|

|

|

|

|

|

Message From The President

|

|

|

By John Witkowski, President & CEO

___________

As August quickly approaches, summer will turn into fall before we know it. But that doesn't mean the summer fun has to come to an end. Close out summer 2019 with IBANYS'

Banking Executive Symposium at the beautiful

1000 Islands Harbor Hotel in Clayton, New York!

This is an important meeting for New York community banks, designed to address issues relevant to:

- Presidents & Senior Managers

- Bank Directors & ALCO Teams

The Symposium will provide strategic insights and critical industry updates that will guide you, your senior management teams and bank to success. Topics and issues to be covered by experts include Critical Issues Facing the Leadership of Today's Community Banks, Cybersecurity, The Importance of the Chief Information Security Officer, Banking & Marijuana, CECL and more. In addition,

IBANYS has been authorized by the New York State Department of Education to award up to 12 Continuing Professional Education (CPE) credits to participants. Various sponsorships are also available.

Full details can be found in the

Banking Executive Symposium brochure, as well as on our

website.

Please note that there is a hotel room cutoff date on Friday, August 16.

After this date we cannot guarantee the room rate. Hotel reservations can be made by calling the hotel directly at (315) 686-1100 and referring to the Independent Bankers Association of New York State.

Don't miss out on our last event of the year on the scenic St. Lawrence River. Endless networking and educational opportunities await, so reserve your room and send us your registration form today!

___________________________________

IBANYS has been reviewing a list of bills that passed both the State Assembly and State Senate in 2019 and are now eligible to be sent to the Governor for his signature of veto. Among other things, they include legislation related to credit unions, foreclosure/"zombie" properties and CRA. IBANYS' Legislative Counsel Bill Crowell, G.R. Director Steve Rice and I reviewed and discussed the list of bills with our Government Relations Committee this week. Bill Crowell will also be attending our September Banking Executive Symposium in Clayton, New York to provide an update on the 2019 session and a preview of what likely awaits in 2020.

___________________________________

. . .We Want To Hear From You!

IBANYS member banks: Is there a particular vendor, consultant or supplier your bank uses who might be a prospective IBANYS associate member? Our associate membership program brings value in three was:

- To our member banks, who gain access to products and services that can provide a boost in their profitability and operations;

- To the associate member firm, which gains a new universe for potential business development, and

- To IBANYS, which benefits from bringing in additional non-dues revenue, and gains potential new allies for sponsorship, exhibit and speaking opportunities.

If you have suggested firms, email Linda Gregware or me and we will follow-up with you.

|

|

Follow IBANYS On Social Media!

Connect With Us Today!

|

|

Banking Executive Symposium

September 9-11, 2019

200 Riverside Drive

Clayton, NY 13624

CPE Credits Available

= 12

Hotel Information

Village View - $169

River View - $189

River View with Balcony - $209

**ROOM CUT-OFF DATE: FRIDAY, AUGUST 16, 2019**

After this date, we cannot guarantee room rate.

Reservations can be made by calling the hotel directly at (315) 686-1100 and refer to the Independent Bankers Association of NY.

__________________________________________________________________

Of course, you also won't want to miss our full calendar of our IBANYS webinars on a wide range of operational, governance and strategic issues.

Have an idea for one of our meetings? Want to see a meeting or forum on a different subject? We want to hear from you!

|

IBANYS Education/Webinars

|

|

|

Have you reviewed our 2019 Webinar Calendar?

The Independent Bankers Association of New York State (IBANYS) partners with CBWN to bring you more than 150 webinars each year covering compliance, lending, regulations, security, operations, new accounts, collections, fraud, security and other topics. Even better, each time you purchase a webinar, you support IBANYS, because a portion of your registration comes directly to us. Thank you!

You can view the 2019 Webinar Schedule here or by category here. In addition, CBWN has made some recent updates to provide better service to its consumers. Unfortunately, some changes may have caused you to miss important webinar announcements. Please read the IBANYS letter to view the updates and ensure that you do not miss another webinar.

NEW WEBINARS ADDED FOR 2019

CBWN has added more than 140 webinars to the IBANYS webinar calendar, covering all the essential topics. Start the new year off right by gaining the knowledge and tools to make 2019 the best year yet!

