|

In This Issue:

- Market Update: Harvest Gaining Strength, Market in Turmoil

- Washington, D.C. Update

- Endigo ZC Approved for Rice Stink Bug Control in Arkansas

- Mexico Update: Long Range Consumption Outlook, Short Term Efforts to Lower the Cost of Food

| |

Rice in Missouri is starting to head out. Farmers are cautiously optimistic for good field and milling yields. This picture, taken this week by USRPA Chairman Alex Clark on his farm near Poplar Bluff, MO is from a field of RiceTec 7321. Note the presence of stink bugs that had Alex preparing to spray “Karate,” a generic Lambda-cyhalothrin. | |

Market Update: Harvest Gaining Strength, Market in Turmoil | |

The USDA reported earlier this week that Texas was 68% headed, which is a little behind schedule. Still, some growers are already tuning up and even running their harvesters. Rice headed is on pace with historical averages for Louisiana, Missouri, and Mississippi, but it’s considerably off in Arkansas where only 19% of the crop has headed. Conversely, in California the early planted rice crop is already 40% headed compared to the norm of 24% for this point and time.

While it is too early into the harvest along the Gulf Coast, first reports are indicating good yields of 42 to 63 barrels per acre. Quality is unknown but what few samples have been graded have resulted in a 55% or better milling yield. No one in any area of the rice growing region has escaped weather and water problems. Bottom line is until this crop is cut, dried, and stored, the real impact on the market is unknown.

The Iraqi sale reported a couple of weeks ago continues to be a dominate factor in the long grain industry. At first, many thought it would be filled with old crop; however, that thought seems to have shifted as most claim it will be new crop now. This may not be fully ironed out for a couple more weeks. It is understood that half the 40,000 MT sale will be serviced by the larger Arkansas rice mills while the other half will be milled, bagged, and delivered to the shipyard via smaller mills.

| While the U.S. milled rice business to Iraq reportedly out of Arkansas is certainly good news, the announcement of rough rice sales of new crop out of southwest Louisiana and east Texas totaling 50,000 tons by the South Louisiana Rail Facility is welcome news for the region’s farmers. Removing early harvest storage pressure supports local price. | |

Approximately 92% of the U.S. rice crop is within an area experiencing drought. This is less than ideal for an origin that is already battling high prices. Between inflated input costs, drought, and a strong U.S. Dollar, U.S. rice export prices have become dislocated from the rest of the world. In addition to higher production costs, the industry will also face higher trucking, drying, and storing costs. Natural gas prices ebbed lower last month only to rebound on pipeline maintenance and turmoil in Ukraine this month.

As a result of these hurdles, Uruguay’s market share in Mexico has risen from 5% in 2020 to 15% in 2022; in Costa Rica, Uruguay is on pace to capture 22% of the market in 2022. Brazil also remains a threat to traditional U.S. markets which is perhaps best seen in Mexico as well, where 54,000 MT of milled rice has already been sold during this calendar year. To the disappointment of Central American rice millers and U.S. paddy exporters, the amount of milled rice imports are surging in these markets. This is exactly what the USRPA was concerned of when CAFTA-DR approached its maturity in a market where the U.S. once had 99% marketshare. Unfortunately the entire U.S. rice industry did not agree. When Brazil’s milled rice prices are being quoted around $570 FOB versus U.S. long grain at $710, it’s not difficult to see why this pattern is forming.

Meanwhile, Asian rice may not be far off from moving west with India 5% brokens trading at $355 FOB. Thailand, currently the most expensive origin in the Far East, is only quoting Thai 5% at $400 FOB. The ongoing container and shipping debacle which was truly exacerbated by COVID-19 in early 2020 has yet to be fleshed out. While this has certainly impeded U.S. rice exports, it has also worked to prevent the infiltration of Asian rice into western markets.

