Message From the President

|

|

By John Witkowski, President & CEO

|

|

Tioga State Bank's Bob Fisher Nominated As Vice Chairman Of ICBA!

|

|

|

Bob Fisher

|

IBANYS congratulates Bob Fisher, Chairman, President & CEO of Tioga State Bank, upon his being nominated as Vice Chairman of the Independent Community Bankers of America (ICBA). A fifth-generation community banker, Bob is a former IBANYS Chairman and current IBANYS board member. He chairs our state political action committee, NYSIBPAC, co-chairs ICBA's federal political action committee, ICBPAC, and ICBA's Policy Development Committee.

Other nominees included Preston Kennedy, President and CEO of Zachary Bancshares Inc. of Zachary, La. as Chairman; Noah W. Wilcox, President, CEO and chairman of Grand Rapids State Bank and its holding company, Wilcox Bancshares Inc. of Grand Rapids, Minn. as Chairman-Elect. ICBA's board of directors will vote on the nominations during the 2019 ICBA national convention, ICBA LIVE®, which will be held March 18-22 in Nashville. Last September, Tioga State Bank received national recognition as one of American Banker magazine's "Best Banks to Work For" and was honored for all that their employees do for their customers and communities.

______________________________________________

2019 Marks Our 46th Year Representing New York Community Banks

It was August of 1974. The New York political landscape was drastically different from today; there was a Republican Governor, State Senate and State Assembly. A group of New York community banks decided they needed stronger legislative representation, specifically in Albany.

That is when they decided to gather in the August heat to create an association that would be the voice for community banks throughout New York. That small group transformed into the association known today as IBANYS.

No matter how things change, IBANYS' purpose and mission has remained consistent the past 46 years:

To represent and advance community banks' interests, priorities and issues in New York and Washington, D.C., provide educational programs for members and keep the public informed about community banking.

How do we ensure we meet those goals and keep those promises? By listening to our members. At IBANYS, everything we do is based off of our membership. We listen to you, your priorities, ideas, needs, etc. But in order to truly succeed,

we need your active involvement.

- Sign up for one of our committees or peer groups;

- Attend our educational conferences, meetings and forums. You can also provide ideas or topics that you would like to see included in our meeting agendas;

- Tell us your ideas, comments and suggestions - we are always open to new things!

______________________________________________

Attend Our 2019 Educational Meetings

This week, I want to update you on our coming schedule of conferences and meetings, and encourage your bank to attend.

We have been finalizing a number of speakers for these upcoming events.

Please review the attached brochures (Compliance Conference & Directors Conference) and watch for more brochures to be added to our website later this week

, and to call Linda Gregware or myself if you have any questions or suggestions.

IBANYS' Regional Education Conferences offer insight on issues facing the community banking industry in 2019 and the tools you need to be prepared, spoken by experts in the field. With convenient locations throughout New York state, attending these one-day education sessions can make all the difference in how your organization faces challenges this year. Our educational conferences are:

- 2019 IBANYS CEO Forum, which will be held Tuesday, April 2 at the Oak Hill Country Club in Rochester, NY. Please save the date and mark you calendar for this special one-day session. We will release more information and details next week.

- IBANYS is expanding our presence downstate, specifically in the New York City metropolitan area. Our first New York area meeting will focus on compliance and will take place April 9 in Manhattan.

We are still finalizing speakers for these upcoming events. Please

review the meetings

, and email Linda Gregware or myself if you have any questions or suggestions. You can also call IBANYS at (518) 436-4646.

______________________________________________

Join Us at ICBA's Capital Summit

Lastly, IBANYS' annual visit to Washington, D.C. takes place at the end of April during the ICBA Capital Summit. We will schedule meetings "on the hill" with members of the new York congressional delegation.

New York has five new members in the delegation, and six members on the House Financial Services Committee. We need a strong showing to represent our New York industry and make our voice heard. Bring your ideas and voice to Washington by emailing

me or

Steve Rice.

Read more about ICBA's Capital Summit.

__________________________________

Remember: IBANYS is YOUR association. Make it work for you!

- John

|

|

Follow IBANYS On Social Media!

Connect With Us Today!

|

|

|

|

|

Get Ready For 2019 Annual Convention!

SAVE THE DATE

When:

June 10-12, 2019

Where:

5218 Patrick Rd, Verona, NY 13478

__________________________________________________________________

Get Ready for 2019 Meetings!

Our 2019 Meeting dates and locations are now available! These educational conferences cover various subjects that are important within the community banking industry, spoken by the experts.

