| Control Chatter July 2018

News that Control Professionals Need to Know |

|

|

*All New* Internal Control online courses

|

The ICI "Certification Series" has been completely updated and is available online to everyone around the world!

Course content prepares individuals to design and/or assess internal control and to assist management in installing internal control processes. In addition, the series prepares candidates for the Certified Internal Control Specialist (CICS) Examination.

To register for one or all of the online training programs click here:

Online course pricing has been reduced by over 70%, so get started today!

****Limited Time Only****

|

|

Test your Knowledge of Internal Control

|

*** Take the

Internal Control Knowledge Mini-Assessment ***

The Internal Control Institute has developed a CICS Common Body of Knowledge Mini-Assessment that helps an individual determine their knowledge as it relates to governance and control practices. Results point out areas of knowledge that may require additional training and experience. The assessment also provides a measurement to the individual's readiness for CICS certification. The assessment measures core knowledge in eight critical areas including: Internal Control - Principles, Terms and Concepts, Internal Control Environment, Risk Management, Assessing Application Controls, Business System Control Assessment, Risk Assessment, Internal Control Measurement and Reporting, and Governance Practices

|

|

|

|

|

|

A Different Kind of Fraud

By Michael Pregmon, Jr., Ph.D., CICP

|

|

|

|

Dr. Michael Pregmon, Jr.

COO and Managing Director

|

|

We have discussed fraud in this space in previous articles. Typically, fraud in business is committed when an employee - often a trusted one - is involved. This type of fraud is common in small to medium organizations. Usually there is a lack of installed internal controls because the company owner feels these are not needed. This very often occurs in medical/dental offices or in companies with absent owners.

A second type of fraud results predominately from the internet's availability and personal greed. These instances occur almost daily, where people are promised a large sum of money in exchange for personal information. At the Institute, we suspect that anyone who has an E-mail address has received at least one of these messages. Unfortunately, some people fall prey to these unethical tactics.

But a third type of fraud occurs with upstart companies. This is not uncommon in instances where the company owner lacks the technical expertise of the business. A knowledgeable expert in the field is hired to provide that expertise. In these cases, the owner must be close at hand and involved in all business activities. But most important the owner must ensure the integrity of the "chief technical expert." In many respects this is like the example above where the main operation of a business is left to others.

J.P. Donlon, Editor of Chief Executive Magazine in July 2018 underscored this in his article entitled "When Entrepreneurs Are Devastated By Fraud." This becomes a significant tragedy for the entrepreneurial business owner. We suggest our readers review the remainder of this newsletter but be certain to come back and click on this link to read how this occurs:

In these cases, the entrepreneur must, at all costs, ensure the integrity of those individuals making key decisions for the company. But then, installing effective internal controls is a must.

|

|

ICI ANNOUNCEMENTS

|

|

PARTNERS WANTED:

HELP US IMPROVE INTERNAL CONTROL SYSTEMS WORLDWIDE

The Internal Control Institute™ (ICI) improves organizational Internal Control worldwide by providing training, products and services and individual Professional Certifications recognized internationally. The Institute's Board of Advisors has determined it would like to further expand into areas where it is not directly represented. ICI provides world-class programs and its intellectual property to affiliates free of charge and shares all program revenue with them. If your organization is interested in partnering with ICI to earn revenue while you contribute to the development of the internal control profession worldwide please contact Dr. Michael Pregmon, Jr., Chief Operations Officer, by email at:

[email protected] or by phone at

727-538-4113

in the USA.

ICI Affiliate News:

The Internal Control Institute is conducting certification training in a classroom format for the internationally recognized CICS (Certified Internal Control Specialist) certification in internal control. Information on these programs regarding dates and schedules can be found on the Events tab on our Website or directed to the affiliate named below.

Training Plans :

Belem - August 6-10

Belo Horizonte - August 27-31, 2018

São Paulo - September 17-21, 2018

Fortaleza - September 24-28, 2018

Rio de Janeiro - October 1-5, 2018

Brasília - November 5-9, 2018

Curitiba - November 19-23, 2018

For more details on planned training please check on the website below, or send a message to Mr. Eduardo Person Pardini

.

China:

Training Plans:

Hangzhou - August 16-19, 2018

Shanghai - August 23-26, 2018

Beijing - September 12-15, 2018

Individuals or companies interested in internal control training and Certification should contact:

Mr. Qiu Jianting

CCSIT

Room 1039, Block A, Jinmao Building, No. 18, Xizhimenwai Street,

Xicheng District, Beijing, China

Zip Code: 100044

Mobile phone:

13810588109

Europe:

Training Plans :

Brussels - September 28, 2018

Luxembourg - October 24, 2018

ICIB president Yves Dupont presented his association and their development in the area of Control Self-Assessment at the FERMA Forum (European Risk Managers association) in Monte-Carlo. He hereby highlighted the complementarity between risk management and internal control, insisting on the role of first line operational management. For more information: http://www.icib.org/other-events.ws

For more information on scheduled training and exams please contact Mr.Yves Dupont of ICI Belgium at:

India

For more information on upcoming activities in this area please contact Mr. Summit Goyal of

ICI India at :

ICI is proud to announce it has entered into an agreement with Better Business Governance - APAC PTE LTD (BBG) as its representative for Products, Services and Internal Control Certifications (CICS/CICP) in Myanmar and Cambodia.

