MARKET WATCH

Despite a global surge of COVID-19 cases, substantial economic uncertainty, and increased geopolitical tensions - mostly surrounding China - the majority of global stock markets rose in July.

Year-to-date, emerging markets are almost flat, the U.S. is a good day away from even, and most other markets are within five per cent of positive territory.

As is typical, when stocks and bonds tend to do one thing, commodities continue on their own, very different, path. In this case, that path involves some pretty dramatic lows and equally dramatic highs.

While remaining level on the month, Canadian energy companies are almost 50 per cent lower than where they were at the end of 2019. Having said that, recent activity indicates even a modest bump in oil prices could result in a surge in their values - meaning that, eventually, we might be looking back on these securities, which are trading at 20-plus year lows, as bargains.

Gold has also been an outlier, but positively so. July has seen the yellow metal continue its ascent as it has risen 10 per cent to trade at an all-time high! For those not keeping track, gold is 28 per cent higher on the year, but up 32 per cent for those - us included - holding it in Canadian dollars.

There are three reasons why it may be doing so well. As I often mention to clients, gold is a safe haven when the you-know-what hits the fan. And let's be honest - there's been plenty of it flying around this year. Second, when a security increases dramatically, as gold has this year, investors often buy it in the hopes of that trend continuing.

Lastly, the U.S. dollar is beginning to be perceived as weak, with some even concerned it may lose its status as the global reserve currency. Should this happen, dollars will be sold in exchange for gold and other currencies, as the U.S. dollar would be needed less often for global trade and foreign reserves. This is obviously bullish for gold if countries increasingly use it to store their wealth, but also, a falling dollar increases the value of gold, as it is priced in greenbacks.

Although August is often a placid month for the markets, given the upcoming U.S. elections and everything else going on in the world, we will remain watchful in case volatility returns. And if it does, we are in a good position to take advantage!

|

|

IN THE REVIEW QUEUE

For the first time in memory, each book I finished this month was either fiction, or related to it, from a dystopian future and a heartbreaking story about terminal illness to a meditation on the importance of literature and everyone's favourite green superhero (except perhaps Ryan Reynolds).

Due to more walks in my schedule, my other diversions included increased podcast-listening. Topic-wise, they leaned towards economics and geopolitics, but also covered eclectic topics like fungus and how to think about spending your time.

If you've come across anything interesting you feel I'd enjoy, please feel free to send it my way!

Books

Green Lantern Omnibus (Volume 1) by Geoff Johns: The Green Lantern has always been my favourite super hero. Green was my favourite colour and who wouldn't love a ring that manifests anything you imagined? Earlier this year, I finally mustered up the courage to watch the widely panned 2011 movie. Though not great, it made me want to dive further into the Green Lantern universe. At more than 40 issues and 1,200 pages, Green Lantern Omnibus (Volume 1) is quite the deep dive.

I'll start with positives. Most of the artwork is stunning! It's modern, detailed, and vibrant. The stories, on the other hand, were nothing special. Many of the issues felt stuck in the over-hashed struggle between good and evil, while written in a traditional hard-boiled style. While I'm glad to have explored it, I hesitate to read Volume 2. If I do, it will be more from a sense of FOMO than an itch to carry on.

The Handmaid's Tale by Margaret Atwood: My first Margaret Atwood book and, given the times, quite the choice. Not only was the dystopian U.S. future she created fascinating, it also felt...plausible. I'm beginning to see why Atwood is revered. This New Yorker article does a nice job of examining her career with an emphasis on The Handmaid's Tale.

