|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

1Consult your tax advisor.

|

President's Corner President's Corner

|

"You have to spend money to make money." We've all heard that well-worn phrase. To a business owner, that means investing funds for supplies, product, advertising, staff salaries, and other operating expenses. For entrepreneurs trying to get a business idea off the ground, spending money with no revenue is difficult without borrowing from friends, family, their financial institution, or if really lucky, a venture capitalist willing to take a risk.

Imagine the difficulty Elon Musk has trying to create an automobile company with new technology. Mr. Musk started off slowly by building a few cars at a time and selling them at a very high price which built up some cash reserves. Later on, the company went public, and more cash from stock issuances came in.

Then came the hard part. Stockholders are patient with new companies for a short time but then expect a reasonable return on their investment, either by a higher stock price or high dividend rate. Mr. Musk's response was to transform Tesla from a niche product to a mass-market vehicle in less than two years. That requires a whole lot of new capital.

There are several ways for Tesla to bring in new money. They can offer more stock, float bonds, ask Mr. Musk to chip in some of his own funds, raise the price of their cars, or a combination of all of them. Each scenario carries its own level of financial risk. While the stock price continues to climb, it makes additional issuance more expensive and dilutes Mr. Musk's stake in the company. Former Federal Reserve head Alan Greenspan feels we're in a bond bubble ready to burst. Mr. Musk reducing his personal net worth is something the average consumer deals with daily. Finally, raising the price of the cars can put a damper on sales.

Tesla's biggest problem at the moment may be Mr. Musk himself. Entrepreneurs by nature are always looking toward the next big thing. He still has an interest in creating commercially-viable space vehicles and colonizing Mars. Company founders are typically not good at managing people and systems. It may be time for Mr. Musk to clear the way for a professional manager to lead the transition of Tesla to a full-scale auto manufacturer.

The latest count is that approximately 450,000 individuals have paid a $1,000 deposit to purchase the mass-market Model 3. The company expects to reach a production rate of 5,000 cars per week by the end of this year and 10,000 per week by the end of 2018. Will consumers at the end of the line wait that long for their car? Given many consumers' needs of wanting things immediately, this will no doubt be an interesting experiment in 21st century economics.

By the way, Plautus, the Roman playwright during the third century BC, was credited with the quote, "You have to spend money to make money." He's also known for creating the joke pattern used for "knock knock" jokes. From personal experience, anyone managing a business, especially one that markets to the public, needs a sense of humor.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

Source: Tom Slefinger, "Weekly Relative Value," Alloya Corporate Federal Credit Union, Week of June 12, 2017

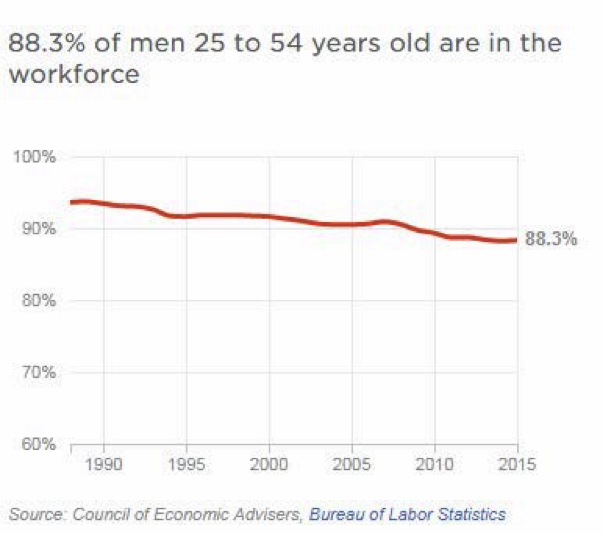

Today, around 10 million American men between the ages of 25 and 54 - mostly too old to be in school and too young to retire - are neither working nor looking for work. This equates to 12% of all men in those prime working ages. To put this number in perspective, in the 1960s, nearly 100% of men between the ages of 25 and 54 worked. This chart shows that the participation rate for males 25-54 has declined from 96% in 1968 to a little over 88% today.

This is way below labor force participation in almost every other developed nation. Of particular note, 57% of these non-working males are on disability.

|

1st Alerts 1st Alerts

|

- Remember, if you are traveling with your 1st Nor Cal debit or credit card, please contact us ahead of time at (925) 335-3855 to ensure your card(s) work(s) properly wherever you are.

- As part of our debit and credit card security enhancement, our fraud department will now contact you by phone, e-mail, or text to confirm card transactions. If you have any questions, please contact us at (925) 335-3855.

