|

In This Issue:

- Global Rice Industry Converges in Cancun, Mexico

- Market Update: A Year Like No Other Continues

- Washington, D.C. Update

| |

Global Rice Industry Converges in Cancun, Mexico | |

|

Last week, representatives of some 185 rice businesses from 35 countries gathered at the Rice Market & Technology Convention in Cancun, Mexico to discuss a rice market unseen by anyone in attendance. The large participation was thanks in part to the conditions of the world market situation over the past two years, which continues to be complicated due to a number of factors such as weather, war, oil prices, COVID-19, soaring production costs, labor, logistics, and related issues.

USRPA President and CEO Marcela Garcia, who has directed the conference for the past 11 years, was pleased but unsurprised by the increased attendance, pointing out, “This is a direct result of the market itself and the industry’s need to interact and conduct business while trying to get a feel for what lies ahead both short term and long term.”

Popular economist Dennis DeLaughter set the tone for the conference with his opening presentation titled “The Law of Unintended Consequences: Embracing Change,” highlighting the impacts on the economy and agriculture caused by world events. The conference consisted of two full days of presentations that ended with “Impacts of Higher Agricultural Input Values and Competitive Crop Pricing on the Rice Sector” by Dr. Thomas Wynn and Jay Davis of Coastal Rice and Futures Inc, giving participants something to talk and think about no matter their country of origin.

Prior to the conference itself, the Central American Rice Federation (FECARROZ) held its regular board meeting while SuperBrix and Applied Milling Systems conducted a well-attended, one-day seminar for rice milling managers titled “Follow the Money: Closing the Rice Profitability Circle.” The class involved milling engineer Norris Bond, well known worldwide in rice milling design and management.

“This year’s conference was a unique one and the RMTC has become exactly what we envisioned many years ago,” according to USRPA market advisor Dwight Roberts, adding that plans to make the 2023 conference even better are underway.