T

hey are also a great opportunity to network and earn CPE credits. Here is what we have planned for 2019:

Compliance Conference

March 12, 2019 March 13, 2019

DoubleTree by Hilton Hilton Garden Inn

1111 Jefferson Road 235 Hoosick Street

Rochester, NY 14623 Troy, NY 12180

Directors Conference

April 16, 2019 April 17, 2019

RIT Inn & Conference Center Hampton Inn Poughkeepsie

5257 W.

Henrietta Road

2361 South Rd.

Henrietta, NY 14467 Poughkeepsie, NY 12601

Security Conference

May 7, 2019 May 8, 2019

RIT Inn & Conference Center Hampton Inn Poughkeepsie

5257 W. Henrietta Road 2361 South Rd.

Henrietta, NY 14467 Poughkeepsie, NY 12601

Lending Conference

May 21-22, 2019

Harbor Hotel Watkins Glen

16 North Franklin Street

Watkins Glen, NY 14891

Banking Executive Symposium

September 9-11, 2019

Location TBD

IBANYS' meetings provide insight into relevant issues spoken by experts in the field. They are also a great opportunity to network and earn CPE credits.

Have an idea for one of our meetings? Want to see a meeting or forum on a different subject? We want to hear from you!

Contact Linda Gregware at [email protected] or me at [email protected] with your thoughts and/or comments.

|

|

|

IBANYS Education/Webinars

|

|

|

The 2019 Webinar is now available!

The Independent Bankers Association of NYS (IBANYS) partners with CBWN to bring you more than 150 webinars each year covering compliance, lending, regulations, security, operations, new accounts, collections, fraud, security and other topics. Even better, each time you purchase a webinar, you support IBANYS, because a portion of your registration comes directly to us. Thank you!

You can view the 2019 Webinar Schedule here or by category here. In addition, CBWN has made some recent updates to provide better service to its consumers. Unfortunately, some changes may have caused you to miss important webinar announcements. Please read the IBANYS letter to view the updates and ensure that you do not miss another webinar.

NEW WEBINARS ADDED FOR 2019

CBWN has added more than 140 webinars to the IBANYS webinar calendar, covering all the essential topics. Start the new year off right by gaining the knowledge and tools to make 2019 the best year yet!

CBWN and IBANYS thank you for your continued support of the education in the community banking industry.

________________________________________________________________

2019 Webinar Series - Available Now

6 Webinars

for the Price of 5

or

10% off a 4-Part Series

Choose From The Following:

4-Part Series 6-Part Series

6-Part Series 6-Part Series

4-Part Series 6-Part Series

4-Part Series 4-Part Series

4-Part Series 4-Part Series

4-Part Series

________________________________________________________________

Protecting Against Potentially Dangerous Decreasing Rates

When: February 26, 2019

Time: 2:00-3:00 P.M. EDT

Scott Hildenbrand, with the Financial Managers Society, will discuss the emerging theme of down risk and its impact on community banking. Tactical balance sheet repositioning, off-balance sheet hedging, and liability restructurings will be covered, among other actionable ideas.

If you have any questions, please contact your Sandler O'Neill representative or email us at

[email protected].

______________________________________________________

FREE WEBINAR: ICS & CDARS

What the New Law Means for Banks

Thanks to the newly signed regulatory relief bill, most reciprocal deposits are no longer brokered. This comes as banks face intense and increasing competition for deposits.

Join Us for a Webinar

Join Promontory Interfinancial Network-- the nation's leading provider and inventor of reciprocal deposit placement services-- for a free webinar that outlines key provisions of the new law and the impact ICS®, or Insured Cash Sweep®, and CDARS® can have on banks' balance sheets. The webinar will also cover how banks can use ICS and CDARS to capitalize on the opportunities at hand; presenters will discuss cost-effective ways to use the services to attract high-value relationships (even as deposit competition intensifies) and to lock-in more low-cost funding (even as interest rates continue to rise.) This webinar is a "must" for decision-makers at banks of all sizes, especially for community banks that utilize collateralized deposits and/or listing services.

Choose a date and time that works for you!

______________________________________________________________

Reg relief makes most reciprocal deposits nonbrokered, providing banks the opportunity to attract even more deposits. Thanks to the newly signed regulatory relief bill, most reciprocal deposits are no longer brokered. This comes as banks face intense and increasing competition for deposits.

Join Promontory Interfinancial Network - the nation's leading provider and inventor of reciprocal deposit placement services - for a free webinar that outlines key provisions of the new law and the impact ICS®, Insured Cash Sweep®, and CDARS® can have on banks' balance sheets. The webinar will also cover how banks can use ICS and CDARS to capitalize on the opportunities at hand; presenters will discuss cost-effective ways to use the services to attract high-value relationships (even as deposit competition intensifies) and to lock-in more low-cost funding (even as interest rates continue to rise). This webinar is a "must" for decision-makers at banks of all sizes, especially for community banks that utilize collateralized deposits and/or listing services.