CBWN and IBANYS thank you for your continued support of the education in the community banking industry.

|

|

|

Albany |

The New York State Legislature is adjourned for the year, and will not return to Albany until January, 2020.

IBANYS' Government Relations Committee will be developing policies and positions regarding our 2020 state legislative program.

______________________

IBANYS Government Relations Committee Reviews Legislation

IBANYS' Government Relations Committee and Board of Directors held a conference call yesterday morning to discuss strategies on how to proceed on the list of bills of interest to community banks that were passed by both the State Senate and Assembly this past legislative session and may now be sent to Governor Cuomo for his signature or veto.

View the list of bills discussed.

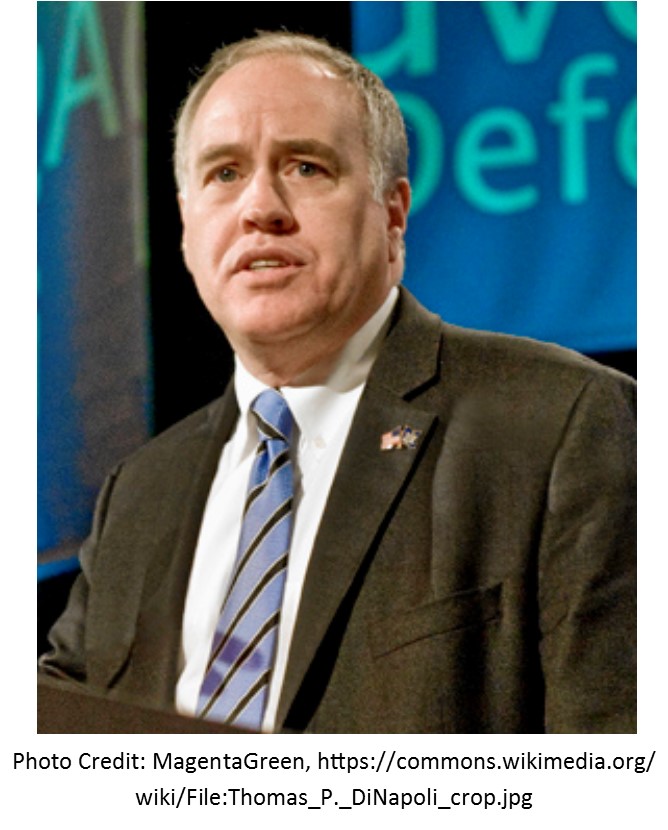

Comptroller DiNapoli Discusses Economic Outlook

In an interview with Spectrum News, State Comptroller DiNapoli discussed the big picture of what the economy will do next, noting:

"Nobody has a crystal ball to say when the economy is going to slow down when we might be in a correction in the market or a recession in terms of the overall economy." The NYS Legislature

and Governor Andrew Cuomo added $250 million to a rainy day fund this year to offset any loss in revenue if the economy turns sour, but DiNapoli says more needs to be done "because

at some point the cycle will go in the other direction." In an interview with Spectrum News, State Comptroller DiNapoli discussed the big picture of what the economy will do next, noting:

"Nobody has a crystal ball to say when the economy is going to slow down when we might be in a correction in the market or a recession in terms of the overall economy." The NYS Legislature

and Governor Andrew Cuomo added $250 million to a rainy day fund this year to offset any loss in revenue if the economy turns sour, but DiNapoli says more needs to be done "because

at some point the cycle will go in the other direction."

He cautioned

the politics in Washington could impact New York's finances, both the state and local governments, and also noted

the $10,000 cap on state and local tax deductions, which could make it harder for state officials to budget.

"The problem with all of this is taxpayer's behavior has been impacted in ways that are now much less predictable," said DiNapoli.

New York last week with several other states filed a federal lawsuit challenging the SALT cap.

