New Report on Status of Economic and Personal Finance Education in PA Released

|

Professional Resource

|

|

The Pennsylvania Department of Education and Pennsylvania Department of Banking and Securities have issued the second report to the state legislature on the status of economic and personal finance education in Pennsylvania. You can view the full report here.

The report provides insight into what schools are doing and makes recommendations for improving financial and economic education going forward. Among the key takeaways are:

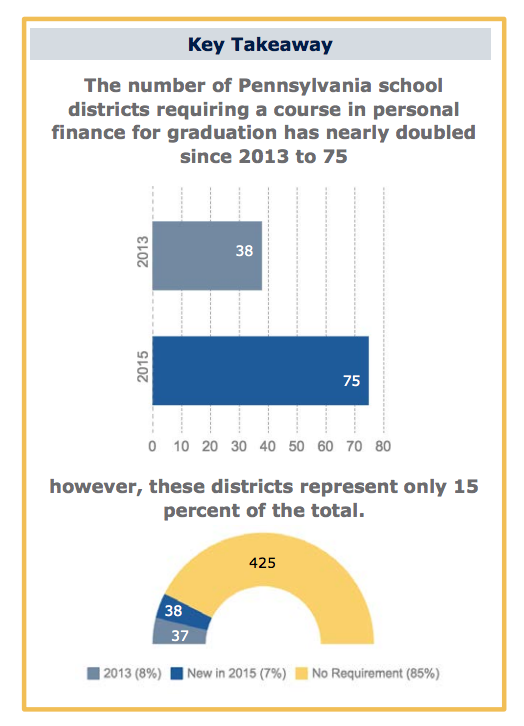

- Nearly twice as many Pennsylvania school districts now require a personal finance course for high school graduation.

- Schools have increased the variety of methods used to teach personal finance concepts.

- High-quality, free and low-cost teaching tools are widely available in new formats.

- Even with such significant growth, only 15 percent of the commonwealth's districts have a personal finance graduation requirement.

Data collection for the next report is underway now. To share information about what your school is doing in regards to personal finance or economic education, please contact Hilary Hunt, director of the Making Cents Project, at [email protected].

|

|

|

Right About Money: Ideas that Power Financial Literacy Right About Money: Ideas that Power Financial Literacy

|

Professional Information

|

Would you like to stay current on financial education news and events - more so than is offered through the Making Cents PA project?

Right About Money: Ideas that Power Financial Literacy is a free email report that is sent most weekdays on topics related to financial education. It is a tremendous resource for educators and any others interested in staying abreast of trends in financial education. Dan Kadlec, the founder, is a long-time journalist whose columns on personal finance have run regularly in Time magazine, Money magazine, and USA Today for 30 years.

Recent headlines include:

|

|

|

March 28th Making Cents Webinars to Feature State and National Experts March 28th Making Cents Webinars to Feature State and National Experts

|

Professional Development

|

Have you ever joined a

Making Cents Webinar for Pennsylvania Teachers? If not, you are missing out! These free, 90-minute professional development opportunities offer information on financial topics, resources for teaching personal finance topics to students, and professional information for teachers.

The last ones for this school year will be offered Tuesday, March 28th and feature nationally recognized experts in their fields. Make sure you

register today to secure your spot! Sessions are offered at 3:00 pm and 6:30 pm.

Topics and speakers include:

- Crowdfunding: What It Is and What to Look Out For presented by Daniel Lee of the Securities and Exchange Commission

- Adapting Financial Education Lessons for Students with Disabilities presented by Susan Tachau of the Pennsylvania Assistive Technologies Foundation and Hilary Hunt of the Making Cents Project

- Right About Money: Ideas that Power Financial Literacy presented by Dan Kadlec of Right About Money

|

|

|

Paper or Plastic? Paper or Plastic?

|

Professional Information

|

How do you pay for purchases? Paper or plastic? When it comes to spending money we have many ways to do so. The basic medium of exchange, paper money, has been around for hundreds of years and is understood by kids to adults. Paper money is the least common denominator and usually requires very little training by users to pay for goods and services.

Fast forward to 2017 and we not only have paper money but plastic in for the form of debit cards, and credit cards. When you pull out a plastic card at the checkout counter you are likely asked, "Debit or credit?" How you respond depends on personal preference for the payment method that suits your habits and way of managing. Each method of plastic payment has pros and cons and are summarized below. What works for one person may not work for another. Whatever your preference, be sure to understand the details of each so you can maximize the benefit for your bottom line.