Numerous new banks are joining the Promontory Network. In order to give these newly on-boarded banks an opportunity to begin transacting, we have decided to extend this incentive program through March 31, 2019.

Choose a date and time that works for you!

|

|

|

Albany |

Taxes Key Component In State Budget

Taxes were featured prominently in Governor Cuomo's proposed $175.2 billion state budget Taxes were featured prominently in Governor Cuomo's proposed $175.2 billion state budget (it is actually $178.3 billion when closing the current $3 billion gap is included.)

- He proposed keeping higher income-tax rates on millionaires set to expire at year's end, and extending the 8.82 rate through 2024, noting it provides about $4.4 billion to the state's coffers.

- He wants to make the state's 2% property-tax cap permanent;

- He would lower the state tax rate from 6.85% to 5.5% for those earning between $40,000 and $150,000, and from 6.85% to 6% for those earning between $150,000 and $300,000.

Reaction to the Governor's spending plan was mixed. Two prominent "think tanks" (

the Citizens Budget Commission and the Empire Center) criticized keeping and extending the "millionaires" tax. They are concerned the state is heavily dependent on high earners, who "pay almost 40 percent of the income tax"

and that more taxes could cause them to leave the state. There was support for Cuomo's proposal

to make the state's property tax cap permanent, and for his holding the line on spending growth (the Governor said he's keeping the spending growth rate to 2 percent).

-

In terms of the banking industry

, the Governor's State of the State indicated he plans to introduce legislation to prevent abuse of confession of judgment/stop predatory merchant cash-advance loans.

-

In the proposed state budget

, Article VII Regulation of student loan servicers appear to be unchanged from last year's budget. It would require student loan servicers to be licensed by DFS, and would establish a regulatory framework for the industry in New York. The bill is necessary to implement the Fiscal Year 2020 budget.

- Financial institutions that are required under Dodd Frank to create subsidiaries received a sales tax exemption for transfer of properties and services to such subsidiaries. The exemption is extended from June 30, 2019 to June 30 2021.

- The carried interest "loophole" would also be eliminated under the Governor's proposal.

New State Office Would Oversee Legal Marijuana & Hemp Industries

The Governor's proposed budget includes a major re-organization of the state's marijuana bureaucracy, consolidating regulation and oversight of the marijuana growing and retail industry under a new state office.

It would create an Office of Cannabis Management to oversee commercial adult-use marijuana, medical marijuana and hemp.

(Medical marijuana is currently overseen by the Department of Health, while Agriculture and Markets regulates hemp production in New York.)

The new office under the umbrella of the State Liquor Authority would have an executive director

with wide authority over new regulations for the potential commercial retail industry for marijuana, including the number of licenses issued and oversight of pricing, including ceilings on retail markup. The state projects the retail marijuana industry will result in $300 million in revenue from a three-tiered tax structure.

There are 39 New State Legislators & 5 New Yorkers

In Congress

. . .Have You Reached Out Yet?

There are

39 new members of the State Legislature, the largest new class in years. IBANYS has provided lists of all the new State Senators, Assembly Members and Congressional Representatives. We ask you to reach out to them to provide information on community banks. These new legislators

need to be informed and educated about New York community banks and the

essential role we play in the local and state economies. There are

39 new members of the State Legislature, the largest new class in years. IBANYS has provided lists of all the new State Senators, Assembly Members and Congressional Representatives. We ask you to reach out to them to provide information on community banks. These new legislators

need to be informed and educated about New York community banks and the

essential role we play in the local and state economies.

Please step up, reach out and play a key role in establishing new relationships. We also encourage you to join our IBANYS Government Relations Committee to assist in our advocacy and share your ideas. Your voice matters!

IBANYS mailed our outreach program to all member banks and encouraged you to meet with your new members of the State Senate, State Assembly and New York Congressional Delegation. The program materials include:

- Talking points for your use in your meetings, emails and phone calls to introduce yourselves and to help inform them about New York's community banks.

Please let us know which state and federal lawmakers you have reached out to and update us on the results of those meetings by emailing both John Witkowski ([email protected]) and Steve Rice ([email protected]).

|

Washington, D.C.

|

|

Waters Urges Financial Institutions: Describe Your Activities

To Help Customers Affected by the Shutdown

|

|

|

|

Maxine Waters

|

|

House Financial Services Chairwoman Maxine Waters (D-CA)

has written to the heads of the financial services industry trade associations and the largest credit reporting agencies and called on them to describe what their institutions and member companies are doing to help consumers affected by the Trump shutdown.

