|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

Know Your Checking Account

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 3.20% APR requires a minimum FICO® 750 Credit Score. 72 months term at 3.20% APR is $15.29 per $1,000.00 borrowed.

|

President's Corner President's Corner

|

The world's biggest company, Amazon, went out to bid on their location for a second headquarters, nicknamed "HQ2." This is a story that goes into the muck and the mud about how large corporations wield their financial and political influence to become even larger and more influential.

There were three "winners" of the bidding contest: Long Island City, New York; Arlington, Virginia; and Nashville, Tennessee. Amazon decided to split HQ2 into two branches in Long Island City and Arlington. Nashville will be home to their East Coast Operations Center. The company will receive up to $1.5 billion in tax incentives and cash grants from the State of New York, $600 million from the State of Virginia, and $100 million from the State of Tennessee. These figures do not include the hundreds of millions of dollars the state and local governments will pick up for infrastructure improvements which could easily increase the taxpayer liability well over $3 billion.

Predictively, certain local elected officials have expressed their concern that the money could be better spent on expanding social programs and fixing potholes in the streets. Also, they chirp (or tweet in many cases), why should Jeff Bezos, the richest man in the world, get over $2 billion in taxpayer funds, derisively known as corporate welfare? These are good points, issues that should be debated with all the stakeholders, including the taxpayers themselves.

That, however, is not how corporate politics work. A big company comes into a town promising high-paying jobs, housing, and revitalized neighborhoods. The politicians get excited and overbid for the privilege. Why would New York pay $900 million more than Virginia? Did New York overpay or Virginia get a great deal?

Coincidentally, the Long Island City location is a short subway train ride from Wall Street, the Arlington location is a hop, skip, and jump over the Potomac River from Capitol Hill, and the Nashville office is in a state with no income tax. Thus, in a few short years, Amazon will have direct access to the most influential money and political centers on Earth.

Amazon has also promised paying 25,000 employees an average salary of $150,000. Just for comparison purposes, the average Google employee earns $112,000, according to payscale.com. Most of those employees are based in the Silicon Valley which is comparable cost of living-wise to New York City. I have a hard time believing Amazon will pay their staff 34% more on average than Google.

The various governments are betting with taxpayer money that the return of incremental tax revenue will far exceed the initial investment. Of course, the elected officials who cut this deal will most likely be long out of office by the time anyone sees substantial tax revenue, if it happens at all. Roger Noll, a Stanford professor emeritus and senior fellow at the Stanford Institute for Economic Policy Research, has said for years it has never been proven that building a sports stadium or hosting a Super Bowl boosts the local economy to any significant degree. Close to home, the small city of Santa Clara guaranteed loans in excess of $900 million to build the San Francisco 49ers' Levi's Stadium. No one will know for decades if Santa Clara made a good deal.

It's possible that New York, Virginia, and Tennessee have made a wise investment. One thing is for sure: Amazon, Inc. will fatten their bottom line and stock value with help from public money. My wish for the holiday season is that the taxpayers in those states get their bottom lines fattened as well.

David M. Green

President/CEO

(925) 335-3802

|

Stat of the Month Stat of the Month

|

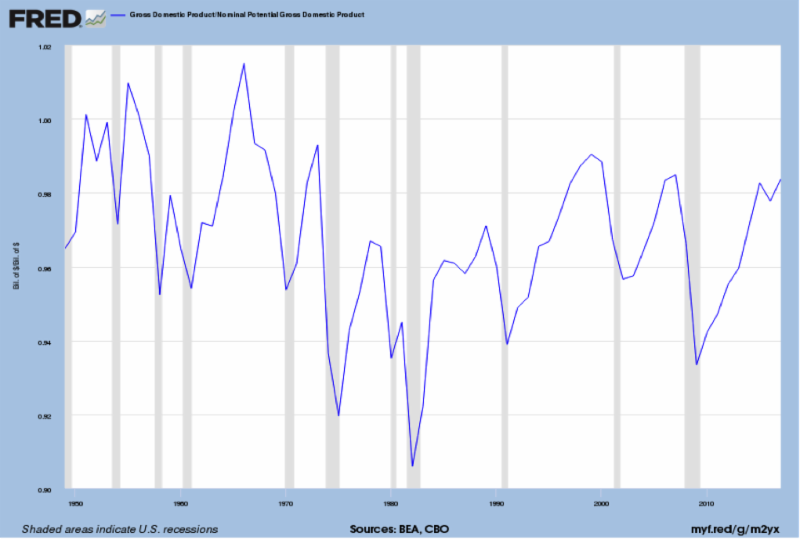

GROSS DOMESTIC PRODUCT (GDP) AS A PERCENTAGE

OF NOMINAL POTENTIAL GDP - 1949-2017

Source: U.S. Congressional Budget Office, Nominal Potential Gross Domestic Product [NGDPPOT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NGDPPOT, November 13, 2018.

The Federal Reserve may go beyond the so-called neutral rate of 3% because the U.S. economy appears to be expanding beyond its full potential as measured by the output gap, which is the difference between the actual output of the economy and its potential output. Potential output is the maximum amount of goods and services an economy can churn out at full capacity. If the ratio in the chart above rises above 1%, it overheats, leading to inflation and asset (investment and housing) bubbles.