New York State Fines Equifax $19.2 Million

State Attorney General Letitia James announced that Equifax has been fined $19.2 million by state regulators stemming from a 2017 data breach as part of a settlement following investigations from the Attorney General's office and State Department of Financial Services (DFS) after the financial and personal information of 8.5 million New Yorkers was exposed. $10 million will be paid to DFS, and $9.2 million to the Attorney General's office. State Attorney General Letitia James announced that Equifax has been fined $19.2 million by state regulators stemming from a 2017 data breach as part of a settlement following investigations from the Attorney General's office and State Department of Financial Services (DFS) after the financial and personal information of 8.5 million New Yorkers was exposed. $10 million will be paid to DFS, and $9.2 million to the Attorney General's office.

Equifax will be required to provide credit monitoring services and free annual credit reports, and to make restitution to consumers financially affected by the breach. Governor Cuomo stated:

"Credit rating agencies have a responsibility to safeguard consumers' financial and personal information

. . .

In New York we are sending a clear message to these agencies that they will be held accountable if they leave consumers' private data vulnerable to exposure, and we will continue our rigorous oversight of these agencies to ensure New Yorkers are protected in the future."

|

Washington, D.C.

|

|

NCUA Quadruples Credit Union Appraisal Threshold

The National Credit Union Administration approved an ICBA-and IBANYS-opposed final rule that quadruples the threshold at which credit union commercial real estate transactions are exempt from appraisals. The NCUA board vote increased the threshold from $250,000 to $1 million, double the banking industry's $500,000 CRE appraisal threshold.

ICBA strongly opposed the move, noting the NCUA is once again pushing the envelope to benefit the industry it is charged with regulating.

ICBA President and CEO Rebeca Romero Rainey noted the "2-1 vote by the divided NCUA board is just the latest example of NCUA acting as an advocate for tax-exempt credit unions."

Community bankers: Continue using

ICBA's "Be Heard" grassroots action center

to urge Congress to investigate the trend of large credit unions buying up community banks. ICBA is also encouraging community bankers to send in examples of egregious credit union actions to

[email protected]

and to use ICBA's customizable op-ed to raise awareness of the acquisition trend.

ICBA also told the NCUA that its proposal to allow credit unions to hold more nonmember shares is the latest example of the agency pushing the envelope to help the industry it regulates.

The NCUA plan would allow federal credit unions to receive public unit and nonmember shares up to 50% of their paid-in and unimpaired capital and surplus, less any public unit and nonmember shares. Current rules limit nonmember shares to 20% of a credit union's total shares or $3 million, whichever is greater.

ICBA noted the plan would allow credit unions to take even more deposits from outside their membership base, further circumventing field-of-membership rules, and that the NCUA should concentrate on improving the overall safety and soundness of the credit union industry.

Fed Nears Decision On Faster Payments

The Federal Reserve appears to be closing in on its decision about whether to take a leadership role in faster payments.

Now is the time for community bankers to be heard on Capitol Hill and at the Fed. ICBA has been urging community bankers to contact policymakers in support of Fed involvement.

June 30 Call Reports Due July 30

A reminder that call reports for the June 30 report date are due by Tuesday, July 30. A final rule expanding eligibility to use the FFIEC 051 Call Report during the first and third quarters takes effect on July 22. That rule applies to institutions with less than $5 billion in total assets that also meet certain other criteria.

An Early Look At Potential 2020 Congressional

ICBA Testifies On Small Business Reg Relief

In testimony before the House Small Business Committee, ICBA stated that regulatory overkill poses a grave threat to community bank small-business lending. At a committee "

field hearing" held

in Tulsa, ICBA discussed several initiatives from its Community Focus 2020 agenda designed to ease excessive and unnecessary regulations, including

Bank Secrecy Act modernization, FinCEN's customer due diligence rule, small-business data collection, a cannabis-banking safe harbor, barriers to raising capital, and more.

Senate Holds Hearing On Cannabis Banking

ICBA submitted

testimony

calling on the Senate Banking Committee to take up legislation that would establish a cannabis-banking safe harbor in states where cannabis is legal. In a written statement for the committee's hearing on the Secure and Fair Enforcement Banking Act, ICBA said the bill would enhance public safety and address regulatory compliance concerns.

At the

hearing

, Chairman Mike Crapo (R-ID) raised concerns about the safe harbor, such as how it would affect banking across state lines. Crapo has previously expressed doubts about the policy, raising questions about what's next for the Senate version of the bill after the House Financial Services Committee passed its version in March.

