|

Living Trust Seminar

|

|

For the public and also for our existing clients who want to bring family or friends!

Tuesday,

May 2

Torrance Marriott Hotel

9:30 - 11:30 am

3635 Fashion Way

Wednesday,

May 10

Torrance Marriott Hotel

9:30 - 11:30 am

990 W. 190th Street, Suite 500

Saturday,

May 20

Torrance Marriott Hotel

9:00 - 11:30 am

3635 Fashion Way

Tuesday,

May 23

Torrance Marriott Hotel

6:30 - 8:30 pm

3635 Fashion Way

|

|

Long-Term Nursing Care Planning

(Medi-Cal) Seminar

|

|

Tuesday,

May 16

Torrance Main Office

9:30 - 11:00 am

990 W. 190th St, #500

|

|

Office Locations

|

|

For your convenience, we have multiple office locations throughout Southern California.

Main Office:

990 W. 190th St.

Suite 500

Torrance, CA 90502

Other Local Offices:

790 E. Colorado Blvd.

9th Floor

Pasadena, CA 91101

5850 Canoga Ave.

4th Floor

Woodland Hills, CA 91367

333 City Drive West

17th Floor

Orange, CA 92868

5000 Birch St.

Suite 8000

Newport Beach, CA 92660

|

|

Contact Us

|

|

You may contact us to make an appointment for your initial consultation, to schedule a review of your current estate plan, or to make a referral.

1-800-756-5596

|

|

OUR WEBSITE

|

Learn more about Learn more about

important estate planning issues by visiting our website.

Also, visit our blog to

keep up on the latest

developments in

estate planning.

|

|

|

By

Attorney, Philip Kavesh

That headline may seem a bit over-the-top or even a little scary. But, like it or not, here are the facts.

If you're under 65, there's a four to five times greater chance you'll be disabled in the next 20 years - -

and unable to handle your own affairs - - than you'll pass away.

And, if you're over 65, there's a better than 70% chance you'll not only be disabled by accident or illness before you're gone, but that you'll require a minimum of 2 ½ to 5 years of long term care.

The reason for this increased likelihood of suffering a lengthy period of disability is simple - - modern

medicine! When I started out as an estate planning attorney some 39 years ago (how time does fly!), if a

client had a heart attack, a stroke, Alzheimer's, dementia, MS or other chronic illness, that person didn't

survive for more than a few weeks or months. Now, thanks to modern medicine, we see these same

patients live 5, 10, 15 years - - a considerable period of time when they can't handle their own financial

and medical decisions.

Unfortunately, this almost inevitable disability issue hasn't been adequately addressed by many estate

planners because it's relatively new (and few planners and their clients have yet to see or know of

many people go through an extended disability period, like we have at our firm).

When (not if) you are disabled, I'm sure you'll want the persons you've chosen to handle your financial

and health decisions to be able to act quickly and efficiently, in accordance with your wishes. So I've put

together the following short checklist of some of the key actions you can take NOW to prepare for your

disability:

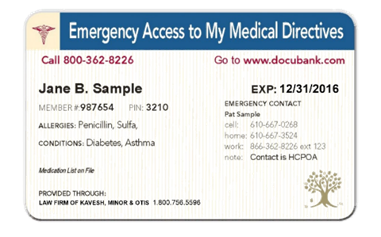

- Be sure you have (and, if necessary, have renewed) your Health Document Emergency Card!

This Card enables a hospital, doctor, or other health care provider immediate access to your

legal documents that are critical to enable your decision makers to act on your behalf (copies o

f your HIPPA Authorization & Advanced Health Care Directive are immediately sent to the

hospital, etc., electronically, 24/7). The card also contains limited space for you to identify your

health decision makers by name along with their contact information (they may not even know

you've been rushed to the hospital!). There's also room for you to disclose important

information regarding allergies (such as latex, sulfa, shellfish) and medications (such as blood

thinner).

Most of our clients received this card when you established or updated your Living Trust plan. If

you don't have it or if it has expired, you can purchase or renew it inexpensively through us

(we get you a special discount, so don't go directly to docubank.com).

Keep this card in your wallet, in front of your health insurance card (because that's where the

hospital will look first, when you're rushed there in an emergency!).

2. Tell your Successor Trustee, the financial decision maker under your Living Trust, where you keep your Owner's Manual (which all our clients receive).

It should be kept in your home some place where it's immediately accessible, not under lock and key. It contains a copy of all your estate plan's legal documents (your originals were separately given to you to keep in a safe place or safe deposit box). Don't give your Successor Trustee a copy of this Owner's Manual now, because you may change your documents later. They just need to know where to find it in an emergency.

3.

Complete (and periodically keep up to date) the "Contact List" and "Location List" found in your Owner's Manual. These provide immediate information that will be extremely useful to your Successor Trustee.

