Week of October 23, 2017 | Vol. 6, Issue 41

|

|

Becton Dickinson Wins Conditional EU Approval for $24 Billion Bard Buy

U.S. medical equipment supplier Becton Dickinson

secured EU antitrust approval for its acquisition of C R Bard

after it agreed to sell two businesses to allay competition concerns.

The deal, the latest in a recent wave of mergers and acquisitions in the medical technology sector, will boost Becton Dickinson's presence in the high-growth oncology and surgery market.

The European Commission demanded the concessions because it was concerned the deal would reduce competition and hurt innovation. The EU antitrust enforcer said Becton Dickinson pledged to sell its global core needle biopsy devices business and a tissue marker product currently in the development stage.

|

Lilly, CureVac Pen $1.8 Billion mRNA Cancer Vaccine Deal

The back-loaded deal moves Lilly into an emerging field that seeks to use mRNA to guide immune attacks on tumors.

Lilly is making a $50 million upfront payment and €45 million equity investment to get the deal up and running. Beyond that, CureVac is in line to receive up to $1.7 billion in milestones as the five vaccines pass development and commercialization milestones.

A lot of work lies between CureVac and those milestones. Lilly and CureVac are divvying up the early workload, with the Big Pharma handling target identification and the biotech applying its mRNA skills to the design and formulation of candidates. When the vaccines reach the clinic, Lilly will run the trials using supplies manufactured by CureVac. The goal is to design candidates that deliver mRNA molecules capable of orchestrating immune attacks against certain neoantigens. In doing so, CureVac and Lilly think they can take out tumors.

|

Visterra Inks $1B Deal With This Bay Area Biotech

Two weeks after securing more than $46 million in financing, Visterra, Inc.

struck a deal worth up to $1 billion with startup Vir Biotechnology.

The deal was a move that Visterra CEO Brian Pereira

told BioSpace

to expect in an interview last week. And this partnership with Vir is not the only one in the works, Pereira said.

"We're expecting to announce additional partnerships in the future," he said. Pereira added that the company will be "well-funded" through these deals. Being a small company of 25 employees, Pereira said partnerships are the key to success since they can provide the resources to help Visterra move products through the clinical phase. Under terms of the deal with Vir, the companies will use Visterra's Hierotope technology platform to target infectious diseases. The Hierotope platform identifies epitopes to design biological medicines, Periera said. He added that the program could hold the key to one-time treatments for some infectious diseases.

|

Below are summaries and charts with the past week's transactions from the different healthcare sectors. For a detailed table showing data for each industry transaction click on any of the charts or use the download link above. Total transaction values are provided in USD millions.

|

|

|

|

Pharma & Biotech

10 transactions totaling $7,039 million

Supplies, Equipment & Services

12 transactions totaling $41 million

Healthcare IT & Managed Care

2 transactions totaling $0

Healthcare Facilities & Distributors

8 transactions totaling $187 million

|

|

|

|

|

|

Pharma & Biotech

20 private placements totaling $594 million

Supplies, Equipment & Services

13 private placements totaling $50 million

Healthcare IT & Managed Care

4 private placements totaling $5 million

Healthcare Facilities & Distributors

1 private placements totaling $0

|

|

|

|

|

Pharma & Biotech

28 public offering totaling $895 million

Supplies, Equipment & Services

5 public offerings totaling $78 million

Healthcare IT & Managed Care

6 public offerings totaling $3,979 million

Healthcare Facilities & Distributors

1 public offering totaling $80 million

|

|

|

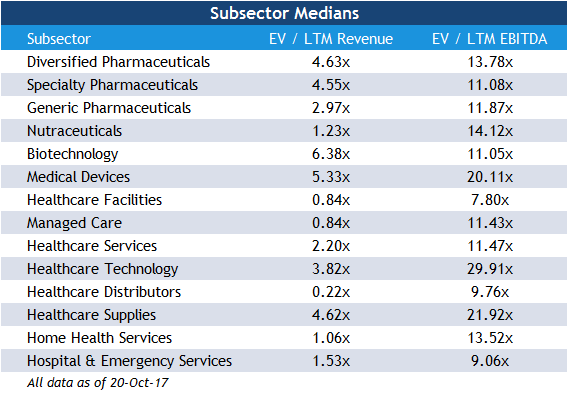

Each week, w

e provide updated trading

comps for leading comp

anies from numerous healthcare subsectors.

To the right you will see a high-level breakdown of median revenue and EBITDA multiples for each of the specific subsectors

For a complete trading comp analysis (including the individual equities that comprise the subsectors), click on the table to the right or use the download link from the top of this newsletter.

Note: data reflects prior week close.

|

RECENT INDUSTRY HEADLINES

A Sampling of Relevant Industry Headlines from the Last Week

Below are snippets from relevant industry news articles from the past week. For additional information or the article's complete text, click the headline link to view the original publication.

|

$710M Gamble Fails as Celgene Terminates Two Phase III Trials

October 20, 2017 -

BioSpace

Celgene is scrapping a late-stage Crohn's disease drug it acquired in a $710 million deal three years ago following an interim data analysis. Celgene said it was pulling the plug on two trials studying GED-0301 after an overall benefit/risk analysis was conducted. Celgene acquired GED-0301in 2014 from privately-held Nogra Pharma Limited

. Celgene announced it was terminating the Phase III Resolve trial for Crohn's disease, as well as the Sustain extension trial based on the recommendation of the data monitoring committee. Additionally, Celgene said it will not initiate the Phase III Define trial in Crohn's disease. The company is waiting to review the full dataset from the phase II trial with GED-0301 in ulcerative colitis (UC) to determine if the company can continue forward in some way with the drug.

October 18, 2017 - Fierce Biotech

Forty Seven has raised another $75 million, bringing its total haul to date up to $150 million. The series B round equips the Stanford University spinout to expand trials of its CD47-targeted approach to dialing up phagocytosis of cancer cells. New backer Wellington Management led the round with the support of Clarus, Lightspeed Venture Partners, Sutter Hill Ventures and GV, the four VCs that drove Forty Seven to its $75 million series A 20 months ago. Forty Seven used that cash to license immuno-oncology programs from Standford and build on the early clinical work initiated by the university.

October 18, 2017 - Fierce Pharma

Pharma companies have faced a gamut of allegations over the years, but a new lawsuit ups the ante by alleging several drugmakers paid bribes in Iraq that helped fuel terrorism.

Filed Tuesday in Washington, D.C., the lawsuit alleged that top pharma companies Pfizer, Roche, Johnson & Johnson and AstraZeneca paid bribes to secure healthcare contracts in Iraq. Those payments ultimately supported terrorism that hurt or killed U.S. service members, the plaintiffs alleged. More than 100 veterans or their family members are suing the drugmakers under the Anti-Terrorism Act.

|

UPCOMING EVENTS

An Overview of Events Hosted or Attended by the Bourne Partners Team

|

36th Annual J.P.Morgan Healthcare Conference

January 8-11, 2018 | San Francisco, CA

|

|

As an international, healthcare-focused merchant bank and financial advisory firm, we provide world-class services and capital to middle-market healthcare companies around the globe. We aim to keep our clients well-informed of healthcare news and events. With this additional insight in mind, together, we can recognize trends and opportunities that benefit our clients. We hope that you will reach out to Bourne Partners to help execute your healthcare operational and transactional needs. To learn more about our firm, visit our website or utilize the links below to engage with us on social media.

Sincerely,

The Bourne Partners Team

Bourne Partners

550 South Caldwell Street

Suite 900

Charlotte, NC 28202

704-552-8407

|

STAY CONNECTED

|

|

|

|

|