|  |  | |

Market Update: A Year Like No Other Continues | |

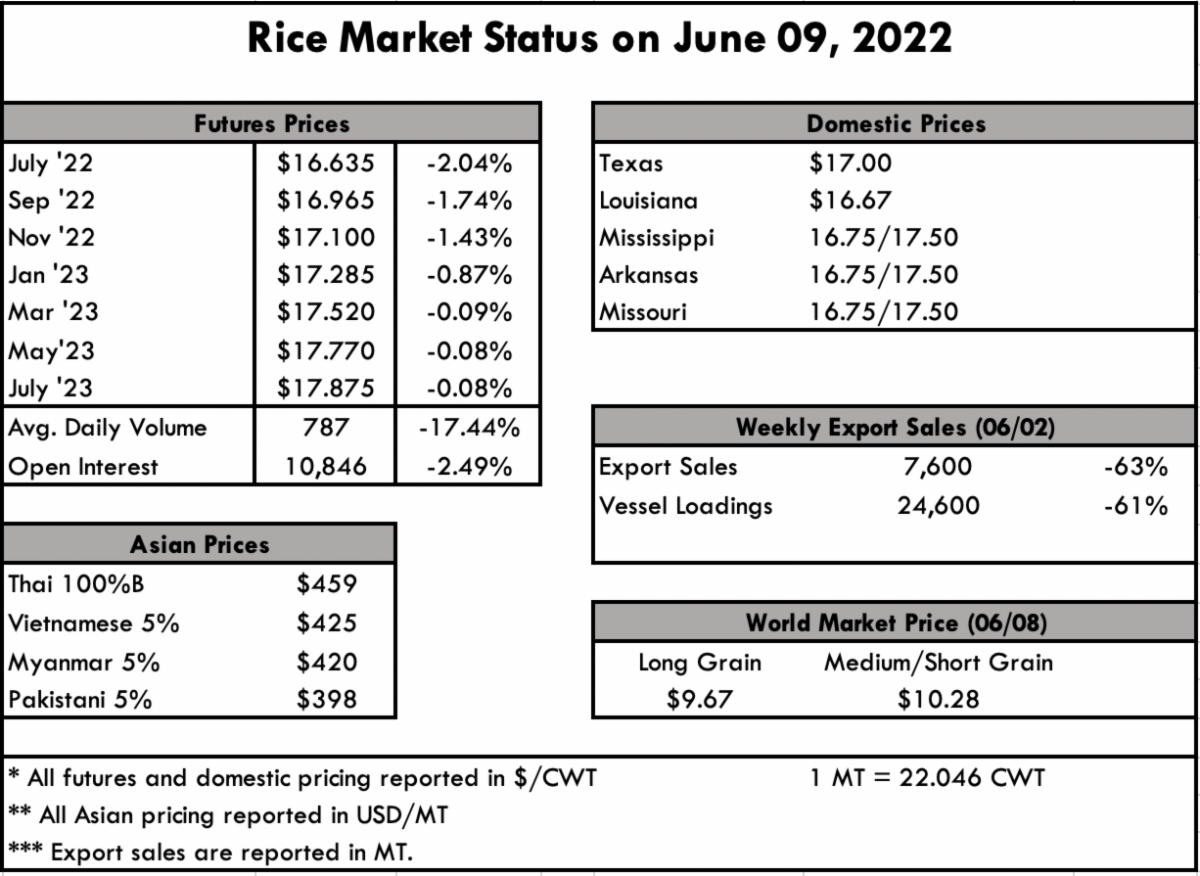

On the ground, all seems to be going as planned now that planting has wrapped up in each state. Sure, there is plenty of consternation about inflamed input costs and where the rice will be marketed once it’s put in the barn, but for now rice is emerging on schedule. The biggest concern is the price of diesel, and possibility for another shortage based on a forecasted heavy hurricane season. Refineries are already dealing with chokepoints from previous shutdowns from hurricanes, and further weather-driven phenomena will only exacerbate the problem of fuel price volatility. The summer milling schedules have set in, which means fewer hours and servicing primarily core domestic customers. This week did notch the marketing-year low for export sales; this is a result of pricing as high as $500 pmt for U.S. LG 5%, which is 22% higher than Uruguay, 27% above Argentina, and 16% premium to Brazil. It’s no wonder our exports are dwindling.

Prices in Texas continue to lead the pack at $17/cwt. This has been relatively unchanged for weeks now. Louisiana is quoted at $16.67/cwt, while Mississippi, Arkansas, and Missouri are each quoted at $16.75/$17.50.

The RMTC sponsored by the USRPA held in Cancun last week revealed several key factors looking at trade in the Western Hemisphere. One of the most significant is the high price of U.S. rice when compared to other origins, and Mexico’s emergency order to cancel tariffs on many products—including rough rice—to battle inflation-driven food cost increases. Quality troubles from U.S. rice among other concerns have resulted in a slow but steady erosion in the Central American markets. While the U.S. used to enjoy nearly 100% market share in Central America, we now struggle to retain over 65% given current market constraints and dynamics. This is why the RMTC is such an excellent platform to openly discuss solutions and new opportunities in the Western Hemisphere.

In Asia, Thai prices are at $459 pmt, still well above Viet prices at $425. Only three weeks ago, these two origins were almost equal in pricing, but with Iraq coming in and building a strategic partnership with Thailand, that has put upward pressure on the price. Demand is steady in the Asian region, which would indicate pricing is firm to up. Reports of India possibly tapering, or even banning their rice exports, are unfounded and pure speculation based on their announcement of a wheat export ban. Prices in India are actually dropping amidst all of the other global food inflation. Only ten weeks ago, Indian rice was trading at $365 pmt, but current reports peg the price down to $350 pmt.

As discussed above, the weekly USDA Export Sales report is dismal this week. Net sales of 7,600 MT for 2021/2022 notch a marketing-year low, down 63% from the previous week and 67% from the prior 4-week average. Exports of 24,600 MT were down 61% from the previous week and 38% from the prior 4-week average. The destinations were primarily to Colombia (14,300 MT), Jordan (4,300 MT), Canada (1,800 MT), Saudi Arabia (1,700 MT), and Mexico (1,200 MT).

|  | |

|

This week, President Biden announced his intent to nominate Doug McKalip as the Chief Agricultural Negotiator for the US Trade Representative. He currently serves as Senior Advisor to US Department of Agriculture (USDA) Secretary Tom Vilsack on issues related to trade, national security, and animal and plant health regulations. In March, the previous nominee, Elaine Trevino, withdrew her name from consideration for the role.

