|

|

|

November 11- Veterans Day Honoring all who have served

|

**IBANYS Member Banks - Dues notices have been mailed.

|

|

|

|

|

Message From The President

|

|

|

By John Witkowski, President & CEO

____________________________________

IBANYS' New Fiscal Year Underway: Have You Reviewed

The Dues Renewal & Strategic Initiatives Update?

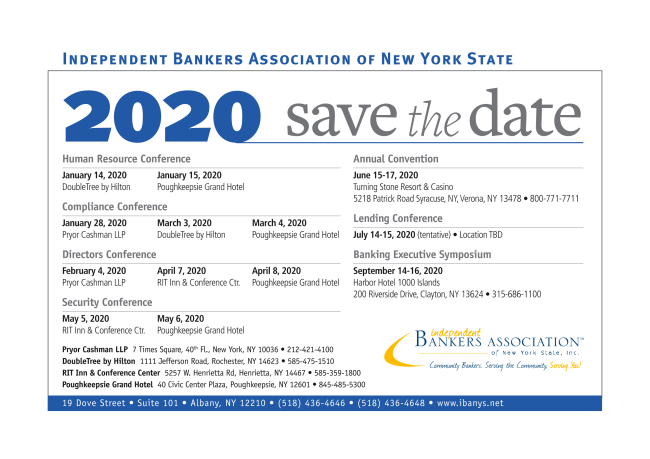

IBANYS' new Fiscal Year officially began November 1, as our new leadership team assumed office under Chairman Mike Wimer (Cattaraugus County Bank), Vice Chairman Tom Carr (Elmira Savings Bank), Treasurer Mario Martinez (Catskill Hudson Bank) and Immediate Past Chairman Tom Amell (Pioneer Bank). IBANYS recently mailed out our 2019-20 dues renewal notices; an update on our 2019 efforts on behalf of community banks; a preview of our 2020 strategic initiatives, and our 2020 meeting dates and locations. We remain focused on our educational programming, government relations efforts and maintaining our strong financial and political standing.

In the summer of 1974, a group of small, independent community bankers banded together to ensure that local community banks throughout New York State were strongly represented in the halls of government. The result? They launched a brand new state trade association, the Independent Bankers Association of New York State, committed to protecting and advancing community bank interests.

Today, more than 45 years later, that remains IBANYS' mission. We have succeeded thanks to the

participation and support of our member banks, board of directors, associate members and preferred partners.

As we begin this new Fiscal Year, rest assured

we will continue building on the strong foundation we have established together.

- - - - - - - - - -

Is YOUR Bank Represented In The

Decision-Making

Process Of YOUR Association?

Many organizations claim to be "member driven," but at IBANYS, it's our way of life. Make sure your voice is heard as IBANYS formulates our government relations policies and positions, educational programs and efforts to increase our non-dues revenue sources. Sign up to serve -- or, designate a representative from your bank to serve -- on our Government Relations Committee, Compliance Peer Group, CFO/Senior Management Peer Group and Innovation Committee. E-mail [email protected] or [email protected].

Latest On Credit Union Branch Openings

According to S&P Global Market Intelligence, U.S. credit unions opened 77 branches and closed 55 during the third quarter.

As of September 30 -- 21,364 credit union branches were operating in the country, up 88 from a year earlier. Two new credit union branches opened in New York state during the quarter.

As a reminder:

- Credit unions in New York State used their tax exemption to avoid paying $108,425,965 in federal income taxes in 2018?

- In 2018, they held a total of $83,906,235,219 in tax-free assets.

- The lost tax revenue from New York credit unions would pay for 785 teachers, 490 police officers, or 573 social workers.

- Credit unions used $35,780,569 of their tax subsidy on non-member expenses.

* Data based on 2018 estimates from BLS Office of Employment/Unemployment Statistics (BLS/OEUS)

Let's double down on our efforts to support ICBA's "Wake Up" campaign to convince policymakers to "open their eyes" to the risks and taxpayer costs posed by credit unions.

Take a look at the action alert in today's newsletter. . . The campaign calls on policymakers and the public to "Wake Up" to the risky practices, costly tax subsidies, and irresponsibly lax oversight of the nation's credit unions.

Let's work together to open some eyes in Washington and Albany!

- - - - - - - - - -

___________________________________

As always, thanks for all you do for community banking in New York State.

