MARKET WATCH

The first month of 2020 has been tumultuous to say the least. On January 3, a United States drone strike killed Iranian Major General Qasem Soleimani while he visited Iraq. Energy prices swiftly rose in anticipation of an Iranian military response, as a war with Iran would potentially jeopardize global energy supplies and lead to shortages. Days later, Iran launched missiles that hit a US army base in Iraq. Although no fatalities resulted from the attack, that same evening, Iran shot down a commercial plane flying from Tehran to the Ukraine. Of the 176 passengers and crew on board, 57 were Canadian, with many more connected to Canada.

As the downing of the plane appears to have been an error, and with President Trump's assurance that Iran was "standing down," global investors assumed the worst was over, and propelled the stock markets higher.

However, a new strain of the highly contagious Coronavirus, detected last month in China, has recently become a cause for concern. As of Tuesday, China had enforced the largest quarantine in history, covering 16 cities and an estimated 46 million people. By Thursday the deadly flu has spread to 15 countries and infected 7,000 people. The potential of this turning into a widespread contagion has shaken investor confidence as markets had their worst day in three months on Monday.

Speaking of global markets, most began the month strongly, but have since given most of their gains back due to news of the potential global pandemic. As is usually the case, there have been outliers. Gold and Canadian REITs - two assets that are usually resilient in the face of uncertainty - are respectively four per cent and five per cent higher on the year. On the other hand, Canadian energy stocks have plunged almost nine per cent in January. Despite this dismal performance, Canadian energy stocks currently trade above their November 30 levels, as they soared an 11 per cent in December.

Looking forward, it appears China's ability (and the 14 countries with infections to a lesser extent) to contain the coronavirus will heavily influence financial markets in the near, but possibly medium term.

|

|

PERSONAL FINANCE

As January comes to an end, now's the time (if you haven't done so already) to start taking advantage of two tax-planning opportunities: Contributing to your TFSA, as the new year has unlocked another $6,000, and contributing to your RRSP (deadline is March 2). To help you understand these two plans, I recently refreshed a previous blog on RRSPs and related strategies, as well as one comparing the TFSA and RRSP.

Lastly, the New Year brings a number of small changes to benefit payments (CPP and EI) and tax rates for 2020, as well.

|

2019'S GREATEST HITS AND THE YEAR AHEAD

The first month of the new year always provides a great opportunity to reflect on the year that was, and look at what you want to achieve for the year ahead.

If you follow me on social media, you may have noticed some of my recent posts around this idea of reflection and goal-setting. One of my recent blogs follows this theme as well.

My Favourites of 2019:

Last year, I spent time exploring interesting content and expanding the breadth of mediums I consumed. This post lists the best things I found in 2019.

|

IN THE REVIEW QUEUE

The Brutal Telling by Louise Penny: Returning to Louise Penny's Inspector Gamache series feels, well, like going home. Weaving references to Emily Carr, Henry David Thoreau, Charlotte's Web, and more into the story, Penny crafts another wonderful read for Book #5 of the series. Spoiler Alert: I've already started the sixth book.

Energy: A Beginner's Guide (Beginner's Guides) 2nd Edition by Vaclav Smil:

Vaclav Smil cares little for eloquent prose. He presents the facts, adds some context and details, then moves on. But if you want to learn anything about energy - he's your guy! This 'Energy 101' book covers everything from ancient energy sources, such as, wood and human muscle, to fossil fuels and potential new sources of power. To get a better sense of Smil, this interview is packed with information on energy and the state of global warming. It ends with the oddest book description I've heard from an author.

Principles for Success by Ray Dalio: I ordered Principles for Success assuming it would be a summary of Ray Dalio's excellent book, Principles. While technically true - it's also written for children. Given that, I'd highly recommend it for young people...less so for adults. I'd also recommend his YouTube channel, which includes most of his philosophies and other interesting information.

