, we thought it would be most convenient for the reader to break up the End of Session Recap Newsletter into 3 parts over the next 3 weeks. This newsletter, Part 1, will deal with the major legislation passed during the session

. Part 2 will deal with what I spent the bulk of my time on this session -- the work of the Human Services Committee and Public Health Committee. And Part 3 will discuss the interim and what to expect going forward from me, my office, and for state government as a whole.

Some of this, especially the information about SB 2 and HB 3, will seem familiar. We have already discussed these two bills in some depth in previous newsletters. However, these two issues (property tax transparency/reform and school finance reform) are what this session will be remembered for so we're including information about them one last time.

It has truly been great being back hom

e in Wichita Falls. I am thankful that a state rep in Texas gets to spend 19 months of every 24-month cycle living in his/her hometown. Not only is this much better for my own quality of life, it makes it much easier for representatives to stay connected to the needs and desires of their communities. I am also grateful for the opportunity recently to speak to various civic groups and organizations, including the Helen Farabee Centers Board, Wichita County Republicans, and Burkburnett Rotary Club. I fielded questions from them about the session and what law changes could mean.

Finally, the July 4th holiday is a reminder of the freedoms that we enjoy and should be a reminder of the sacrifices of those who died to give us these freedoms and opportunities. While it is fashionable in some circles to insult our country, it is clear by the number of people trying desperately to get into the United States that it remains a beacon of freedom and hope. These freedoms and opportunities seem evident to the world, but are missed by many within our borders.

May God bless you and your family,

|

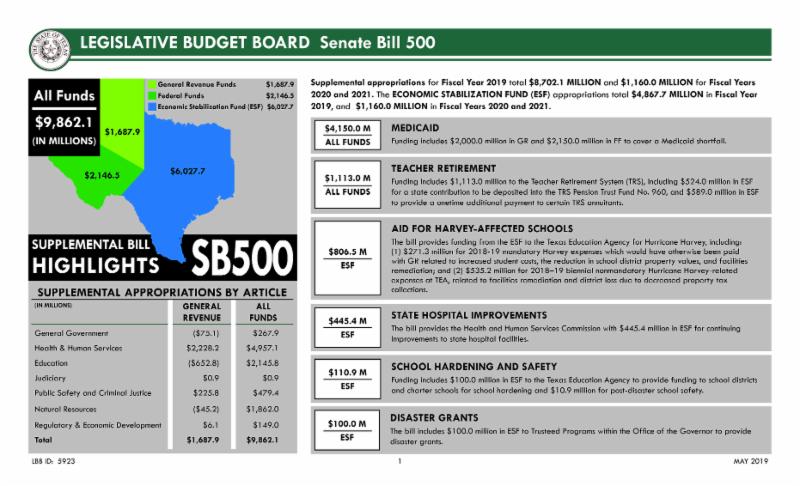

The Budget (HB 1 and SB 500)

SB 500

The one "must pass" item of every session, the budget is essentially made up of two bills -- SB 500 (the supplemental budget) and HB 1 (the appropriations act). Since making a two-year budget is always going to be an inexact science, the Legislature has to come back every session and true up the budget with a supplemental to pay for cost overruns or unforeseen expenditures. This year's supplemental, SB 500, spent $9.8 billion in All Funds. Of that nearly $10 billion, over $4 billion was spent to cover a Medicaid shortfall. The next largest line items were $1.1 billion for retired teachers (shoring up the TRS Pension Fund and providing a one-time "13th check" to annuitants), $806 million for aid to Hurricane Harvey-affected schools and school districts, and $840 million for grant funding for new flood-related projects. All told, a little over $6 billion of the $9.8 billion is coming out of the Economic Stabilization Fund (Rainy Day Fund) to pay for these supplemental expenses/projects. A detailed run-down of SB 500 is available

HERE

.

(Graphic Courtesy of Legislative Budget Board)

HB 1

HB 1, the budget for the upcoming biennium, appropriates $250 billion in All Funds, which includes $5 billion in property tax relief. With tax relief included, this represents a 6.3% growth in the budget from the 18-19 biennium (4.2% if you take out the tax relief). With population growth plus inflation over the previous biennium at approximately 8%, I believe the budget represents a growth rate that is reasonable and sustainable.

Of the $250 billion, $118.9 billion is General-Revenue (47.6%), the form of revenue which the Legislature has discretion on spending. This is the pot of money that the budget actually directs. The other portions of the budget are in Federal Funds ($86.4 billion or 34.6%), Dedicated General-Revenue ($6.2 billion or 2.4%), and Other Funds ($39.2 billion or 15.7%).

As you might expect in a session where school finance reform took center stage, the most notable growth in funding is in Public Education, which received $12.1 billion in additional funding over the previous biennium (20% growth). The Legislature also allocated $2.4 billion in new funding in the budget for Harvey-related disaster recovery, nearly all of it federal money.