- - - - -

|

|

Follow IBANYS On Social Media!

Connect With Us Today!

|

Meetings

|

Mark Your Calendars For These Upcoming IBANYS Conferences:

Meeting Agendas & Registration Information Coming Soon

- Have an idea for one of our meetings? Want to see a meeting or forum on a different subject? We want to hear from you!

|

IBANYS Education/Webinars

|

|

The Independent Bankers Association of New York State (IBANYS) partners with CBWN to bring you more than 150 webinars each year covering compliance, lending, regulations, security, operations, new accounts, collections, fraud, security and other topics. Not only that, but every time you purchase a webinar, you support IBANYS, because a portion of your registration comes directly to us. Thank you!

You can view the 2019 Webinar Schedule here or by category here. In addition, CBWN has made some recent updates to provide better service to its consumers. Unfortunately, some changes may have caused you to miss important webinar announcements. Please read the IBANYS letter to view the updates and ensure that you do not miss another webinar.

CBWN and IBANYS thank you for your continued support of the education in the community banking industry.

Purchase Webinars Individually or Purchase the Series to Save 10%!

|

|

|

Albany |

The New York State Legislature will return to Albany in January for the 2020 session.

______________________

DFS Publishes Basic Banking Regs -- Effective November 12

The New York State Department of Financial Services (DFS) has published Regulations on

basic banking accounts

to reflect new requirements passed by the Legislature during the 2019 legislative session and signed by the Governor in September. The new requirements, which include eight withdrawal transactions for account holders under sixty-five years of age, and twelve for account holders sixty-five years of age or older, will take effect next Tuesday, November 12, 2019.

Tuesday's Off-Year Election Results:

- Republican Chautauqua County Executive George Borrello held the state senate seat in the 57th district that was vacated by the retirement of Cathy Young (R) in Western New York. Democrats hold 40 of the 63 seats in the State Senate.

- Democrats maintained control of two key county executive posts: Mark Poloncarz was re-elected Erie County executive, and Steve Bellone will serve a third term as Suffolk County executive. Onondaga County Executive Ryan McMahon won a full term after replacing Joanie Mahoney; Republican Dutchess County Executive Marc Molinaro was re-elected, while Monroe County Executive Cheryl Dinolfo lost to Democrat Adam Bello.

Governor Forms Committee For Advancement Of Women In Leadership

In Financial Services

|

|

|

|

Linda Lacewell, NYS Financial Services Superintendent.

|

|

Governor Cuomo has formed

the state's first-ever women's committee to address the representation and advancement of women in the financial services industry, and to identify the hurdles and obstacles to increasing the number of women in leadership roles, including promoting diverse women. The Governor stated: "This committee will help increase the representation and advancement of women in the financial services industry by finding new and innovative ways to break down barriers to success for women." The committee is co-chaired by Secretary to the Governor Melissa DeRosa and NYS Financial Services Superintendent Linda Lacewell, who noted: "Companies that have more women leaders are more profitable, have a better understanding of their customers, and create more value. Simply put, when women advance, we all advance. This demonstrates the importance of helping women, including women of color, achieve parity with their male counterparts in the financial services industry." Also named to the committee was

Shirin Emami, DFS Executive Deputy Superintendent of Banking. The announcement cited a

2018 study that reported

women hold just 19% of C-suite positions In the financial services industry, despite representing roughly half of entry-level positions, and that with each level higher there are disproportionately fewer women in leadership roles. The gap among women of color was reportedly even larger.

______________________________

IBANYS' Plan of Action for 2020

IBANYS is preparing for the 2020 state legislative session that begins in January, developing positions and policies and encouraging member banks to meet with their local legislators to continue informing them about community banks, our priorities and the vital role we play in New York State. Please email us your ideas, thoughts and comments on issues you want to see on the 2020 IBANYS legislative agenda.

|

Washington, D.C.

|

|

Feds Update Thresholds for Higher-Priced Loans, Reg Z & Reg M

Federal regulators said the threshold for exempting loans from special appraisal requirements for higher-priced mortgage loans during 2020 will increase from $26,700 to $27,200. The threshold amount will be effective Jan. 1, 2020, and is based on the annual percentage increase in the Consumer Price Index as of June 1, 2019.

