|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

Tips from the Credit Squirrel

|

Let the Credit Squirrel teach you about credit scores and why they're important!

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 2.49% APR requires a minimum FICO® 750 Credit Score. 72 months term at 2.49% APR is $14.97 per $1,000.00 borrowed.

|

President's Corner President's Corner

|

Every year at this time, the Nobel Prize winners are announced. These prestigious honors, which are worth about $1 million to the winners, are awarded in Physics, Chemistry, Medicine, Literature, Economic Sciences, and Peace. Alfred Nobel established a foundation upon his death to recognize outstanding achievements in these disciplines, sort of an Oscar for brainiacs.

Dr. Richard Thaler of the University of Chicago is this year's recipient of the Nobel Prize in Economics. Usually, this particular Nobel Prize goes to someone who developed a complex economic theory. Recent winners tackled the rarefied subjects of contract theory, empirical analysis of asset prices, cause and effect in the macro economy, and markets with search friction. Dr. Thaler's subject earned his Nobel Prize for his contributions to behavioral economics. His body of work is a little less Econ 101 and a little more Psych 10, which was the basic survey course at my alma mater. This is not to denigrate Dr. Thaler's research, but rather distinguish it from past honorees.

Dr. Thaler's hypothesis is known as limited rationality, which theorizes how people make financial decisions by focusing on the impact of the individual decision rather than its overall effect. In other words, people make bad financial decisions using only a limited amount of information which usually means thinking short-term instead of long-term. For example, an investor will sell a strong stock to feel they made money instead of a weak stock which they hold to hopefully make their money back. "Buy low and sell high" looks good on a billboard and sounds nice in theory but rarely is utilized in practice.

This theory is nothing new to anyone who works or has worked in a credit union, bank, securities brokerage, or financial planning company and is something we've known and I've mentioned in this column for many years. For whatever reason - family history, preconceived notions about investing, or trying to "time the market" - economic decisions are made on a human level and are not made strictly rationally. Human behavior is the reason why we buy a shirt at Nordstrom instead of the exact same but cheaper shirt at J.C. Penney, why people buy a Lexus instead of the lower-priced Toyota (it's all the same under the hood), and why amateur investors think they will be millionaires by day trading.

But this doesn't mean people can't change their behavior. With apologies to Dr. Thaler, people's mindsets can change from wants to needs. If a consumer focuses on their needs instead of wants, they will look for the best price for a product or not even buy that product and save the difference. For instance, Walmart, for better or for worse, has changed the way consumers shop for everyday goods. Online shopping has also changed consumer behavior but has turned out to be a convenience rather than cost saving.

The Nobel Prize for Economics is a relatively new award, starting nearly 70 years after the other disciplines started to be awarded. As a result, some doubt Nobel winners in Economics are the equal to the other winners. However, Dr. Thaler brought humanity to the forefront of an otherwise pretty dry and statistics-heavy subject. The good doctor himself brought some humor into his award when he replied to the question of how he will use his award winnings, "I will say that I will try to spend it as irrationally as possible." He also expressed disappointment for not being considered for a real Oscar for playing himself in the 2015 film "The Big Short." Yes, economists are humans, too.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

Source:

Tom Slefinger, Balance Sheet Solutions, "Weekly Relative Value," Week of October 30, 2017