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 2.49% APR requires a minimum FICO® 750 Credit Score. 72 months term at 2.49% APR is $14.97 per $1,000.00 borrowed.

|

1st in the Community 1st in the Community

|

Animal Shelter Drive Success

During the months of May and June, we hosted a drive in our lobbies to collect donations for the Contra Costa County Animal Shelter. We collected blankets, beds, towels, food and much more, and ended up being able to do two drop-offs to the shelter!

On behalf of all the doggies and kitties currently in the shelter, we thank you for your support!

|

Credit Corner Credit Corner

|

Speed or Service?

In the old days of the mid to late 20th century, financial institutions would take up to a week to evaluate a loan application. Today's technology with online applications and smartphones has shortened the wait time to mere seconds. Rocket Mortgage promotes, "Goodbye, Paperwork" and "Get Approved Fast." Tap n Loan brags, "A Better Day is a Tap Away." Speedy Cash says it all in their name.

But is faster always better? While it's much more convenient to complete the loan application online, there are shortcomings in dealing with online-only institutions. First of all, there's no place to go if the borrower has questions. There are no "brick and mortar" branches, and phone support is spotty at best. Secondly, these sites claim to do a comparison of other large banks' and credit unions' rates but routinely omit smaller local institutions. The net effect is the borrower not necessarily receiving the best possible interest rate on the loan. Thirdly, the online-only outfits do not typically offer a full array of products. Finally, according to NerdWallet, a personal finance website, notes that Quicken Loans, the parent company of Rocket Mortgage, only looks at credit scores and debt-to-income ratios instead of alternative credit data such as employment history, payment track record, and monthly cash flow.

The president of Quicken Loans said recently, "I think the branch loan officer is a dying profession." Technology is very effective for application processing and integration with other data sources to provide a full picture of the borrower but for now cannot reason and evaluate the way a human loan officer can. The borrower does have the choice today of an automated decision based on a predetermined set of criteria or a human decision based on reasoning and creativity.

- David Green

|

Tips for Teens Tips for Teens

|

Give up the Green for the Privilege to Stream

It's no secret that I've been against investing in streaming services for a while (like Spotify or Netflix) since they add up to be more expensive than buying the media that you stream from these services. Not to mention that once you cancel your subscription, you lose access to all the media you streamed, making your investment worthless. I was pretty strong on my position, that is, before I finally caved into my phone's persistent plea to sign up for a trial of one of these streaming services, which I will refer to as

Orange. It was without a doubt an addicting and joyful experience. But like all great things, it had to come to an end. The

Orange trial ended exactly three months later, as did all my access to the songs I streamed.

I had three options after I lost access to

Orange. I could have officially signed up for the service, paid for the individual songs themselves, found another way of legally streaming them (i.e. YouTube or Vevo),

or found a way to download the songs without paying for them.

Some people might assume that illegally downloading music (or videos) may be no harm no foul, but it is a pretty big foul. The content creator, whether it be Taylor Swift or Medina, go unpaid for their work, discouraging the artist from creating more music. While it seems that one person might not hurt their wealth, you might not be the only one thinking that and eventually it adds up. Illegal downloads is essentially the same as shoplifting, and like shopping, your activity is being monitored. Stores will check to see why their inventory is disappearing and law enforcement also keeps an eye out for torrent sites, like Pirate Bay, and shuts them down. Furthermore, your IP address is permanently logged onto the torrent site, so if you did download something, the log will show it which could be used against you in court.

Streaming services and purchasing your own music might be expensive, and I'm not arguing that. However, the price is justified when you think about the right you are doing society by paying up to stream Shake it Off for hours on end.

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Tips for Keeping Your Home Secure Tips for Keeping Your Home Secure

|

Everyone wants to keep their home safe from burglars or intruders, but not everyone wants to have an alarm system installed. There are plenty of people who prefer the do-it-yourself route, whether it's home improvement or home security.

Do-it-yourself options

The widespread availability of electronic tools means that homeowners can set up their own monitoring systems if they choose, without the help of a home-security company.

- Cameras: Smaller and more inexpensive than ever, cameras can be placed nearly anywhere on the exterior of your home and monitored from inside wirelessly - or set to record footage for review later. Available software even allows you to point your laptop camera in a particular direction (say, at the front door) and check the images from a remote location.

- Lights: Motion-detecting floodlights are an excellent deterrent to thieves, because they don't want to be seen. Make sure they're installed near entryways, and that they aren't easily reached from the ground. And using timers for interior lights is a good way to give the appearance that your home is occupied.