Separately, federal regulators also announced the 2020 dollar thresholds in Regulation Z (Truth in Lending) and Regulation M (Consumer Leasing) that will apply for determining exempt consumer credit and lease transactions. The protections generally will apply to consumer credit transactions and consumer leases of $58,300 or less in 2020. Private education loans and loans secured by real property are subject to the Truth in Lending Act regardless of the loan amount.

Senate Approves Ag Spending Package

The Senate last week passed a fiscal 2020 spending package that includes funds for agriculture, rural development, and housing, among other federal programs. The $332 billion appropriations bill, which passed 84-9, marks the fourth of 12 fiscal 2020 spending bills passed by the Senate. Congress has until Nov. 21 to pass the appropriations bills or approve another short-term extension known as a continuing resolution.

Two Important Action Alerts:

Tell Your Members Of Congress Congress: "Wake Up"

To Credit Union Reality

As part of ICBA's new "Wake Up" campaign, community banks can use ICBA's "Be Heard" grassroots action center to tell Congress to "open their eyes" to the risks and taxpayer costs posed by credit unions.

The campaign

calls on policymakers and the public to "Wake Up" to the risky practices, costly tax subsidies, and irresponsibly lax oversight of the nation's credit unions. The new effort

is part of ICBA's (and IBANYS') long-standing opposition to the credit union industry's unwarranted federal tax subsidy and mission creep. ICBA distributed to Congress its new "Do They Know They're Tax Exempt?" white paper on credit union mission creep. Read the White paper here.

The White Paper Finds Credit Unions:

- Do not primarily serve individuals of modest means

- Do not restrict their activities to the specific communities they are mandated to serve

- Withhold 21 to 33 cents of every dollar in tax subsidies they receive (In 2018, that amounted to between $500 million and $900 million in taxpayer dollars not directed toward credit union members.)

IBANYS strongly supports ICBA's "Wake Up" campaign to "open the eyes" of policymakers about the many ways that tax-exempt credit unions have an unfair advantage, and are using it to take out their tax-paying community bank competition. IBANYS is also exploring ways to host sessions for state legislators to discuss these issues.

Seek Equal Treatment For Community Banks On Military Bases

IBANYS joins ICBA in asking IBANYS members to urge their local Members of Congress to advance legislation that will help community continue to serve military bases and rural communities. ICBA's "Be Heard" grassroots action center (

www.icba.org) can provide important information to help you. 1)

Urge lawmakers

to include language in a defense bill to extend

the same "rent-free" benefits

to on-base banks that are currently enjoyed by credit unions; 2)

Support legislation

that would exempt from taxable income interest on loans secured by agricultural real estate, and 3)

Thank members of the House

who voted to pass ICBA-advocated legislation to establish a cannabis-banking safe harbor.

A Conference Committee is currently working to reconcile a defense appropriations bill to support the provision to require the Department of Defense to treat banks and credit unions operating on military bases equally.

New Yorkers on the conference committee include Senator Gillibrand and Reps. Delgado, Katko, Engel, Meeks, Nadler, Rose, Stefanik, Tonko, and Velazquez.

|

|

IBANYS Preferred Partners

|

For more information on IBANYS Preferred Partners - click here: https://ibanys.net/preferred-partners/

- Pentegra Retirement Services

- Luse Gorman, PC

- Compliance Anchor

- Freed Maxick CPAs

- T.Gschwender & Associates, Inc.

- Homestead Funding Corp. -

- Promontory Interfinancial Network

- Travelers

- ICBA

|

Industry Trends & Updates

|

|

USDA Posts Hemp Production Webinar

The USDA

has

posted a webinar

to provide an overview of the Domestic Hemp Production Program, which was established to create a consistent regulatory framework around U.S. hemp production. The webinar discusses the differences between hemp-related provisions of the 2014 and 2018 farm bills and provides details of the interim final rule published on Oct. 31. Visit ams.usda.gov. Under Resources,

click on the link to

Webinar - U.S. Domestic Hemp Production Program Overview

NCUA Director Urges Stricter Regulatory Exams For

Larger Credit Unions

Todd Harper, a member of the board of the National Credit Union Administration (NCUA), called for creating a special compliance examination for the larger, complex credit unions. Harper said the NCUA's compliance examinations and consumer financial protection reviews lag those performed by bank regulators, and proposed the creation of a dedicated consumer compliance exam program for large, complex credit unions because the NCUA's regulatory regime has not evolved with credit union growth. He said 317 credit unions with 71.7 million members exceed $1 billion in assets, while the NCUA is on track to complete only 25 fair lending exams of more than 5,300 federally insured credit unions in 2019. Harper has also criticized the NCUA's role in the New York City taxi medallion scandal and voted against NCUA efforts to expand the powers of tax-exempt credit unions.