Better Business Governance will be responsible for all development activities, including professional training and Certification. For more information on upcoming activities in this area please contact:

Better Business Governance

Mr. Sanjeev Gathani

1 Claymore Drive

#08-14, Orchard Towers (Rear Block)

Singapore 229594

Mexico:

For more information on upcoming activities in this area please contact the following:

Middle East:

|

|

|

CICS preparation program Amman-Jordan July 22-30, 2018

|

|

The CICS exam is now being

provided in Arabic.

Osool Training and Consulting has courses and testing available in Jordan, Libya, Muscat, Sudan, Qatar, the United Arab Emirates, Kuwait and Palestine.

Training Plan 2018

Certification Preparation Programs are scheduled as follows:

Certified Internal Control Specialist (CICS) Amman-Jordan October 7-16

Certified Internal Control Specialist (CICS) Amman-Jordan October 22-30

Certified Internal Control Specialist (CICS) Tunis-Tunisia October 6-11

Certified Internal Control Specialist (CICS)

Riyadh-Saudi Arabia

November

18-22

Certified Internal Control Specialist (CICS)

Dubai-UAE

November

18-22

Certified Internal Control Specialist (CICS)

Kuwait-Kuwait

November

25-29

Certified Internal Control Specialist (CICS)

Doha-Qatar December 2-6

Certified Internal Control Specialist (CICS)

Dubai-UAE

December

23-27

Interested applicants in that region should contact Osool for scheduling for future programs.

For additional information on scheduled ICI Certification and program sessions, please contact:

Lina Salameh

Assistant General Manager

O

SOOL

for Training & Consulting

Mob Oman: +968 95 98 98 20

Mob Jordan: +962 7 99589666

Tel: +962 6 5927171 Ext. 107

Fax: +962 6 5927172

Nigeria:

Leadway Consulting conducts CICS training sessions and examinations in Nigeria.

For more information on upcoming activities in Nigeria please contact:

Pakistan:

For more information on activities in Pakistan individuals or companies should contact : Muhammad Farooq Hammodi

E-Mail:

nardac_k@yahoo.com

Singapore, Malaysia, Indonesia and Taiwan:

ICI has entered into an agreement with GRC Consultancy Pte Ltd. (ICI Singapore, Malaysia, Indonesia and Taiwan) as its representative for Products, Services and Internal Control Certifications (CICS/CICP) in those territories.

Individuals or companies interested in internal control training or Certification should contact:

Turkey:

Training Plans:

September 22-23, 2018

For information on scheduled ICI Certification and program sessions, please contact ICI Turkey

below:

GOP Mahallesi, İran Caddesi, Karum İs Merkezi

No:21, D Blok, 4. Kat, D:398-399

06700

Kavaklıdere/Çankaya/Ankara

+90 (312) 4425015 T

+90 (533) 4474444 D

CICS examinations to be held in Vietnam:

September 2018

December 2018

For more information on upcoming activities in Vietnam please contact: NGUYEN THANH TUNG (MBA. M.Eng, PhD.) Director, FMIT Institute of Financial Management & Information Technology,

Level 5

, 126 Nguyen Thi Minh Khai Street, Ward 6, District 3, HCMC, Viet Nam

Office: 848 3803 5020 - 848 3512 9371 - 848 3512 7652

Zimbabwe:

Internal Control Institute Zimbabwe has been conducting in house Certified Internal Control Specialist (CICS) training. One company has given three groups to be trained in house for a total of 35 individuals.

For more information on activities being planned please contact:

|

|

Internal Control Chatter

|

|

Each month the staff of The Internal Control Institute reviews hundreds of articles related to Internal Control and Corporate Governance. Here are brief summaries of some of the top articles (along with links to the original article) that may be of interest to you.

|

|

What's your fraud IQ?

By Ron Cresswell, J.D., and Andi McNeal, CPA

journalofaccountancy.com

July 1, 2018

|

CPAs often collect, view, and store sensitive personal information about their clients and other individuals. Unlike many countries, the United States has no generally applicable federal law that protects this type of data, which is sometimes called personally identifiable information. Other countries have strict data protection laws that govern the collection, handling, and storage of personal information, and the European Union's new General Data Protection Regulation, which went into effect May 25, imposes enhanced data privacy measures on all companies that use personal data of people in EU countries, even if those companies don't have an office in the EU.