ICBA will continue working to advance the legislation in the House and Senate.

Federal Regulators Emphasize Risk-Based BSA/AML Oversight

Federal regulators issued a joint statement to improve the transparency of their risk-focused approach to Bank Secrecy Act and anti-money-laundering supervision. The statement outlines common practices for assessing bank risk profiles to help examiners evaluate compliance. The agencies' risk-based approach is designed to allocate more resources to higher-risk areas and fewer resources to lower-risk areas during BSA/AML exams.

Rep. Ocasio-Cortez Topped House

Financial Services Committee Democrats In Fundraising

Among House Financial Services Committee Democrats, Rep. Alexandria Ocasio-Cortez ranks No. 1 in terms of total receipts raised for her re-election with nearly $2 million, according Federal Election Commission data for the first half of the year. Rep. Ocasio-Cortez, who has approximately 5 million Twitter followers, reported raising almost all of it from individual contributors, with none of the money coming from corporate political action committees.

August Is Coming: Time To Meet With Your

Representatives In Their Districts!

The State Legislature is adjourned until January, and the Congress is about to begin its long August recess that will last through Labor Day. This is a great opportunity to contact your representatives and arrange meetings with them back home in their districts. Explain to them the value and importance of community banks, both to local communities and the nation. You can even invite them for a tour of your bank!

Let's demonstrate to our elected officials the significance our community banks have, locally and nationally.

|

|

|

|

Industry Trends & Updates

|

|

|

Community Banks Bolstering Farm Lending - While Largest Banks'

Ag Lending Declines

In a

new op-ed on "Medium," ICBA President & CEO Rebeca Romero Rainey cited

a recent Reuters report that found agricultural lending by the nation's largest banks is down significantly in recent years, while overall bank lending to the farm sector has grown. She noted:

"Fortunately for rural America and the citizens who call it home, the nation's community banks are bolstering their farm lending at this crucial time-demonstrating once again why policymakers should work to strengthen community banks, which stick with their customers and communities in good times and bad."

_________________________________________

Bob Fisher Named To ICBA Securities Board Of Directors

ICBA Securities Inc., the broker-dealer subsidiary of the Independent Community Bankers of America (ICBA),

announced the appointments of ICBA Vice Chairman Bob Fisher, president and CEO, Tioga State Bank, Spencer, N.Y., and Jack Hopkins, president and CEO, CorTrust Bank, Mitchell, S.D.,

to its Board of Directors.

Bob, a former Chairman of IBANYS, currently serves as a member of our Board of Directors and Government Relations Committee and chairs NYSIBPAC, our state political action committee.

"ICBA Securities is fortunate to have such distinguished community bank leaders join our board," said ICBA Securities Chairman Dennis Doyle, president and CEO of $836 million-asset Great Midwest Bank in Brookfield, Wis. "These new directors provide valuable insights and continue ICBA Securities' rich tradition of seeking credible, respected community bankers on its board."

Also serving on the ICBA Securities board of directors are Leon Blankstein, president and CEO, American Business Bank, Los Angeles; Scott Heitkamp, president and CEO, ValueBank Texas, Corpus Christi, Texas; Kathy Underwood, president and CEO, Ledyard National Bank, Hanover, N.H.; and John Witkowski, president and CEO, Independent Bankers Association of New York State, Albany, N.Y.

"We are pleased to welcome Bob and Jack to the board and look forward to their fresh perspectives as we refine our investment portfolio and educational offerings that help foster continued growth and prosperity for the nation's community banks," said ICBA president and CEO Jim Reber.

Since 1989, ICBA Securities, a wholly owned subsidiary of ICBA, has offered broker-dealer services with an inventory of portfolio investment products to community banks through its exclusively endorsed broker Vining Sparks, one of the nation's top 20 underwriters of agency securities.

_________________________________________

Banking The Hemp Industry: Five Things You Should Know

There is considerable confusion and misinformation regarding the legality of hemp and the ability of financial institutions to meet the banking needs of hemp-related businesses. The attached Alert provides some guidance and hopefully clarity for financial institutions relating to the business of banking hemp. Luse Gorman, P.C. is actively assisting depository institutions nationwide in accessing and

addressing the risks related to providing products and services to customers involved at all levels

of the hemp industry. Read the full text of the article entitled, "Banking The Hemp Industry: Five Things You Should Know."