(THREE TWO ZERO FIVE ZERO)

|

1st Alerts 1st Alerts

|

- All 1st Nor Cal branches will be closed Tuesday, December 25, 2018 in observance of Christmas Day and Tuesday, January 1, 2019 in observance of New Year's Day.

- NEW Scam Alerts Posted >> Read Here

- If you have @ccessOnline Home Banking with us, you can transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

'Tis The Season To Be Jolly and Smart! 'Tis The Season To Be Jolly and Smart!

|

|

Check out our low fixed rates now.

|

|

Oh joy - just look at all those lovely holiday expenses... gifts for friends, family and coworkers, travel to see the in-laws, holiday entertaining. The Holidays are truly wonderful,

and expensive. Luckily, you have an equally wonderful payment option - a

1st Nor Cal FIXED Rate VISA. It's true, unlike most credit cards, our VISA features a low FIXED rate which makes it the smart choice for all your seasonal purchases. We also don't charge a fee for balance transfers, so debt consolidation after the Holidays really makes sense. Plus, it's easy. You can do it yourself through @ccess Online home banking.

Learn more about our Visa Credit Cards!

If you need help with a balance transfer or if you don't have a 1st Nor Cal VISA, call us and we'll get you all set up.

(925) 335-3850

|

1st in the Community 1st in the Community

|

Buy a Kid a Bike Fundraiser

Our Buy a Kid a Bike fundraiser during the months of November and December, benefiting the Richmond Fire & Police Holiday Program, was a success! Our members helped to raise over $500 which covered the cost of purchasing 10 bikes and helmets for children in need over the Holidays.

Thank you to all who participated!

|

1: APR = Annual Percentage Rate. Loan amount and terms subject to approval; your rate may be different depending on loan amount, term, credit score and other factors. Your rate will be disclosed prior to funding. Daily periodic rate for 7.9% APR is .02165. Minimum payment on a 1st Line of credit with a limit up to $2,000.00 is $50.00 per month. Maximum limit is $20,000.00 with a minimum payment of $475.00. Rates are subject to change.

|

A Financial Checklist for the Holidays

By Jason Vitucci, CFP® & Gene A. Schnabel

As the year draws to a close, most of us look to holiday planning, being sure our house is ready for guests, gifts and good times. It's also a good time to look at another type of planning for the holidays -making sure your financial house is in order at the end of 2018.

To help you navigate year-end tasks as well as future planning, here is a list of things to consider before year-end.

- Maximize company retirement plan contributions: Look into maximizing your retirement plan contributions (be careful of contribution limits).

- Ensure you have taken any required minimum distributions (RMDs): If you're 70½ or older, you're required by the IRS to take RMDs from certain retirement accounts by December 31-or face a penalty equal to 50% of the sum you failed to withdraw.

- Reduce capital gains: Selling underperforming investments can help offset realized gains, but the breakpoints have changed. Gifting assets can reduce the size of your estate (but don't forget the carryover basis and capital gains). Your tax or legal professional can help you navigate these situations if they apply to you.

- Inherited IRAs or Qualified Plans: RMDs may be the responsibility of the beneficiary, and you should take any required beneficiary distributions before December 31, 2018.

- 529 Contributions: To take advantage of any state-income-tax benefits or to be eligible for the federal gift-tax exclusion contributions must be made prior to the end of the year. There are new regulations allowing 529 plan withdrawals that are tax-free at the federal level for K-12 education for public, private, or religious schools, but you should confirm with your tax professional if they are tax-free at the state level.

- Check Flexible Spending Accounts balances: Don't forfeit money in these accounts as many require that funds be used by the end of the year. Some plans offer grace periods or carry overs, just make sure you know the terms of your accounts.

Remember, the greatest gift you can give your loved ones - at the holidays or any other time of year - is a responsible and well-thought-out financial plan.

To learn more about the financial planning process and how we help out clients with keeping their financial plans up to date, contact our office today. If you feel that we may be a good fit to work together, please don't hesitate to contact us. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Happy Holidays from the Vitucci Integrated Planning team.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

|

|

Insurance Tips Insurance Tips

|

Make Home Safety a Priority While You're Away for the Holidays

The holidays can be a great time to visit family you rarely get to see, hit the slopes or flee to the beach. Regardless of how you spend your time away, you need to ensure your house stays safe while you're gone. Help save yourself some worry about what could be happening at home by protecting it from theft and damage while you are away. Here is a checklist to help you have a relaxing and peaceful vacation.

- Make sure all electrical appliances are turned off.

- Clean the refrigerator of all perishable foods, and take out the garbage.

- Lock all windows and doors.

- Arrange to have the newspaper and mail held until your return, or have them picked up by a trusted neighbor.

- Ask a neighbor to set out your trash on collection day and then retrieve empty cans and recycling bins the same day.

- Let a trusted neighbor know you will be away and have them keep an eye on your home. It is a good idea to leave your vacation address and telephone number with a neighbor so you can be reached in case of an emergency.

- Never leave your house key hidden outside your home.

- Set timers on interior lights.

- Make sure to unplug televisions, computers and appliances susceptible to lightning and power surges.

- Advise your alarm company and local police if you will be gone for an extended period.

- Store jewelry and valuable items in a safe-deposit box.

- Arrange for the care of pets.

- Set the heating system to provide minimum heat of 55 degrees.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, health, business, and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(TWO ONE SIX NINE SEVEN)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|