Credit Card Pros

- Allow you to use of other people's money temporarily.

- Builds a credit history when used responsibly. A favorable credit history is the key to getting loans with low interest rates.

- Each transaction appears on your credit card statement.

- Liability for fraudulent charges is limited to $50 per card or zero if a lost card is reported before used.

- Depending on the card, you could earn rewards such as a percentage cash back for the total spent (1%, 2%) or points for travel or products.

- Buys you time or a little float if you are short on cash but will have the money needed by the time your bill payment date arrives.

- Can be used for on-line purchases.

- Accepted worldwide.

- May or may not have a foreign transaction fee when used outside of the country.

- Some cards feature an estimate of your credit score as a feature or a yearly summary of charges by major budget categories.

- Safer than carrying large sums of cash.

- Makes handling emergencies easier if you can pay the bill in full the next billing cycle or within a few months of making an unexpected charge.

Credit Card Cons

- Interest charges will add to the cost of goods and services purchased if you do not pay monthly balances in full.

- Research shows that credit card users spend more because they are not held to sticking to a budget as they would if cash were being used for same purchases.

- Unexpected fees if you do not read the fine print.

Debit Card Pros

- Each transaction appears on your monthly bank statement.

- Use of non-network ATMs can cost an additional fee for you to use.

- Faster than writing a paper check at checkout counters.

- Spending is limited to what is in your account unless you have overdraft protection linked to a savings account that transfers in additional funds as needed.

- Can be used for on-line purchases.

- Accepted worldwide but have fees related to each transaction, especially cash withdrawals in local currency.

- Safer than carrying large sums of cash.

Debit Card Cons

- Liability varies for fraudulent use. Unauthorized use reported within) two days of misuse is limited to $50, b) 60 days is limited to $500, c) 61 days or more is unlimited. Thus, your checking account could be cleaned out before you notice it if you do not monitor your account closely.

- Use does not help you build a credit history.

- Requires you to remember a PIN.

|

Tips for Using Credit and Debit Cards

- Check monthly statements for accuracy of transactions.

- Know the key features of your card.

- Review yearly statement that announce any card changes, especially fees

- Know your credit limit and keep use to 30% or less of the credit limit for each card. This is also credit utilization and helps you maintain a favorable credit score. For example, if your card has a credit limit of $1000, keep the maximum charges to $300 per billing cycle.

|

|

Federal Reserve Bank of Philadelphia Professional Development Opportunities

|

Professional

Development

|

Looking for high-quality, lost-cost professional development opportunities this spring or summer? The Federal Reserve Bank of Philadelphia is offering a variety of programs for teachers at different grade levels.

|

Dates

|

Program

|

|

March 22 & 29

|

Human Behavior and Our Economy

|

|

April 5

|

Financial Fables for

the Elementary Classroom

|

|

April 12, 20, & 26

|

Personal Finance fo

r the Middle School Classroom II

|

|

July 10-14

|

Keys to Financial

Success Training

|

|

July 24-28

|

Making Cents of Money and Banking

|

Visit their website for more information:

|

|

|

|

|

Professional

Development

|

Harrisburg University offers a free monthly discussion examining financial literacy that is open to the community. On April 19th the discussion will focus on Financial Education in Pennsylvania-Past, Present and Future, featuring financial literacy expert Hilary Hunt. Scheduled for 11:30 a.m. to 1 p.m., this talk is part of the Financial Literacy Education Series at HU organized by Dr. Jay Liebowitz, Distinguished Chair of Applied Business and Finance at Harrisburg University.

How is financial education taught in elementary and secondary schools across Pennsylvania? Which schools require a course in personal finance for graduation? What can be done to increase the quality and quantity of financial education in Pennsylvania schools? These questions and more will be addressed in this lecture by Ms. Hunt. Her lecture will feature information on trends in financial education in Pennsylvania over the past two decades as well as steps those interested in promoting financial education can take within their own communities.

|

|

|

Have you missed a message from us in the past? Get caught up! Visit our archive of previous Making Cents eBlasts

here.

|

|

Making Cents is a cooperative effort by the Pennsylvania Department of Education and the Pennsylvania State University. If you find the content useful, please consider forwarding it to your colleagues.

Team Members: Sally Flaherty, PDE Cathy F. Bowen, PSU Hilary Hunt, The Making Cents Project |

|