|

LONG THINGS THAT AREN'T BOOKS

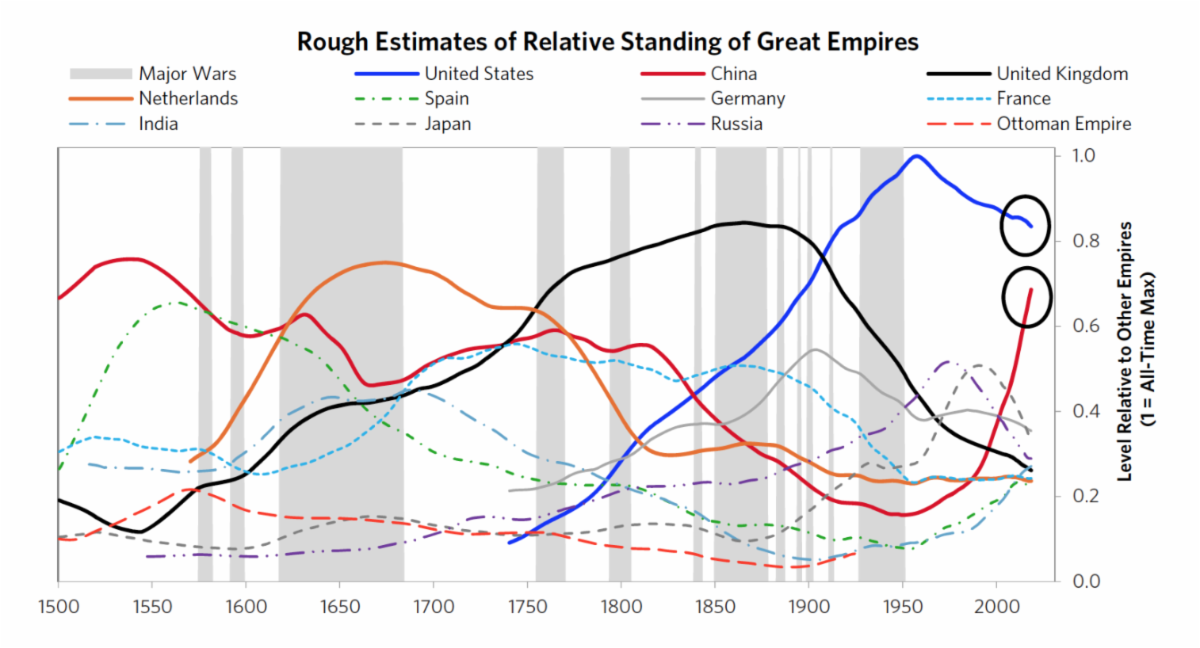

The Changing World Order (Chapter 4 - Part 1) by Ray Dalio:

The fourth chapter of Ray Dalio's upcoming book focuses on the economic history of the U.S. The first half of the chapter covers America from its creation to and including the Second World War. Once completed, Dalio's book is shaping up to be a must-read for those interested in understanding the global economic system and wanting an indication of what the future holds.

The Ethics of Economic Growth by Cato Unbound: A great series of essays debating the importance of economic growth. Beginning with Tyler Cowen's theory on why growth is imperative, the next three respond to his position. These are followed by a number of shorter rejoinders. Each piece is thoughtful and, perhaps most notable, respectful.

I believe we need more publications to host debates like

Cato Unbound. This model provides a superior way to learn about a topic and a thoughtful platform on which to discuss them.

|

ARTICLES

Market Observer by Canso: This month's Canso newsletter discusses the pandemic and the current state of the markets.

Saving the Nile by Aljazeera: I'm fascinated by water. It has always influenced human development and, in turn, we have attempted to assert command over it to serve our needs - often with varying success. The latest attempt in this vein is the Grand Ethiopian Renaissance Dam (GERD) near the Sudanese border. This interactive article explains much about the dam itself, but also the quagmire of geopolitical issues surrounding it. If these can be resolved, it should be a game-changer, not only for Ethiopia's 110 million citizens, but also for its neighbouring countries that lack dependable energy sources. This video provides supplementary information on the Nile and the affect the GERD could have on it.

Why China and India are Fighting by Confluence: A few weeks ago the world's two most populous countries had a notable skirmish on their common border. Confluence explores why it happened and what it could mean moving forward.

Permanent Assumptions by Morgan Housel:

The more things change, the more they stay the same. This is about how they stay the same.

Joe Rogan Is the New Mainstream Media by Bari Weiss: When I started listening to podcasts, few people knew what they were, and even less cared. That has changed. This New York Times article discusses why The Joe Rogan Experience has become such a huge success. How huge? It's estimated Spotify is paying him $100 million for exclusive rights to his podcast.

Incidentally, this article was the author's last for The Times. Her resignation letter created quite a stir as she cited the paper's intolerance of politically moderate views for her departure.

|

VIDEOS AND PODCASTS

Supernova in the East (Part 4) by Dan Carlin: This episode of Hardcore History's series on Japan in WWII illuminates the friction often experienced between the branches of a nation's armed forces. It also features the chaotic battle of Midway. Great stuff!

Interview with Peter Theil by The Portal: Stimulating conversation between two brilliant contrarian thinkers. Their discussion includes the corruption of academia and their assertion that, contrary to popular belief, scientific progress has actually stagnated. They also examine mimetic theory, which states that "most of human behavior is based upon imitation. The imitation of desires leads to conflict, and when a buildup of conflict threatens to destroy all involved, they use a scapegoat to return to balance."

Last episode of the Sunday Edition by Michael Enright: Michael Enright has hosted CBC's The Sunday Edition for 20 years. Happily, Tanya and I caught most of it live, as we drove to Cambridge on our first trip outside Toronto since the beginning of the pandemic. A nice blend of nostalgia and reminder that things still haven't returned to normal.

Why All Maps Are Wrong by Vox: Fun video explaining why every map is inaccurate. I found the actual size of land masses, like Greenland and Africa surprising.

|

JUST FOR LAUGHS

Although it reflects a sad truth, this cartoon made me laugh:

|

SELECT INSIGHTS

"As we move through life, we should swing between the discipline of work and the fullness of leisure. But in both cases, we should remember the scarcity of time and never kill it."

- David Perell

"That means that the important categories of your life are no longer the subject and the object, the watcher and the things being watched: the important categories are what you have to do and what you want to do - in other words, necessity and freedom."

- Northorp Frye

|

|

|

|

This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

The views of the author do not necessarily reflect those of Raymond James. This article is for information only. Raymond James Ltd. Member-Canadian Investor Protection Fund.

|

|

Copyright © 2017. All Rights Reserved.

|

|

|

|