New York Fed's Recommended Alternative To LIBOR

The Federal Reserve Bank of New York proposed daily publication of three compounded averages of the Secured Overnight Financing Rate with tenors of 30, 90, and 180 calendar days. The New York Fed plans to initiate publication in the first half of 2020, and would also publish a daily SOFR index with custom time periods. The SOFR is the Alternative Reference Rates Committee's recommended alternative to the London Interbank Offered Rate, which could be discontinued in 2021.

Regulators Closed Three Banks In One Week

Regulators closed three banks during the week between

October 25 and November 1 -- one each in New Jersey, Ohio and Kentucky. A total of four banks have now closed during 2019.

There were no bank failures in 2108.

__________________________________________________

The Economy: By The Numbers

- The U.S. Labor Department reported nonfarm productivity, which measures hourly output per worker, fell at a 0.3% annualized rate between July and September, the biggest decline in almost four years. The last drop that was sharper was in the fourth quarter of 2015. Analysts had expected productivity growth of 0.9%.

- The U.S. Commerce Department reported personal income increased 0.3% in September, while personal expenditures rose 0.2%. Disposable personal income rose 0.3%.

- According to the business and executive coaching firm Challenger, Gray & Christmas, October continuing the record-setting pace of exits this year by the heads of U.S. businesses. It marked the highest month on record, with 172 CEOs leaving their posts. CEO departures hit a record high for the year through October, with 1,332 U.S. based companies announcing CEO departures.

|

|

|

Banking News

|

|

Excelsior Growth Fund Can Help Your Small Business Customers

Excelsior Growth Fund (EGF) is NYBDC's nonprofit Community Development Financial Institution and IBANYS' exclusive online lending partner. Join the growing number of banks that work with EGF to offer their customers an affordable and responsible option when they do not qualify for traditional financing. EGF offers loans up to $500,000 with a convenient, digital process. Loans under $100,000 are disbursed within 5 business days.

EGF's experienced team can work hand-in-hand with yours to develop a customized process to make referring seamless. To learn more about offering your customers a second look through EGF contact Bryan Doxford, SVP, at

[email protected] at at (212) 430-4512.

|

|

IBANYS Spotlight Is On...

|

|

Luse Gorman, PC has specialized in

representing community financial institutions for over 25 years. They are consistently one of the leading law firms nationally in mergers and acquistions, and the leader in capital raising transactions, including stock and debt offerings, mutual-to-stock conversions, mutual holding company reorganizations and other capital raising transactions. Their attorneys have completed more than 150 mergers in the past ten years alone, and nearly 100 capital raising transactions during this time period. The Firm also advises financial institutions on a broad range of executive compensation and employee benefits matters, including ESOPs. A substantial part of the Firm's practice also includes advising clients on SEC reporting and compliance, stockholder relations, corporate governance, strategic planning and bank regulatory and enforcement matters. C

ontact Jeff Cardone, Partner:

(202) 274-2033,

[email protected]. Or visit the website at

www.luselaw.com

|

|

|

|

|

|

. . .That passbooks, also called bank books, first appeared in the 18th century, allowing banking customers to hold transaction information in their own hands for the first time. Up until then, transactions were recorded in ledgers at the bank only; customers had no history of their own deposits and withdrawals. Traditionally, a passbook was used for accounts with a low transaction volume, such as a savings account. A bank teller or postmaster would write by hand, the date and amount of the transaction and the updated balance and enter his or her initials. In the late 20th century, small dot matrix or inkjet printers were introduced capable of updating the passbook at the account holder's convenience, either at an ATM or a passbook printer.

. . .Now you know.

|

|

|

|

New York community banks play a key role in our state and local economies. Help spread the good news among our customers, business, elected leaders and the media!

John J. Witkowski

President & Chief Executive Officer

Stephen W. Rice

Director of Government Relations & Communications

Linda Gregware

Director of Administration & Membership Services

William Y. Crowell III

Legislative Counsel

|

|

|

|