These laws can apply anytime a CPA handles the personal information of citizens of such countries. Legal duties aside, personal information should be protected because it is a common target of identity thieves and other fraudsters. Are you familiar with the best practices for protecting personal information?

|

|

PwC must pay FDIC $625M for failing to uncover fraud scheme

By Reuters

nypost.com

July 2, 2018

|

A federal judge on Monday said PricewaterhouseCoopers must pay the Federal Deposit Insurance Corp. $625.3 million in damages for failing to uncover a fraud scheme between its client Colonial Bank and the mortgage lender Taylor, Bean & Whitaker.

US District Judge Barbara Rothstein ruled

after a non-jury trial on damages held in March

. She had ruled in December that PwC was liable, without setting damages.

Colonial and Taylor Bean both failed in August 2009.

Colonial, based in Montgomery, Ala., had been among the 25 largest US banks, while Ocala, Fla.-based Taylor Bean was the nation's 12th-largest mortgage lender.

|

|

GAO issues revised Yellow Book standards for government auditors

By Ken Tysiac

journalofaccountancy.com

July 17, 2018 |

Revised standards issued Tuesday by the U.S. Government Accountability Office (GAO) are designed to provide a framework for high-quality governmental audits, which include audits of government entities and entities receiving government awards.

In a transmittal letter to the standards, U.S. Comptroller Gene Dodaro states that the new

generally accepted government auditing standards

(GAGAS) reinforce the principles of transparency and accountability for auditors as they provide objective analysis and information in service to the public.

Also known as the "Yellow Book," the revision supersedes the 2011 revision of the standards.

|

|

Internal Controls, Anti-Fraud Strategies for Companies in India

by Rohini Singh

india-briefing.com

|

India is among the world's fastest growing emerging markets, aided by liberal foreign investment policies and an expanding consumer base.

This has catapulted the number of market players - foreign and domestic - and led to high levels of competition in each industry, often exposing firms to the threat of fraud and other risks.

A recent industry survey showed that in 2017, 89 percent of the companies based in India were victims of at least one instance of fraud; 33 percent of them suffered revenue losses of more than seven percent due to this.

Foreign investors expanding to the Indian market therefore need to prioritize conducting due diligence when entering into partnerships and contracts with firms and vendors in India...

To reduce their risk exposure,companies must put in place clear

internal control mechanisms

that can prevent, detect, and deter fraudulent behavior conducted by employees,

vendors

, consultants, or various levels of management.

|

|

The board's role in promoting an ethical culture

By Sabine Vollmer

journalofaccountancy.com

July 1, 2018

|

Research over the past 20 years has continued to underscore that integrity drives performance. Corporate culture and tone at the top are considered key drivers of ethical behavior, but boards of directors often devote little time to the

topic.

Board members generally recognize their responsibility to oversee ethics and compliance, said Pat Harned, CEO of the Ethics and Compliance Initiative, a U.S. think tank. What they struggle with, she said, "[is] to know what questions to ask and what information to look for. I don't think directors are particularly

well

-

versed

in recognizing red flags."