_________________________________________

Safe Deposit Boxes: Not Safe?

There are an estimated 25 million safe deposit boxes in America, and they operate in a legal gray zone within the highly regulated banking industry. There are no federal laws governing the boxes; no rules require banks to compensate customers if their property is stolen or destroyed. Read a recent article from The New York Times on this issue.

_________________________________________

Equifax To Pay Highest Fine Ever In Data Breach Settlement

Equifax will pay up to $700 million in monetary relief and penalties to consumers under a settlement with federal and state regulators over its 2017 data breach. The settlement includes up to $425 million in consumer relief and a $100 million civil money penalty. The settlement does not affect the bank lawsuit seeking compensation for community banks and improved security at the credit bureau. The Equifax

data breach exposed the financial information of more than 148 million people. The settlement will be the largest fine ever paid for a data breach, and ends multiple investigations, including those by the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC).

_________________________________________

The Economy By The Numbers

-

Congressional and White House negotiators have agreed to increase federal spending and increase the government's borrowing limit as part of the deal to suspend the debt ceiling until the end of July 2021 (after the 2020 elections). The agreement also raises spending nearly $50 billion in the next fiscal year, and omits spending cuts the White House initially wanted. Congressional and White House negotiators have agreed to increase federal spending and increase the government's borrowing limit as part of the deal to suspend the debt ceiling until the end of July 2021 (after the 2020 elections). The agreement also raises spending nearly $50 billion in the next fiscal year, and omits spending cuts the White House initially wanted.

- Morgan Stanley economists see a 20% chance of a recession in the year ahead, but that could move up quickly depending on circumstances.Ellen Zentner, Morgan Stanley's chief U.S. economist, noted trade tensions that could lead to layoffs and a pullback from consumers as being at the center of the case for recession. A Fed rate cut may not be enough to stave off a slowdown that would start as a demand shock, according to the forecast. The New York Fed, which gauges a recession chance by measuring the spread between government bond yields, estimates a 33% chance of a downturn coming in the next 12 months, the highest level since the Great Recession that ended in mid-2009.

- The National Association of Realtors reported that existing-home sales decreased 1.75% in June as the nation continues to grapple with a housing shortage. NAR said supply is not meeting demand for mid- and lower- priced homes, with declines in the South and the West leading the drop.

_________________________________________

The Bond Academy

Learn Bond Basics with your Peers!

Where: Embassy Suites

1022 S. Shady Grove Road

Memphis, TN 38120

The Bond Academy is designed to provide community bankers with the basic knowledge needed to help plan and create effective investment portfolios.

A high performance investment portfolio can provide a noticeable increase to your bank's bottom line. The learning objectives of Bond Academy are aimed at providing you with the tools to understand how debt instruments work and their overall role in complementing the entire balance sheet.

This all new curriculum has been specifically designed to equip a new portfolio manager with basic portfolio management issues. Specifically, fundamentals of bond pricing, valuation, and selection will be covered extensively. You'll learn the basics of the bank portfolio investment process. There is also an opportunity to earn up to 12 CPE credits!

Who Should Attend?

CPAs and those new to their roles as investment officers, cashiers, controllers, and internal control professionals will benefit the most from Bond Academy. New directors serving on the investment or asset-liability committee will also find this course beneficial. No advance preparation is necessary.

You Will Learn:

- Bond basics, including bond pricing, duration, and price volatility

- Bond types, including agencies, municipals, mortgage securities, and floating rate instruments

- The composition of a high performing portfolio

- How to understand the rate market: yield curves, spreads, monetary policy

- How economic data affects the bond market

- The impact of interest rate risk on portfolio management

- Portfolio strategies of laddering, barbells, riding the yield curve

- Day-to-day portfolio management techniques

- Evaluating investment portfolio performance

Fees:

- ICBA Members - $595 / session

- Nonmembers - $695 / session

- Members & Non-Members: Save $150/session for each additional registration from your bank.