Last week, USDA released the Drought Resilience Interagency Working Group’s summary report. The report highlights accomplishments, including the formalization of new drought-related interagency Memorandums of Agreement (MOAs), coordinated water supply operations, financial assistance, drought roundtables, listening sessions, and webinars. The report also highlights the investments, through the Bipartisan Infrastructure Law, being made for drought-related projects. The full report can be read here.

Congress is still slowly working through the appropriations process for FY 2023. The House and Senate Agriculture Appropriations Subcommittees held their hearings to discuss USDA’s budget request. Throughout both hearings, Members highlighted the need for increased investment in climate resilience, support for rural economies, aid to disadvantaged farmers, funding to address food insecurity, inflation, and global food chain concerns.

Throughout the month of April, the House Appropriations Committee collected requests from members for the 2023 fiscal year. The Senate Appropriations Committee, which is typically slightly behind the House, wrapped up its member request submission process last month, officially closing out the submission process in both chambers.

The House Appropriations Committee will begin the committee markup process this month. Subcommittees will plan to markup their bills June 13 – June 22, with full committee markups scheduled for June 22 – June 30.

Additionally, the Senate Agriculture Committee announced its next field hearing to discuss the upcoming farm bill. The hearing will be on June 17th in Jonesboro, Arkansas. The House Agriculture Committee held an additional hearing on Title I Commodities and Title XI Crop Insurance. While the committees are gathering information for the 2023 Farm Bill, the 2022 elections will shape party priorities and, ultimately, the final bill.

With several state’s primary elections complete, Blue Dog losses are raising concerns about the Democratic party’s ability to compete politically if it continues to move left. Both Rep. Kurt Schrader (OR) and Rep. Carolyn Bourdeaux (GA) lost their primaries to more progressive challengers, and several others face competitive races in November. The Blue Dog Coalition, comprised of centrist Democrats in support of bipartisanship and fiscal constraint, is considered crucial to holding the House majority.

Finally, Secretary Vilsack announced the USDA’s plan to transform food systems in the United States by targeting four basic elements: production, processing, distribution/aggregation, and market development. The main goals of the transformation are to sustainably grow food with a net zero carbon emission, raise rural incomes, create resilience across supply chains, and ensure food and equity for all. This transformation effort will be funded through the American Rescue Plan Act (ARPA), the USDA Budget, and the Commodity Credit Corporation. The webcast may be seen here. Senate Agriculture Committee Chairwoman Stabenow (D-MI) issued a statement in support of the initiative here, while House Agriculture Committee Ranking Member Thompson expressed much concern about the initiative in his statement here.

|  | | |

|  |

Food and Ag Regulatory and Policy Roundup | | |

|

India: Grain & Feed Update

The Indian government has lowered the allocation of wheat, replacing it with additional rice volume, under its various domestic food security programs from May 2022 onwards. The MY 2021/2022 rice consumption estimate is raised to 109.5 MMT and ending stocks lowered to 36 MMT.

| |  |

|

Vietnam: Rice Trade - Monthly

This report provides trade data on Vietnam's monthly rice exports by grade and destination and weekly export quotes for rice by grade.

| | |

|

Arkansas Rice Updates

from the

Arkansas Row Crops Blog

| |  |

| | |

|  |

TAMU AgriLife 47th Annual Rice Field Day, Eagle Lake, Texas | | |

|  |

Texas A&M AgriLife Research Center 74th Annual Rice Field Day Tour & Program, Beaumont, Texas | | |

|  |

RiceTec Field Day (in-person), Harrisburg, Arkansas | | |

|  |

|

Missouri Rice Research & Merchandising Council Field Day,

Glennonville, Missouri

| |

USRPA does not discriminate in its programs on the basis of race, color, national origin, gender identity, sexual orientation, religion, age, disability, political beliefs, or marital/family status. Persons who require alternative means for communication of information (such as Braille, large print, sign language interpreter or translation) should contact USRPA at 713-974-7423. | | | | |