She wrote:

"President Trump's shutdown of the federal government is inflicting tremendous harm to millions of Americans. Affected employees, contractors, and other individuals who did not cause the shutdown and should not suffer any adverse consequences from these circumstances. It's in no one's interest to punish those who may be enduring financial stress through no fault of their own.

I appreciate that some of your institutions and member companies have already been announcing accommodations for affected consumers, but it is important that there be a robust effort by all institutions to do what they can to help. I ask that each of you provide a prompt written response no later than January 25, 2019, to describe what your institutions and member companies are doing to help innocent consumers in response to this unprecedented federal government shutdown." Read the full letter.

Six New Yorkers Named To House Financial Services Committee

|

|

|

From left to right (top): Carolyn Maloney, Greg Meeks & Nydia Velazquez

From left to right (bottom): Alexandria Ocasio-Cortez, Peter King & Lee Zeldin

|

Six members of the New York congressional delegation will serve as members of the Financial Services Committee. There are four

Democrats --

Carolyn Maloney (Manhattan), Greg Meeks (Queens), Nydia Velazquez (Brooklyn) and Alexandria Ocasio-Cortez (Queens/Bronx) and two Republicans -- Peter King and Lee Zeldin (both from L.I.)

Chairwoman Waters has indicated her priorities for the committee will include

ending the partial government shutdown, reversing Consumer Financial Protection Bureau reforms, ensuring protections for fintech consumers, passing housing-finance and fair-housing reforms and promoting diversity and inclusion.

Meanwhile,

"Politico" reports

Rep. Ocasio-Cortez will also likely be named to the House

Oversight Committee, which could play an important role as Democrats have pledged to launch wide-ranging investigations into the president and his administration. Ocasio-Cortez will be part of

a group of progressive Democrats added to the committee, along with Reps.

Rashida Tlaib (D-MI), Ayanna Pressley (D-MA) and Ro Khanna (D-CA).

Fannie, Freddie Issues New Mortgage Origination Requirements

As Shutdown Continues

Fannie Mae and Freddie Mac, in consultation with the Federal Housing Finance Agency, announced new mortgage origination requirements in light of the ongoing government shutdown.

In its original guidelines issued earlier in January, Fannie Mae explained it was assuming the shutdown would be temporary. Fannie Mae and Freddie Mac, in consultation with the Federal Housing Finance Agency, announced new mortgage origination requirements in light of the ongoing government shutdown.

In its original guidelines issued earlier in January, Fannie Mae explained it was assuming the shutdown would be temporary.

But now, as the shutdown drags on, the GSEs issued further guidance.

"With the shutdown extending for a longer period of time, we are concerned about the impact that continued income interruption may have on borrowers' ability to meet their mortgage payment and other monthly obligations," Fannie Mae said in its letter to lenders. "In light of this, we developed this Lender Letter jointly with Freddie Mac and in consultation with FHFA." The GSEs are imposing a minimum reserves requirement that will serve as a compensation factor to offset the risk associated with the interruption of income. There is also more flexibility regarding the verbal verification of employment and paystub age requirements. These temporary requirements will apply to all borrowers impacted by the shutdown and will automatically expire once the government is fully funded and resumes operations.

New Treasury Rule Impacts Subchapter S Bank Shareholders

Under a new Treasury Department final rule, Subchapter S bank shareholders will have significantly expanded access to the 20 percent tax deduction for pass-through businesses. The rule, which includes

ICBA and IBANYS advocated reforms,

expands the availability of the Tax Cuts and Jobs Act's deduction on qualified business income to include income from the origination and sale of mortgage loans - a significant change that will benefit hundreds of community banks.

ICBA continues reviewing the final rule, which does not appear to rectify other banking activities ineligible for the deduction, such as wealth management and retirement planning. It remains unclear how the disqualification of "investing and investment management services" would apply to trust or fiduciary services offered by a bank. Further, de minimis thresholds to qualify for the full deduction were not changed, despite ICBA calls to raise the thresholds to a flat 25 percent.

ICBA is preparing an analysis of the final rule and will continue working with policymakers to maximize Sub S community bank eligibility for the tax deduction.

ICBA Laments Regulators Insufficient Action

To Reduce Reporting Burdens

ICBA expressed disappointment in federal regulators' "insufficient" proposal to reduce reporting burdens, and reiterated its call for a true short-form call report. ICBA expressed disappointment in federal regulators' "insufficient" proposal to reduce reporting burdens, and reiterated its call for a true short-form call report.