|

|

|

|

Pioneer Bancorp, Inc. Announces Closing Of Mutual Holding Company

Reorganization & Stock Offering

Pioneer Bancorp, Inc. holding company for Pioneer Bank, has announced that it has closed its stock offering in connection with the completion of the reorganization of Pioneer Bank into the two-tier mutual holding company form of organization. "This reorganization is the result of many months of dedicated effort by the Pioneer Bank team and our partners, and we are all excited to celebrate this milestone together. Not only will Pioneer Bank raise additional capital with which to continue our growth and provide even greater value to our customers, we will also build on our commitment to the community through an additional contribution to the Pioneer Bank Charitable Foundation," said Pioneer Bank President and CEO Thomas Amell. Mr. Amell also serves as Chairman of the Independent Bankers Association of New York State (IBANYS). Pioneer Bancorp, Inc. holding company for Pioneer Bank, has announced that it has closed its stock offering in connection with the completion of the reorganization of Pioneer Bank into the two-tier mutual holding company form of organization. "This reorganization is the result of many months of dedicated effort by the Pioneer Bank team and our partners, and we are all excited to celebrate this milestone together. Not only will Pioneer Bank raise additional capital with which to continue our growth and provide even greater value to our customers, we will also build on our commitment to the community through an additional contribution to the Pioneer Bank Charitable Foundation," said Pioneer Bank President and CEO Thomas Amell. Mr. Amell also serves as Chairman of the Independent Bankers Association of New York State (IBANYS).

Shares of the Company's common stock began trading July 18, 2019 on the Nasdaq Capital Market under the trading symbol "PBFS." Pioneer Bank President and CEO Thomas Amell rang the Nasdaq Closing Bell in New York City.

__________________________________________

Community Bank System Completes Merger With Kinderhook Bank

Community Bank System, Inc. (parent company of Community Bank, N.A.) has completed its merger with Kinderhook Bank Corp. and its banking subsidiary, The National Union Bank of Kinderhook. Mark E. Tryniski, President & CEO of Community Bank System, commented: "We are pleased to welcome the customers and employees of Kinderhook Bank to Community Bank. Kinderhook Bank has an impressive 165-year history of service to its customers, its communities and its stockholders, and its values align closely with those of Community Bank. . .".

Community Bank System, Inc. operates more than 234 customer facilities across Upstate New York, Northeastern Pennsylvania, Vermont, and Western Massachusetts through its banking subsidiary, Community Bank, N.A. With assets of over $11.0 billion, the DeWitt, N.Y. headquartered company is among the country's 150 largest financial institutions.

__________________________________________

Keep The Door Open For Your Small Business Customers

Excelsior Growth Fund (EGF) is NYBDC's nonprofit Community Development Financial Institution and IBANYS' exclusive online lending partner. Join the growing number of banks that work with EGF to offer their customers an affordable and responsible option when they do not qualify for traditional financing. EGF offers loans up to $500,000 with a convenient, digital process. Loans under $100,000 are disbursed within 5 business days.

EGF's experienced team can work hand-in-hand with yours to develop a customized process to make referring seamless. To learn more about offering your customers a second look through EGF contact Bryan Doxford, SVP, at

[email protected] at at (212) 430-4512.

|

|

|

|

IBANYS Spotlight Is On...

|

S.R. Snodgrass, P.C. was built on a strong foundation of stability, integrity, and high-quality customer service. Since 1946, their independent accounting and consulting firm has assisted clients in their ever-changing world by taking a consultative approach.

As The Banking Experts, they serve approximately 160 financial institutions and are in banks daily. Their professionals provide vast expertise in the areas of auditing and assurance, internal audit and regulatory compliance outsourcing, information technology, consulting, enterprise risk management, and tax management.

For more information, contact:

Christina Lukas, Marketing & Communications Coordinator

Phone: (724) 934-0344

|

|

|

|

|

IBANYS identifies offers products and services that provide value to your banks, companies, employees communities. These brief summaries provide links for information. Please contact IBANYS President John Witkowski with questions.

Health & Wellness

My Wellness Resource & TELADOC

The health and wellness landscape continues to evolve. "My Wellness Resource" can be a nice addition to your existing benefit package.

