|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

A Day in the Life of Hugo.

Hugo wants to buy a car and checks out

1st Nor Cal's auto loan rates.

|

President's Corner President's Corner

|

Jake Blues (played by John Belushi in the 1980 classic movie "The Blues Brothers") was covered in mud after a burst of gunfire from his former fiancée (played by the late Carrie Fisher) while he was trying to explain to her why he left her at the altar.

"I ran out of gas. I got a flat tire. I didn't have change for cab fare. I lost my tux at the cleaners. I locked my keys in the car. An old friend came in from out of town. Someone stole my car. There was an earthquake. A terrible flood! Locusts! IT WASN'T MY FAULT!..."

Sometimes, we look for excuses or scapegoats when things do not go our way. Since our charter conversion and name change two years ago, a few of our members would say after not getting the answer they wanted, "Service was better before 1st Nor Cal took over our Credit Union."

As we explained in numerous communications to our members before, during, and after the conversion that we were not taken over by a larger credit union or some out of town corporate entity in which we know neither their names nor faces. If that were the case, the Board of Directors would have been replaced, and I certainly would no longer be here. Most of the staff would have been paid a small incentive to leave or laid off altogether.

Nevertheless, here we are, two years later. The Board is intact, and I am still the President and CEO. All of our staff stayed, save a few subsequent terminations, which is normal for any business. In fact, I am very proud of the fact that even in my 26th year at Contra Costa/1st Nor Cal, there are still eight staff members who have more seniority than I. That is highly unusual and almost unheard of for an organization of our size. The low turnover rate is a testament to the high quality and loyalty of our staff. It also means members are being serviced by the same people as before the name change.

We made it a point to keep everything as much the same as possible, but change, which few people like, is necessary. We changed our name to be attractive to our members' neighbors and local companies they do business with in Solano and Alameda Counties. Later this year, we will be closing our Pittsburg branch, which we inherited after acquiring the Pittsburg Employees Federal Credit Union, because members complained the lobby was too small and our Antioch branch because the members complained the surrounding neighborhood has changed for the worse. In its place, we are constructing a larger branch at the Century Plaza Shopping Center right next to Target on the Pittsburg/Antioch border that will more than accommodate members visiting the two current offices.

There will be other changes as well. We are looking at an office in Brentwood that is slated to be our first "1st Nor Cal Express" that will have most of the same services as the other branches. These smaller outlets will allow us to build more physical presence in the three-county East Bay Area.

One thing that has not changed since the Credit Union was founded in 1949 is our superior member service. We do everything we can to give members what the financial services they need but admit we do not make every member happy all of the time. However, we promise to try to find a suitable solution to enhance our members' financial lives. We also promise no locusts.

David M. Green

President/CEO

(925) 335-3802

|

Stat of the Month Stat of the Month

|

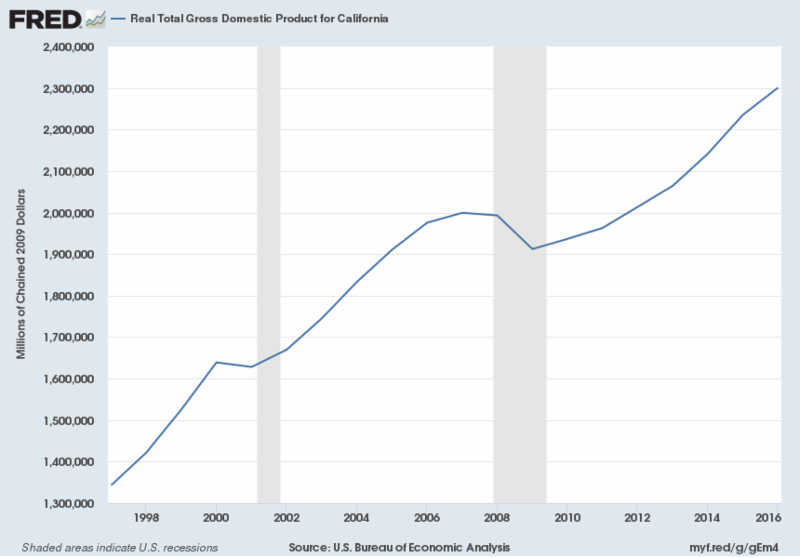

REAL GROSS DOMESTIC PRODUCT (GDP)

FOR CALIFORNIA 1997-2016

Source: U.S. Bureau of Economic Analysis, Real Total Gross Domestic Product for California [CARGSP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CARGSP, January 29, 2018.

California GDP was a record-high $2.3 trillion in 2016 representing 14% of United States GDP and is the largest state economy in the nation. California's per-capita GDP is almost $59,000, compared to $51,000 for the U.S. During 2011-16, the California economy grew in real terms by 17% at an annual growth rate of 3.2% per year.