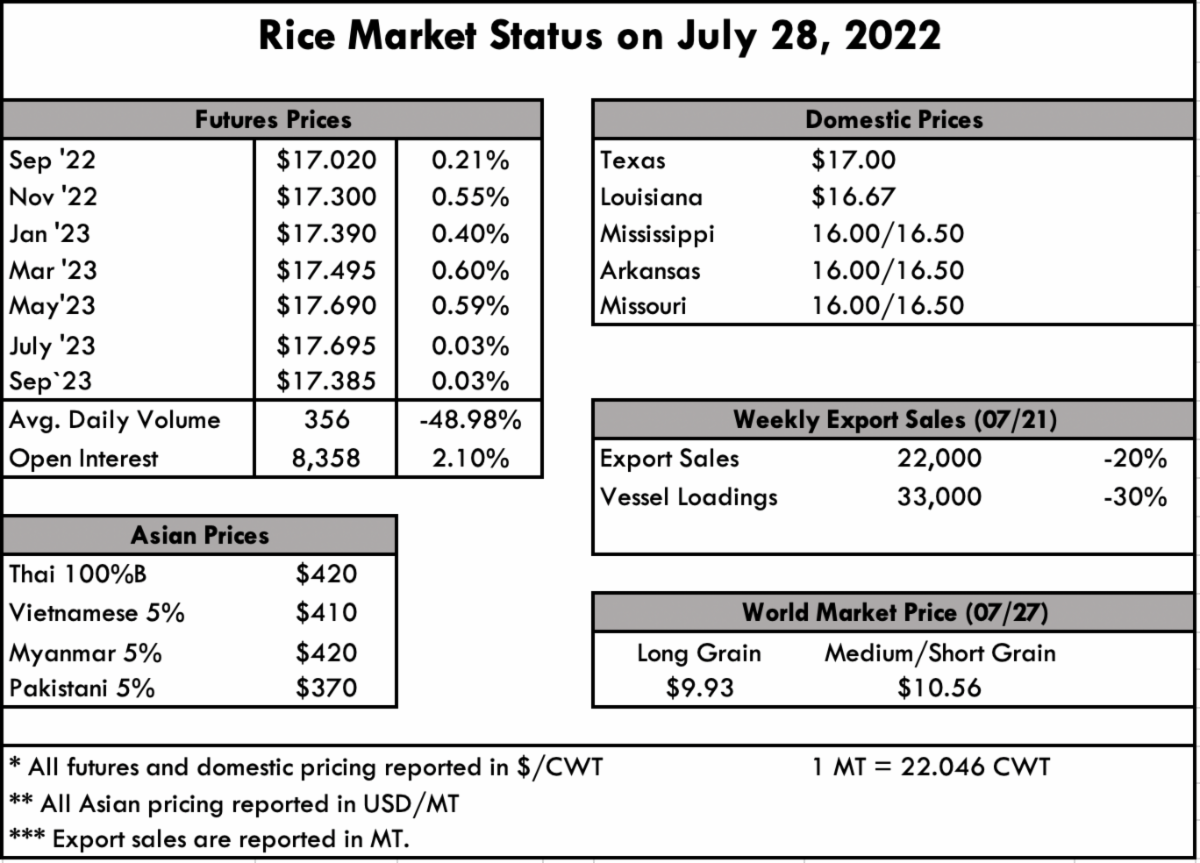

The futures market, as expected, edged higher again this week, touching a nearby high of $17.19 per cwt. Although the market gave back some of its gains, it still ended the week well.

|  | |

|

Last week, USRPA visited with Congressional offices alongside other members of the U.S. Agriculture Coalition for Cuba (USACC). USACC scheduled and arranged meetings with House and Senate staff to discuss the positive impact that opening the Cuban market would have on Domestic producers. USRPA joined representatives from the American Soybean Association, CoBank, the International Dairy Foods Association, the National Association of Beverage Importers, the National Association of Wheat Growers, the U.S. Dairy Export Council, and the USA Rice Federation to discuss potential legislation to reduce trade barriers with Cuba and consider strategy for future legislation. Currently, Cuba imports $250 million of rice each year, primarily from Vietnam and Brazil.

On July 27, Senate Majority Leader Chuck Schumer announced an agreement with Sen. Joe Manchin on H. R. 5376 “Inflation Reduction Act of 2022”. The bill is associated with President Biden’s “Build Back Better” reconciliation framework. The bill would provide $369 billion in climate-related provisions, including $1 billion for conservation technical assistance and $300 million to USDA's Natural Resources Conservation Service to measure the impact of agricultural practices on greenhouse gas emissions. It also included $19.9 billion for Title II Farm Bill programs: Environmental Quality Incentives Program, Regional Conservation Partnership Program, Conservation Stewardship Program, and Agricultural Conservation Easement Program. Additionally, the bill would provide $500 million for biofuel infrastructure, fund the Rural Energy for America Program and rural electric co-ops, provide $9.7 billion for electric co-ops to use for carbon-capture projects, extend the tax credit for biodiesel through 2024, and creates a new "clean fuels" tax credit for low-carbon biofuels. Cut from deal was a provision that would have provided payments of $25 an acre to farmers that plant cover crops through the Environmental Quality Incentives Program. The bill can be found here.

On July 28, the Senate Committee on Finance convened a hearing to consider the nomination of Douglas J. McKalip to be Chief Agricultural Negotiator, with the rank of Ambassador, at the Office of the United States Trade Representative. Senators from both parties voiced approval of Mr. McKalip and agreed that U.S. trade policy must focus on increasing market access and enforcing trade agreements already in place. Democrats voiced approval of the Biden Administration’s overall trade policy and efforts to open new market. Republicans criticized the Administration on its overall handling of trade agreements and frameworks as well as the timeline of President Biden’s nomination of Mr. McKalip. Other issues discussed included enforcement of USMCA for Mexico and Canada, enforcement of the Indo-Pacific Economic Framework, and the impact of agricultural imports on domestic farmers and producers.