Teladoc can save your banks time and money, and provide real value to your employees as this testimonial from a New York community bank CEO proves:

HERE'S WHAT YOUR FELLOW NEW YORK

COMMUNITY BANKER SAYS. . .

"I wanted to let you know that some of our employees and I have been using "Teladoc" and it is one of the best things we have done for the bank. We all love it: We are saving time, avoiding waiting in an urgent care center or a doctor's waiting room for non-emergency related illnesses

. . .and it is easy to use and convenient. Once you use it, you are hooked! This was a great find! Would recommend it to all banks."

Mario Martinez

Chairman & CEO

Catskill Hudson Bank

Contact Alan Justin: (716) 907-5500.

"Cure the Blue" Helps Banking Industry Battle Prostate Cancer!

The "Cure the Blue" program sponsored by the Buffalo Bills Alumni Foundation allows New Yorkers to participate in one of the most comprehensive efforts to help promote prostate cancer awareness and research in the United States.

Lake Shore Savings Bank has provided prostate cancer literature and Cure the Blue information at all eleven of its  branches and their headquarters in Dunkirk. The bank also offered Cure the Blue ceramic lapel ribbon pins for a $5.00 donations to Cure the Blue to all their customers. "We fully understand the severity of this disease and the devastating effect it can have on families" said Lake Shore Savings Bank President and CEO Dan Reininga. "Our support of the Buffalo Bills Alumni Foundation's "Cure the Blue" initiative is something that we are taking very seriously and are proud to support." Buffalo Bills Wall of Famer and Alumni Foundation President Booker Edgerson, a two time prostate cancer survivor, said the bank has been a tremendous longtime supporter, noting: "They have really stepped up to the plate with their unwavering support of our Cure the Blue initiative." branches and their headquarters in Dunkirk. The bank also offered Cure the Blue ceramic lapel ribbon pins for a $5.00 donations to Cure the Blue to all their customers. "We fully understand the severity of this disease and the devastating effect it can have on families" said Lake Shore Savings Bank President and CEO Dan Reininga. "Our support of the Buffalo Bills Alumni Foundation's "Cure the Blue" initiative is something that we are taking very seriously and are proud to support." Buffalo Bills Wall of Famer and Alumni Foundation President Booker Edgerson, a two time prostate cancer survivor, said the bank has been a tremendous longtime supporter, noting: "They have really stepped up to the plate with their unwavering support of our Cure the Blue initiative."

IBANYS urges all of our member banks, associate members and allies to join the effort. Cure the Blue" raises funds and awareness regarding prostate cancer in New York State. Visit

curetheblue.com

to get involved! Of all new cancer cases in the nation, prostate cancer represents 9.6%. In 2017, there were an estimated 161,000 new cases, and more than 26,000 fatalities due to the disease. Support IBANYS' "Cure the Blue" campaign to help New Yorkers participate to promote prostate cancer awareness and research.

Secure, Enhanced Internet Presence

The .bank program by fTLD operates trusted, verified, more secure, easily-identifiable internet locations for financial companies and

customers. www.icba.org

|

|

|

. . .That "The Thousand Islands" (where IBANYS' Bank Executive Symposium will be held in Clayton, New York September 9-11) consist of 1,864 islands straddling the Canada-US border in the Saint Lawrence River? The Canadian islands are in the province of Ontario and the U.S. islands in the state of New York. The islands range in size from over 40 square miles to smaller islands occupied by a single residence, or uninhabited outcroppings of rocks. To count as one of the Thousand Islands, emergent land within the river channel must have at least one square foot of land above water level year-round, and support at least two living trees. Prior to European colonization, the Thousand Islands region was home to, or visited by, members of the Iroquois Confederacy and Ojibwa people. Their name for the islands was "Manitouana" (Garden of the Great Spirit.)

|

|

|

|

New York community banks play a key role in our state and local economies. Help spread the good news among our customers, business, elected leaders and the media!

John J. Witkowski

President & Chief Executive Officer

Stephen W. Rice

Director of Government Relations & Communications

Linda Gregware

Director of Administration & Membership Services

William Y. Crowell III

Legislative Counsel

Natalie Rowan

Marketing & Social Media Assistant

|

|

|

|