|

|

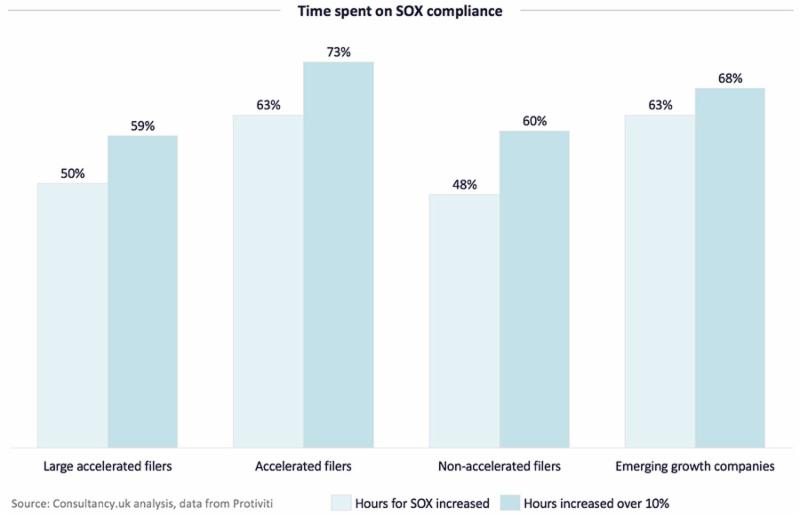

Workload needed for Sarbanes-Oxley (SOX) compliance continues to rise

by Consultancy.uk

consultancy.uk

19 July 2017

|

It has been fifteen years since Sarbanes-Oxley (SOX) became a law. New research from Protiviti finds that time devoted to SOX compliance activities increased for a majority of organisations, and for two out of three of these companies, hours increased markedly underscoring that compliance remains a key focus area of operations. The study, conducted by the global consulting firm among over 450 chief audit executives, and internal audit/finance leaders and professionals in US listed public companies, explores the impact of SOX on businesses and how they are dealing with the law in terms of regulatory compliance. The law, also known as the 'Corporate and Auditing Accountability, Responsibility, and Transparency Act', was accepted in 2002 as a federal law, and set stricter compliance requirements for all US public company boards, management and public accounting firms. SOX - which is relevant for US companies operating across the globe - also includes a number of provisions that apply to privately held companies. SOX's main elements focus on improved financial reporting, management governance, accountability, and auditor independence. The key takeaway from the study is that hours required for SOX compliance continue to go up. Time devoted to SOX compliance activities increased for a majority of organisations, across all filer types. It has been fifteen years since Sarbanes-Oxley (SOX) became a law. New research from Protiviti finds that time devoted to SOX compliance activities increased for a majority of organisations, and for two out of three of these companies, hours increased markedly underscoring that compliance remains a key focus area of operations. The study, conducted by the global consulting firm among over 450 chief audit executives, and internal audit/finance leaders and professionals in US listed public companies, explores the impact of SOX on businesses and how they are dealing with the law in terms of regulatory compliance. The law, also known as the 'Corporate and Auditing Accountability, Responsibility, and Transparency Act', was accepted in 2002 as a federal law, and set stricter compliance requirements for all US public company boards, management and public accounting firms. SOX - which is relevant for US companies operating across the globe - also includes a number of provisions that apply to privately held companies. SOX's main elements focus on improved financial reporting, management governance, accountability, and auditor independence. The key takeaway from the study is that hours required for SOX compliance continue to go up. Time devoted to SOX compliance activities increased for a majority of organisations, across all filer types.

|

Bosses face clampdown on share sales after Carillion collapse

By Mark Kleinman

news.sky.com

Saturday 14 July 2018

|

The bosses of Britain's biggest public companies could be forced to hold onto shares for years after they retire under new corporate governance rules to be unveiled next week.

Sky News has learnt that executives will face a ban on the sale of shares awarded under long-term incentive plans for up to five years as part of a clampdown aimed at rebuilding public trust in business.

Sources said that the Financial Reporting Council's (FRC) revamped Corporate Governance Code would impose a new provision for remuneration committees to consider whether executives should be required to continue to hold shares for a period after their employment ends.

That would represent a departure from current policy, and will be seen as a response to public and political anger over the conduct of directors of Carillion, the construction giant which went bust in January.

It emerged weeks later that Richard Adam, Carillion's former finance director, had sold £800,000 of shares soon after retiring from its board.

|

|

Why financial reporting is essential

July 24,2018

|

Nigerian Stock Exchange (NSE) Executive Director, Regulations Ms Tinuade Awe has emphasised the importance of financial reporting saying it is very important because people can rely on the statements to take serious decisions.

Awe shared her perspective on the quality of financial reporting in a recent forum on corporate governance in Lagos. She said people use those statements to move from one point to another, and if the quality is poor it will lead to decisions taken from faulty information.

The Executive Director stated that Directors are responsible for driving corporate governance code in companies, guided by the provisions of the Company and Allied Matters Act (CAMA) and the Investments and Securities Act.

|

|

Control Quotes

|

"Leadership is a matter of having people look at you and gain confidence, seeing how you react. If you're in control, they're in control."

Tom Landry

|

Help Keep Everyone Informed...

|

| If you see a news story concerning internal control or corporate governance that you feel is important for other professionals to know please send it to us . |

| ABOUT ICI |

The Internal Control Institute™ (ICI) is a worldwide organization devoted exclusively to internal control and corporate governance. The Institute is dedicated to the development of world-class educational programs and best practice guidelines on internal control and corporate governance, based on the Sarbanes-Oxley Act and the COSO internal control framework. Visit us on the web at the Internal Control Institute

The Internal Control Institute™ (ICI) is a worldwide organization devoted exclusively to internal control and corporate governance. The Institute is dedicated to the development of world-class educational programs and best practice guidelines on internal control and corporate governance, based on the Sarbanes-Oxley Act and the COSO internal control framework. Visit us on the web at the Internal Control Institute

|

|

| Control Chatter is a monthly news summary of the top stories concerning internal control and corporate governance. Control Chatter is prepared by the staff of Internal Control Institute for the benefit of their members and associates. Please consider it for your personal use or pass it on to associates who may have an interest in one or more of the topics by clicking on the Forward email button below. |

|

| |

|