If I can highlight one thing, I'd like to point out just how much education and healthcare dwarf everything else in the state budget. Article 3, covering Public Education and Higher Education, comes in at $94.5 billion, $66 billion of which is out of GR. Article 2, covering Health and Human Services, is at $84.4 billion, of which $33.7 billion is GR. Of that $84.4 billion, Medicaid alone comprises $66.5 billion. I point this out to help understand why the fights over seemingly small changes in school funding, Medicaid eligibility, and health care can often loom tremendously large.

These are such big portions of the budget that even small changes can mean hundreds of millions or billions of dollars.

Here's a link to the Summary of the Budget if you're interested (HERE) as well as the full budget in all of its glory (HERE). If you have specific questions or are interested in specific items, don't hesitate to reach out to me.

|

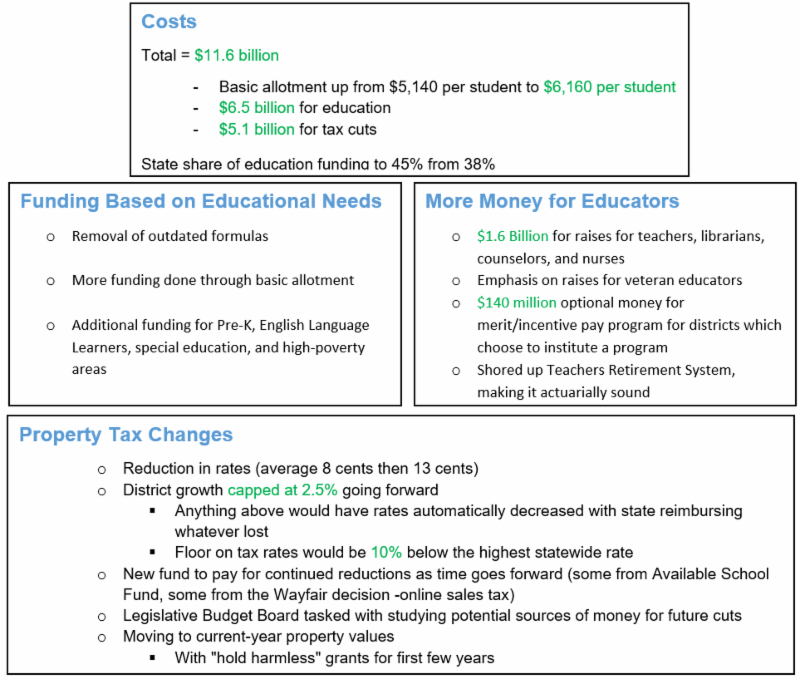

House Bill 3

(School Finance Reform and Property Tax Relief)

Many months in the making, HB 3 creates a better school finance system built more around student educational needs, putting additional resources to our educators, and achieves real property tax relief.

HD-69 will see an average reduction in school district tax rates of 9 cents in 2020 and 10 cents in 2021 while the school districts in our area will see over

$48 million in brand new state revenue at the same time. A significant portion of the new funding will go to increased pay for teachers and other school personnel. Additionally, our districts will have the opportunity to institute a merit-pay system to reward their educators, with flexibility to design a program that makes sense for their district.

It's not the "perfect" plan I might have drawn up if it were strictly up to me. However, that doesn't mean it's not a meaningful step forward on school finance. Considering the realities of 181 legislators representing different constituencies and political pressures with hard deadlines, and considering that meaningful school finance reform is rarely, if ever, done without a court order, I believe the Legislature achieved a great deal with HB 3 this session.

