|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

Learn some easy tips on how to avoid Identity Theft!

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 2.49% APR requires a minimum FICO® 750 Credit Score. 72 months term at 2.49% APR is $14.97 per $1,000.00 borrowed.

|

President's Corner President's Corner

|

The year 2017 had no shortage of drama and debate in business, politics, or pop culture. My favorite moment last year happened at the very end of the year and was predictably sports-related. In the last game of the NFL regular season, Andy Dalton, the oft-maligned quarterback of the perennially woeful Cincinnati Bengals threw a touchdown pass to beat the Baltimore Ravens. Neither team made the playoffs, but the Bengals' win sent the Buffalo Bills to the playoffs for the first time since 1999.

Usually, that does not elicit much of a response among fans or players. But in this case, Bills fans took their joy to another level. To show their appreciation, 15,000 Buffalonians flooded the Andy & Jordan Dalton Foundation with more than $350,000 in donations, many of which in $17 increments representing every year of the Bills' postseason drought. The morning of the Bills playoff game against the Jacksonville Jaguars, the foundation received donations at a rate of 25 per minute. The money was supplemented by 1,440 chicken wings and nine gallons of wing sauce donated by Buffalo-based Duff's Famous Wings and delivered to Autism Services at the Children's Home of Cincinnati.

I bring this up because of the new federal tax plan beginning in 2018. The standard deduction has doubled which will effectively eliminate the charitable donation deduction on most of our tax returns. According to the IRS, only about 30% of taxpayers itemize their deductions. Some tax experts estimate that fewer than 10% will continue to itemize under the new law. Americans are by far the most generous people in the world, but the possibility exists that the tax rules going into effect will put a damper on charitable donations. In a high tax state such as California, the loss of the charitable contribution deduction will leave middle-income taxpayers less to donate.

As discretionary government services are being cut to the bone, the roles of nonprofits and foundations are filling holes in the social safety net. Charities have stepped up to provide emergency relief and long-term aid to victims of the California wildfires, the Gulf Coast and Puerto Rican floods and hurricanes, and the Las Vegas and Texas mass shootings. Routinely, these agencies work with immigrants, homeless people, abused women, hungry children, and disabled individuals.

I was on the board of directors of a social service nonprofit and experienced first-hand how difficult it is for those entities to maintain their funding or receive grants from other foundations. It will be more difficult to provide necessary services as the less successful nonprofits disappear because of lack of funding.

I have pledged to donate to charities at a greater rate than last year. I will not receive a tax deduction, but in return, I hope I can make my little corner of the world a little bit better place to live.

Many of the Bills fans' donations to Andy Dalton's foundation were most likely non-tax deductible. However, what is encouraging is that at that moment in time those fans/citizens/taxpayers did not care about how much taxes they may have to pay this year and in future years. They were changing lives, $17 at a time.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

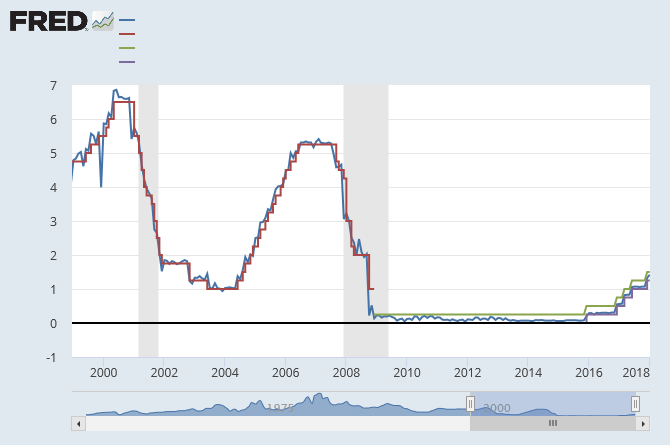

Source: Board of Governors of the Federal Reserve System

The traditional policy tool of the Fed is to target the federal funds rate. Note the term target. Indeed, the Fed does not set this interest rate; rather, it sets the target and then conducts open market operations so that the overnight interest rate on funds deposited by banks at the Fed reaches that target. Obviously, reaching the target is sometimes harder to do, especially in times when there is a lot of uncertainty in the markets. The graph above compares the target (or target band more recently) with the effective federal funds rate. While the two coincide quite well over most of the 10-year period, there are important deviations that correspond to various financial market events. Nevertheless, these deviations are short-lived, which shows that the open market operations do have the desired effect.

(FIVE EIGHT TWO EIGHT NINE)

|

1st Alerts 1st Alerts

|

- We're upgrading @ccessOnline Home Banking! Learn more: www.1stnorcalcu.org/online-banking/upgrade

- Please be informed that loan life insurance expired as of October 31, 2017. No claims will be processed after that date.

- Click here for information regarding the Equifax Breach.

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

Buy a Kid a Bike Fundraiser

Buy a Kid a Bike Fundraiser

Our Buy a Kid a Bike fundraiser during the months of November and December, benefiting the Richmond Fire & Police Holiday Program, was a huge success! Our members helped to raise over $2200, which covered the cost of purchasing 45 bikes and helmets for children in need over the Holidays.

Thank you to all who participated!

|

Tips for Teens Tips for Teens

|

It's Beginning to Look Like a Bunch of Holiwaste!