(ONE NINE TWO ZERO EIGHT)

|

1st Alerts 1st Alerts

|

- We upgraded @ccessOnline Home Banking! Learn more: www.1stnorcalcu.org/online-banking/upgrade

- Please be informed that loan life insurance expired as of October 31, 2017. No claims will be processed after that date.

- Click here for information regarding the Equifax Breach.

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

We all love saving time and money.

|

Check out how simple it can be!

With a $400,000.00 Mortgage

30 year, fixed rate mortgage at

4.25% APR

2

has a principal and interest payment of

$1967.76

with finance charges estimated at

20 year, fixed rate mortgage at 3.875% APR

2

has a principal and interest payment of

$2397.66

and finance charges estimated at

$175,436.86

So for about $430.00 more per month, you can

Save 10 Years and around $133,000.00

in finance charges!

Call us today to save some

serious time and money!

(925) 335-3870

2: APR = Annual Percentage Rate. Mortgage amount, rates and terms are only examples and estimations.

Call our Mortgage Department at 925 335-3870 for actual costs. Example Quotes: 4.302% APR for 30 years and 3.946% APR for 20 years. Taxes and insurance are not included in these calculations. Rates cannot be guaranteed and are subject to change without notice. Loans subject to all policies and procedures. Quoted conforming rates are based on a loan amount of $400,000 with loan-to-value (LTV) not to exceed 75% of appraised value. There are no pre-payment penalties on these quotes.

1st Northern California Credit Union does not charge points.

1st Northern California Credit Union - NMLS ID # 580488

|

Scam of the Month Scam of the Month

|

|

Tax identity theft is still on the rise. Last year, the IRS identified 14,000 fraudulent tax returns with $900 million claimed in fraudulent refunds, according to an audit report from the U.S. Treasury Inspector for Tax Administration. The IRS uses your Social Security Number (SSN) to make sure your filing is accurate and complete, and that you get any refund you are due. Identity theft can affect how your tax return is processed. An unexpected notice or letter from the IRS could alert you that someone else is using your SSN. The IRS does not start contact with a taxpayer by sending an email, text or social media message that asks for personal or financial information. If you get an email that claims to be from the IRS, do not reply or click on any links. Instead, forward it to

[email protected]

.

If someone uses your SSN to file for a tax refund before you do, the IRS might think you already filed and got your refund. When you file your return later, IRS records will show the first filing and refund, and you will get a notice or letter from the IRS saying more than one return was filed for you.

- Get an Identity Protection PIN (IP PIN) from the IRS.

An IP PIN is a six-digit number assigned to eligible taxpayers that helps prevent the misuse of your Social Security number on fraudulent federal income tax returns. You cannot use the IP PIN as your e-file signature PIN.

- Check your mail and credit union account statements every month.

If you discover an account you did not open, balance discrepancy, or a purchase you did not make, contact the financial institution or creditor immediately to report the activity.

- Monitor your credit reports on a regular basis.

The federal government has set up www.annualcreditreport.com for all Americans to receive a free, no-obligation credit report from the three major credit bureaus every twelve months. Read the reports carefully to see if the information is correct. Contact the credit reporting company if there are any mistakes or signs of fraud.

If you think someone used your SSN for a tax refund or a job - or the IRS sends you a notice or letter indicating a problem - contact the IRS immediately. Specialists will work with you to get your tax return filed, get you any refund you are due, and protect your IRS account from identity thieves in the future.

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 2.49% APR requires a minimum FICO® 750 Credit Score. 72 months term at 2.49% APR is $14.97 per $1,000.00 borrowed.

|

Tips for Teens Tips for Teens

|

College Textbooks: The Cheapskate Way

College. It's like handing over an ounce of gold at the bookstore for a years' worth of supplies. Seriously though, according to the College Board, the "yearly books-and-supplies in-state estimate for the average full-time undergraduate student at a four-year public college is about $1,298"

3 and gold is currently trading at about $1,300 per oz. Thankfully, there are some ways to minimize the impact to the point where FASFA might actually be enough!

Don't forget to check the public library!

Let's face it, it's probably been a long time since you last set foot in a public library. They're still there and they often have the books you need to check out for free! For example, suppose the books your professor asks for are George Orwell's

1984, John Steinbeck's

The Grapes of Wrath, and F. Scott Fitzgerald's

The Great Gatsby. One option would be to cough up $25 dollars for three books that realistically will never be read again and just take up room on your bookshelf. Option two is to check to see if these books are old enough to be in the public domain. Books in the public domain are free and are usually uploaded in a PDF format by a reputable source, like a .edu, .org, or 3rd party eBook distributor like the Google Play Bookstore or the Amazon Kindle store. Unlike PDFs that you find on Google after searching for

The Great Gatsby Free PDF, these PDFs and legal to use, redistribute, and print since their copyright expired. The former PDFs are infringing on the books' copyright and you might run into legal trouble if caught using one. However, the third and fail safe route is to use the public library. Just go back in, renew or apply for a library card, then go to the website to place holds on the books that are needed that semester. Just remember to return them after you're done using them to avoid late fees.