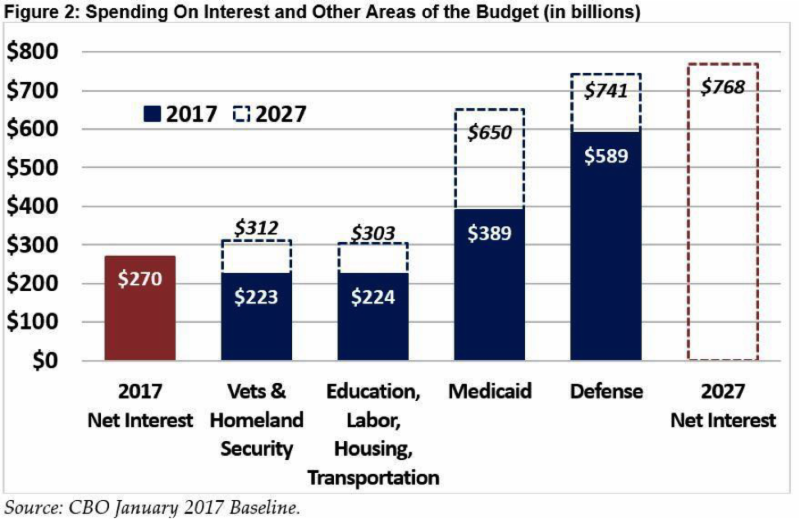

Congress recently passed a $20 trillion budget. It is clear the largest component of the budget is interest on the national debt, which represents 107% of Gross Domestic Product. U.S. debt doubled between 2007 and 2014. The federal debt does not include unfunded liabilities of Social Security, Medicare, and Medicaid; debt issued by federal agencies and government-sponsored enterprises, like Fannie Mae; and state and local debt. The federal debt works out to $62,000 per person, or $250,000 for a family of four. If interest rates go up, the interest portion could skyrocket to an unsustainable level.

(THREE SEVEN ONE SEVEN SIX)

|

1st Alerts 1st Alerts

|

- Please be informed that loan life insurance expired as of October 31, 2017. No claims will be processed after that date.

- Click here for information regarding the Equifax Breach.

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

|

Buy a Kid a Bike

Buy a Kid a Bike

to benefit the Richmond Fire & Police Holiday Program

You can help a child in need this holiday season! Make a donation now through December 15th at any 1st Nor Cal® branch location. Any amount helps! Each $49 collected buys a bike and helmet for one child.

Trunk-or-Treat

On October 29th, Christina Antunez and Kristina Bryan represented 1st Nor Cal with a pirate-themed trunk at the Trunk-or-Treat Spooktacular event in downtown Martinez where local businesses lined Main St to give out candy to the children of our community. Over 2000 kids stopped by for treats and info about how they can become youth members of our credit union!

|

Tips for Teens Tips for Teens

|

Happy Thanksgiving!

The aftermath of the recent Santa Rosa fire is, needless to say, devastating. Roughly 3,000 homes were lost, causing $1.2 billion dollars in damage. Homes and money can be replaced, but the pain and suffering of the 43 families who lost their loved ones to the fires is priceless. On October 9th, the Red Cross put out an online volunteer form and they reached their immediate need of volunteers within hours of posting it. Lost and missing pets were sent to different shelters and foster homes across the Bay Area where they were cared for until their families were ready to take them home. Neighbors supplied each other with air masks once the hardware stores ran out. Despite the negative tone that seems to plague the downfall of society, genuine kindness and desire to help really shined through a difficult week.

I'd like to thank all of the First Responders, volunteers, pet shelters and foster homes, neighbors, and everyone else that truly made a difference to someone in need.

- - - - -

With the holiday season quickly approaching, there's something that comes to mind that I can't seem to forget no matter how hard I try. Remember the 2013 Target hack and the 40 million affected people? While I was fortunate not to be effected, I want to do everything I can to minimize the chances of being the 40 millionth and 1 person to have to call my financial institution and the credit bureaus.

The two safest options when making payments are to utilize the chip on your debit/credit card or to use Mobile Wallet. They both work the same way. In short, the chip creates a unique code that the merchant receives with just enough information for that transaction to go through but not enough for a hacker to steal your information. The process is repeated with a different code the next time you use your card for a transaction.

The only downside to using the chip, as you may have noticed, is that it can take a little longer to approve the transaction. A friend of mine worked at a restaurant before and after chip cards became common practice, and their feelings toward the chip cards were mixed. They believed it was a safer option, but it also slowed down the checking out process dramatically.

Enter Mobile Wallet. This refers to Apple Pay, Android Pay, Samsung Pay (and others) but it's all the same technology. Like a chip card, a unique code is created when you go to pay at a terminal, but instead of waiting after you insert your card, the process happens quickly on your phone, therefore, avoiding those death stares from the people behind you who wait while you hold up the line.

Sounds like something you would like to test yourself? You can try it now with your 1st Nor Cal debit or credit card! 1st Nor Cal now supports Apple Pay, Android Pay, and Samsung Pay. (We've created a page with all the info

here).

Sure, there's always the option to use cash to avoid your information being stolen. However, these two methods have proven themselves to be safer than the old magstripe. I personally look forward to finally being able to rock out to Android Pay this season and enjoy the 10 seconds of amusement that comes with each transaction.