Following its weeks-long grassroots advocacy campaign, ICBA said the call report for the first and third quarters should consist of a balance sheet, income statement, and statement of changes in shareholders' equity.

In a formal comment letter and separate message from ICBA President and CEO Rebeca Romero Rainey, ICBA said the proposal does not meet the intent of Congress, which advanced ICBA's longtime push for a short-form call report via the S. 2155 regulatory relief law enacted last year. Romero Rainey noted: "The proposed 'short-form' call report results in a relatively insignificant reduction in quarterly reporting burden of 1.18 hours on average for most community banks."

ICBA Advocacy Survey - Please Take A Moment To Complete

Advocacy is everyone's responsibility Advocacy is everyone's responsibility. Whether you're a community bank president, employee, or director, you have a direct stake in

making sure lawmakers in Congress hear your voice.

To more effectively advance our collective mission to create and promote an environment where community banks flourish, ICBA and IBANYS need your help. The following survey seeks to refine the tools and resources ICBA can offer you to better enable the important conversations and relationships required to drive positive policy outcomes for the community banking sector. Additionally, ICBA is seeking to build greater visibility of the existing personal or professional relationships that you as a community banker or director may already have with returning or new lawmakers.

This survey should take less than 10 minutes to complete. Please contact Ryan Hadley at

[email protected] with any questions regarding this survey.

Join IBANYS In Washington, D.C.This Spring

For the

2019 ICBA Capital Summit

The 2019 ICBA Capital Summit will be held April 28 - May 1 in Washington. Community bankers from around the nation will travel to Washington to meet with their Members of Congress in their offices "on the hill" and hear federal financial regulators to discuss key issues. We'll hear firsthand from financial and policy leaders, and influence the policy-making process. New York community bankers: Mark your calendars and hold the dates.

IBANYS will be scheduling meetings with the members of the New York congressional delegation. With a Democratic House of Representatives, a new agenda in the House Financial Services Committee, five new Representatives from New York and six New Yorkers on the House Financial Services Committee, it is more important than ever to bring your voices, your priorities and your stories to their attention.

Other News From Washington:

- The Federal Housing Finance Agency (FHFA) has raised the asset threshold for Federal Home Loan Banks to be considered "community financial institutions" to $1.199 billion in assets. The newly revised threshold took effect January 1.

- Morris Morgan has been named Senior Deputy Comptroller & COO of the Office of Comptroller of the Currency (OCC). Comptroller Joseph Otting created the COO position as part of structural changes to the agency. Morgan joined the OCC in 1985 and has served as senior deputy comptroller for large bank supervision since December 2016. Among his responsibilities will be overseeing the OCC's bank supervision unit.

- The Trump administration is said to be considering whether to re-nominate Marvin Goodfriend to the Federal Reserve Board. His nomination lapsed at the end of 2018. Goodfriend was nominated in November 2017, but the full Senate never voted on his nomination because Republican leaders reportedly weren't certain he could get enough support.

|

|

|

|

Industry Trends & Updates

|

|

ICBA Names Loughlin Cleary To Head Member Relations Team

|

|

|

Loughlin Cleary

|

ICBA announced the promotion of Loughlin Cleary to executive vice president, business development, effective Feb. 1, 2019. Cleary, who is currently vice president of member relations for ICBA's Northeast region, will lead national initiatives to broaden member engagement with ICBA's state-of-the-art educational programs and its extensive network of products and services tailored specifically for community bankers.

"Since joining ICBA in 2016, Loughlin has served a pivotal role in expanding ICBA's membership footprint in the Northeast region," ICBA President and CEO Rebeca Romero Rainey said. "Loughlin's industry expertise and exceptional ability to serve our members is an asset to ICBA as we continue to expand the value we bring to our members and help them achieve their business goals. We are thrilled to announce Loughlin's promotion to lead our dedicated and talented member relations team and wish him all the best in his expanded role."

Prior to joining ICBA, Cleary

worked for a retail bank and a trust company and spent 17 years at the Federal Home Loan Bank of Boston, where he served in various roles including sales, financial management and product development. Most recently, Loughlin served as vice president, member solutions manager. Cleary is a graduate of Dickinson College and has his Master of Business Administration from Boston College.