What about textbooks?

Glad you asked about that. Certain textbooks can also be checked out through the public library. I personally haven't had any luck with my public library system carrying any of the textbooks that I need, but it is one of the 71 library systems that participate in Link+, a library cooperative available from participating libraries in California and Nevada. There, almost any textbook that is needed for the semester is available since some of the participating libraries are colleges and universities. There's no cost to use or enroll in Link+ and as long as your library card is in good standing, you're in! Check with your local public library to see if it's one of the library systems that participate in Link+ (Contra Costa, Solano, or Alameda County Libraries all participate in Link+) or check for yourself here:

https://csul.iii.com/screens/members.html

Alternatively, check your school's library and ask to checkout a textbook on reserve. Usually these books are only available to you for 3 hours and can only be used inside of the library. The advantage of this is that it forces you to do your homework during that time rather than procrastinating.

Okay, and the supplies?

Scantrons and Bluebooks are the unfortunate monopoly that hovers over school supplies. Thankfully, Scantrons can sometimes be obtained for free by attending orientation events at the start of the semester and during finals week. As for pens, pencils, highlighters, and notecards, use your supplies from last year. If you're all out of those too, remember to pick some up next semester from an orientation event. You can also save on transportation by checking your public transit system to see if they offer any discounts for students such as free bus fare for UC Berkeley students and BOGO tickets offered by the County Connection.

Whatever you do, remember that the financial office at your college or university might also offer bonus financial aid based on your FASFA, which as a reminder, has a deadline to file by March 2nd!

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Insurance Tips Insurance Tips

|

Did you know that this year it is estimated that Americans will spend $4,300,000,000 (yes billion) on jewelry for Valentine's Day?

If you have jewelry, whether it's a diamond ring, a Rolex watch or a family heirloom, you should consider purchasing additional coverage. A Homeowners or Renters Insurance policy provides very limited coverage, typically between $1,000 - $2,500 and does not provide coverage for accidental loss or lost stones. In order to insure, most carriers will require a current appraisal. The annual cost for insuring jewelry is about $15 per $1,000 of coverage. The advantage to specifically insuring an item is that it is then covered on an "All-Risk" basic and generally does not have a deductible. Protect those special items you cherish, and skip the heartbreak later!

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, umbrella, earthquake, flood, business and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

Tax Laws - 2018: Six Changes to Know About

By Jason Vitucci, CFP® & Gene A. Schnabel

The Tax Cuts and Jobs Act of 2017 ushered in a broad range of changes impacting virtually all American taxpayers. Below are six of the most significant changes individuals and families need to know about as they plan for and manage their income and finances in the months ahead.

New tax brackets -

While there are still seven different income tax brackets, rates and income thresholds for those brackets changed as of January 1, 2018, resulting in lower income tax rates for many taxpayers. A complete list of 2018 income tax rates and brackets is available at https://taxfoundation.org/2018-tax-brackets/.

Standard deductions increase

- The personal exemption (which allowed taxpayers to deduct a set amount for themselves, their spouses, and each dependent) has been repealed through 2025. However, standard deductions have nearly doubled to $12,000 for single filers, $18,000 for heads of household, and $24,000 for married taxpayers filing jointly.

Many itemized deductions have been limited or eliminated

- While taxpayers may continue to choose between claiming a standard deduction or itemizing their deductions, a number of itemized deductions have been capped or repealed. SALT, the state and local tax deduction, was capped at $10,000 and the mortgage interest deduction was capped at loans of no more than $750,000. In addition, all miscellaneous itemized deductions subject to the 2% adjusted gross income (AGI) floor were repealed along with the home equity loan interest deduction. The casualty and loss reduction remains, but will be limited to presidentially declared disasters.

Change to medical expense deduction

- The floor for the out-of-pocket medical expense deduction was lowered from 10% of adjusted gross income (AGI) to 7.5% of AGI for tax years 2017 and 2018 only. This is good news for those with significant, qualifying medical expenses.

Child tax credit doubles

- While parents will no longer be able to claim personal exemptions for their children, they can claim the child tax credit which doubled from $1,000 per child to $2,000 per child. In addition, $1,400 of this tax credit is refundable, meaning taxpayers can claim this much over and above their tax bill for the year, generating a refund. The child tax credit income threshold also increased but begins to phase out at an annual income of $200,000 for single parents and $400,000 for married filing jointly parents.

New non-child dependent credit

- Taxpayers with non-child dependents may be eligible for a nonrefundable $500 tax credit for each qualifying dependent. This applies to children over the age of 17, elderly parents, and adult children with disabilities.

We help our clients navigate through the confusing maze of tax planning as it relates to financial planning. If you feel that we may be a good fit to work together, please don't hesitate to contact our office. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(FIVE ONE NINE NINE SEVEN)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|