MARKET WATCH

This month, Canadian energy stocks led the pack, followed by the U.S., and then other global securities. The notable laggard was gold. While the yellow metal climbed to an all-time high of almost $2,100USD in August, it now trades around $1,950USD. Despite the decline, it remains more than 20 per cent higher on the year.

I rarely comment on currencies, but recent trends warrant mentioning. Since early April, the U.S. dollar index, which measures the American currency against a basket of international currencies, has fallen roughly nine per cent. This has led many to speculate this trend will continue. However, I'm not yet convinced of this inevitability.

In many ways, the U.S. dollar is performing as usual. Since becoming the world's reserve currency, it has been a safe harbour during economic storms. When securities decline, as they did earlier in the year, investors flock to the dollar, causing it to rise (which it did in February and March). As you may have guessed, when stocks rise, which they have since April, investors sell the dollar to invest in riskier areas that will maximize profits - leading the dollar to decline. In other words, this year, the U.S. dollar has moved as one would expect.

There are reasons to doubt its continued decline as well. Most prominent of these is the unknown. If COVID cases spike in the fall, the economy and global stock markets could worsen - once again leading to greater investor interest in the American currency. Government spending has also surged in an attempt to support citizens and economies. When spending returns to normal, the economy may be ripe for a recession - which would be bullish for the dollar.

That all being said, there are good reasons the U.S. dollar might continue to decline, as well. The U.S. Federal Reserve is printing money at unprecedented levels, diluting the currency in existence and leaving investors less optimistic than usual.

Typically, the global dependence on the U.S. dollar - roughly 55 per cent of transactions occur through the American currency - allows the U.S. to print money more liberally than other countries. However, if China, whose economy is almost the size of the U.S's., continues flexing its geopolitical muscles, it could expand the Renminbi's usages and potentially diminish demand for the greenback. Although this is not likely to occur for some time - only two per cent of global reserves are in the Renminbi - anything is possible.

As for our portfolios, we are strongly positioned should the U.S. dollar slump further. Historically, a weak American currency is correlated with strong returns for commodities (priced in U.S. dollars), foreign securities (especially emerging markets), and value stocks. We are overweight in each of these areas.

|

|

U.S. ELECTIONS

As most political pundits were wrong about the outcome of the last U.S. presidential election, I'm noticing that the current polls are being treated with some skepticism.

With that in mind, I present you with Nate Silver's website FiveThirtyEight.com. It has consistently been one of the most accurate sources for political polls, as well as for anything influenced by stats and uncertainty, such as COVID-19. If you are looking for a reliable source for election forecasts, it's the one I trust most. It's impartial, nuanced, understands how to incorporate new polls, and controls for uncertainty. Is it a little geeky? Well, yes. But, it's also user-friendly.

|

IN THE REVIEW QUEUE

American Gods by Neil Gaiman: After moving from Great Britain to the U.S., Neil Gaiman struggled to understand what America was or stood for. American Gods was his attempt to explain it to himself. Part road trip, part murder mystery, and, as the title alludes, loaded with more myths than you can hang from an Ash tree. It's great fun, but perhaps also makes you consider the elements behind a nation's spirit, and the hidden struggles to sway it.

Zero to One by Peter Theil: Several years ago, I listened to Zero to One. I wasn't very impressed. But I've heard it recommended so many times, I thought a more careful read was in order. This time, I read the physical book and realized how much I missed. Though written for start-up founders, it's filled with wisdom, including offering insights into mimetic theory, why new creations are so valuable to society, the importance of understanding power laws, and many more. It's a must-read if you own a business.

If you know little about Peter Theil, he's not only one of the world's most successful entrepreneurs and investors, he's also considered one of its smartest and most unique thinkers. This article by David Perell is an excellent step into all things Theil.

|

LONG THINGS THAT AREN'T BOOKS

The Changing World Order (Chapter 4 - Part 2) by Ray Dalio: This section of Dalio's upcoming book details post-WWII American hegemony, the economic trends during this period, and China's increasing economic and geopolitical power. I'm eagerly awaiting Chapter 5, which exclusively focuses on China.

|

ARTICLES

Is Marijuana as Safe as We Think? by Malcolm Gladwell: I've always considered marijuana use to be mostly benign. After reading Malcolm Gladwell's article, I'm less sure of that notion. Worth a read if you know regular users.

History is Written by the Losers by The Scholar's Stage: We've often been told that history is written by the winners. While it may be mostly true, this article sites numerous examples where, counterintuitively, the opposite occurred.

Yield Curve Control by Bridgewater: Bridgewater discusses the potential interest rate environment in the coming years.

|

PODCASTS

Econ Talk with Nasim Taleb: Slightly geeky conversation about the pandemic, stats, and how to know when a new virus outbreak should be taken seriously. If you like discussions on "fat tails", randomness, and power laws, this is for you.

- Ryan Holiday: Wide-ranging conversation covering topics, such as journalism, ancient wisdom, and how some bestseller book lists (like the New York Times) purposely fail to reflect the number of books sold.

- Brian Callen: When I was at the half-way mark, I had decided not to include this podcast in the newsletter. Brian Callen's language is colourful (he's a comedian) and some may take issue with his traditionally male-centric opinions. However, the second half of the conversation was so interesting I felt it was worth sharing.

- Mass Media, Markets and Human Malware: A Portal Q & A: A particularly thought-provoking Q & A. Questions include the tension between economic growth and inequality, the flaws of capitalism as it stands, and the issues around American policy with regards to skilled immigrants in science.