__________________________________

Empire National Bank Announces Interest-Free Short-Term Loans

For Government Workers Impacted By Shutdown

Empire National Bank Chairman and Chief Executive Officer Doug Manditch announced the bank will make interest-free short-term loans available to government workers impacted by the current national government shutdown. The financial institution has allocated $2,500,000 for this short-term program. Available to residents of Nassau and Suffolk Counties, these loans will be payable upon receipt of back pay. Amounts for each loan will be determined on an individual basis. Manditch, a former Chairman of IBANYS, stated:

"As a community bank, we feel an obligation to help these hard-working men and women during this difficult time. By making these funds available, we hope it will ease the burden these government employees face trying to meet their day-to-day expenses without the benefit of a paycheck."

__________________________________

Consumer Sentiment Falls To 26-Month Low

The University of Michigan consumer sentiment index fell to 90.7 this month - its lowest since October 2016 - from 98.3 in December, preliminary data showed. Economists polled by Refinitiv expected the index to fall to 96.4.

Consumer sentiment dropped to its lowest level since before the 2016 presidential election amid growing concerns over U.S. economic growth.

Richard Curtin, Chief Economist for the Surveys of Consumers, noted: "The loss was due to a host of issues including the partial government shutdown, the impact of tariffs, instabilities in financial markets, the global slowdown, and the lack of clarity about monetary policies."

__________________________________

Existing Home Sales Down Significantly

Real estate brokers are reportedly trying to figure out why sales of existing homes plunged in December.

The 4.6 percent monthly move was unusually large, regardless of direction. The shift was one of the largest that didn't involve some sort of change in government policy, like the homebuyer tax credit. The tally from the National Association of Realtors usually moves in the very low single digits month to month. The median home price of $259,100 in 2018 was the highest on record. Mortgage rates did drop in December, but the expectation is that they will move higher this year, which could hurt affordability further. Real estate brokers are reportedly trying to figure out why sales of existing homes plunged in December.

The 4.6 percent monthly move was unusually large, regardless of direction. The shift was one of the largest that didn't involve some sort of change in government policy, like the homebuyer tax credit. The tally from the National Association of Realtors usually moves in the very low single digits month to month. The median home price of $259,100 in 2018 was the highest on record. Mortgage rates did drop in December, but the expectation is that they will move higher this year, which could hurt affordability further.

__________________________________

Vining Sparks & ICBA Securities Balance Sheet Academy

Registration is now open for Vining Sparks and ICBA Securities' Balance Sheet Academy seminar in Memphis, Tennessee from Monday, April 29 to Tuesday, April 30 2019. This

advanced seminar is designed to expose seasoned community bank portfolio and balance sheet managers to advanced products and concepts. The objective is to enable the attendees to consistently outperform their peers. The dynamics of a community bank balance sheet require an investment professional to be versed in a wide range of topics.

Balance Sheet Academy

provides discussion and practical classroom exercises to equip the attendees for these demands. Examples of these topics include:

- Advanced interest rate risk management strategies;

- Low cost funding strategies; and

- Strategies for serving bank customers while managing interest rate risk.

Attendees will learn how the changing economic data impacts market interest rates from Vining Sparks' Chief Economist. The Balance Sheet Academy is structured for more experienced investment managers, particularly those who have attended Bond Academy.

It incorporates balance sheet strategies into the day-to-day management of an institution's investment portfolio, wholesale funding and interest rate risk management. Bank personnel with an intermediate level of understanding of investments who are integral to the investment and balance sheet management process will benefit the most from this advanced course. New directors serving on the investment or asset-liability committee will also find this course beneficial.

Contact:

|

|

|

|

Further Your Education at Barret Graduate School of Banking

Barret and IBANYS are aligned with a common interest: to represent the interests of the industry through effective advocacy and high quality educational offerings.

Located in Memphis, TN, Barret Graduate School of Banking offers a comprehensive graduate learning program for professionals in the financial services field. IBANYS has established partnerships with key industry educators including the Barret Graduate School of Banking. The school provides community bankers with an opportunity for a graduate degree in banking.

We are currently endorsed by ICBA, ICBA Securities, Arkansas Community Bankers, CBAofGA, Indiana Bankers Association, CBAofKS, MIBA, CBAofOH, CBAofWV - with a couple more on the way.

To learn more about Barret Graduate School of Banking, please visit

www.barret.ws.

__________________________________

Keep The Door Open For Your Small Business Customers

Excelsior Growth Fund (EGF) is NYBDC's nonprofit Community Development Financial Institution and IBANYS' exclusive online lending partner. Join the growing number of banks that work with EGF to offer their customers an affordable and responsible option when they do not qualify for traditional financing. EGF offers loans up to $500,000 with a convenient, digital process. Loans under $100,000 are disbursed within 5 business days.