|

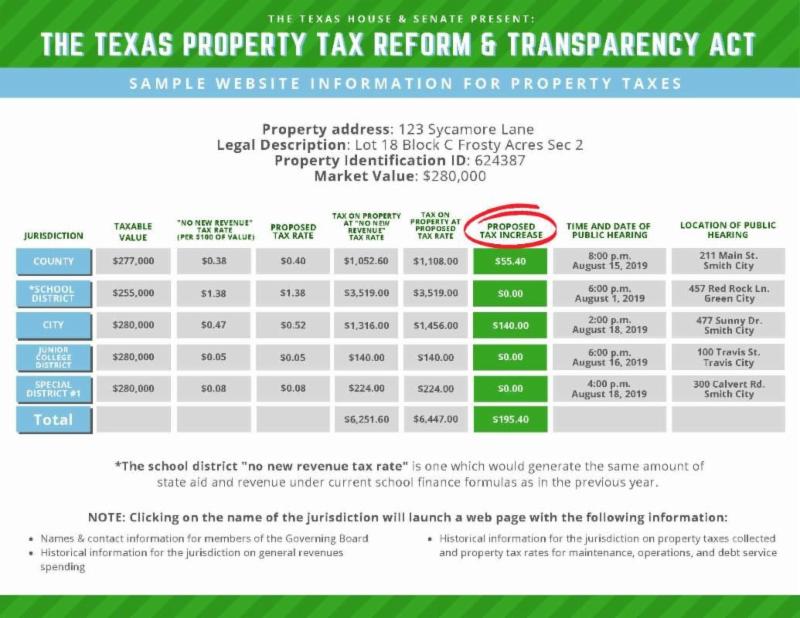

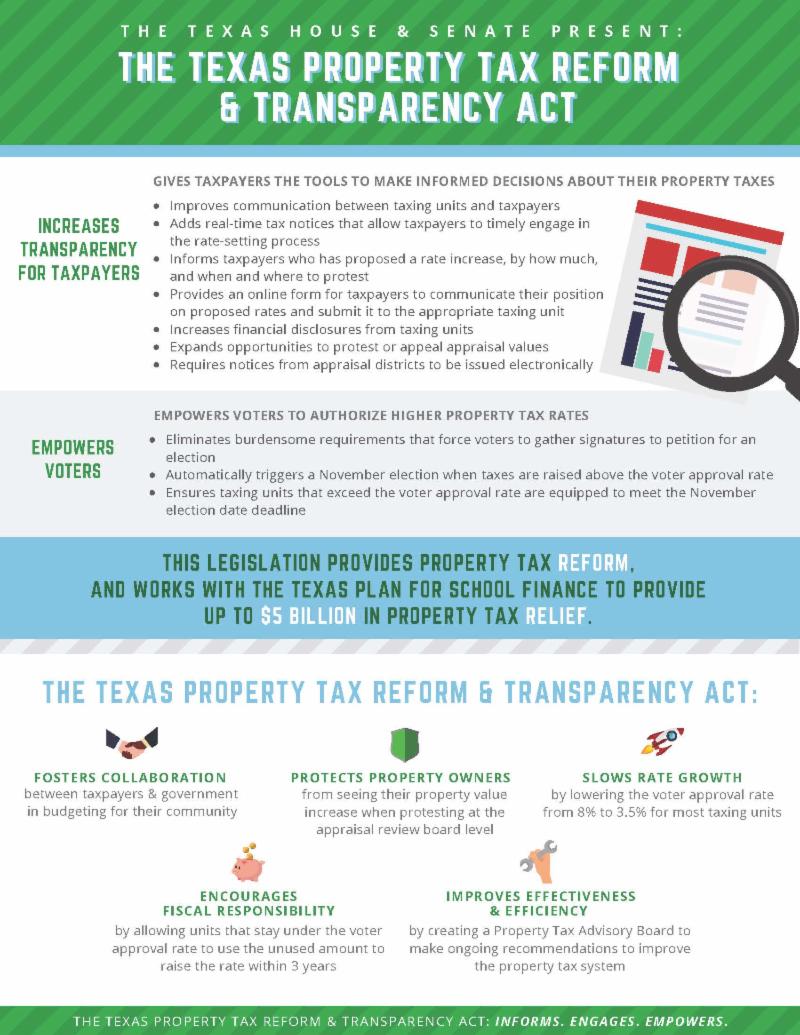

Senate Bill 2 (Property Tax Transparency and Reform)

SB 2 was the primary bill for meaningful, substantial property tax reform this session and I was proud to vote in support of it. The bill is 145 pages long, so I'll do my best to briefly explain its provisions in just a couple of paragraphs. There are two overarching goals in the bill: limiting future tax increases and transparency in the property tax rate setting process.

In order to deal with the first issue, the Legislature has dramatically lowered the rollback rate from 8% to 3.5% for most taxing entities. This means that local elected officials will automatically have to go to voters in order to increase property taxes more than 3.5% annually. The final version also made some in-the-weeds changes to ensure that very small towns and small rural counties are able to function in this new system while still giving taxpayers new protections. When all is said and done, no taxpayer will be worse off with the new law than they are under the current one and the vast, vast majority of Texans will see smaller property tax growth than they would have without SB 2.

On the transparency front, the bill enforces new requirements for tax notices to property owners that are easier to read, understand, and give much clearer direction for how they can get involved in the rate-setting process. SB 2 also makes it easier for taxpayers to protest or appeal their appraisal values and gives them new protections during that process.

Taken together, I believe the reforms achieved in SB 2 will have a measurable, meaningful impact on property taxes across the state.

|

|

Spread the Word

Please feel free to forward this newsletter along to friends and family and, if you have not done so already, please find me on

Facebook and

Twitter.

Additionally, if you would like for me to join your group or organization to discuss the recent legislative session or the upcoming interim, please reach out to me at [email protected].

|

|

Once again, thank you for the honor of being your representative. Please do not hesitate to contact us if we can be of assistance.

Capitol Office: District Office:

Texas Capitol, E2.604 1206 Hatton Road

P.O. Box 2910 Wichita Falls, TX 76302

Austin, TX 78768 Phone: (940) 767-1700

Phone: (512) 463-0534

Fax: (512) 463-8161

|

|

STAY CONNECTED

|

|

|

|

|