- Tyler Cowen: What do you get when a mathematician and economist talk about evolutionary theory, ethics, music, and much more? A fascinating conversation! Much of the first half is fairly technical, so if you're interested in their conversation on music, it starts at 1:36:08.

WTF with Jerry Seinfeld by Marc Maron: Seinfeld and WTF host Marc Maron discuss the history of stand-up comedy, Seinfeld's writing method, and why he chose comedy.

North Star with Tyler Cowen by David Perell: In February and March, when uncertainty was at its highest, Tyler Cowen's website and Twitter feed were among my primary resources. In this interview, he and host, David Perell, discuss the importance of compound growth (not just for investing), learning, and how many high performers often have a significant advantage in a key area. For Tyler, this advantage is in his reading speed - I'd be ecstatic to comprehend at half his rate.

|

VIDEOS & INFOGRAPHICS

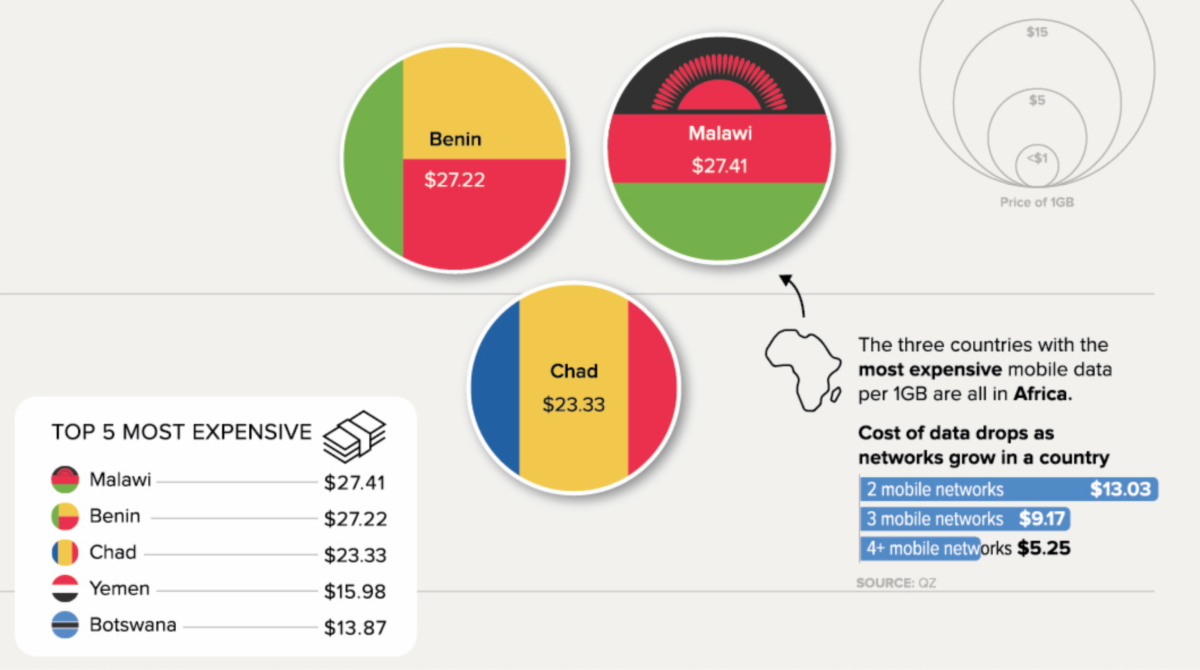

What does 1GB of Mobile Data Cost in Every Country?: Curious about how much Canadians pay for data compared to other countries? Spoiler Alert: You won't like it. What does 1GB of Mobile Data Cost in Every Country?: Curious about how much Canadians pay for data compared to other countries? Spoiler Alert: You won't like it.

Canada is Quietly Building the Trading Empire of the World by Jack Chappel: Interesting video on how global trade may increasingly move through Canadian waters.

Cricket Fever by Netflix: I knew almost nothing about cricket before watching this documentary. To be honest, I still don't, but it didn't stop me from binge-watching this eight-episode documentary in under a week.

Conservative Fairy Tales & Liberal Allegories? by Just Write: "The most important difference between the fairy tale and the liberal allegory is that the fairy tale is not really about the social order at all. The societies they depict are simply a setting that makes the real story possible. The allegory tells the story of an entire community; the fairy tale, a story of one or two people. The allegory searches for social change; the fairy tale, moral growth. The allegory says that life's problems are embedded in the structures of the world outside you; the fairy tale replies that their source is embedded deep in the soul inside you."

|

SELECT INSIGHTS

"The key is not to predict the future but to prepare for it."

- Pericles

"I am thankful for all the hard times I've been through and all the tears I've cried because that has put me as closer [sic] to God and made me the strong woman I am today."

- Angela Merkel

"Populists seize the opportunity to promise immediate action while liberalism only ever offers mediated action via law, political representatives, editorial peer review and so on. All of this comes to be experienced as intolerably slow and self-interested in the age of the platform."

- William Davies, comparing how populism and liberalism are viewed

|

|

|

|

This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. The views of the author do not necessarily reflect those of Raymond James. This article is for information only. Raymond James Ltd. Member-Canadian Investor Protection Fund.

|

|

Copyright © 2017. All Rights Reserved.

|

|

|

|