EGF's experienced team can work hand-in-hand with yours to develop a customized process to make referring seamless. To learn more about offering your customers a second look through EGF contact Bryan Doxford, SVP, at [email protected] at at (212) 430-4512.

|

|

|

Spotlight Bank of the Week

|

|

|

|

|

|

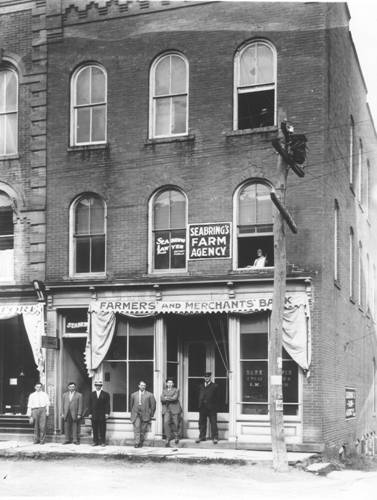

M.D. Fisher

|

|

Tioga State Bank is an independent, family owned and operated

financial institution. The bank was founded in 1864 when local business owners joined together to form a community bank to provide highly needed banking services to our communities. The bank's first president was M.D. Fisher and our current President, Robert M. Fisher is the fifth generation to run Tioga State Bank.

Tioga State Bank is still currently the only

bank headquartered in Tioga County, NY. Tioga State Bank currently has 11 locations and serves the financial needs of the Southern Tier of New York and Northern Pennsylvania.

Tioga State Bank offers a full range of consumer, business,

|

|

|

The Fishers

|

investment and financial products and personalized services tailored to meet the needs of our local community. We want to be our customers' trusted financial advisor for life. We also seek to provide additional benefits to our customers by sending them relevant, helpful information and offering expert insight to help them reach their financial goals.

Giving back and community involvement are themes that are seen throughout TSB's culture. One of Tioga's guiding principles is care for our community, which we show in many ways. Over the last 5 years, we have donated over $400,000 to local charities and organizations to help our communities thrive. We helped support the construction of a home health facility, raised funds to make a local library handicap accessible, donated to all three local healthcare systems, funded one week of food for over 9,000 students, among many others.

We also encourage those in our local community to play a part in growing our local economy and to support local businesses. We do this through our monthly #GoLocal campaigns where we highlight local business customers on social media, social media contests, and sharing local businesses' stories and events.

Our staff is also very involved in the communities we  serve. The majority of our employees belong to a community organization or charity. Each year we host a car and truck show, participate with a team of runners in many local 5k's, and walk in our local American Heart Association event. During the holiday season, staffers hand out fresh fruit and vegetables to at-risk families. Each month we host a blue jeans for charity day with many of our employees participating by wearing jeans to the office in exchange for a donation to a local charity. 2 years ago, we also started hosting our own 5k to help benefit Cure the Blue. Cure the Blue collects funds for prostate cancer and was founded by former Buffalo Bills player, in conjunction with the Buffalo Bills Alumni Association, Booker Edgerson. Participation in and giving back to the communities we serve is at the core of who we are at Tioga State Bank. serve. The majority of our employees belong to a community organization or charity. Each year we host a car and truck show, participate with a team of runners in many local 5k's, and walk in our local American Heart Association event. During the holiday season, staffers hand out fresh fruit and vegetables to at-risk families. Each month we host a blue jeans for charity day with many of our employees participating by wearing jeans to the office in exchange for a donation to a local charity. 2 years ago, we also started hosting our own 5k to help benefit Cure the Blue. Cure the Blue collects funds for prostate cancer and was founded by former Buffalo Bills player, in conjunction with the Buffalo Bills Alumni Association, Booker Edgerson. Participation in and giving back to the communities we serve is at the core of who we are at Tioga State Bank.

__________________________________

|

About Spotlight Bank of the Week

Spotlight Bank of the Week is a new feature that we have added to our website and e-newsletter. It is an opportunity to promote anything about your organization, such as fun facts, organization news, special events, etc. The Spotlight Bank of the Week will be featured on our homepage slider, e-newsletter, and our social media platforms for one week. So don't miss out on this exceptional opportunity to showcase your bank to thousands of people!

View banks that have been featured as our Spotlight in the past!

|

|

IBANYS Spotlight Is On...

|

Luse Gorman, PC -

an IBANYS preferred partner - has specialized in representing community financial institutions for over 25 years. They are consistently one of the leading law firms nationally in mergers and acquistions, and the leader in capital raising transactions, including stock and debt offerings, mutual-to-stock conversions, mutual holding company reorganizations and other capital raising transactions. Their attorneys have completed more than 150 mergers in the past ten years alone, and nearly 100

capital raising transactions during this time period.