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Insurance Tips Insurance Tips

|

5 Tips for Deep Frying a Turkey this Thanksgiving

Those of us who have tasted deep-fried turkey usually say there's simply no comparison to an oven-roasted bird - turkey out of the fryer is moist, with crispy skin and a beautiful color. But, if you're not careful, frying a turkey can ruin your Thanksgiving, too. You've no doubt seen videos of people accidentally starting fires with their attempts. In some cases, families have even lost their homes.

With a little common sense, though, you can safely enjoy that great taste and fast cooking time. Here are five tips for cooking a great deep-fried turkey - without doing any damage (except maybe to your waistline):

- Find a safe place to cook. Don't ever set up a fryer any closer than 10 feet from your home, garage or any other structure. Make sure the area is flat to keep the fryer from tipping, and never put it on a deck or other flammable surface.

- Don't use too much turkey. You don't want to drop a 20-pound bird in your fryer; it's just too big. Keep your turkey to 12 pounds or less, don't stuff it and make sure it's completely thawed and dry.

- Don't use too much oil, either. When it comes to the oil, use something with a high smoke point (for example, canola or safflower) and do a test with water beforehand to figure out how much you need. Put the turkey in your fryer and fill with water until it is covered. Then take the turkey out and make a mental note of the water line - that's how much oil to use. Be sure to dry everything completely after your test.

- Use caution when it's time to cook. Don't just drop the turkey into the fryer, unless you want to splash hot oil on yourself (bad) or the burner (even worse). Gently lower it into the oil, and then monitor everything as it's cooking. Keep an eye on the oil temperature to make sure it doesn't get too hot. Keep an eye on the clock, because you want your turkey to cook for about 3-5 minutes per pound. And, watch kids and pets so they don't get too close to the fryer.

- Be prepared for disaster. If you're cautious, the odds are you won't need a fire extinguisher, but you should have one on hand anyway - a multi-purpose model with dry powder. Don't ever spray water on a fryer fire. If you don't have an extinguisher, dump a large amount of baking soda on the blaze. And, if all else fails, call 911 - quickly.

Wishing you a happy and safe Thanksgiving!

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, umbrella, earthquake, flood, business and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

2017 Year-End Tax Strategies & Charitable Giving Considerations

By Jason Vitucci, CFP® & Gene A. Schnabel

While it's hard to believe, another holiday season will be upon us shortly. That makes now the perfect time to review and plan for the important year-end tax, investment, and charitable giving opportunities listed below.

Keep in mind that December 31, 2017 is the deadline for:

- Tax-year 2017 charitable contributions (cash, non-cash, and securities)

- Gifts to family members (annual gift tax exclusion is $14,000 per recipient)

- Tax harvesting: selling stocks or listed options to realize a gain or loss

- Making employee contributions to certain qualified retirement plans, such as 401(k) and 403(b) plans

- Completing a 2017 Roth IRA conversion

- Deferring bonuses or self-employment income into 2018

- Rolling over FSA balances in employer-sponsored plans

- Paying for qualified out-of-pocket healthcare services, procedures, or equipment if you plan to itemize medical expenses (in 2017, qualified expenses must exceed 10% of your adjusted gross income (AGI) regardless of your age)

- Avoiding tax penalties by adjusting withholding or estimated tax payments to make up for any shortfall

- Accelerating income to "zero-out" AMT (check with your tax advisor first; this can be counterproductive for certain taxpayers)

As we prepare to enter what is traditionally the giving season, keep the following tips in mind when making any charitable donations:

- Qualified charitable organizations are required to provide written confirmation for any cash donations over $75; keep your receipts for tax-filing purposes.

- If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, some adjustments may have to be made.

- Avoid scams by verifying organizations before you give by visiting www.charitynavigator.org, www.charitywatch.org or www.irs.gov/charities-non-profits/contributors.

- Those over age 70 ½ with qualified retirement accounts who are subject to required minimum distributions (RMDs) have the option of making a Qualified Charitable Distribution (QCD) in place of an RMD. QCDs permit a direct transfer of up to $100,000 from your IRA to a qualified charity and automatically satisfy RMDs for the year the QCD is made. However, funds that have already been distributed from an IRA to the IRA owner, and are then contributed to charity, don't qualify as a QCD.

If you have questions or need assistance with year-end financial and tax planning or charitable giving strategies, don't hesitate to contact our office. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal. 1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities. Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(ONE TWO TWO SEVEN SIX)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|