The Contact List lets them know the names and contact info for your alternate trustees, beneficiaries, family and friends you'd like contacted if something happens to you, as well as contact info for your key advisors, like your attorney, CPA or tax preparer, doctors, financial advisors, insurance agent, etc...

The Location List helps tell your Successor Trustee (including your spouse) where to find important papers quickly, like your bank and investment statements, deeds, insurance policies, past income tax returns, prepaid funeral arrangement, etc.

4.

Give your Successor Trustee a copy (or the original) of the Trustee Manual you may also have. all your estate plan's legal documents (your originals were separately given to you to keep in a safe place or safe deposit box). Don't give your Successor Trustee a copy of this Owner's Manual now, because you may change your documents later. They just need to know where to find it in an emergency.

This set of invaluable, easy to follow instructions and checklists for your Successor Trustee will save them a lot of anxiety, headaches, wasted time and even reduce their legal fees!

If you don't have this Trustee Manual, contact us about getting one.

5.

Establish a relationship with a Financial Advisor now, so you can "build a bridge" that will make it easier for your Successor Trustee (including your spouse) to step in and take over for you when you're disabled (or gone).

By working with a Financial Advisor now, who is familiar with your assets, cash flow needs, investment approach and tax situation, your Successor Trustee won't have to come in "cold" and waste a lot of time and energy to figure things out. Instead, your important financial matters can be immediately transitioned without "skipping a beat".

If you don't have a Financial Advisor, contact us and we can arrange a free initial consultation for you with one.

6.

Once you start feeling your competency slipping, contact us right away.

We can help you bring in your Successor Trustee right away to act as a Co-Trustee with you, before you become completely disabled. As a Co-Trustee, you will still retain a lot of control over decisions and can start to legally delegate certain tasks to your other Co-Trustee to make life easier on you, like paying your bills. This also makes it possible for your Successor Trustee to be up-to-date with your financial affairs before they later have to act alone; as your competency declines, you can choose to resign off as Co-Trustee and your Successor Trustee can take over completely.

If you are entering (or already in) a nursing care facility, we may also be able to do planning to obtain government benefits that can help pay your bills, if you contact us right away.

When you fail to contact us before you become completely disabled, then in order for your Successor Trustee to step in he or she will have to get letters from two doctors who examine you and confirm your incapacity, which can take time when important matters may need to be handled quickly. It may also be harder to obtain long term nursing care benefits once you're completely disabled.

There's More...

There's a lot more that goes into complete and proper disability planning, such as obtaining insurance coverage of your long term care costs, that are beyond the limited space available for this article. To learn more, attend one of our upcoming special client seminars especially on disability planning. [

Click Here to find out more information about our "PROTECT YOURSELF IN YOUR LATER YEARS" Seminar

]

|

|

|

Recipe of the Month

|

Grandma's Lemon Meringue Pie

8 servings, total cooking time: 1 hour & 20 minutes

Ingredients

- 1 cup white sugar

- 2 tablespoons all-purpose flour

-

3 tablespoons constarch

- 1/4 teaspoon salt

- 1 1/2 cups water

- 2 lemons, juiced and zested

- 2 tablespoons butter

- 4 egg yolks, beaten

- 1 (9 inch) pie crust, baked

- 4 egg whites

- 6 tablespoons white sugar

Directions

-

Preheat oven to 350 degrees F (175 degrees C).

- To Make Lemon Filling: In a medium saucepan, whisk together 1 cup sugar, flour, cornstarch, and salt. Stir in water, lemon juice and lemon zest. Cook over medium-high heat, stirring frequently, until mixture comes to a boil. Stir in butter. Place egg yolks in a small bowl and gradually whisk in 1/2 cup of hot sugar mixture. Whisk egg yolk mixture back into remaining sugar mixture. Bring to a boil and continue to cook while stirring constantly until thick. Remove from heat. Pour filling into baked pastry shell.

-

To Make Meringue: In a large glass or metal bowl, whip egg whites until foamy. Add sugar gradually, and continue to whip until stiff peaks form. Spread meringue over pie, sealing the edges at the crust.

-

Bake in preheated oven for 10 minutes, or until meringue is golden brown.

|

|

|

Here is a very special THANK YOU to all of our clients who have referred family and friends, or forwarded our newsletter to them! If you are part of a group or club and you would be interested in having us speak to the members on important estate planning topics of interest, please contact us at

[email protected]

.

|

|

Quote of the Month

|

|

I can't change the direction of the wind, but I can adjust my sails to always reach my destination.

I can't change the direction of the wind, but I can adjust my sails to always reach my destination.

Jimmy Dean

© 2017 The Law Firm of Kavesh, Minor & Otis, Inc.

|

|

| |

|