50 Years at Gombe by Jane Goodall: I've long been interested in primatology. As it's the study of our closest animal relatives, I believe we have much to learn about ourselves from them. As the first person to study chimpanzees in the wild, Jane Goodall's story is inspiring and educational. I'd also recommend the documentary Jane on her life's work.

|

LONG THINGS THAT AREN'T BOOKS

Political Disney World by Tim Urban

(Wait But Why):

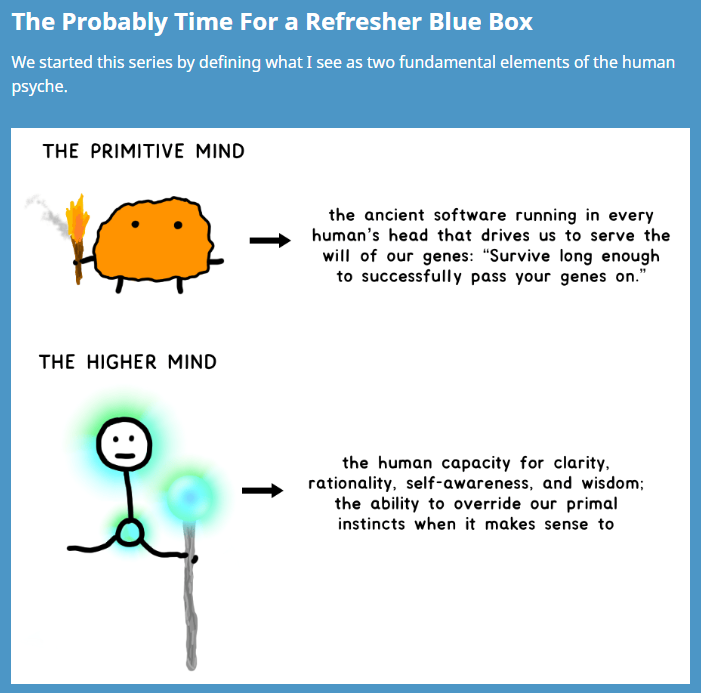

The 10th installment of Tim Urban's

The Story of Us

delves further into America's political mess. Although focused on the U.S., much applies to other countries including Canada.

The chosen title reflects how, much like Disney stories, politics has devolved into simple archetypes: good vs. bad, right vs. wrong, selfless vs. selfish, etc. This oversimplification encourages us to pick sides, resulting in the tribal (us vs. them) behaviour currently seen in the press and social media. The Story of Us remains the best resource I've seen on the state of today's environment, and what it has done to society.

How to Write with Flair by Shani Raja: Great Udemy course on the ins and outs of writing. No offence to Neil Gaiman (and please don't tell him), but I've learned more about writing from Shani Raja's course than any other source.

|

ARTICLES, PODCASTS AND INFOGRAPHICS

10 Big Myths About World War One Debunked by BBC News:

Some hard-to-believe facts about World War I. So hard that I'm struggling to believe #9. However, I'm hesitant to pit my knowledge against the BBC News...

How to Do What You Love by Paul Graham:

Doing what you love isn't just a good idea because you'll enjoy it. It also enables you to excel at what you do.

The Last Chapter in the Middle East? by Peter Zeihan:

A client recommended I read Peter Zeihan's work. So far I'm impressed. This short article delves into the recent flare-up between the U.S. and Iran, provides Saudi Arabia's perspective on the situation, and shares thoughts on the region's future.

Behind the Curve by Daniel J. Clark: A few years ago, I started to hear about people who actually believe the world is flat. Since then, I've wanted to learn how they were convinced of such a thing. Upon recently finding a documentary on the subject, well, I was almost giddy! Behind the Curve is fascinating. It's remarkable how far some people go to justify a story they believe in. Gather enough of these "intellectual outcasts," and you begin to understand how cults and radical movements come to be.

|

SOMETHING TO THINK ABOUT

"Real wealth is not about money.

Real wealth is:

-not having to go to meetings

-not having to spend time with jerks

-not being locked into status games

-not feeling like you have to say "yes"

-not worrying about others claiming your time and energy

Real wealth is about freedom. Money can help achieve these things, but there are plenty of people who make lots of money yet aren't free."

- James Clear

|

|

|

|

This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

The views of the author do not necessarily reflect those of Raymond James. This article is for information only. Raymond James Ltd. Member-Canadian Investor Protection Fund.

|

|

Copyright © 2017. All Rights Reserved.

|

|

|

|