They also advise financial institutions on a broad range of executive compensation and employee benefits matters, including ESOPs. A substantial part of the Firm's practice

also includes advising clients on SEC reporting and compliance, stockholder relations,

corporate governance, strategic planning and bank regulatory and enforcement matters.

For additional information, contact:

Jeff Cardone, Partner

|

|

|

|

|

IBANYS identifies offers products and services that provide value to your banks, companies, employees communities. These brief summaries provide links for information. Please contact IBANYS President John Witkowski with questions.

Health & Wellness

My Wellness Resource & TELADOC

The health and wellness landscape continues to evolve. "My Wellness Resource" can be a nice addition to your existing benefit package.

Teladoc can save your banks time and money, and provide real value to your employees as this testimonial from a New York community bank CEO proves:

HERE'S WHAT YOUR FELLOW NEW YORK

COMMUNITY BANKER SAYS. . .

"I wanted to let you know that some of our employees and I have been using "Teladoc" and it is one of the best things we have done for the bank. We all love it: We are saving time, avoiding waiting in an urgent care center or a doctor's waiting room for non-emergency related illnesses

. . .and it is easy to use and convenient. Once you use it, you are hooked! This was a great find! Would recommend it to all banks."

Mario Martinez

Chairman & CEO

Catskill Hudson Bank

Contact Alan Justin: (716) 907-5500.

"Cure the Blue" Helps Banking Industry Battle Prostate Cancer!

The "Cure the Blue" program sponsored by the Buffalo Bills Alumni Foundation allows New Yorkers to participate in one of the most comprehensive efforts to help promote prostate cancer awareness and research in the United States.

Lake Shore Savings Bank has provided prostate cancer literature and Cure the Blue information at all eleven of its  branches and their headquarters in Dunkirk. The bank also offered Cure the Blue ceramic lapel ribbon pins for a $5.00 donations to Cure the Blue to all their customers. "We fully understand the severity of this disease and the devastating effect it can have on families" said Lake Shore Savings Bank President and CEO Dan Reininga. "Our support of the Buffalo Bills Alumni Foundation's "Cure the Blue" initiative is something that we are taking very seriously and are proud to support." Buffalo Bills Wall of Famer and Alumni Foundation President Booker Edgerson, a two time prostate cancer survivor, said the bank has been a tremendous longtime supporter, noting: "They have really stepped up to the plate with their unwavering support of our Cure the Blue initiative." branches and their headquarters in Dunkirk. The bank also offered Cure the Blue ceramic lapel ribbon pins for a $5.00 donations to Cure the Blue to all their customers. "We fully understand the severity of this disease and the devastating effect it can have on families" said Lake Shore Savings Bank President and CEO Dan Reininga. "Our support of the Buffalo Bills Alumni Foundation's "Cure the Blue" initiative is something that we are taking very seriously and are proud to support." Buffalo Bills Wall of Famer and Alumni Foundation President Booker Edgerson, a two time prostate cancer survivor, said the bank has been a tremendous longtime supporter, noting: "They have really stepped up to the plate with their unwavering support of our Cure the Blue initiative."

IBANYS urges all of our member banks, associate members and allies to join the effort. Cure the Blue" raises funds and awareness regarding prostate cancer in New York State. Visit

curetheblue.com

to get involved! Of all new cancer cases in the nation, prostate cancer represents 9.6%. In 2017, there were an estimated 161,000 new cases, and more than 26,000 fatalities due to the disease. Support IBANYS' "Cure the Blue" campaign to help New Yorkers participate to promote prostate cancer awareness and research.

Secure, Enhanced Internet Presence

The .bank program by fTLD operates trusted, verified, more secure, easily-identifiable internet locations for financial companies and

customers. www.icba.org

|

|

|

. . .That the first general hourly minimum wage in New York State was established in 1960, at the rate of $1.00 an hour? In 1974, the year IBANYS was established, the minimum wage in New York State was increased from $1.85 an hour to $2.00 an hour.

As of December 31, 2018, the rate is:

- $11.10 an hour for most of New Yoirk State;

- $12.00 for Long Island and Westchester County;

- $13.50 in New York City for small employers with 10 or fewer employees, and

- $15.00 for New York City firms with 11 or more employees.

Prior to 1960, state minimum wage rates varied from industry to industry.

|

|

|

|

New York community banks play a key role in our state and local economies. Help spread the good news among our customers, business, elected leaders and the media!

John J. Witkowski

President & Chief Executive Officer

Stephen W. Rice

Director of Government Relations & Communications

Linda Gregware

Director of Administration & Membership Services

William Y. Crowell III

Legislative Counsel

Natalie Rowan

Marketing & Social Media Assistant

|

|

|