MARKET WATCH

Everyone knows we're in the middle of a pandemic. That is, everyone but the stock markets. April, seemingly out of nowhere, registered one of the best monthly returns in years.

As a follow-up act, May also had a strong showing.

But, as is usually the case, returns varied. Gold and Canadian REITs, were even on the month. Canadian and emerging markets rose four per cent, Canadian energy stocks increased five, while the U.S. and international markets jumped seven.

Year-to-date, the ledger is mixed as well, but gold has been the clear standout. The position we own remains 32 per cent higher on the year, after factoring in the loonie.

On the negative side, most international markets are 10 per cent lower, while the U.S. is only eight points below its December 31 value. The two worst performers have been Canadian REITs (24 per cent lower) and Canadian energy stocks (46 per cent lower).

There is no doubt the pandemic has improved since March. However, for most international markets to only be 10 per cent lower, while the U.S. is down eight, well, that seems optimistic to me. If we knew when a vaccine will be available, these valuations could make sense. Or, if government deficits began falling, these levels might possibly be justified. Or, perhaps if retail stores and restaurants were fully open, non-essential international travel resumed, sporting events returned, U.S.-China trade normalized or all those temporarily laid off could return to work - these factors would justify these market levels. But, of course, they aren't. As the saying goes, it's like Wall/Bay Street has no idea what is happening on Main Street.

Don't get me wrong. As I mentioned a few months ago, this will pass. But before then, there is an awful lot of uncertainty. So we will remain patient and may rebalance portfolios as need be. We will not be getting more aggressive yet. I don't know what the future holds, but I'm fairly confident we will see more market volatility before 2020 comes to a close.

|

|

IN THE REVIEW QUEUE

Something's been missing...I know you've felt it too. Despite a reference here, an off-hand remark there, it's been some time since I've read anything by Neil Gaiman. Well, fret no longer. This month's perusements include a double-dose of Gaiman for your pleasure.

Also part of the offerings below is an interesting book on microbes, the first few chapters of Ray Dalio's upcoming book, musings on our current and future financial situation, and an eclectic smattering of other pieces worth a read, listen or view.

Hope you enjoy!

Books:

The Graveyard Book by Neil Gaiman

: Tanya and I started listening to The Graveyard Book a few months ago on our trip to Quebec. While it took us longer to return to the story than anticipated, once we got back to it, we couldn't stop. This was my second listen, but it often felt like my first. It's a wonderful story, crafted and read by the master himself.

I Contain Multitudes by Ed Yong: Being in the midst of a pandemic caused by microbes, made me realize how little I knew about them. I recently picked up Ed Yong's I Contain Multitudes. As it turns out, the little critters are everywhere - as in, one-million-microbes-can-fit-on-the-tip-of-a-pin, everywhere. But that's a good thing. Without them, there wouldn't be much life on Earth.

The book helped me realize that, as the title implies, not only do we live in an ecosystem, our very bodies contain multiple ecosystems of their own. And these ecosystems are influenced by the places we go, the people (and animals) we see, and the food we eat (I never realized the role our diets play regarding the microbes that live within us).

If you'd like to learn more about I Contain Multitudes, this YouTube video and book summary provides a good idea of what it contains.

|

LONG THINGS THAT AREN'T BOOKS

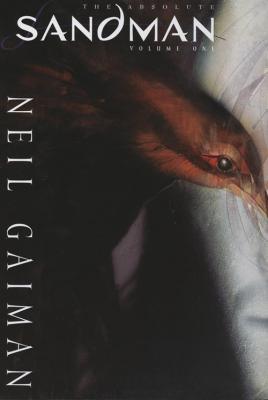

Absolute Sandman (Volume 1 - Issues 1-20) by Neil Gaiman: Having written more than 30 books and dozens of articles, it's often forgotten that Neil Gaiman's popularity began with his epic graphic novel, The Sandman. Absolute Sandman (Volume 1 (of 5)),

contains the series' first 20 issues. It's absolutely horrifying. It's also more tender and thought-provoking than you'd expect from a graphic novel.

The way a physical book looks is perhaps the last thing I consider when I'm reading. However, Absolute Sandman is no ordinary book. It's (and pardon the word-play) an absolutely beautiful book. The nicest I own, and possibly the nicest I've ever seen. Oversized, with thick, textured, midnight-black covers, and a framed front-facing eerie cover picture, perhaps to foreshadow the horrors that lurk inside. Within, you'll find 600 pages of wonderfully inked high stock paper. In short, it's also a collector's item.

If you like your graphic novels to be of the superhero variety, The Sandman is not for you. Its protagonist Dreamis no choir boy. But if you're not squeamish and are looking for something completely different, this may be up your alley.

For a better sense of Absolute Sandman, the following reviews of

issues 1-8

,

issues 9-16

and

17 - 20

are quite good. However, they're also full of spoilers.

The Changing World Order (Chapters 1 & 2) by Ray Dalio: The first two chapters of Ray Dalio's upcoming book on why nations succeed or fail.Though the book is mostly about the past, it contains a number of important lessons to consider for the future.

|

ARTICLES AND VIDEOS

Unbuttoned by David Sedaris: Squeamish, funny, open and upsetting. Classic David Sedaris.

Uncertainty by Howard Marks: Another stellar note from Howard Marks. This one reminds us how uncertain the future is and the importance of remaining intellectually humble. It also includes great quotes by Albert Einstein, Paul Simon, Warren Buffett, and others.

The Underpinnings of Sweden's Permissive COVID Regime by Nils Karlson, Charlotta Stern, Daniel Klein: Some believe Sweden's approach to the pandemic - being relatively laissez-faire - should be adopted by Canada and the U.S. They argue the Swedish approach will result in less financial and mental health ramifications. I believe they have overlooked one important detail: Sweden's unique culture. Without it, such an approach wouldn't be remotely possible. This article discusses the factors that make it unique.

More Money is Coming Your Way by Mackenzie Investments: Some thoughts from Mackenzie Investments on what the huge increase in money supply means and how to profit from it.

How Long Will a Vaccine Really Take? by Stuart A. Thompson: A detailed, interactive look at how long it usually takes to develop a vaccine and why this process takes so long. (Pair with article above for best understanding.)

|

SELECT INSIGHTS

"Wealth is the power to choose.

Financial wealth is the power to choose how to spend money.

Social wealth is the power to choose who to hang out with.

Time wealth is the power to choose how to spend your day.

Mental wealth is the power to choose how to spend your attention."

- James Clear

|

|

|

|

This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

The views of the author do not necessarily reflect those of Raymond James. This article is for information only. Raymond James Ltd. Member-Canadian Investor Protection Fund.

|

|

Copyright © 2017. All Rights Reserved.

|

|

|

|