This week, the Senate released its appropriations bills for fiscal year 2023. Total funding across these bills was $1.7 trillion, including $27.02 billion in discretionary funding for USDA and the Food and Drug Administration, $2.3 billion more than what was enacted for fiscal year 2022. The House passed a six-bill package containing the agriculture appropriations bill earlier this month. The Senate bill can be found here.

| |

Endigo ZC Approved for Rice Stink Bug Control in Arkansas

A Section 18 Emergency Exemption for the use of Endigo ZC for control of rice stink bug in rice has been authorized for the 2022 growing season.

Read full details on the University of Arkansas Row Crops Blog:

| | |

Mexico Update: Long Range Consumption Outlook, Short Term Efforts to Lower the Cost of Food | by Raul Caballero, USRPA Representative in Mexico | |

Greetings from Mexico! Did you know?

According to the Mexican Department of Agriculture’s 2017-2030 National Agricultural Plan, rice is considered as one of the most important basic foods in the Sustainable Rural Development Law, due to its relevance in the Mexican diet, with a per capita consumption estimated at 8.8 kilos per year. It is the second crop representing the highest food money expenditure for Mexican families. In the same report, it was estimated that consumption will increase 16.5%, passing from 1.17 million MT in 2017 to 1.37 million MT per year by 2030. Production is expected to increase 12.55%, passing from 250,000 MT in 2017 to 290,000 MT in 2030.

In the beginning of 2022, rice from countries outside the USMCA (United States-Mexico-Canada Agreement) were subject to duties of up to 28%. However, in the first week of May, Mexican President AMLO announced several measures to lower the cost of food and agricultural inputs and to produce more basic grains this Spring-Summer season, after inflation reached its highest since 2001 at 7.72% in the first half of April, and the price of the basic food basket increased 29%. The plan includes:

-

Temporary import duties exemption of basic grains for one year (May 2022 – May 2023), from countries outside the USMCA, including corn, dry beans, rice, milk and other basic food and raw materials including corn flour, wheat flour, white corn, sorghum and wheat. Other duties of agricultural inputs will also be temporarily suspended, such as fertilizers, including the ammonium sulfate compensatory duties. Duties exempted, will range, for example, from 10% to 45% for beans outside USMCA, and 75% for pork meat, accumulating close to US$8 billion in exemptions.

-

Basic food price negotiations with retailers, grocers, and wholesalers, who committed to not increase prices of 24 basic products for the next six months, despite the increased inflation. These products include: dry beans, rice, white eggs, corn tortillas, milk, canola oil, sugar, canned tuna, canned sardines, beef, pork chops, whole chicken, onions, jalapeno peppers, tomatoes, potatoes, carrots, lime, apples, oranges, pasta for soup, boxed bread, and toilet paper. Some of the retailers in the program are: Walmart, Soriana, Chedraui, Casa Ley, LaComer, Marza, Super del Norte and H-E-B. Wholesalers include: Ragasa, Schettino Hermanos, and Grupo Porres. Food Processors include: La Moderna, SuKarne, Pilgrims, Bachoco, Lala, Alpura, Maseca, Bimbo, and Kimberly-Clark.

| | |

|  |

Food and Ag Regulatory and Policy Roundup | | |

|

Argentina: Grain & Feed Update

Rice exports in MY 2022-2023 are forecast at 350,000 tons, 9 percent higher than USDA. The main markets are forecast to be Brazil and Spain, followed by Chile and the Netherlands. Exports of brown rice have lately increased, with the EU as the main destination.

| |  |

|

Osiriz/InterRice

Monthly Report No. 220

| | | |

|

Arkansas Rice Updates

from the

Arkansas Row Crops Blog

| |  |

| |

|

August 2, 2022

Preparing for Farm Succession Planning Workshop

Presented by MU Extension Agricultural Business & Policy

Jackson, Missouri

More Information & Registration

| |

|

August 5, 2022

University of Arkansas Rice Research & Extension Center Field Day

Stuttgart, Arkansas

More Information

| |

|

August 11, 2022

RiceTec Field Day

Harrisburg, Arkansas

| |

|

August 23, 2022

Missouri Rice Research & Merchandising Council Annual Field Day

Glennonville, Missouri

More Information

| |

|

August 26, 2022

University of Missouri Fisher Delta Research, Education, & Extension Center Field Day

Portageville, Missouri

| | |

USRPA does not discriminate in its programs on the basis of race, color, national origin, gender identity, sexual orientation, religion, age, disability, political beliefs, or marital/family status. Persons who require alternative means for communication of information (such as Braille, large print, sign language interpreter or translation) should contact USRPA at 713-974-7423. |

| | | |