- Alarms: Vibration alarms are available for windows, alerting you if someone is trying to get in. Similarly, other monitors can be installed near doors and programmed to sound if a person comes within a set distance. Some even emit barking sounds to make it appear that a dog is in the house.

Even if you aren't interested in installing security equipment around your home, there are a number of things you can do to increase safety:

- Keep your home locked. It sounds simple, but you'd be surprised how many people leave windows or doors unlocked. Make sure that sliding doors and windows have extra security, such as a track lock or dowel in the track.

- Don't leave a key outside. If you need to provide access to your home while you're away, leave your key with a trusted neighbor or friend.

- Watch the landscaping. Thick shrubs and bushes around your porch or yard can give thieves a good place to hide. Keep them well-trimmed and ensure that problematic areas can be illuminated with your outdoor lighting.

- Use common sense. If you're going away on vacation, cancel your newspaper and other deliveries. Ask a neighbor to keep watch, and park a car out front. Don't post publicly on social media or leave a message on your answering machine or voicemail indicating that you'll be away for an extended period.

It's a great time for a home inventory

If your home was burglarized, would you know what was missing? A home inventory is a crucial tool to help replace everything that was lost.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will work with you to make sure you've got the coverage you need, while at the same time, using all possible credits and discounts to make that coverage affordable. We are an independent insurance agent and can provide you with home, auto, life, health, business and many other types of insurance coverage.

Contact me today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

By Jason Vitucci, CFP & Gene A. Schnabel

An orchestra is merely a collection of instruments, each creating a unique sound. It is only when a conductor leads them that they produce the beautiful music imagined by the composer.

The same can be said about your retirement strategy.

The typical retirement strategy is built on the pillars of your 401(k) plan, your IRA, and taxable savings. Getting the instruments of your retirement to work in concert has the potential to help you realize the retirement you imagine.1

Hierarchy of Savings

Maximizing the effectiveness of your retirement strategy begins with understanding the hierarchy of savings.

If you're like most Americans, the amount you can save for retirement is not unlimited. Consequently, you may want to make sure that your savings are directed to the highest priority retirement funding options first. For many, that hierarchy begins with the 401(k), is followed by an IRA and, after that, put toward taxable savings.

You will then want to consider how to invest each of these savings pools. One strategy is to simply mirror your desired asset allocation in all retirement accounts.2

Another approach is to put the income-generating portion of the allocation, such as bonds, into tax-deferred accounts, while using taxable accounts to invest in assets whose gains come from capital appreciation, like stocks.3

Withdrawal Strategy

When it comes to living off your savings, you'll want to coordinate your withdrawals. One school of thought recommends that you tap your taxable accounts first so that your tax-deferred savings will be afforded more time for potential growth.

Another school of thought suggests taking distributions first from your poorer performing retirement accounts, since this money is not working as hard for you.

Finally, because many individuals have both traditional and Roth accounts, your expectations about future tax rates may affect what account you withdraw from first. (If you think tax rates are going higher, then you might want to withdraw from the traditional before the Roth). If you're uncertain, you may want to consider withdrawing from the traditional up to the lowest tax bracket, then withdrawing from the Roth after that.4

In any case, each person's circumstances are unique and any strategy ought to reflect your particular risk tolerance, time horizon, and goals.

At Vitucci Integrated Planning, we would love the opportunity to take a look at your current retirement plan. Retirement preparedness varies by age and personal financial situation. If you have questions or concerns about your retirement plan, please give the office a call. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, our workshops, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal. 1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities. Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

- Distributions from 401(k) plans and traditional IRAs are taxed as ordinary income and, if taken before age 59 1/2, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70 1/2, you must begin taking required minimum distributions. 401(k) plans and IRAs have exceptions to avoid the 10% withdrawal penalty, including death and disability. Contributions to a traditional IRA may be fully or partially deductible, depending on your individual circumstances.

- Asset allocation is an approach to help manage investment risk. Asset allocation does not guarantee against investment loss.

- The market value of a bond will fluctuate with changes in interest rates. As rates rise, the value of existing bonds typically falls. If an investor sells a bond before maturity, it may be worth more or less than the initial purchase price. By holding a bond to maturity an investor will receive the interest payments due plus his or her original principal, barring default by the issuer. Investments seeking to achieve higher yields also involve a higher degree of risk. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

- Roth IRA contributions cannot be made by taxpayers with high incomes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawal can also be taken under certain other circumstances, such as a result of the owner's death. The original Roth IRA owner is not required to take minimum annual withdrawals.

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(FIVE ZERO ZERO FOUR ONE ZERO ZERO)

|

YouTube - How To Series YouTube - How To Series

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|