The holidays have come and gone. The songs have been sung, decorations put away, food long ago eaten. Now comes the age old question,

where did I put the gift receipts? It's understandable if you need a different size or if Pantone 448C really isn't your color, and you're not alone. According to CNN Money, 7% of Millennials do return their holiday gifts and another 15% to 30% of all online gifts will be returned, accounting for $32 billion dollars in refunds. My point being, you probably opened that box that had the *fill in the blank* inside and decided on returning it. The store will most likely take it back, but will think twice about putting it back on the shelf. That's because it's often less expensive for the retailer to dispose of a good than it is to sell it again. For example, let's say you were planning on returning that $80 Pantone 448C sweater your sweet, dear, twice-removed relative gifted you. The retailer will give you back your $80 but since it doesn't look exactly fresh off the press, they'll either put it back on the shelf for 75% off, bringing the price down to $20 dollars, which would be a hypothetical loss of $10 dollars, or they could use the space they would have used for the sweater to sell something more eye appealing.

So in the end, where does the sweater end up? Sadly, it might end up in a landfill. Think this is bad? Online returns are slightly worse because of the carbon dioxide shipping the item both ways releases, contributing to climate change and air pollution. What can you do?

Well, many stores will gladly give you a refund for an online order at a brick-and-mortar location. Do you have an item from Amazon that needs returning? Stop by your local Kohl's and they'll gladly help you out through a partnership they signed last summer. This won't solve the issue of the possibility of your returns ending in a landfill, but you'll reduce your carbon footprint.

However, if your mind is set on preventing your gift from ending up in a landfill, why not donate it? A local thrift store will be more than happy to accept it. You could also re-gift the item to someone who might appreciate it more than you.

No matter what you decide to do with your gifts, don't forget to thank the people who gifted them to you for thinking of you over the holidays!

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Insurance Tips Insurance Tips

|

This time of year is when many of us put together a New Year's Resolution list. While that list probably doesn't include doing a review of your insurance, it may include finding a way to save money. Insurance professionals recommend that you review your policies at least once a year. Are you currently paying too much? Do you have adequate coverage or would a loss be financially devastating? Being underinsured could leave you with huge bills, while being overinsured means you are throwing money away.

Insurance is a very simple thing... it is there to protect you when something unplanned happens. If you unexpectedly lose your house or belongings to a catastrophe or theft, insurance will help you get back to normal. Same thing with your car, boat, vacation home, motorcycle, or anything else that you would choose to insure.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, umbrella, earthquake, flood, business and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

Eight Mistakes That Can Upend Your Retirement

By Jason Vitucci, CFP® & Gene A. Schnabel

Pursuing your retirement dreams is challenging enough without making some common, and very avoidable, mistakes. Here are eight big mistakes to steer clear of, if possible.

No Strategy:

Yes, the biggest mistake is having no strategy at all. Without a strategy, you may have no goals, leaving you no way of knowing how you'll get there-and if you've even arrived. Creating a strategy may increase your potential for success, both before and after retirement. The earlier you create your goal and strategy to reach that, the longer you have to succeed in reaching that goal.

Frequent Trading:

Chasing "hot" investments often leads to despair. Create an asset allocation strategy that is properly diversified to reflect your objectives, risk tolerance, and time horizon; then make adjustments based on changes in your personal situation, not due to market ups and downs.1

Not Maximizing Tax-Deferred Savings:

Workers have tax-advantaged ways to save for retirement. Not participating in your employer's 401(k) may be a mistake, especially when you're passing up free money in the form of employer-matching contributions.2 If your company has a retirement plan in place, it is always a good idea to ask if they have a company match. Even if they don't, you can start your retirement savings and reduce your taxable income.

Prioritizing College Funding over Retirement:

Your kids' college education is important, but you may not want to sacrifice your retirement for it. Remember, you can get loans and grants for college, but you can't for your retirement. If at all possible, if may be a good idea to start a savings plan early in your child's life so that you have a starting block for them when they reach college age.

Overlooking Healthcare Costs:

Extended care may be an expense that can undermine your financial strategy for retirement if you don't prepare for it. Sometimes there are strategies that can help insure you against this.

Not Adjusting Your Investment Approach Well Before Retirement:

The last thing your retirement portfolio can afford is a sharp fall in stock prices and a sustained bear market at the moment you're ready to stop working. Consider adjusting your asset allocation in advance of tapping your savings so you're not selling stocks when prices are depressed.3

Retiring with Too Much Debt:

If too much debt is bad when you're making money, it can be deadly when you're living in retirement. Consider doing your best to manage or reduce your debt level before you retire.

It's Not Only About Money:

Above all, a rewarding retirement requires good health, so maintain a healthy diet, exercise regularly, stay socially involved, and remain intellectually active.

If you have questions or need assistance formulating a retirement savings plan, don't hesitate to contact our office. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal. 1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities. Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

- The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost. Asset allocation and diversification are approaches to help manage investment risk. Asset allocation and diversification do not guarantee against investment loss. Past performance does not guarantee future results.

- Distributions from 401(k) plans and most other employer-sponsored retirement plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions.

-

The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost. Asset allocation is an approach to help manage investment risk. Asset allocation does not guarantee against investment loss. Past performance does not guarantee future results.

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(NINE SEVEN TWO SIX)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|